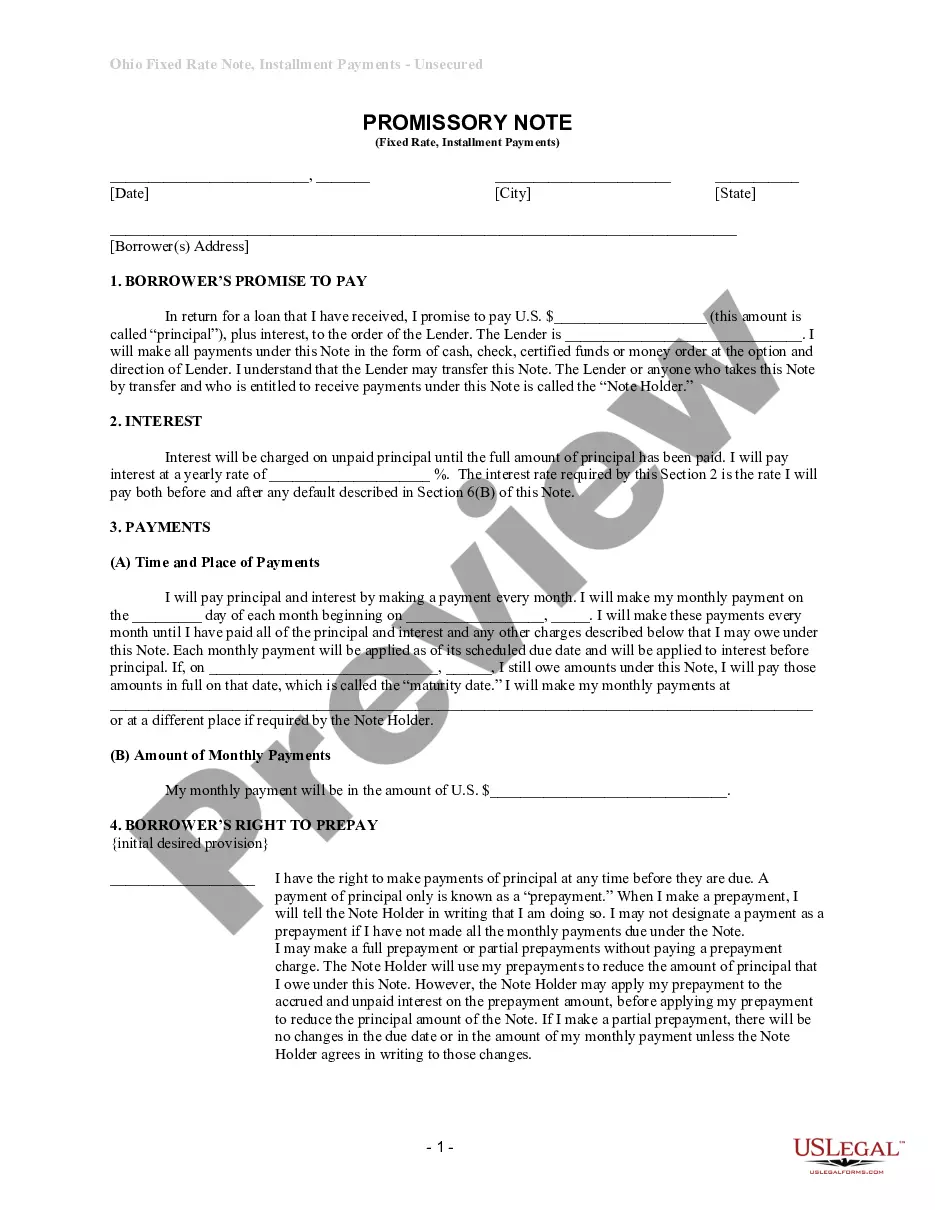

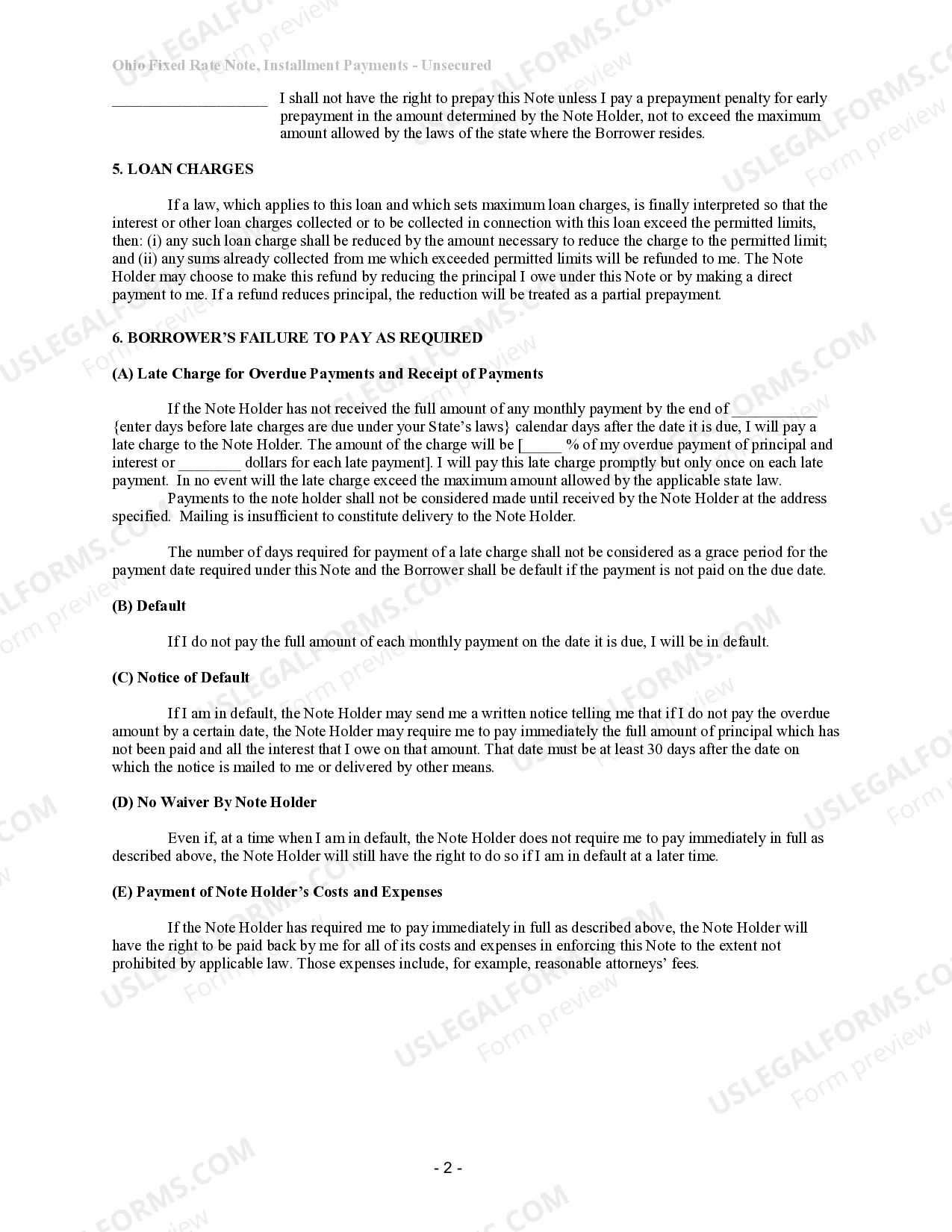

This is a Promissory Note for your state. The promissory note is unsecured, with a fixed interest rate, and contains a provision for installment payments.

Toledo Ohio Unsecured Installment Payment Promissory Note for Fixed Rate

Description

How to fill out Ohio Unsecured Installment Payment Promissory Note For Fixed Rate?

If you are looking for an authentic form template, it’s incredibly challenging to find a superior platform compared to the US Legal Forms website – arguably the largest online repositories.

With this collection, you can obtain thousands of document samples for business and personal needs categorized by types and states or keywords.

With our enhanced search functionality, locating the latest Toledo Ohio Unsecured Installment Payment Promissory Note for Fixed Rate is as simple as 1-2-3.

Complete the payment process. Use your credit card or PayPal account to finalize the registration.

Obtain the template. Specify the format and download it to your device.

