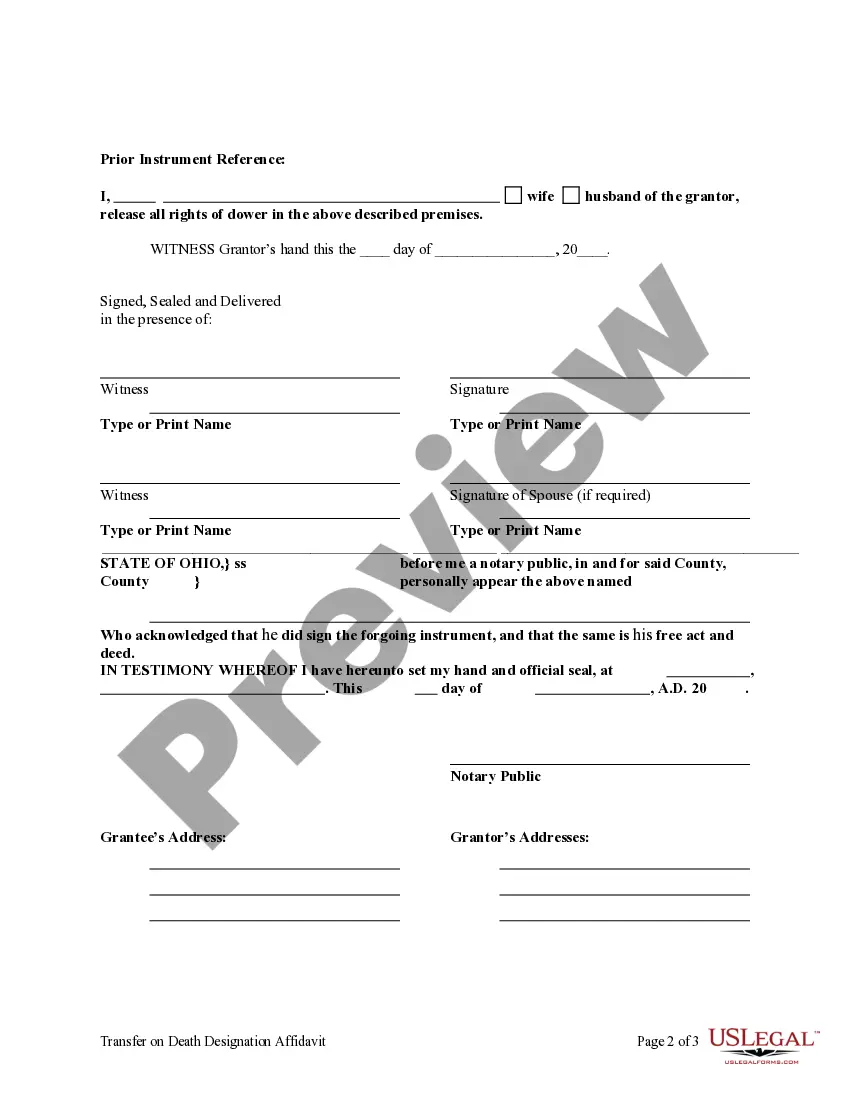

Transfer on Death Designation Affidavit from Individual to Individual: This affidavit is used to transfer the title of a parcel of land, attaching any existing covenants, upon the death of the Affiant/Owner to the Beneficiary. It should be signed in front of a Notary Public. The form does NOT include provision for an contingent beneficiary in the event the designated beneficiary predeceases the affiant/owner. The designation of the beneficiary in an affidavit of transfer on death may be revoked or changed at any time, without the consent of that designated transfer on death beneficiary, by the owner of the interest by executing in accordance with Chapter 5301. of the Ohio Revised Code and recording a transfer on death designation affidavit conveying the owner's entire, separate interest in the real property to one or more persons, including the owner, with or without the designation of another transfer on death beneficiary.

Dayton Ohio Transfer on Death Designation Affidavit - TOD from Individual to Individual without Contingent Beneficiary

Description

How to fill out Ohio Transfer On Death Designation Affidavit - TOD From Individual To Individual Without Contingent Beneficiary?

Utilize the US Legal Forms and gain instant access to any form template you require.

Our user-friendly website with a vast selection of templates makes it effortless to locate and acquire nearly any document sample you need.

