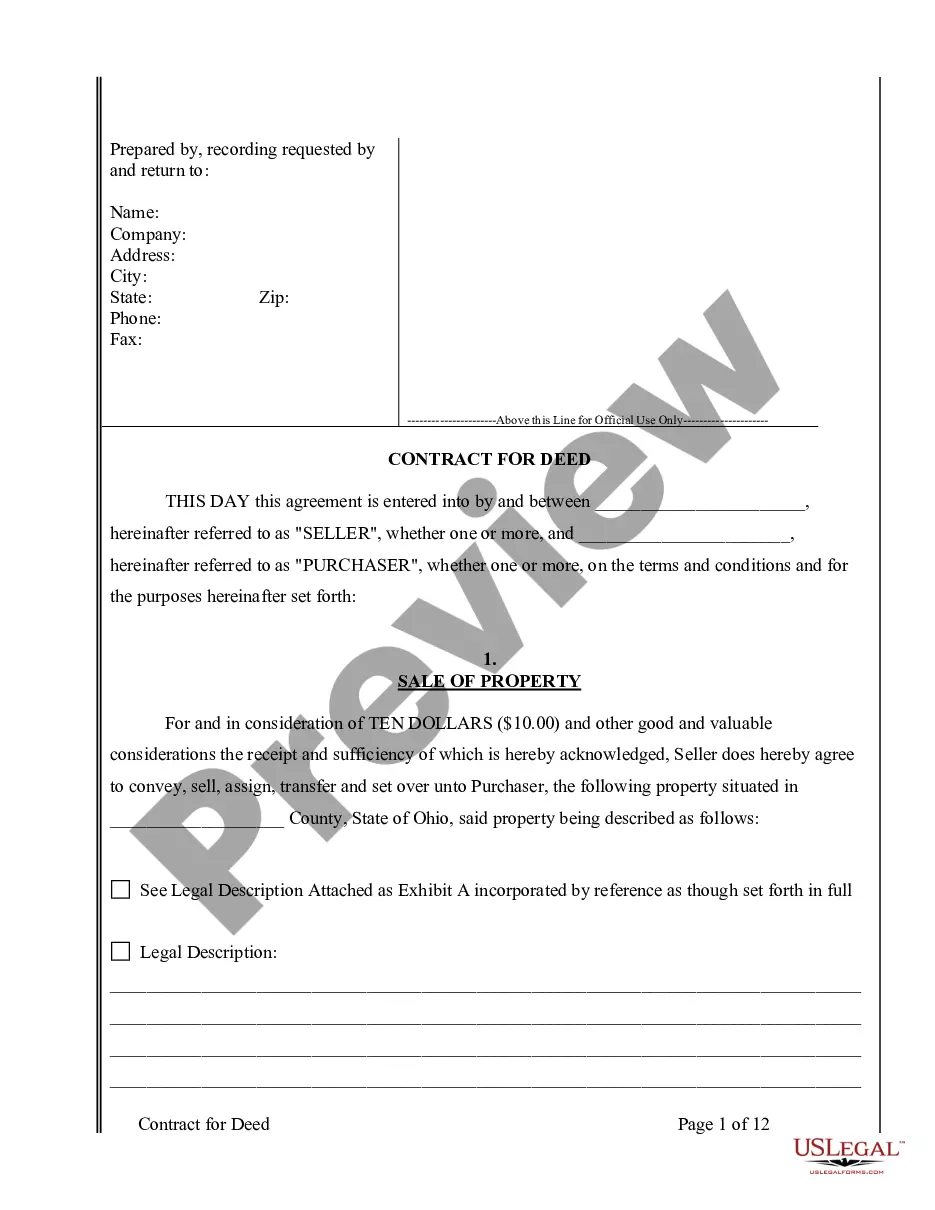

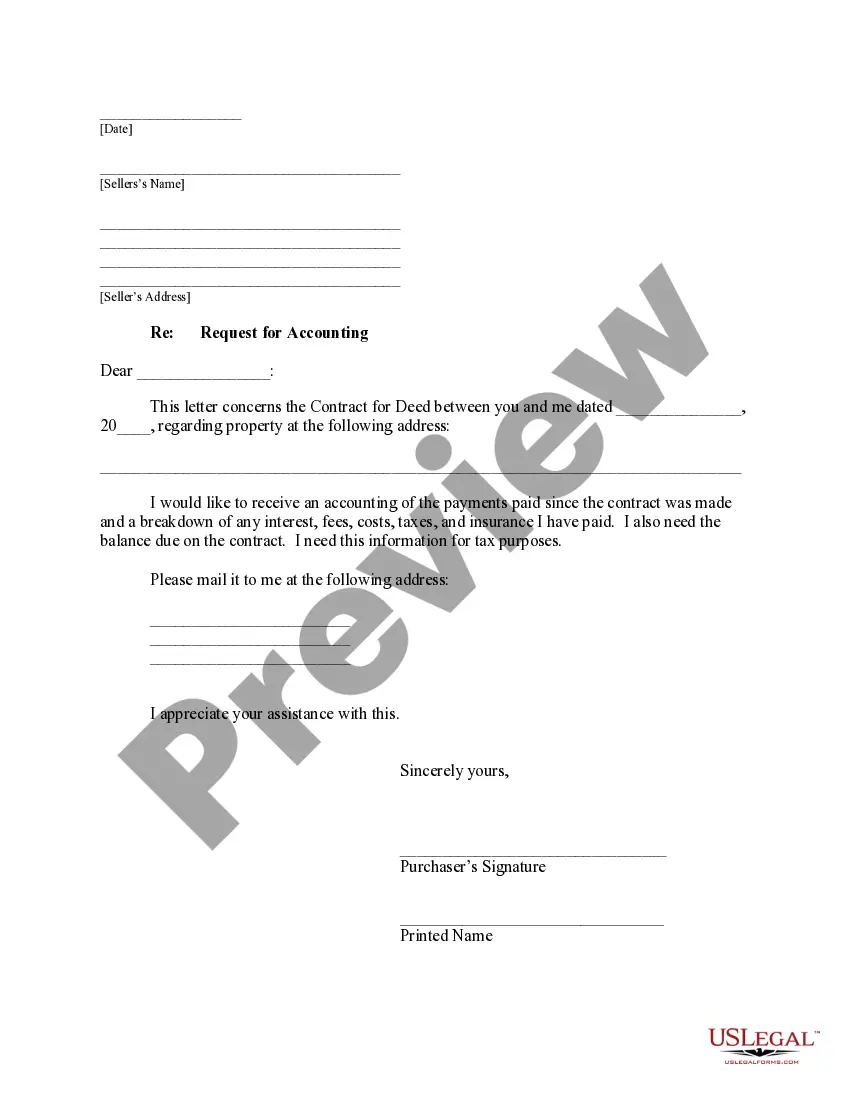

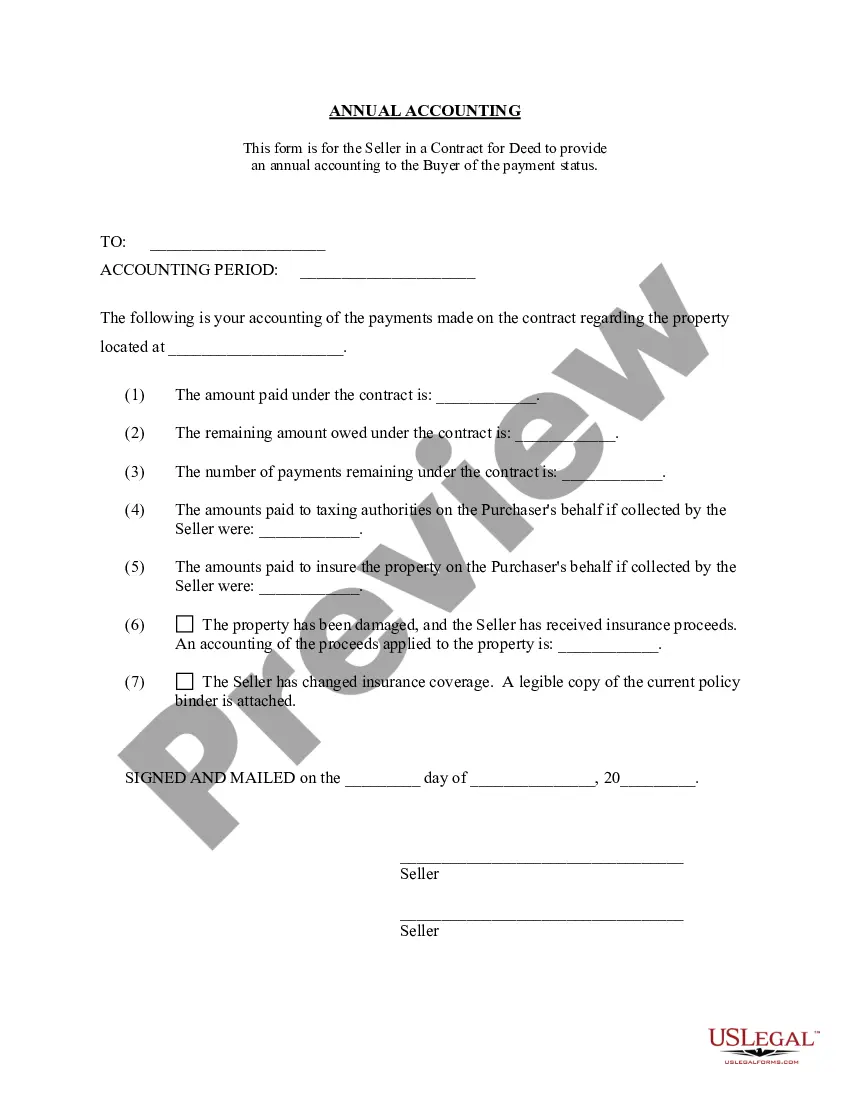

This is a Seller's Annual Accounting Statement notifying the Purchaser of the number and amount of payments received toward contract for deed's purchase price and interest. This document is provided annually by Seller to Purchaser.

Columbus Ohio Contract for Deed Seller's Annual Accounting Statement

Description

How to fill out Ohio Contract For Deed Seller's Annual Accounting Statement?

Regardless of social or occupational standing, completing legal documents is a regrettable requirement in the modern professional landscape.

Frequently, it’s nearly unfeasible for an individual without a legal background to create such documents from scratch due to the intricate terminology and legal subtleties involved.

This is where US Legal Forms proves to be beneficial.

Ensure that the form you have located is tailored to your region, as regulations from one state or area may not apply to another.

Review the document and consider a brief overview (if available) of scenarios for which the document can be utilized.

- Our platform provides an extensive collection of over 85,000 ready-to-use, state-specific forms suitable for nearly any legal circumstance.

