The Kings New York Employer's Statement of Wage Earnings for Workers' Compensation is a crucial document used in workers' compensation claims. It serves as a detailed record of an employee's wages and salary history, providing essential information for calculating compensation benefits. This statement is required by Kings New York employers to accurately determine the earnings of an injured worker when filing a workers' compensation claim. The Kings New York Employer's Statement of Wage Earnings covers various key areas, including the employee's personal information, their current position, and their employment history. Additionally, this official statement contains significant details about an employee's wages, such as their regular hourly rate or salary, any overtime payments, bonuses, commissions, and other forms of compensation received. This comprehensive information allows the claims' administrator to determine the injured worker's average weekly wage and the appropriate compensation they should receive. It's important to note that there may be different types of Kings New York Employer's Statement of Wage Earnings for Workers' Compensation, depending on the complexity of the employee's work arrangement. For example, there might be specific templates for full-time employees, part-time employees, seasonal workers, or those paid on a commission or piece-rate basis. These different categories ensure that all employees are accurately represented in their claims, enabling a fair assessment of their wage earnings. When completing the Kings New York Employer's Statement of Wage Earnings for Workers' Compensation, employers must ensure that all information is precise, comprehensive, and supported by relevant records. Accuracy is vital to prevent any disputes or delays in the workers' compensation claims process. It is recommended that employers consult with legal or human resources professionals to ensure compliance with applicable laws and provide accurate wage details. In conclusion, the Kings New York Employer's Statement of Wage Earnings for Workers' Compensation is a crucial document that helps determine the appropriate compensation for injured employees. By providing comprehensive wage information, this statement ensures fairness and accuracy in the workers' compensation claims process. Employers must carefully complete this document, taking into account the unique circumstances of their employees and utilizing the appropriate template if different variations of the statement exist.

