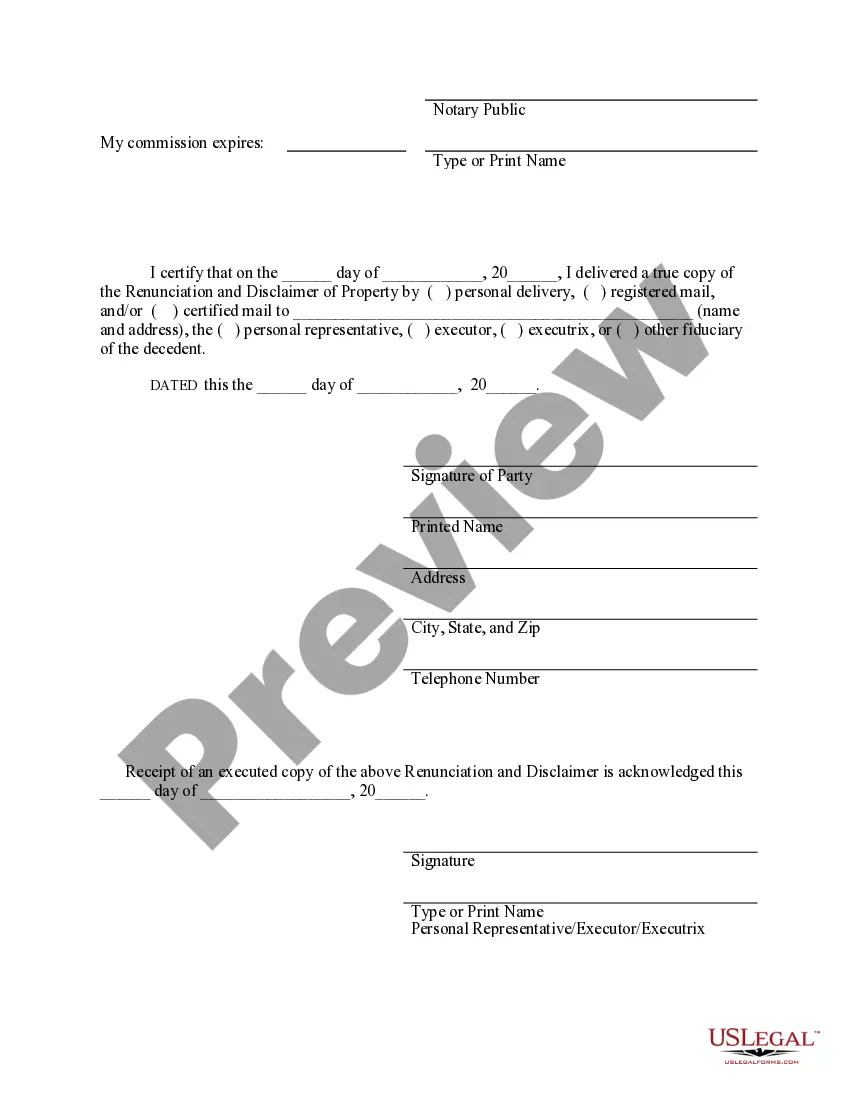

This form is a Renunciation and Disclaimer of Property acquired by the beneficiary through the last will and testament of the decedent, where, upon the death of the decedent, the beneficiary gained an interest in the property of the decedent, but, pursuant to the Oklahoma Statutes, Title 60, Chapter 15, has chosen to disclaim a portion of or the entire interest in the property. The property will now devolve to others as though the beneficiary predeceased the decedent. The form also includes a state specific acknowledgment and a certificate to verify document delivery.

Oklahoma City Oklahoma Renunciation And Disclaimer of Property from Will by Testate

Description

How to fill out Oklahoma Renunciation And Disclaimer Of Property From Will By Testate?

We consistently strive to diminish or avert legal harm when navigating intricate legal or financial matters.

To achieve this, we enroll in legal services that are typically quite costly.

Nonetheless, not every legal matter is as complicated.

Many of these can be handled independently.

Take advantage of US Legal Forms whenever you need to locate and retrieve the Oklahoma City Oklahoma Renunciation And Disclaimer of Property from Will by Testate or any other form quickly and securely.

- US Legal Forms is a digital archive of current DIY legal paperwork encompassing everything from wills and powers of attorney to articles of incorporation and dissolution petitions.

- Our system empowers you to manage your affairs autonomously without needing to consult a lawyer.

- We provide access to legal form templates that are not always available to the public.

- Our templates are tailored to specific states and regions, which significantly eases the search process.

Form popularity

FAQ

Disclaiming a legacy If you simply do not wish to receive a gift due to you from an estate, without being concerned about who else should, you may disclaim your inheritance. You may disclaim your gift in full as long as you have not accepted any part of it.

Disclaiming means that you give up your rights to receive the inheritance. If you choose to do so, whatever assets you were meant to receive would be passed along to the next beneficiary in line. It's not typical for people to disclaim inheritance assets.

This is because a valid will allows the decedent (the person who passed away) the ability to tell the Oklahoma County Probate Court how they wanted their assets distributed. They could also use their will to name a guardian for their minor child.

Key Takeaways. Common reasons for disclaiming an inheritance include not wishing to pay taxes on the assets or ensuring that the inheritance goes to another beneficiary?for example, a grandchild. Specific IRS requirements must be followed in order for a disclaimer to be qualified under federal law.

In Oklahoma, the district court judge will appoint a personal representative for probating the estate if the deceased dies without a will or the will doesn't name and Executor. This responsible party is appointed at a hearing for the sole purpose of carrying out certain duties.

In the law of inheritance, wills and trusts, a disclaimer of interest (also called a renunciation) is an attempt by a person to renounce their legal right to benefit from an inheritance (either under a will or through intestacy) or through a trust.

Three Scenarios TRANSFER OF PROPERTY TO AN HEIR IN A DECEASED ESTATE. The Executor would pass transfer of the Property in terms of the Will or of Intestate Succession; Read More.SALE OF THE PROPERTY BY THE DECEASED PRIOR TO DEATH.SALE BY THE EXECUTOR DIRECTLY TO A PURCHASER.

In the context of a contract, a renunciation occurs when one party, by words or conduct, evinces an intention not to perform, or expressly declares that they will be unable to perform their obligations under the contract in some essential respect. The renunciation may occur before or at the time of performance.

An Oklahoma TOD deed must substantially comply with the statutory format to effectively transfer title to the beneficiary upon the owner's death. The TOD deed must be signed by the property owner of record, notarized, and recorded in the county land records.

Renunciation of inheritance means that an heir renounces his/her right to inherit any of legacy when the heir does not want to inherit the legacy of the ancestor (a deceased person).