Suffolk New York Last Will and Testament for a Married Person with No Children

Description

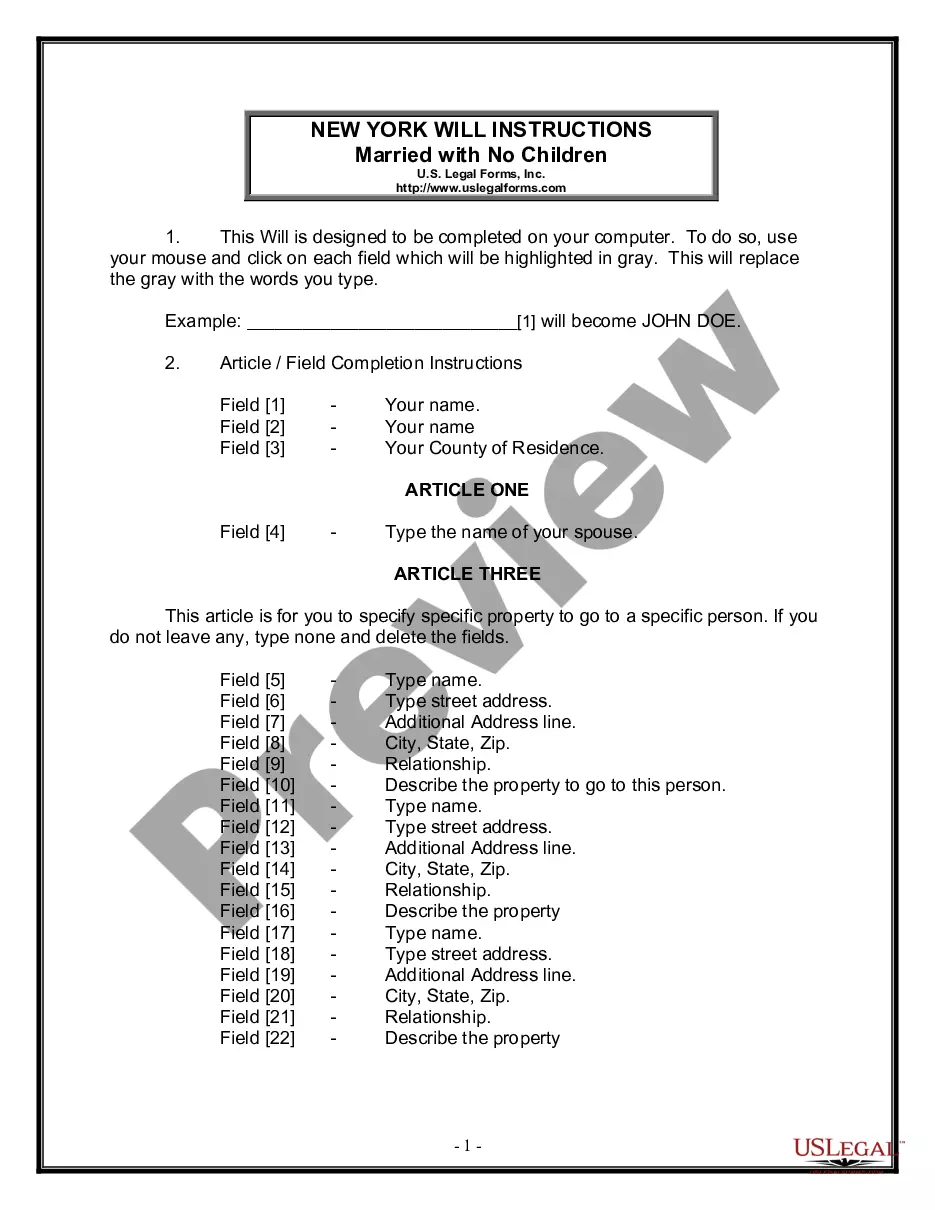

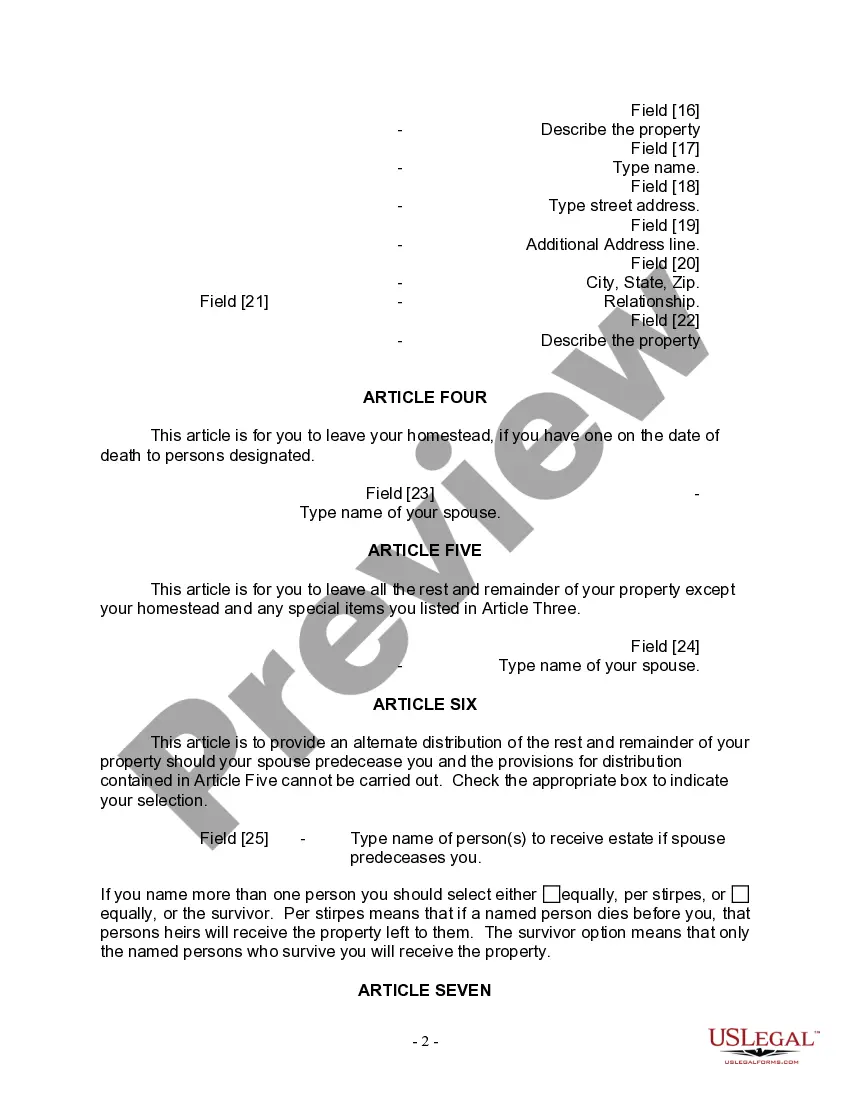

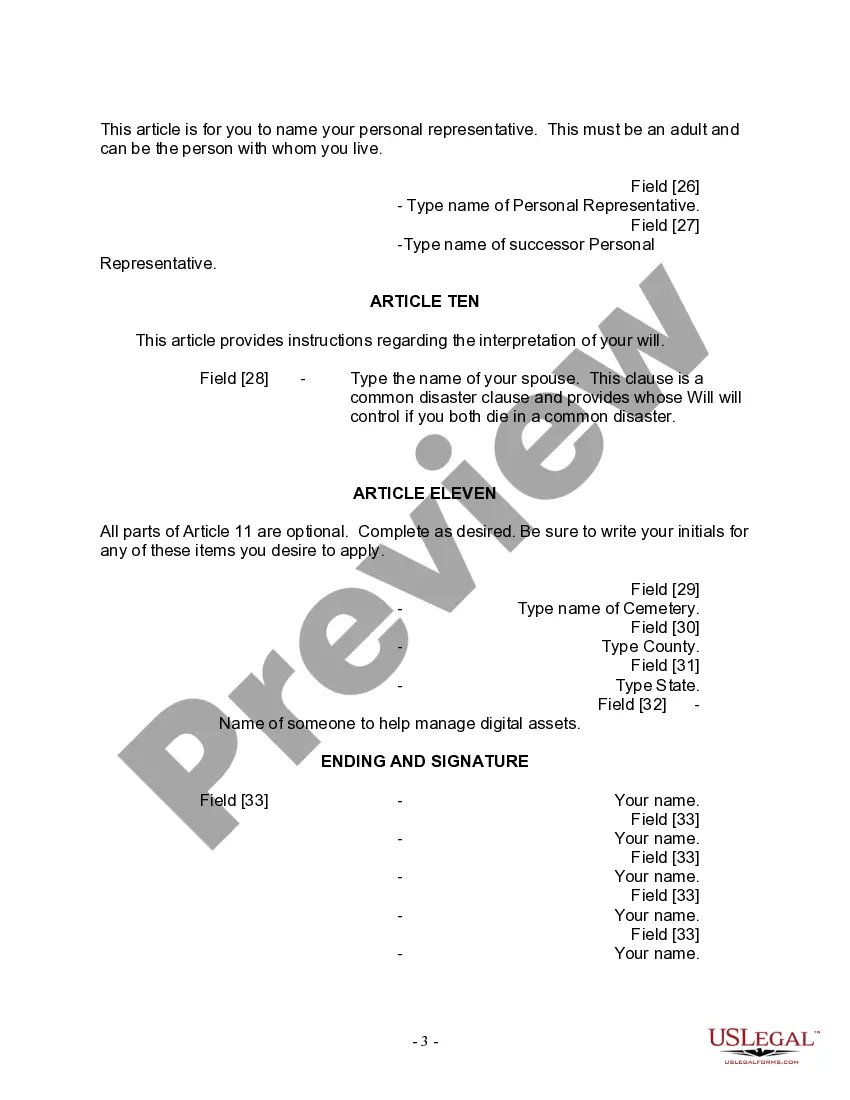

How to fill out New York Last Will And Testament For A Married Person With No Children?

Regardless of social or occupational standing, completing law-related paperwork is a regrettable requirement in the contemporary world.

Frequently, it’s nearly impossible for an individual lacking legal expertise to create this type of documents from the beginning, primarily due to the intricate terminology and legal nuances they encompass.

This is where US Legal Forms provides assistance.

Confirm that the form you have located is appropriate for your area because the laws of one state or county do not apply to another.

Examine the document and read a short summary (if available) of the scenarios for which the document can be utilized.

- Our platform presents a vast array of over 85,000 ready-to-use state-specific documents suitable for almost every legal circumstance.

- US Legal Forms also acts as a valuable resource for associates or legal advisors aiming to save time by using our DIY forms.

- Whether you require the Suffolk New York Legal Last Will and Testament Form for a Married Individual without Children or any other documentation valid in your state or county, US Legal Forms has everything available.

