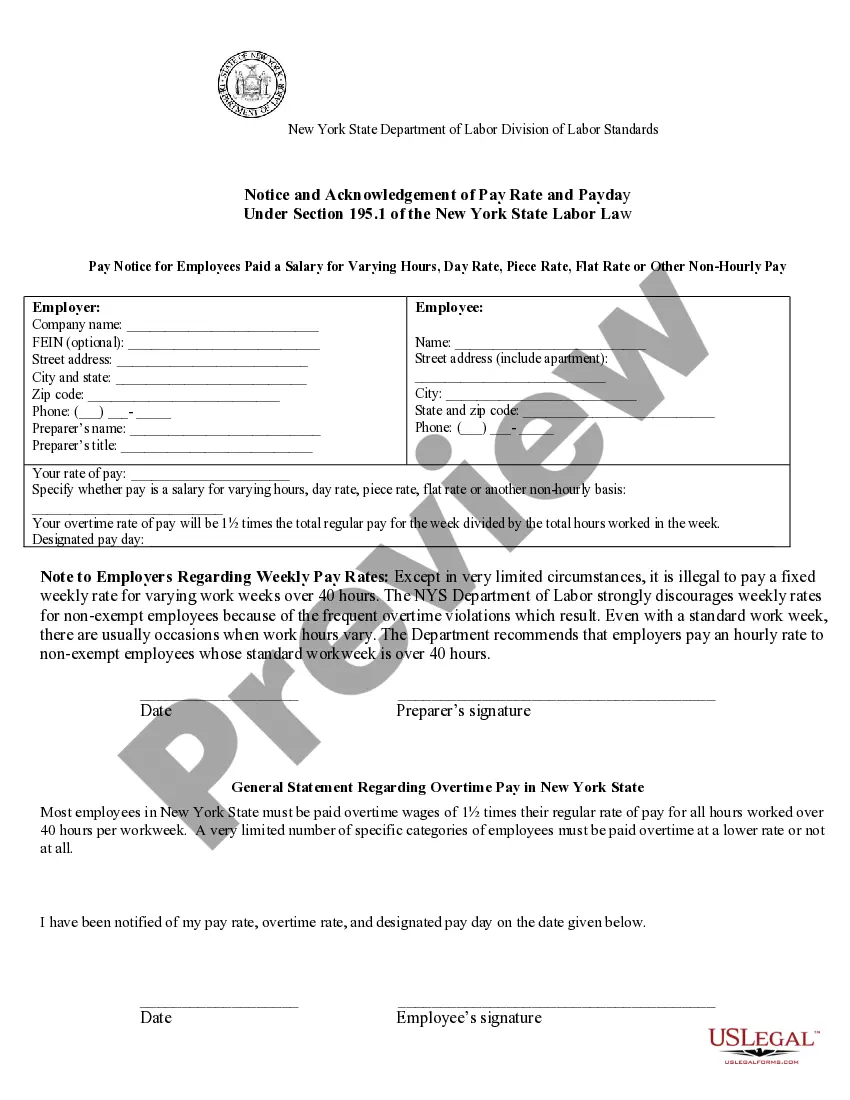

Rochester New York Pay Notice for Multiple Hourly Rates- Notice and Acknowledgement of Pay Rate and Payday

Description

How to fill out New York Pay Notice For Multiple Hourly Rates- Notice And Acknowledgement Of Pay Rate And Payday?

We continually endeavor to minimize or avert legal repercussions when handling intricate legal or financial matters.

To accomplish this, we seek attorney services that are generally very expensive.

However, not all legal matters are equally intricate; many can be managed independently.

US Legal Forms is an online repository of current DIY legal documents ranging from wills and powers of attorney to incorporation articles and petitions for dissolution.

Simply Log In to your account and click the Get button next to the desired form. If you misplace the document, it can be re-downloaded from the My documents section. The process remains straightforward even for newcomers to the website! You can establish your account in a matter of minutes. Ensure that the Rochester New York Pay Notice for Multiple Hourly Rates- Notice and Acknowledgement of Pay Rate and Payday is compliant with the laws and regulations of your state and locality. It's also important to review the form’s description (if available), and if you detect any inconsistencies with your original needs, search for an alternate template. Once you’ve verified that the Rochester New York Pay Notice for Multiple Hourly Rates- Notice and Acknowledgement of Pay Rate and Payday suits your requirements, select your subscription plan and proceed to payment. You can then download the document in any of the available file formats. After over 24 years in the market, we have assisted millions by providing ready-to-customize and current legal forms. Take advantage of US Legal Forms now to save time and resources!

- Our collection empowers you to manage your affairs independently without engaging legal counsel.

- We provide access to legal form templates that are not always readily available.

- Our templates are specific to states and regions, making the search process significantly easier.

- Utilize US Legal Forms whenever you need to quickly and securely find and download the Rochester New York Pay Notice for Multiple Hourly Rates- Notice and Acknowledgement of Pay Rate and Payday, or any other form.

Form popularity

FAQ

If an employee is exempt from FLSA and any state, local, or union overtime laws, then it is legal to work 60 hours a week on salary. Some employers do pay exempt employees for overtime work through time-and-a-half, bonuses, or extra time off.

If you quit without 72 hours' notice, your employer has 72 hours to pay commissions that can be reasonably calculated. If you quit with 72 hours' notice, your employer must pay your commissions on your last day.

Your name. Dates covered in payment period. Type of payment (hourly, salary, commission, etc) Rate of payment (regular rate and overtime rate)

All commissions earned by a commission salesperson are legally considered wages and must be paid to the salesperson even if the employment relationship with the employer has ended.

Final And Unclaimed Paychecks Laws In New York New York requires that final paychecks be paid on the next scheduled payday, regardless of whether the employee quit or was terminated.

The Wage Theft Prevention Act (?WTPA?), passed in 2011, requires employers to provide employees with an annual notice regarding their compensation and other terms of employment. The notice must be provided to all employees between January 1 and February 1 of each year, regardless if they previously received a notice.

Are commissions included in severance? Yes, generally speaking, commissions are included in the calculation of your severance, particularly if your commissions formed an integral part of your overall compensation.

The State of New York requires that employers tell their employees what their compensation will be in plain terms. The compensation could be paid out hourly, daily, weekly, or monthly. If the salary is paid weekly, then the employer should clearly explain to the employee the number of hours covered by the weekly rate.

A pay stub typically includes: Employee information ? name, social security number, address. Dates for the pay period. Employee's pay rate.

Work any number of hours each week: Employers are not restricted to a 40-hour work week. This means that your employer has the authority to require you to work more than 40 hours in a given calendar week. Of course, overtime laws apply to any hours over 40 worked in a calendar week.