Queens New York Pay Notice for Prevailing Rate and Other Jobs - Notice and Acknowledgement of Pay Rate and Payday

Description

How to fill out New York Pay Notice For Prevailing Rate And Other Jobs - Notice And Acknowledgement Of Pay Rate And Payday?

Finding authenticated templates tailored to your regional statutes can be arduous unless you utilize the US Legal Forms repository.

It’s a digital compilation of over 85,000 legal documents for both personal and professional requirements and various real-world scenarios.

All the files are correctly categorized by usage area and jurisdiction sectors, making the search for the Queens New York Pay Notice for Prevailing Rate and Other Jobs - Notice and Acknowledgement of Pay Rate and Payday as swift and straightforward as ABC.

Acquire the document. Click on the Buy Now button and select the subscription bundle you desire. You must create an account to access the library’s offerings.

- For those familiar with our service and who have utilized it previously, obtaining the Queens New York Pay Notice for Prevailing Rate and Other Jobs - Notice and Acknowledgement of Pay Rate and Payday takes only a few clicks.

- Simply Log In to your account, select the document, and click Download to save it on your device.

- This procedure will require just a couple of extra steps for new users.

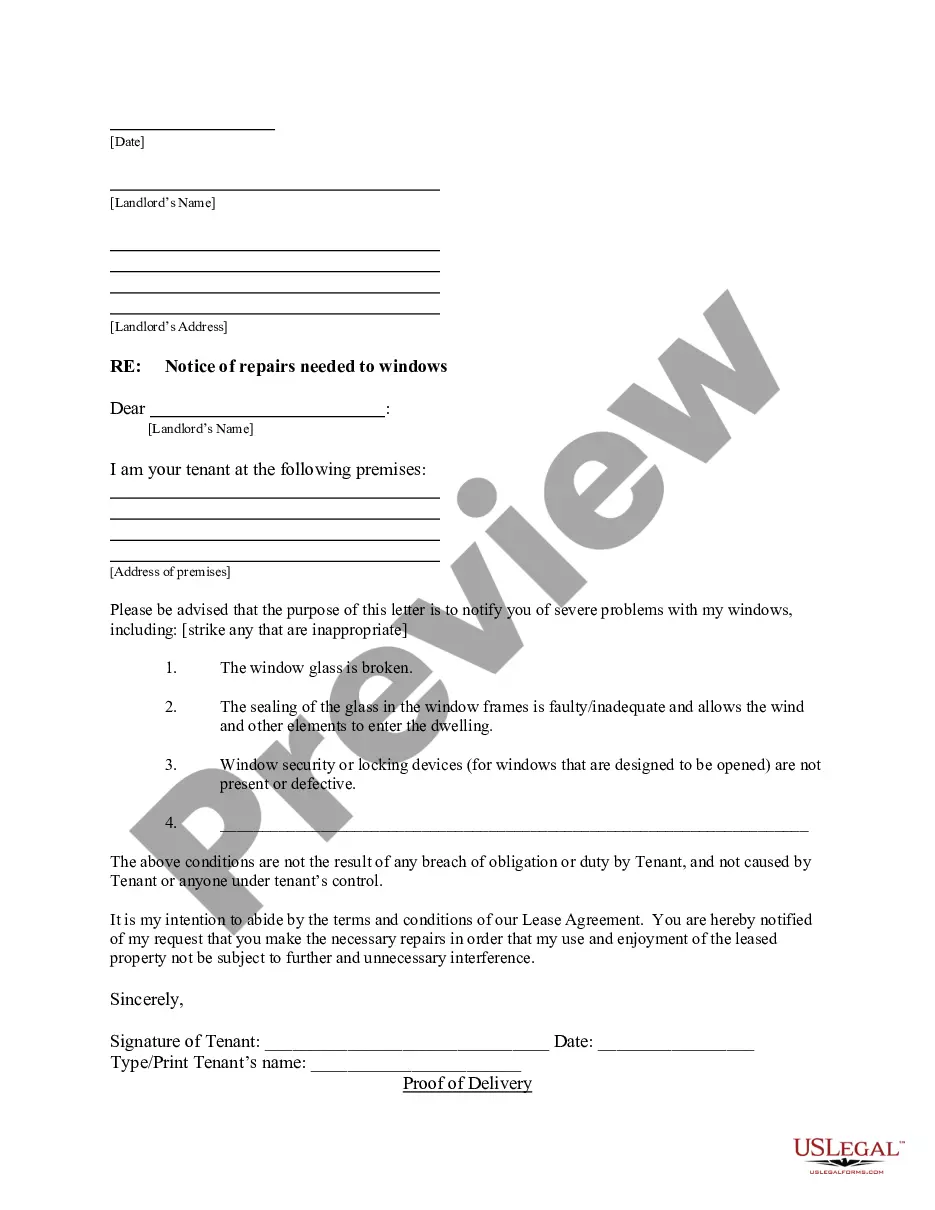

- Review the Preview mode and form description. Ensure you’ve chosen the correct one that fulfills your requirements and aligns with your local jurisdiction standards.

- Look for another template, if necessary. If you encounter any discrepancies, use the Search tab above to locate the correct one. If it meets your needs, proceed to the following step.

Form popularity

FAQ

All commissions earned by a commission salesperson are legally considered wages and must be paid to the salesperson even if the employment relationship with the employer has ended.

Notice and Acknowledgement of Pay Rate and Payday Under Section 195.1 of the New York State Labor Law.

Salespeople are entitled to all ?earned? commission pay, even after they quit or are terminated from their position. Regardless of which party ends the contract, salespeople must receive earned commission pay, which is legally considered wages under labor law and laws for commission pay.

A pay stub typically includes the following: Employee information, including name, social security number, and address. Employer information, including name and address. The dates of the pay period. Employee pay rate. Gross earnings, or their earnings before taxes, employee contributions, and deductions are taken out.

Nine Things You Should Look For In Your Pay Stubs Gross wages earned; Total hours worked; All deductions; Net wages earned; The inclusive dates of the period for which the employee is paid; The name of the employee and only the last four digits of his/her Social Security Number and/or Employee ID number;

If you quit without 72 hours' notice, your employer has 72 hours to pay commissions that can be reasonably calculated. If you quit with 72 hours' notice, your employer must pay your commissions on your last day.

A pay stub typically includes: Employee information ? name, social security number, address. Dates for the pay period. Employee's pay rate.

Your name. Dates covered in payment period. Type of payment (hourly, salary, commission, etc) Rate of payment (regular rate and overtime rate)

New York requires that final paychecks be paid on the next scheduled payday, regardless of whether the employee quit or was terminated.

The Wage Theft Prevention Act (WTPA) took effect on April 9, 2011. The law requires employers to give written notice of wage rates to each new hire. The notice must include: Rate or rates of pay, including overtime rate of pay (if it applies)