Kings New York Employer's Statement Of Wage Earnings for Workers' Compensation

Description

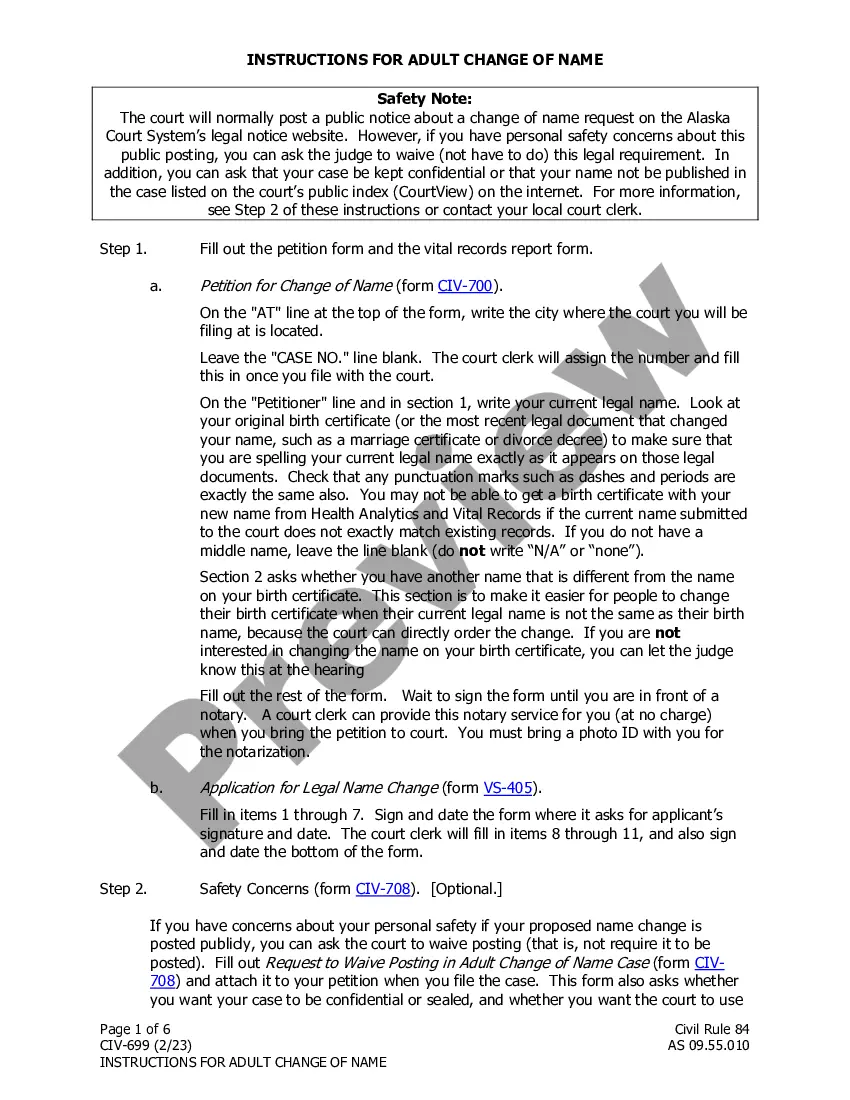

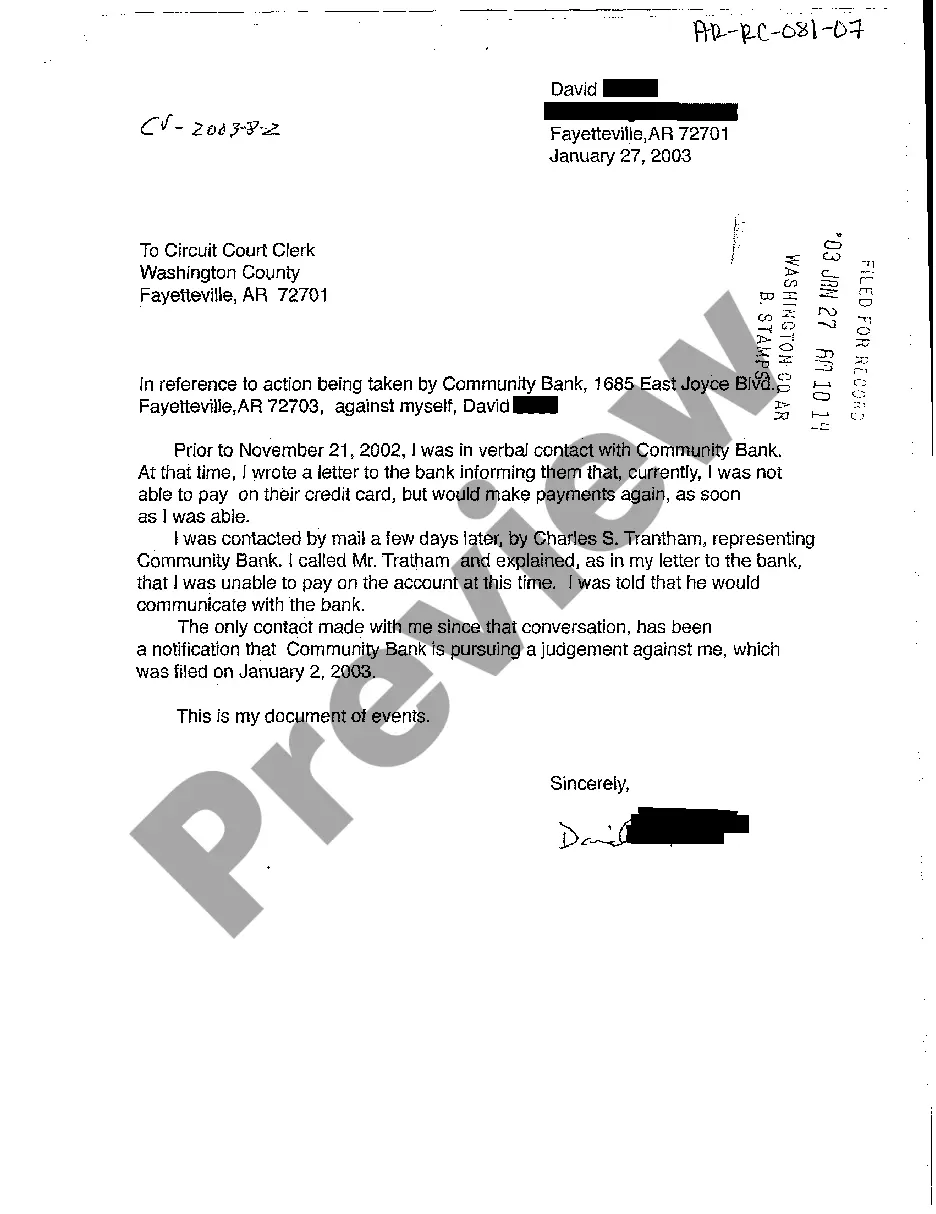

How to fill out Kings New York Employer's Statement Of Wage Earnings For Workers' Compensation?

