Rochester New York Assignment to Living Trust

Description

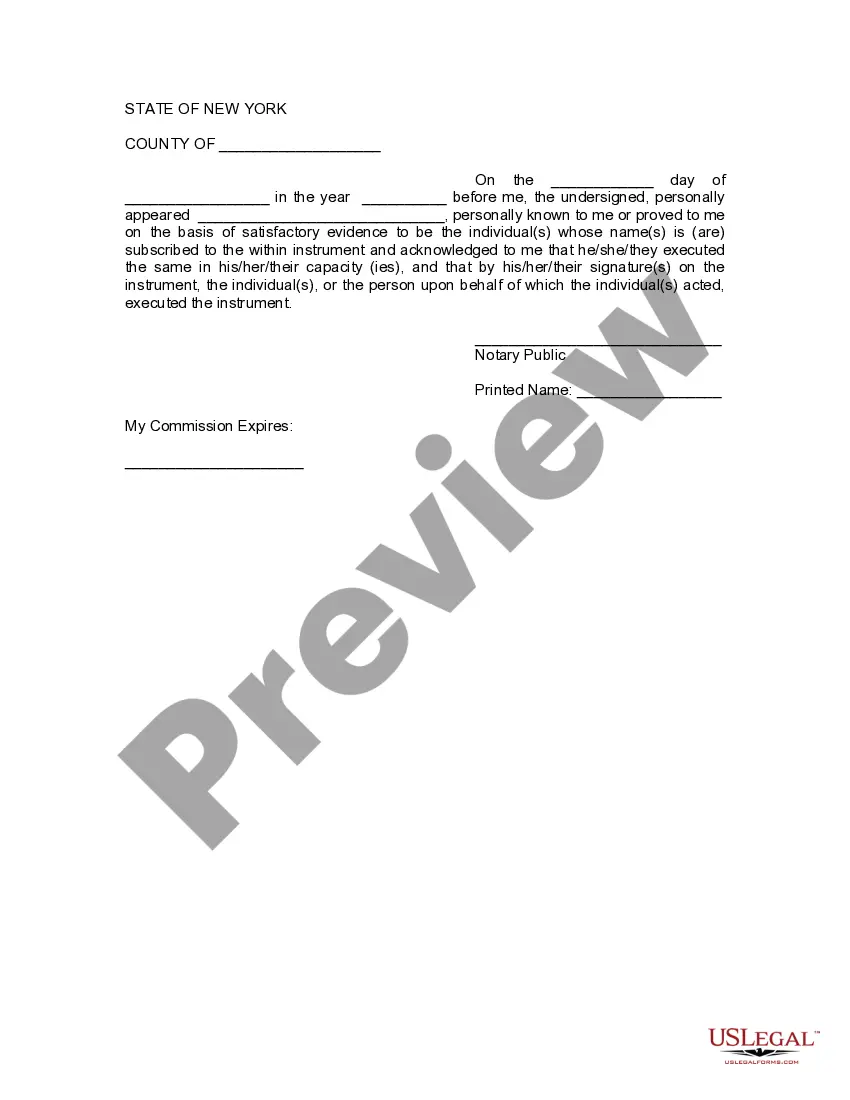

How to fill out New York Assignment To Living Trust?

In case you have previously made use of our service, Log In to your account and retrieve the Rochester New York Assignment to Living Trust onto your device by clicking the Download button. Ensure that your subscription remains active. If not, renew it according to your payment plan.

If this is your initial time using our service, follow these straightforward steps to acquire your file.

You have everlasting access to every document you have acquired: you can locate it in your profile under the My documents menu whenever you wish to reuse it. Leverage the US Legal Forms service to easily discover and save any template for your personal or professional requirements!

- Ensure you have located the correct document. Review the description and utilize the Preview option, if available, to verify if it aligns with your requirements. If it doesn't meet your needs, use the Search tab above to find the appropriate one.

- Buy the template. Hit the Buy Now button and select a monthly or annual subscription plan.

- Create an account and process a payment. Provide your credit card information or opt for the PayPal option to finalize the transaction.

- Receive your Rochester New York Assignment to Living Trust. Choose the file format for your document and save it on your device.

- Complete your form. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

Form popularity

FAQ

To set up a living trust in New York, begin by selecting a trustee and determining the assets you want to include. After drafting the trust document, ensure you execute it according to New York laws. Using online services, such as US Legal Forms, can provide you the tools necessary for a seamless Rochester New York Assignment to Living Trust setup.

Placing your assets into a living trust involves transferring titles and ownership to the trust. You will need to update property deeds, bank accounts, and other asset registrations to reflect the trust as the new owner. A well-structured approach, such as using US Legal Forms, can guide you through the process of Rochester New York Assignment to Living Trust.

To create a living trust in New York, start by deciding on the type of trust that best suits your needs. Next, you will need to draft the trust document, which outlines how your assets will be managed. Utilizing services like US Legal Forms can simplify the process and ensure compliance with Rochester New York Assignment to Living Trust laws.

Creating a living trust can be affordable if you utilize online legal services. Many platforms, like US Legal Forms, offer templates and guidance specifically for a Rochester New York Assignment to Living Trust. By using these resources, you can save on attorney fees while ensuring your trust meets legal requirements.

The best type of trust for putting your house in Rochester, New York, is typically a revocable living trust. This trust allows you to retain control over your property while providing a clear plan for your heirs. Additionally, using uslegalforms can help you compare different trust options and choose the one that aligns best with your estate planning goals.

To transfer your property into a trust in Rochester, New York, you need to execute a deed that conveys the property from your name to the name of the trust. Make sure to record this deed with the local county clerk to ensure that the transfer is recognized legally. Consider using uslegalforms for guidance on preparing and filing the proper documentation, making the process smoother and more efficient.

There is no set minimum amount required to create a living trust in Rochester, New York. However, it typically makes financial sense to establish a trust if you have substantial assets to protect and manage. By leveraging uslegalforms, you can determine the most beneficial approach for your financial situation and ensure that your trust serves its intended purpose effectively.

Transferring property to a trust in Rochester, New York, involves executing a new deed that names the trust as the property owner. This ensures that the property is legally part of the trust, allowing for efficient management and distribution according to the terms outlined. It is essential to follow New York’s legal requirements for property transfers; platforms like uslegalforms can help you navigate these requirements easily.

One significant mistake parents often make when establishing a trust fund is forgetting to fund the trust with their assets. In Rochester, New York, even a correctly drafted trust won’t serve its purpose unless you transfer your assets into it. To ensure a smooth process, consider utilizing resources available through uslegalforms, which can provide clarity and insight on how to properly fund your trust.

To set up a living trust in Rochester, New York, start by gathering your assets and deciding which ones you want to include in the trust. Next, draft the trust document, which outlines how you want to manage these assets while you are alive and how they will be distributed after your death. Using a comprehensive platform like uslegalforms can simplify this process, guiding you through the necessary steps and paperwork.