You can download, fill out, and certify the Dayton Ohio Transfer on Death Designation Affidavit - TOD from Individual to Individual without Contingent Beneficiary in just a few minutes instead of spending hours browsing the Internet for a suitable template.

Leveraging our collection is an excellent way to enhance the security of your document submission.

- Our experienced attorneys routinely examine all documents to ensure that the forms are suitable for a specific area and adhere to current laws and regulations.

- How do you obtain the Dayton Ohio Transfer on Death Designation Affidavit - TOD from Individual to Individual without Contingent Beneficiary.

- If you have a subscription, simply Log In to your account. The Download option will be activated for all the samples you review. Additionally, you can access all previously saved files in the My documents section.

Form popularity

FAQ

Generally, Transfer on Death accounts do not accommodate contingent beneficiaries. This limitation means that careful planning is essential when determining who will inherit your assets. When establishing your Dayton Ohio Transfer on Death Designation Affidavit - TOD from Individual to Individual without Contingent Beneficiary, consider how your choices reflect your overall estate planning strategy.

You can obtain Transfer on Death forms from various sources, including local state offices or legal document websites. Reputable platforms, like uslegalforms, provide easy access to the necessary Dayton Ohio Transfer on Death Designation Affidavit - TOD from Individual to Individual without Contingent Beneficiary forms. Ensure you select a reliable resource to avoid mistakes in your documentation.

Yes, one significant benefit of Transfer on Death accounts is that they allow your assets to bypass the probate process. This means your heirs can access the assets relatively quickly after your passing, as long as all the required conditions are met. By utilizing a Dayton Ohio Transfer on Death Designation Affidavit - TOD from Individual to Individual without Contingent Beneficiary, you can streamline the estate transition for your loved ones.

While it is not legally required to hire a lawyer to complete a transfer on death deed, it is often advisable, especially if you have questions. A legal professional can help ensure that your Dayton Ohio Transfer on Death Designation Affidavit - TOD from Individual to Individual without Contingent Beneficiary meets all necessary requirements, thus reducing the risk of errors that could complicate asset distribution later.

Typically, Transfer on Death accounts do not allow for contingent beneficiaries, which makes them unique in estate planning. This exclusion means that if your primary beneficiary is unable to inherit, the assets will not transfer as you might intend. Understanding this aspect of the Dayton Ohio Transfer on Death Designation Affidavit - TOD from Individual to Individual without Contingent Beneficiary is crucial for effective estate management.

Transfer on Death (TOD) is a specific type of beneficiary designation that allows assets to transfer upon the owner's death without going through probate. While both concepts involve naming heirs, they differ in how assets are managed prior to the owner's passing. With a Dayton Ohio Transfer on Death Designation Affidavit - TOD from Individual to Individual without Contingent Beneficiary, you ensure that your assets are distributed according to your wishes without additional probate hassles.

One key disadvantage of Transfer on Death accounts is the lack of immediate access to funds for beneficiaries in certain circumstances, like financial emergencies. Additionally, TOD accounts may not suit your estate plan if you have multiple assets or complex wishes for asset distribution. While the Dayton Ohio Transfer on Death Designation Affidavit - TOD from Individual to Individual without Contingent Beneficiary simplifies certain processes, it also has limitations that users must consider.

Contingent beneficiaries are secondary heirs who inherit only if the primary beneficiary cannot. This means, in cases where the primary beneficiary passes away before the asset owner, the contingent beneficiary steps in. In the context of a Dayton Ohio Transfer on Death Designation Affidavit - TOD from Individual to Individual without Contingent Beneficiary, it is essential that the owner understands how their decisions impact asset distribution and whether a contingent beneficiary is suitable.

Yes, you can add someone to your car title in Ohio, which allows the individual to share ownership of the vehicle. This inclusion can be beneficial for estate planning, especially when combined with a Transfer on Death Designation Affidavit - TOD from Individual to Individual without Contingent Beneficiary. To ensure the process is handled correctly, consult your local DMV or utilize resources like uslegalforms for additional guidance.

To obtain a duplicate car title for a deceased individual in Ohio, you need to provide specific documentation, including the death certificate and proof of your relationship to the deceased. The title must typically be transferred using a Transfer on Death Designation Affidavit - TOD from Individual to Individual without Contingent Beneficiary if applicable. For tailored assistance and detailed steps, consider using the uslegalforms platform to guide you through the process smoothly.