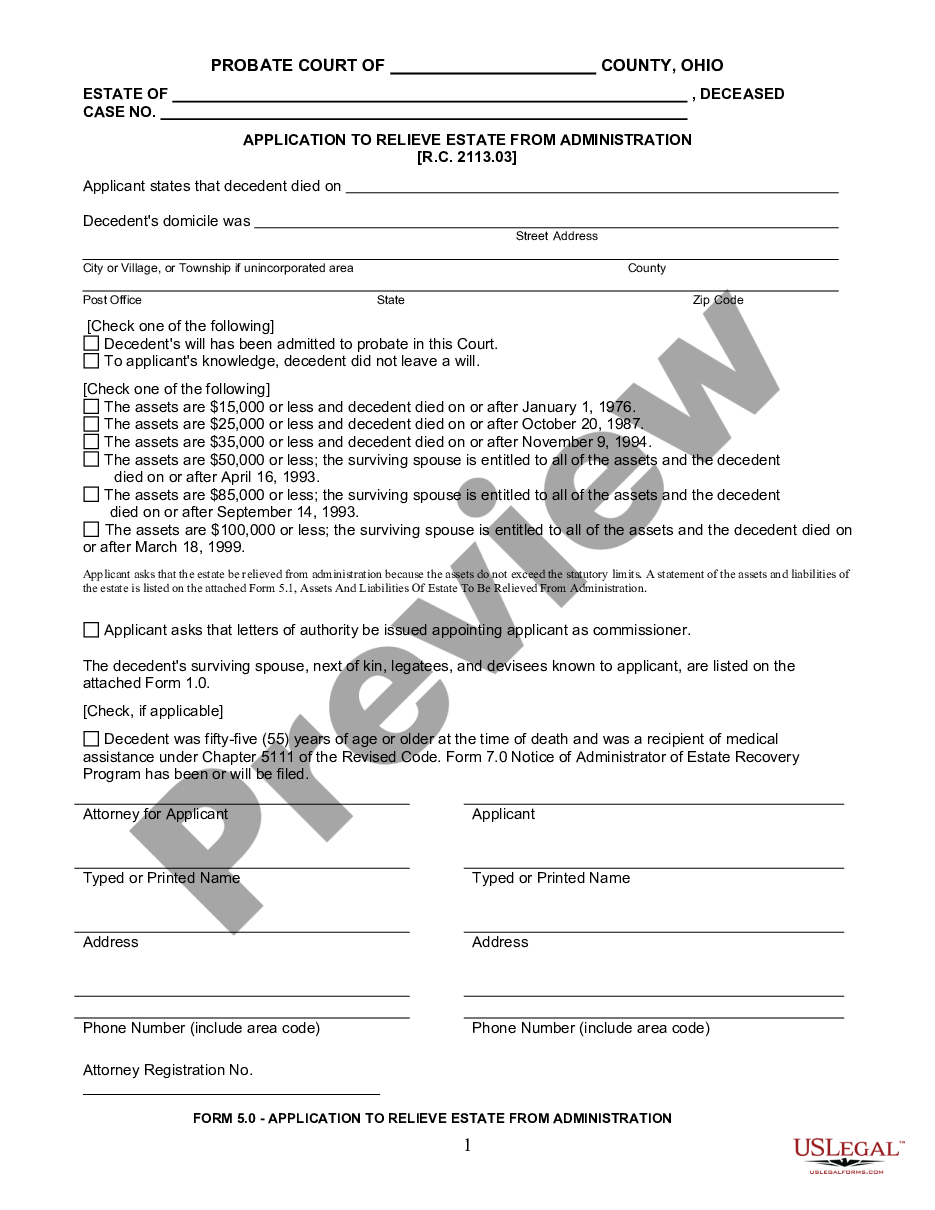

Akron Ohio Small Estate Affidavit for Estates Not More Than $35,00, or $100,000 and Inherited Fully by Spouse

Description

How to fill out Ohio Small Estate Affidavit For Estates Not More Than $35,00, Or $100,000 And Inherited Fully By Spouse?