- Here’s how to swiftly obtain the Suffolk New York Legal Last Will and Testament Form for a Married Individual without Children using our reliable platform.

- If you are already a current customer, you can proceed to Log In to your account to access the necessary form.

- However, if you are not acquainted with our platform, make sure to take these steps before downloading the Suffolk New York Legal Last Will and Testament Form for a Married Individual without Children.

Form popularity

FAQ

Wills for married couples work by outlining how assets should be distributed upon death. A Suffolk New York Last Will and Testament ensures both spouses know their rights and entitlements. Each spouse can designate the other as the primary beneficiary, creating a straightforward transfer of assets. This clarity provides peace of mind, knowing that your loved one’s needs are met and secured.

A married couple does not necessarily need two separate wills, but it can simplify matters. One Suffolk New York Last Will and Testament for each spouse allows for clear articulation of each individual’s wishes. This method can reduce confusion and ensures that both parties are protected. Having separate documents often addresses specific preferences better.

For a married couple with no children, a joint will or individual wills that mirror each other can often be the best choice. A Suffolk New York Last Will and Testament allows couples to outline their wishes clearly. It provides an efficient way to pass assets to the surviving spouse while minimizing potential legal issues. This approach offers clarity and security in uncertain times.

In New York, a spouse may automatically inherit everything, particularly if there are no children involved. A properly drafted Suffolk New York Last Will and Testament reinforces this entitlement. However, if there are children from previous relationships, the inheritance rules become more complex. A well-prepared will helps clearly define asset distribution and ensures your spouse is secure.

In New York, a wife is entitled to a significant portion of her husband's estate if he passes away. With a Suffolk New York Last Will and Testament in place, she can inherit everything if no children exist, allowing for a smooth transfer of assets. Furthermore, if there is no will, New York state law guarantees the wife a share of the estate. This clarity is essential to ensure that her rights are protected.

A will serves as a legal document that outlines how you want your assets distributed after your death. For a married person with no children, the Suffolk New York Last Will and Testament simplifies this process by directing all assets to the surviving spouse. This ensures your wishes are honored and helps avoid potential disputes. It is crucial to have this document prepared to avoid confusion and to protect your spouse's interests.

