Queens New York Pay Notice for Multiple Hourly Rates- Notice and Acknowledgement of Pay Rate and Payday

Description

How to fill out New York Pay Notice For Multiple Hourly Rates- Notice And Acknowledgement Of Pay Rate And Payday?

Do you require a reliable and affordable provider of legal forms to acquire the Queens New York Pay Notice for Multiple Hourly Rates - Notice and Acknowledgement of Pay Rate and Payday? US Legal Forms is your ideal choice.

Whether you need a simple agreement to establish rules for living together with your significant other or a collection of forms to facilitate your separation or divorce through the judicial system, we have you covered.

Our site offers over 85,000 current legal document templates for personal and commercial purposes. All templates that we make available are not generic and are tailored according to the demands of specific state and county regulations.

To obtain the document, you must Log In to your account, find the desired template, and click the Download button adjacent to it. Please keep in mind that you can retrieve your previously acquired document templates at any time from the My documents section.

Now you can set up your account. Then select the subscription option and complete the payment process.

Once the payment is finalized, download the Queens New York Pay Notice for Multiple Hourly Rates - Notice and Acknowledgement of Pay Rate and Payday in any available format. You can revisit the website at any moment and redownload the document without charge.

Obtaining current legal forms has never been simpler. Try US Legal Forms today, and say goodbye to spending hours researching legal documents online.

- Are you unfamiliar with our platform? No problem.

- You can create an account in just a few minutes, but first, please ensure to do the following.

- Verify that the Queens New York Pay Notice for Multiple Hourly Rates - Notice and Acknowledgement of Pay Rate and Payday adheres to your state and local regulations.

- Review the form's description (if available) to understand who and what the document serves.

- Start the search over if the template does not meet your particular needs.

Form popularity

FAQ

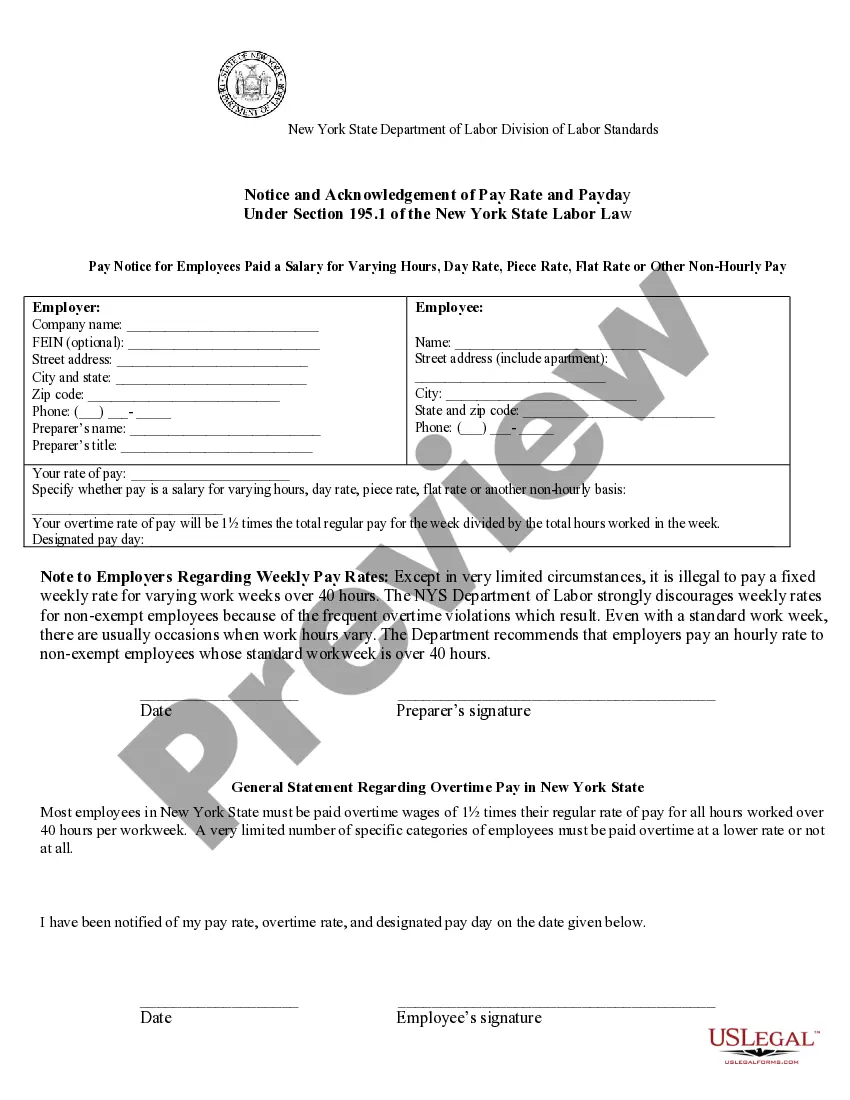

The Wage Theft Prevention Act (WTPA) took effect on April 9, 2011. The law requires employers to give written notice of wage rates to each new hire. The notice must include: Rate or rates of pay, including overtime rate of pay (if it applies)

Work any number of hours each week: Employers are not restricted to a 40-hour work week. This means that your employer has the authority to require you to work more than 40 hours in a given calendar week. Of course, overtime laws apply to any hours over 40 worked in a calendar week.

Notice and Acknowledgement of Pay Rate and Payday Under Section 195.1 of the New York State Labor Law.

Review Solicitors An employment contract cannot be unilaterally varied by one party without the consent of the other. If an employer attempts to reduce an employee's salary without their consent, this will entitle the employee to take any of the following action: Resign from their position.

Pay parity is a term used to signify the lack of a pay gap, Holloway said. ?A lot of organizations seek to have pay parity. Shareholders may demand it,? she said. Organizations often will define what they mean with this term. Generally, the goal is to pay fairly for people performing the same job, she said.

A wage statement (sometimes called a pay stub) is a document employers give their employees every pay period that explains how their paycheck was calculated. ?1 California has specific laws that govern the information that employees are entitled to receive when they are paid.

Your name. Dates covered in payment period. Type of payment (hourly, salary, commission, etc) Rate of payment (regular rate and overtime rate)

The amount of money an employee would get for the hours worked. This does not include any additional overtime payment.

Section 193, subdivision 1(c), of the New York State Labor Law permits an employer to make deductions from an employee's wages for ?an overpayment of wages where such overpayment is due to a mathematical or other clerical error by the employer.? Such deductions are only permitted as follows: (a) Timing and duration.

LS 54 Notice for Hourly Rate Employees This form is for hourly employees who are not exempt from coverage under the applicable State and Federal overtime provisions. For example, use for an employee whose regular rate of pay is $10 per hour and overtime rate is $15 per hour.