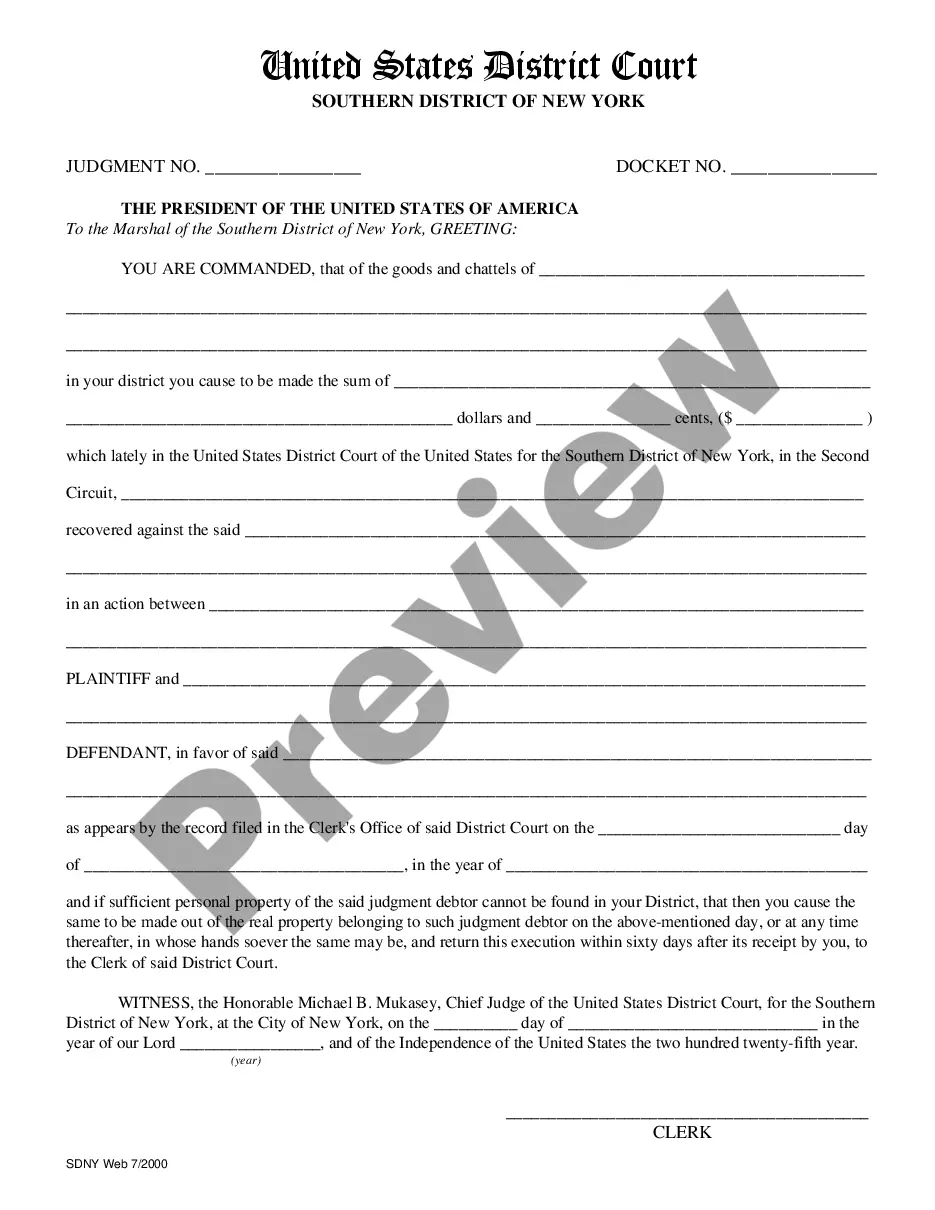

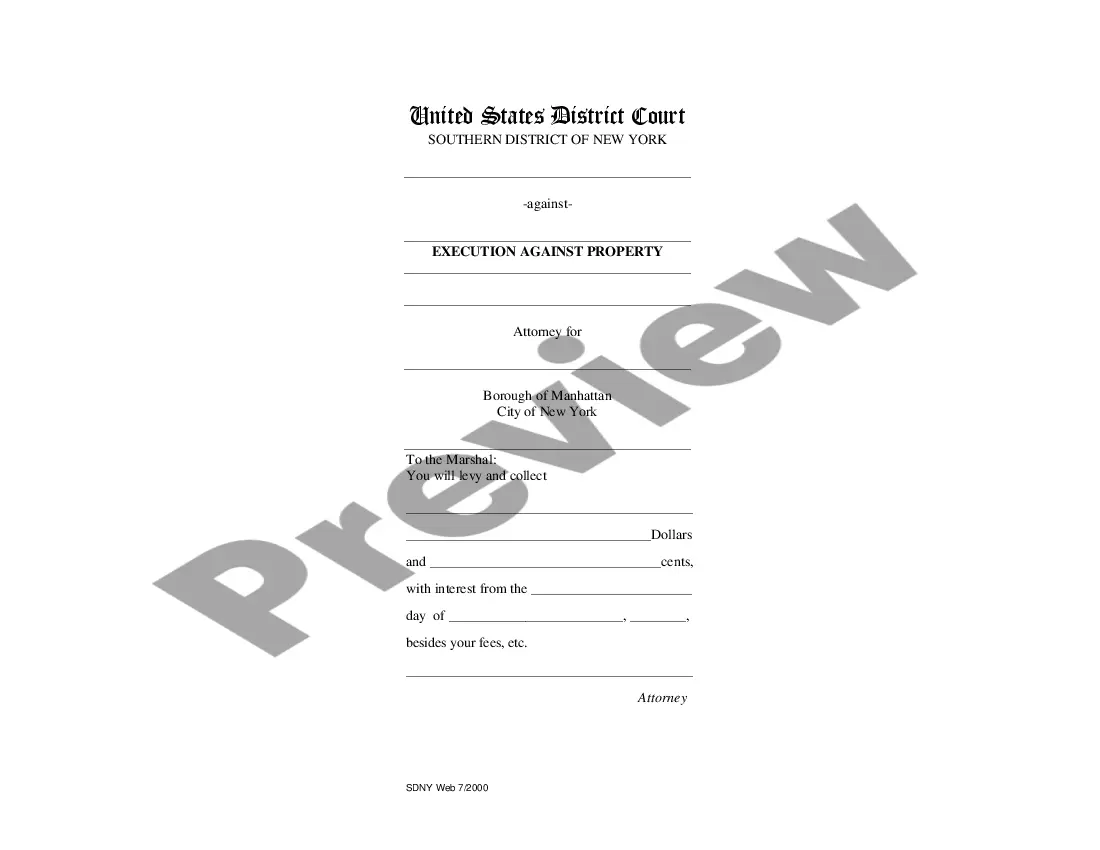

Queens New York Execution Against Property

Description

How to fill out New York Execution Against Property?

Regardless of social or professional standing, completing legal documents is a regrettable requirement in the modern world.

Frequently, it’s nearly impossible for an individual without legal training to generate this type of paperwork from scratch, primarily due to the intricate terminology and legal subtleties they involve.

This is where US Legal Forms proves to be useful.

Ensure that the form you have selected is tailored to your location since the regulations of one state or region do not apply to another.

Examine the document and read a brief summary (if available) of the purposes for which the document can be utilized.

- Our platform provides an extensive collection of over 85,000 ready-to-use state-specific documents suitable for almost any legal circumstance.

- US Legal Forms is also a valuable resource for associates or legal advisors who aim to enhance their efficiency using our DYI templates.

- Whether you require the Queens New York Execution Against Property or any other documents that will be applicable in your state or region, with US Legal Forms, everything is readily available.

- Here’s how to quickly obtain the Queens New York Execution Against Property utilizing our reliable platform.

- If you are already a subscriber, you can simply Log In to your account to access the correct form.

- However, if you are new to our platform, please follow these steps before securing the Queens New York Execution Against Property.

Form popularity

FAQ

In Queens, New York, wages can typically be garnished after a default judgment is entered. This process often begins 21 days after the judgment, provided that the creditor has taken the necessary steps to enforce the judgment. However, it's crucial to understand that New York law limits the amount that can be garnished to ensure you retain enough for living expenses. If you're facing this situation, consider using USLegalForms to navigate the specifics of Queens New York Execution Against Property.

Yes, in New York, creditors can potentially take your house, depending on the situation and the type of debt. If they successfully pursue a court judgment and follow through with an execution against property, they may have the ability to seize your home. However, there are legal protections that can safeguard your primary residence. To explore your options and rights, consider leveraging resources offered by US Legal Forms.

In New York, the types of personal property that may be seized under a judgment can include vehicles, bank accounts, and certain valuables. However, the law also protects some of your personal belongings, ensuring that you can maintain a basic standard of living. If you're facing this situation, understanding the specifics about property execution in Queens, New York, is essential. You might find it helpful to consult platforms like US Legal Forms for guidance.

In Queens, New York, a judgment creditor may seek to enforce a judgment through a process called execution against property. This means that your house could potentially be seized if a court allows it. However, certain protections exist that can keep your primary residence safe from being taken. It's wise to consult with professionals who can help you navigate these legal waters.

