This Closing Statement is for a real estate transaction where the transaction is a cash sale or provides for owner financing. This settlement statement is verified and signed by both the seller and the buyer.

Dayton Ohio Closing Statement

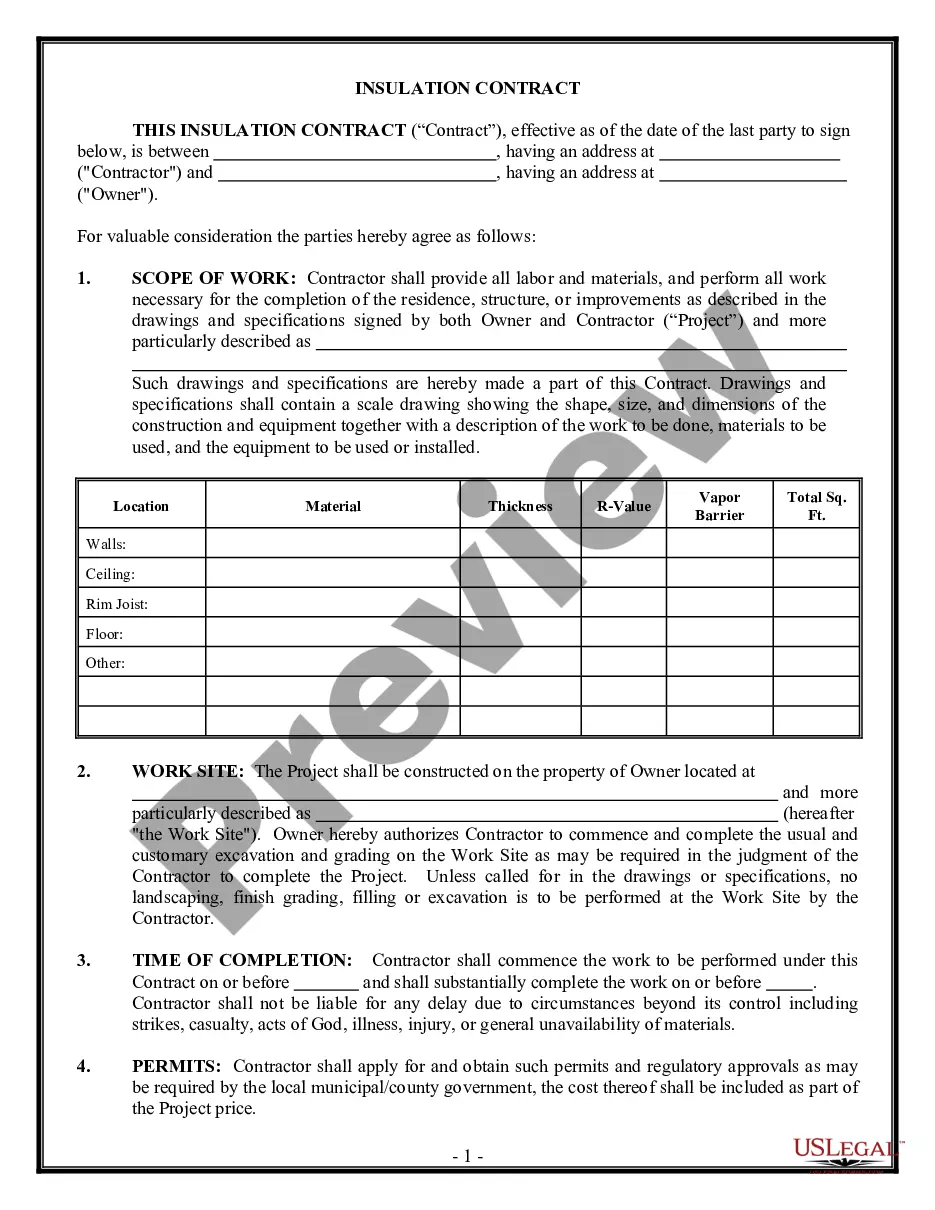

Description

How to fill out Ohio Closing Statement?

Utilize the US Legal Forms and gain instant access to any form you require.

Our user-friendly platform with numerous templates enables you to discover and obtain nearly any document sample you need.

You can download, complete, and sign the Dayton Ohio Closing Statement in just a few minutes instead of searching the internet for hours trying to locate a suitable template.

Using our collection is an excellent tactic to enhance the security of your document filing.

The Download button will be activated on all samples you view.

Furthermore, you can access all previously saved files in the My documents section.

- Our skilled legal experts regularly review all the documents to ensure that the forms are suitable for a specific state and compliant with current laws and regulations.

- How can you acquire the Dayton Ohio Closing Statement.

- If you have an account, simply Log In to your profile.

Form popularity

FAQ

Filing school taxes in Ohio requires you to gather all relevant income documents, including your Dayton Ohio Closing Statement if applicable. Once you have all your information, you can complete the necessary forms online or with a tax professional. Staying compliant is crucial, so consider consulting resources that provide guidance on local tax regulations.

To cancel a vendor license in Ohio, you must file a cancellation request with your local government. Ensure that you have settled any outstanding business activities or permits related to your license. By organizing your financial documents, including your Dayton Ohio Closing Statement, you can find the process more manageable.

Canceling your vendor's license in Ohio involves submitting a cancellation request to the appropriate local authority. Ensure that all account details are up to date, and any associated duties are fulfilled. Utilizing services like uslegalforms can simplify the necessary documentation, making the process smoother while you prepare your Dayton Ohio Closing Statement.

To cancel your sales tax account in Ohio, you need to submit a request through the Ohio Department of Taxation. Make sure to report any outstanding liabilities before proceeding with the cancellation. Having your Dayton Ohio Closing Statement on hand can help ensure that your records are accurate when you finalize this process.

Yes, if you earn income in a city that imposes a city income tax, you must file the Ohio CCA city tax form. This requirement generally applies to both residents and non-residents working within these jurisdictions. Preparing your financial documents, especially your Dayton Ohio Closing Statement, will facilitate an easier filing process.

To cancel your Ohio CAT (Commercial Activity Tax) account, you need to complete the appropriate forms and submit them to the Department of Taxation. Ensure all tax liabilities are settled before cancellation to avoid complications. Keeping accurate records, including your Dayton Ohio Closing Statement, can assist you in this process.

Yes, TurboTax offers features for filing Ohio city taxes. If you’re handling your taxes for the first time, TurboTax provides a user-friendly interface to guide you through the process. It's helpful to have your Dayton Ohio Closing Statement handy, as it contains crucial financial details that can affect your city tax submission.

Yes, an Ohio vendor's license does expire. Typically, these licenses are valid for a two-year period. It’s essential to keep track of your expiration date to ensure compliance with state regulations. When renewing your license, you may also need to review any associated financial documents, including your Dayton Ohio Closing Statement.

To format a closing statement, start with essential information, such as the date of the transaction and contact details for both parties. Then, categorize all financial items into sections for clarity, using headings and subheadings as necessary. For your Dayton Ohio Closing Statement, ensure all figures are presented accurately and based on local regulations. Effective formatting not only enhances understanding but also makes the document more professional.

Formatting a closing statement involves clear labeling and an orderly presentation of all fees and charges. Begin with the transaction details, then list all costs and credits in a sequence that flows logically. When preparing a Dayton Ohio Closing Statement, it’s essential to present the information in a way that is easy to read and understand. Good formatting contributes to a smoother closing experience and helps in preventing disputes.