- US Legal Forms also acts as a valuable resource for associates or legal advisors looking to save time through our DIY forms.

- Whether you need the Columbus Ohio Contract for Deed Seller's Annual Accounting Statement or any other relevant paperwork for your region, US Legal Forms has everything readily available.

- Here’s how to quickly acquire the Columbus Ohio Contract for Deed Seller's Annual Accounting Statement using our reliable service.

- If you are already a registered user, simply Log In to your account to obtain the required form.

- However, if you are new to our library, ensure you follow these steps prior to acquiring the Columbus Ohio Contract for Deed Seller's Annual Accounting Statement.

Form popularity

FAQ

In a land contract, the seller agrees to finance the property for the buyer in exchange for the buyer meeting the terms agreed upon in the land contract. In a traditional land contract, the seller keeps the legal title to the property until the land contract is fully paid off.

(b) The contract must be signed by both parties either as one document or as identical documents each signed by one party which are then exchanged. Letters offering to sell land and a confirmatory response will generally not be enough.

While it is generally wise to record your deed, Ohio law does not require a deed to be recorded for title to pass from you (the grantor) to a grantee. To transfer title, you must deliver the executed and acknowledged deed to the grantee.

A contract for deed is an alternative financing agreement in which the seller finances the sale of the property rather than a lender. No Mortgage Registration Tax (MRT) is due on the recording of a contract for deed because a contract for deed is exempted under the MRT law.

Does a Land Contract Have to be Recorded in Michigan? A land contract is not legally required to be recorded in Michigan. However, both the buyer and the seller may wish to record the contract to protect their interests in the property.

When buying or selling a home, you may wonder ?does a real estate purchase agreement need to be notarized?. The answer is that real estate purchase agreements do not need to be notarized or witnessed in order to be legally binding.

Where to Record? (WI Stat § 706.05) ? Deeds must be filed with the County Register of Deeds in the jurisdiction of the property being conveyed, along with a Real Estate Transfer Return (RETR).