The Creditor must either file the Satisfaction of Judgment with the County Clerk, or provide it to the Debtor so that the Debtor may file it with the County Clerk. The Satisfaction of Judgment must also be filed with the City Court. A Satisfaction of Judgment form can be purchased from any stationary store.

The Creditor must either file the Satisfaction of Judgment with the County Clerk, or provide it to the Debtor so that the Debtor may file it with the County Clerk. The Satisfaction of Judgment must also be filed with the City Court. A Satisfaction of Judgment form can be purchased from any stationary store.

A judgment is good for 20 years, but if the plaintiff wants to enforce the judgment against land it is only good for 10 years unless the plaintiff renews it for another 10 years.

What to do If the Defendant Does Not Pay Voluntarily. If the Judgment Debtor, the party who lost during the trial, does not pay you voluntarily, you may contact an enforcement officer. The enforcement officer will either be a Sheriff who works for the County or a City Marshal who is independent.

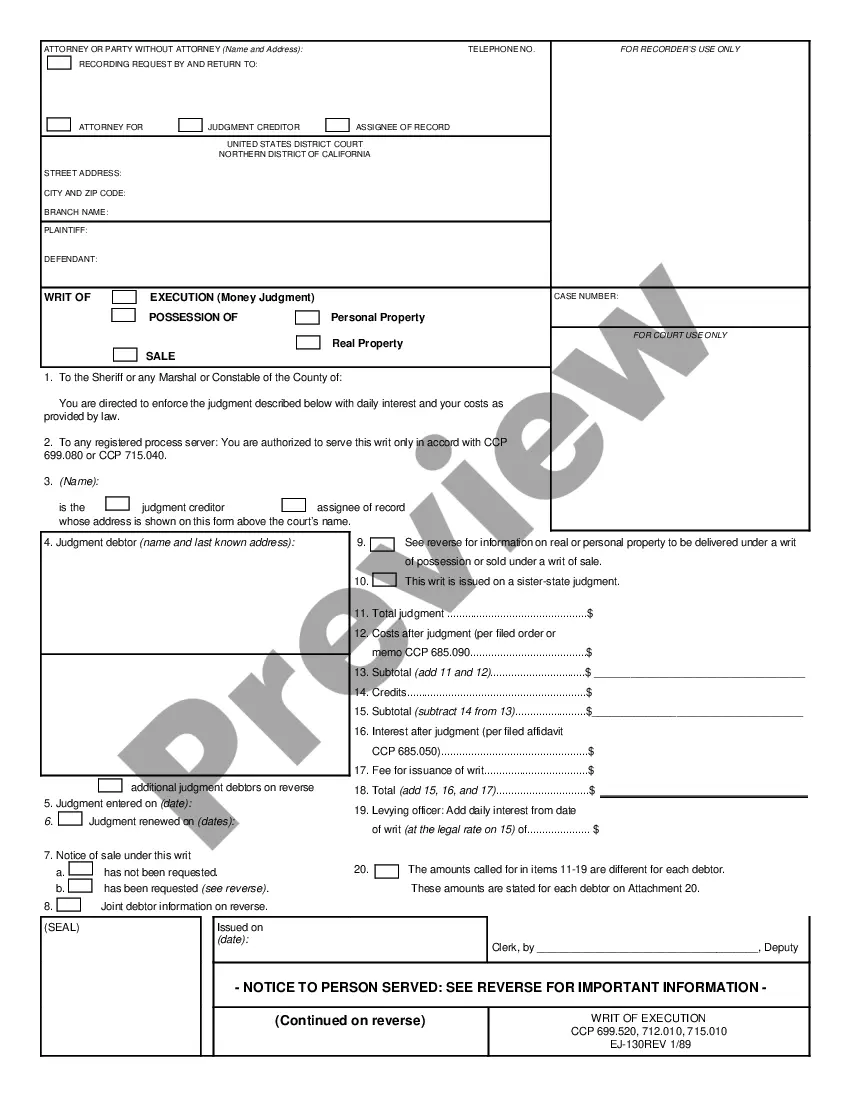

A WRIT OF EXECUTION must be submitted to the Clerk's Office in paper form and include an original signature from the attorney. The Writ may be mailed to the Orders and Judgments Clerk with a stamped, self-addressed return envelope, or hand delivered.

A judgement will state that you have not paid your debt and it will reflect on your credit record for 5 years. When a judgement is granted, a creditor can apply for a warrant where the sheriff can attach goods such as your furniture and sell these to pay your debt.