Even if you do not have children, having a will is still advisable. A Suffolk New York Last Will and Testament for a Married Person with No Children helps clarify how you want your assets distributed, avoiding potential conflicts among family members. Without a will, state law will determine how your property is divided, which may not reflect your wishes. Uslegalforms can provide the necessary tools to create a will that suits your needs.

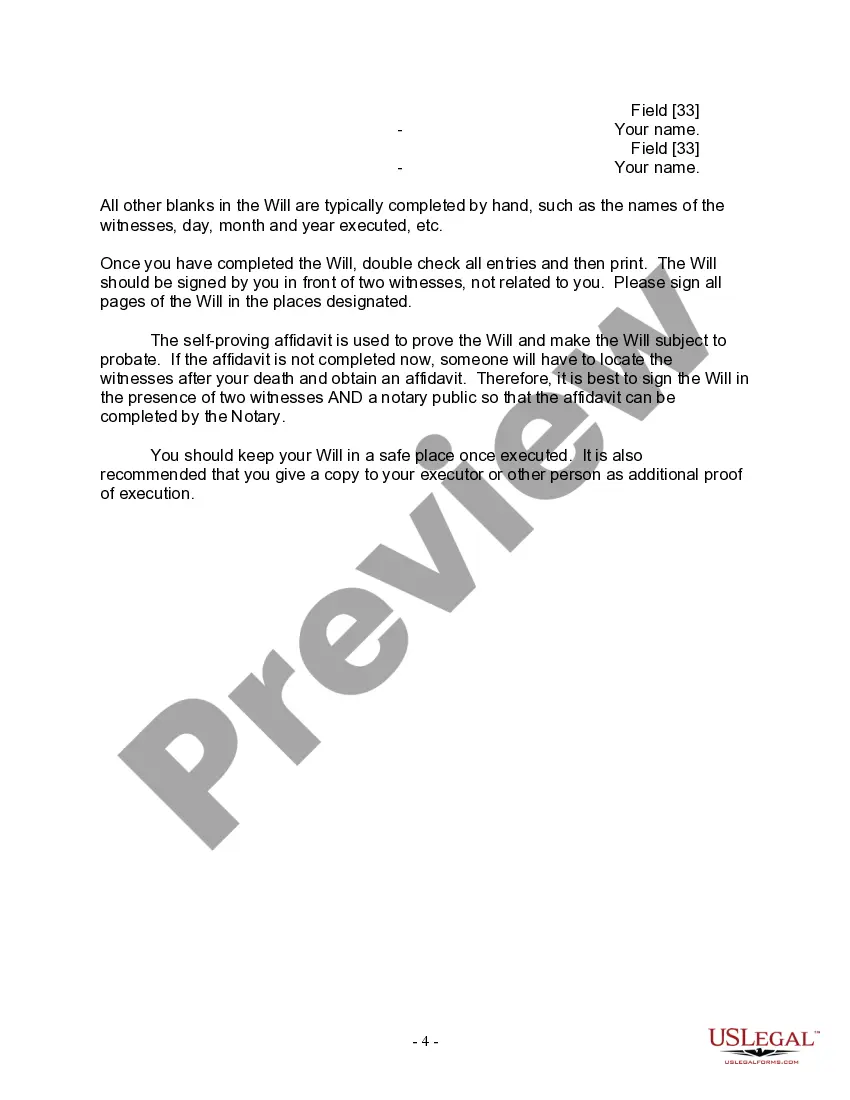

No, a will in New York State does not need to be notarized to be valid, but it must be signed by you and witnessed by at least two people. However, having a notarized will can simplify matters later, especially if questions arise about its authenticity. For a Suffolk New York Last Will and Testament for a Married Person with No Children, ensuring proper witnessing is essential to uphold the will's validity. You may want to consult uslegalforms for guidance.

In New York State, the laws regarding inheritance can be complex. While a spouse typically inherits a significant portion of the estate, the precise distribution may depend on whether there are surviving family members. Without a valid Suffolk New York Last Will and Testament for a Married Person with No Children, state laws will dictate the distribution of assets. Therefore, it's wise to draft a will to clarify your intentions.

Yes, you can create a Suffolk New York Last Will and Testament for a Married Person with No Children without a lawyer. However, it's important to ensure that your will meets all legal requirements to be valid. Using resources like uslegalforms can help simplify the process, providing templates that comply with New York state law. This way, you can express your wishes clearly and legally.