Finding authenticated templates that align with your regional regulations can be challenging unless you utilize the US Legal Forms library.

This online repository contains over 85,000 legal forms for various personal and professional requirements, along with any practical situations.

All documents are meticulously sorted based on their usage area and jurisdiction regions, allowing you to swiftly and easily locate the Akron Ohio Small Estate Affidavit for Estates Not Exceeding $35,000 or $100,000, fully inherited by a spouse.

Pay using your credit card information or your PayPal account for the service. After that, save the Akron Ohio Small Estate Affidavit for Estates Not Exceeding $35,000 or $100,000 and fully inherited by a spouse on your device to complete it, and access it anytime through the My documents menu in your profile.

- Familiarize yourself with the Preview mode and document description.

- Ensure that you've selected the correct one that fulfills your needs and aligns with your local legal prerequisites.

- Search for another template, if necessary.

- If you discover any discrepancies, utilize the Search tab above to find the correct one. If it meets your needs, proceed to the next step.

- Purchase the document.

Form popularity

FAQ

In Ohio, there is no specific minimum value for an estate to enter probate; however, certain factors influence this process. If the gross value of the estate exceeds $35,000 and it is not inherited fully by a spouse, or if it involves real estate, then probate proceedings may be necessary. Understanding these thresholds can help you determine whether to use the Akron Ohio Small Estate Affidavit for Estates Not More Than $35,000, or $100,000 and Inherited Fully by Spouse, to avoid a lengthy probate process.

