Suffolk New York Quitclaim Deed for Three Individuals to Two Individuals as Joint Tenants with the Right of Survivorship

Description

How to fill out New York Quitclaim Deed For Three Individuals To Two Individuals As Joint Tenants With The Right Of Survivorship?

We consistently endeavor to diminish or avert legal complications when engaging with intricate legal or financial matters.

To achieve this, we enroll in legal assistance services that are generally quite expensive.

Nevertheless, not every legal concern is equally intricate; many can be managed independently.

US Legal Forms is a digital repository of current DIY legal documents covering everything from wills and power of attorney to articles of incorporation and petitions for dissolution.

Simply Log In to your account and click the Get button next to it. If you happen to misplace the document, you can always re-download it in the My documents tab. The process is just as simple if you’re new to the website! You can set up your account in just a few minutes.

- Our repository enables you to handle your own affairs without needing an attorney.

- We offer access to legal form templates that aren’t always available to the public.

- Our templates are specific to states and regions, significantly simplifying the search process.

- Utilize US Legal Forms whenever you require to locate and download the Suffolk New York Quitclaim Deed for Three Individuals to Two Individuals as Joint Tenants with the Right of Survivorship or any other form efficiently and securely.

Form popularity

FAQ

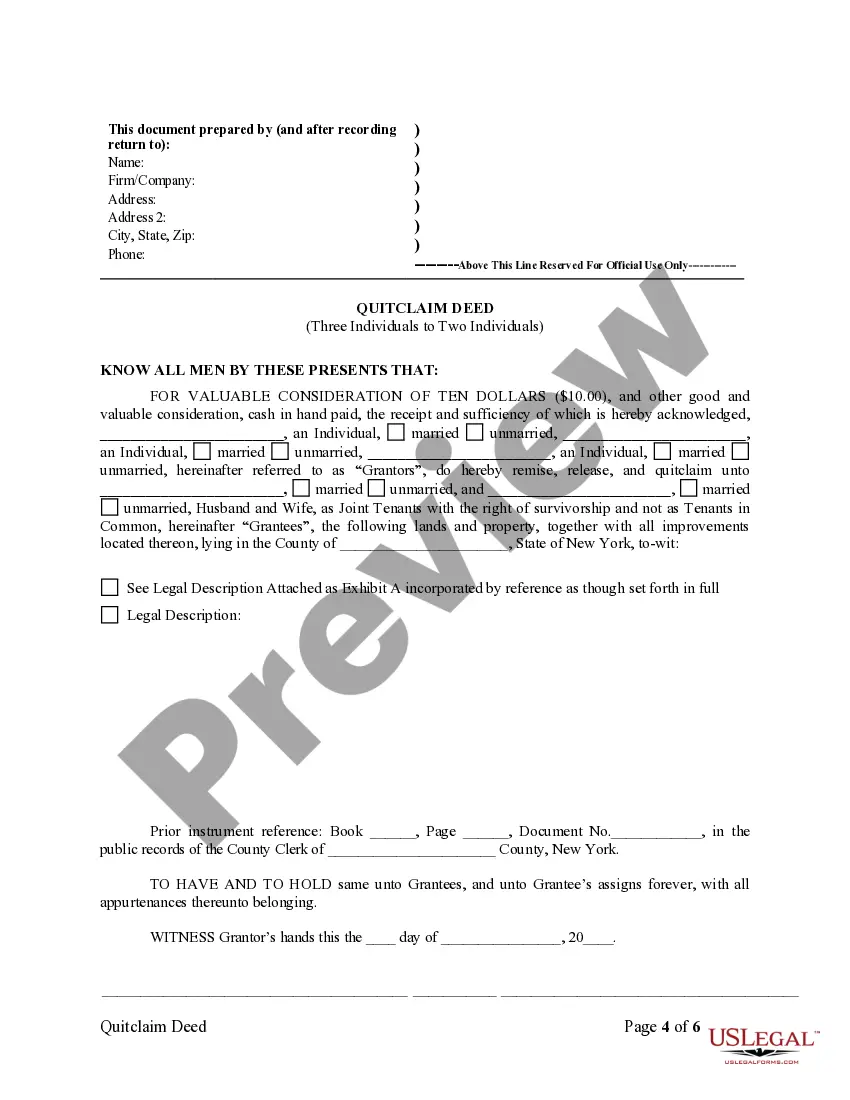

To add survivorship rights to a deed, you need to create a new deed that specifies the arrangement. This document must clearly state the intention for joint ownership with rights of survivorship among the owners. For a smooth process in Suffolk, using a Suffolk New York Quitclaim Deed for Three Individuals to Two Individuals as Joint Tenants with the Right of Survivorship can effectively establish these rights and ensure legal clarity.