A seller can also regain legal possession of the real estate property through a forfeiture process or sometimes a foreclosure. Does a land contract have to be recorded? Yes, a land contract (Ohio-based and in other states) must be recorded shortly after the agreement is executed.

A land contract should be recorded in the county real estate records. If the land contract is recorded, then the buyer has priority over later seller debts. However, some land contracts don't get recorded. If the contract isn't recorded, the seller could easily put a new mortgage on the property.

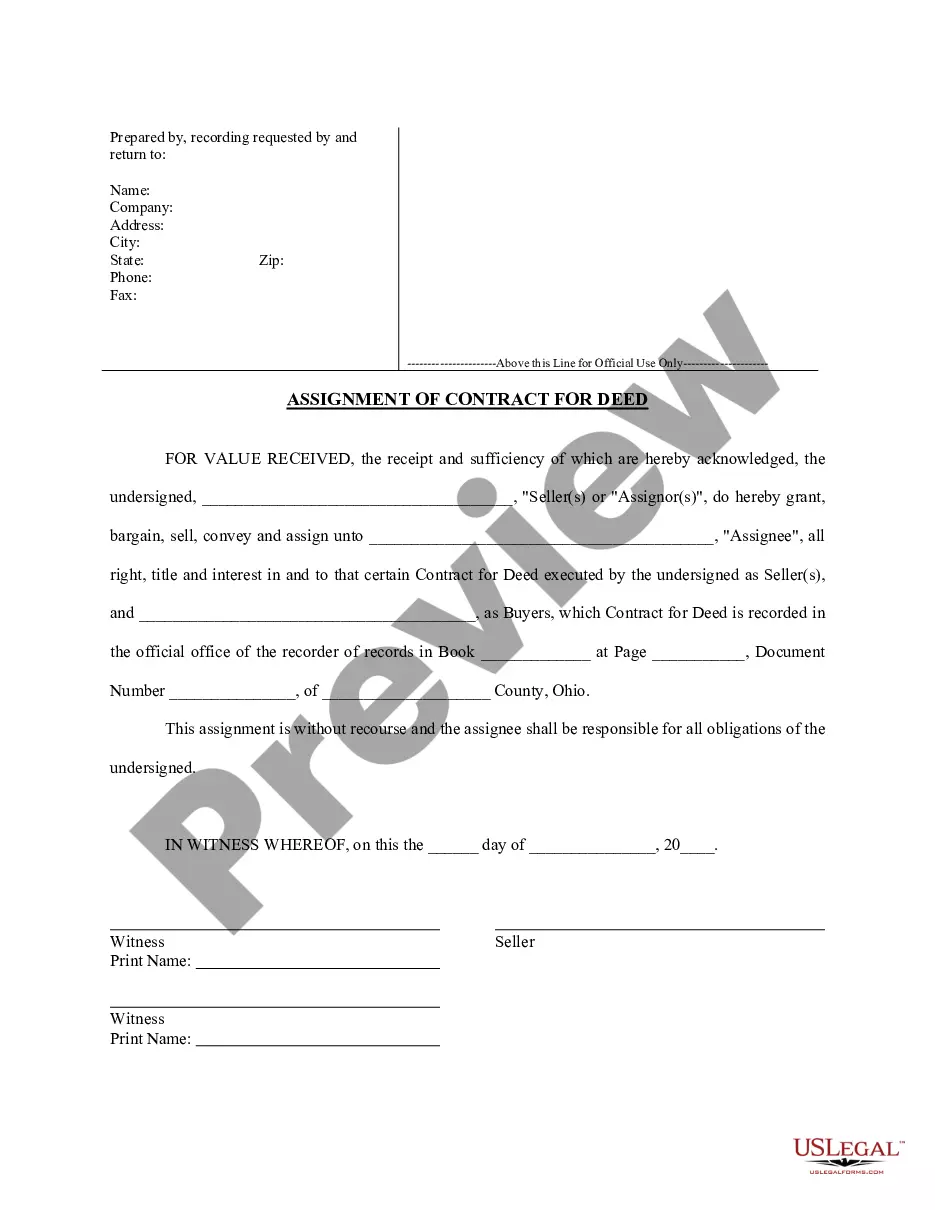

Except in counties where deeds or other instruments are required as provided in this section, a land contract that is recorded in the office of the county recorder may be cancelled, partially released by the vendor and vendee, or assigned by either of them by writing the cancellation, partial release, or assignment on