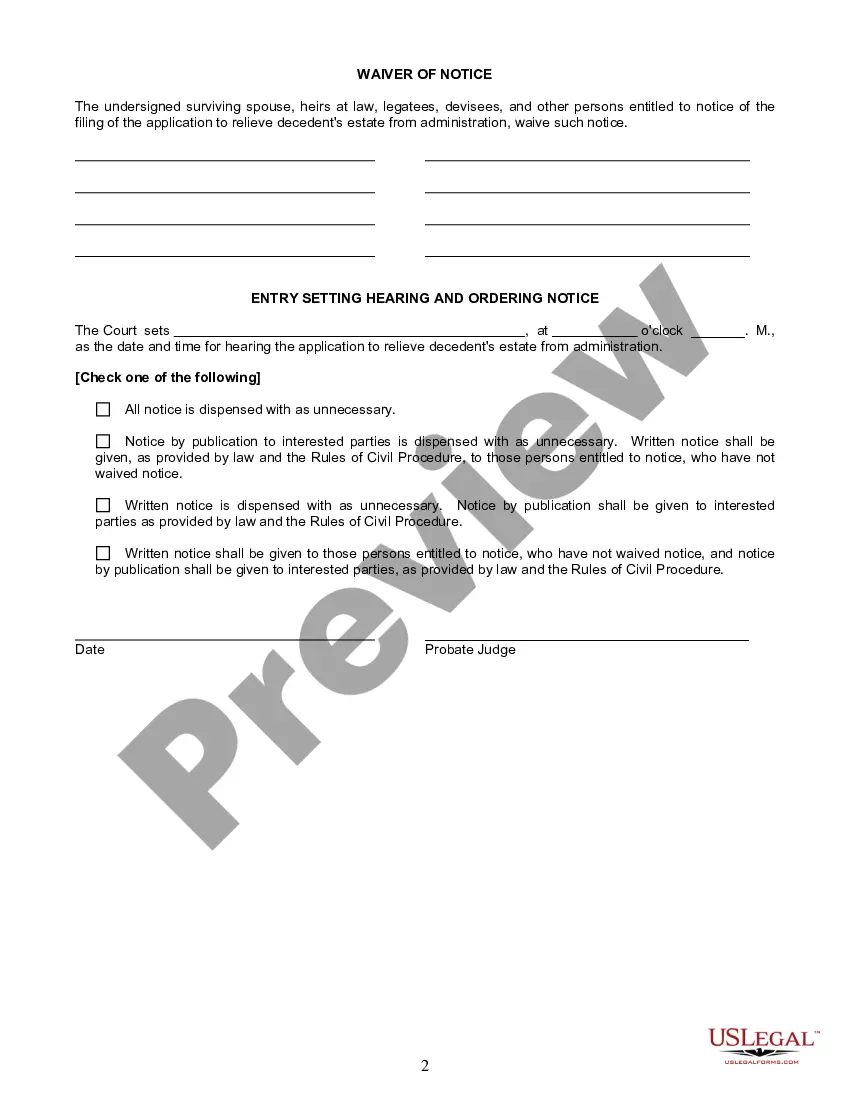

Obtaining a small estate affidavit in Ohio involves a few straightforward steps. You must first complete the necessary forms, which can be easily accessed through various legal resources or platforms like USLegalForms. After gathering the required documents, including proof of the estate's value, you will submit the affidavit to the probate court within your county, facilitating a smoother asset transfer process using the Akron Ohio Small Estate Affidavit for Estates Not More Than $35,000, or $100,000 and Inherited Fully by Spouse.

In Ohio, the threshold for a small estate affidavit is currently set at $35,000 for estates not inherited fully by a spouse and $100,000 for estates inherited entirely by a spouse. This means that if the total value of the estate, excluding certain expenses, falls within these limits, you may qualify to use an Akron Ohio Small Estate Affidavit for Estates Not More Than $35,000, or $100,000 and Inherited Fully by Spouse. Utilizing this affidavit streamlines the process of transferring assets without undergoing probate, making it a practical choice for families.

The limit for a small estate affidavit in Ohio is $35,000, except when the estate is fully inherited by a spouse, in which case the limit is $100,000. This means that if your loved one's estate meets these criteria, you can efficiently access the assets without going through a lengthy probate process. Consider using resources like USLegalForms to guide you through filing a small estate affidavit.

In Ohio, a small estate is defined as one with a total value of not more than $35,000 for individuals who do not have a surviving spouse. If the estate is inherited fully by a spouse, the threshold increases to $100,000. This definition allows families to expedite the transfer of assets, especially using the small estate affidavit.

The family allowance in Ohio allows a surviving spouse and minor children to receive financial support during the probate process. This allowance is determined by the court and is designed to assist with living expenses while the estate is settled. Utilizing the Akron Ohio Small Estate Affidavit for Estates Not More Than $35,000 or $100,000 can simplify the process of accessing funds for the family.

Typically, a car that is solely owned by the deceased may need to go through probate in Ohio. However, if the estate qualifies for a small estate affidavit, and if the vehicle is not valued above the limits, you can bypass probate. Using an Akron Ohio Small Estate Affidavit for Estates Not More Than $35,000 or $100,000, Inherited Fully by Spouse, can expedite this process.

In Ohio, estates valued above $35,000 generally require probate. However, if the estate is fully inherited by a spouse and qualifies as a small estate, you may use the small estate affidavit process instead. This option eases the burden for families and streamlines the transfer of assets without lengthy court procedures.

To obtain a small estate affidavit in Ohio, you will need to complete the necessary forms, which are available through the local probate court or online platforms like USLegalForms. After filling out the required documents, you must file them with the probate court in your jurisdiction. This process simplifies the transfer of assets for estates not exceeding $35,000 or $100,000, especially those inherited fully by a spouse.

In Ohio, an estate must be worth more than $35,000 to typically require probate. For estates under this value, individuals can often use the Akron Ohio Small Estate Affidavit for Estates Not More Than $35,000 or $100,000 and Inherited Fully by Spouse for a more straightforward resolution. Understanding the valuation of your estate is crucial, as it directly influences the pathway of asset distribution.