- Additionally, the accuracy of each document is confirmed by a team of qualified attorneys who consistently review the templates on our site and update them in line with the latest state and county regulations.

- If you are already familiar with our site and possess a registered account, all you need to obtain the Toledo Ohio Unsecured Installment Payment Promissory Note for Fixed Rate is to Log In to your user profile and click the Download button.

- If you are using US Legal Forms for the first time, simply adhere to the guidelines below.

- Ensure you have located the sample you desire. Review its description and utilize the Preview feature (if available) to examine its content. If it doesn’t meet your requirements, use the Search option at the top of the page to find the suitable document.

- Confirm your choice. Click the Buy now button. Afterwards, select your preferred pricing plan and provide your details to register for an account.

Form popularity

FAQ

Examples of promissory notes include personal loans, car loans, and business loans, each varying in structure and terms. A Toledo Ohio Unsecured Installment Payment Promissory Note for Fixed Rate would specifically detail the fixed interest rate and installment payments required. You can find tailored examples online that suit different financial situations. Utilizing uslegalforms provides a variety of templates to guide you in drafting your specific note.

No, promissory notes in Ohio do not have to be notarized to be effective. A Toledo Ohio Unsecured Installment Payment Promissory Note for Fixed Rate is valid based on the agreement between the parties involved. However, notarization may offer additional reassurance and proof in legal situations. If you're drafting a promissory note, consider using platforms like uslegalforms to ensure completeness and compliance.

Typically, promissory notes are not filed with any public office, as they are private agreements between parties. However, a Toledo Ohio Unsecured Installment Payment Promissory Note for Fixed Rate may be recorded with the county recorder if it is secured by property. This filing can help protect the lender’s interests. Keeping a copy of the note in a secure location is also essential for personal records.

In Ohio, a promissory note does not need to be notarized to be considered valid. A Toledo Ohio Unsecured Installment Payment Promissory Note for Fixed Rate can stand independently without notarization, provided it meets legal requirements. However, notarization may be beneficial in disputes or when attempting to enforce the note, as it proves authenticity. Always consider your situation and consult a legal advisor if you're uncertain.

Yes, a Toledo Ohio Unsecured Installment Payment Promissory Note for Fixed Rate can be legally binding even if it is not notarized. The essential elements of a promissory note include clear terms and the signatures of both parties. Notarization adds an extra layer of validation, but it is not required for legality. Understanding these aspects is crucial before engaging in any financial arrangements.

To obtain a promissory note, you can use online platforms like USLegalForms. They offer templates specifically designed for a Toledo Ohio Unsecured Installment Payment Promissory Note for Fixed Rate. This makes it easy for you to customize the note to fit your specific needs. Simply select a template, fill in the details, and you will have a legally sound document ready to use.

Yes, you can create your own promissory note. However, you should ensure that it meets the legal requirements for a Toledo Ohio Unsecured Installment Payment Promissory Note for Fixed Rate. Using a reliable template or service like USLegalForms can simplify the process and ensure you include all necessary details. This approach helps protect your interests and provides clarity for both parties involved.

To obtain a Toledo Ohio Unsecured Installment Payment Promissory Note for Fixed Rate, you can start by visiting a reliable online legal document platform, such as USLegalForms. This platform offers customizable templates that allow you to create a promissory note tailored to your specific needs. After selecting the appropriate template, simply fill in the required information and ensure all parties sign the document. Following these steps will provide you with a legally binding promissory note that secures your payment agreement.

You can record a Toledo Ohio Unsecured Installment Payment Promissory Note for Fixed Rate at your local county recorder's office. This recording makes the note part of the public record, which can provide legal protection for the lender. Ensure you have all required documents and fees ready when you visit the office. For those who prefer a streamlined approach, platforms like US Legal Forms offer resources to help you prepare and record your notes efficiently.

To report a Toledo Ohio Unsecured Installment Payment Promissory Note for Fixed Rate on your taxes, you will need to report any interest income you receive from the note. Typically, this interest income gets reported on Schedule B of your personal tax return. It's also important to keep proper documentation of the payment schedule and any agreements related to the promissory note. Consider consulting a tax professional to ensure you follow the correct reporting procedures.