A quitclaim deed with rights of survivorship is a legal document used to transfer property ownership while ensuring surviving owners retain rights to the property after one owner dies. This type of deed does not guarantee any legal claims but establishes joint ownership with an automatic transfer of rights upon death. Individuals engaging in such transactions, especially in Suffolk, benefit from utilizing a Suffolk New York Quitclaim Deed for Three Individuals to Two Individuals as Joint Tenants with the Right of Survivorship to simplify estate planning.

A joint account does not typically receive a step-up in basis like real estate property does. Instead, ownership of a joint account generally transfers to the surviving account holder without an adjustment in tax basis. Therefore, understanding the differences between accounts and real estate is important for those involved in a Suffolk New York Quitclaim Deed for Three Individuals to Two Individuals as Joint Tenants with the Right of Survivorship.

In New York, when one owner of a jointly owned property with rights of survivorship passes away, their share automatically transfers to the surviving owner(s). This transfer occurs outside of probate, making the process quicker and more efficient. This feature is essential for those using a Suffolk New York Quitclaim Deed for Three Individuals to Two Individuals as Joint Tenants with the Right of Survivorship, as it ensures a smooth transition of ownership.

The step-up basis for joint tenants with rights of survivorship refers to the method of adjusting the property’s tax basis at the time of an owner's death. In Suffolk New York, when one joint tenant passes away, the surviving tenants receive an adjusted basis equal to the fair market value at the time of death. This adjustment can significantly reduce capital gains taxes when the property is eventually sold. Understanding this concept is crucial when executing a Suffolk New York Quitclaim Deed for Three Individuals to Two Individuals as Joint Tenants with the Right of Survivorship.

A quit claim deed with the rights of survivorship is a legal document used to transfer ownership of property, ensuring that all owners share the right of survivorship. This means that if one owner passes away, their interest in the property automatically passes to the surviving owners without going through probate. This is often utilized in scenarios like the Suffolk New York Quitclaim Deed for Three Individuals to Two Individuals as Joint Tenants with the Right of Survivorship, providing clarity and expedience in real estate transfers.

The terms joint tenancy and joint with survivorship often refer to the same concept, but there can be slight nuances. Joint tenancy typically includes the right of survivorship, meaning a deceased owner's share directly passes to the surviving owners. This distinction is critical when drafting legal documents, such as a Suffolk New York Quitclaim Deed for Three Individuals to Two Individuals as Joint Tenants with the Right of Survivorship, to clarify ownership intentions.

A joint tenants with a right of survivorship account is a shared financial account owned by two or more people. Each account holder has equal access to the funds, and upon the death of one owner, the remaining holders automatically retain ownership of the account. This financial arrangement can be beneficial in various scenarios, including property ownership established through methods like the Suffolk New York Quitclaim Deed for Three Individuals to Two Individuals as Joint Tenants with the Right of Survivorship.

While joint tenancy with the right of survivorship offers benefits, it also has disadvantages. One major drawback is that any debts owed by one joint tenant can affect the property, placing it at risk. Additionally, joint tenancy may not allow for flexibility in property distribution upon death, which can complicate estate planning, a concern those using a Suffolk New York Quitclaim Deed for a specific ownership structure should consider.

The step-up basis for joint tenants with a right of survivorship refers to the tax benefit received when one owner passes away. The property's value is reassessed to its current market value at the time of death, potentially reducing capital gains taxes if the property is later sold. This feature can be crucial for those using a Suffolk New York Quitclaim Deed for Three Individuals to Two Individuals as Joint Tenants with the Right of Survivorship to manage asset transfers.