If you’ve already utilized our service before, log in to your account and save the Kings New York Employer's Statement Of Wage Earnings for Workers' Compensation on your device by clicking the Download button. Make sure your subscription is valid. Otherwise, renew it in accordance with your payment plan.

If this is your first experience with our service, adhere to these simple steps to get your document:

- Ensure you’ve found a suitable document. Look through the description and use the Preview option, if available, to check if it meets your requirements. If it doesn’t fit you, utilize the Search tab above to get the appropriate one.

- Purchase the template. Click the Buy Now button and select a monthly or annual subscription plan.

- Create an account and make a payment. Utilize your credit card details or the PayPal option to complete the purchase.

- Get your Kings New York Employer's Statement Of Wage Earnings for Workers' Compensation. Select the file format for your document and save it to your device.

- Complete your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have constant access to each piece of paperwork you have bought: you can find it in your profile within the My Forms menu whenever you need to reuse it again. Take advantage of the US Legal Forms service to rapidly find and save any template for your personal or professional needs!

Form popularity

FAQ

Sole-Proprietors included on workers' compensation coverage must use a minimum payroll amount of $37,700 and a maximum payroll amount of $114,400 for rating their overall workers' compensation cost. Partners and LLC must be included at a minimum of $35,100 and a maximum of $106,600.

A wage statement (sometimes called a pay stub) is a document employers give their employees every pay period that explains how their paycheck was calculated. ?1 California has specific laws that govern the information that employees are entitled to receive when they are paid.

Related Definitions Wage records means all records evidencing all wages, commissions, overtime pay, gratuities, meals, board, rent, housing or lodging received from any employer during all time periods relevant to the act.

The amount that a worker receives is based on his/her average weekly wage for the 52-week period immediately prior to the date of the accident. The following formula is used to calculate benefits: 2/3 x average weekly wage x % of disability = weekly benefit.

To obtain a certificate immediately, please use the on-line application at . Once the application is completed on-line, you can immediately print the certificate on your printer. Please review the separate instructions (form CE-200 instructions) prior to completing this application.

Earnings statements (also called pay stubs or check stubs) are important payroll records for employers and employees that document information about wages paid, hours worked, deductions made and benefits accrued by an employee.

(Labor Code Section 226(a)(7)) The following information is required to be on your itemized statement: Gross wages earned. Total hours worked (not required for salaried exempt employees) The number of piece-rate units earned and any applicable piece rate if the employee is paid on a piece rate basis.

Wage Statements The employee's name and address. The hours worked by the employee. The employee's wage rate. The overtime wage rate. The hours worked at the overtime rate. Any other payment to which the employee is entitled (e.g., a bonus) The amount and purpose of all deductions.

Nine Things You Should Look For In Your Pay Stubs Gross wages earned; Total hours worked; All deductions; Net wages earned; The inclusive dates of the period for which the employee is paid; The name of the employee and only the last four digits of his/her Social Security Number and/or Employee ID number;

For most employees, a pay stub or wage statement must include the ?total hours worked by the employee.? If an employee's pay stub does not include total hours worked, the employer may be in violation of California wage statement laws.

More info

The New York State Health Care Workers' Compensation Board. The Board is a division of the Department of Health and Mental Hygiene. 4. Insurance industry. The state of New York has a relatively large insurance market based on the number of licensed insurers. 6. Types of insurance that are readily accepted. The state doesn't require that your insurance company do any kind of background check on you before you sign on. 7. Health insurance benefits are based on the type of company that is paying the premiums. In order to be reimbursed for benefits under the workers' compensation program, the employer will be required as a condition of the insurance agreement to pay at least 80 percent of the benefits for the employee for a given workweek. 8. You'll have to carry the workers' compensation certificate for 10 to 30 years if you've been the victim of a work-related injury. How Does the Job Site Affect Mental Health?

Disclaimer

The materials in this section are taken from public sources. We disclaim all representations or any warranties, express or implied, as to the accuracy, authenticity, reliability, accessibility, adequacy, or completeness of any data in this paragraph. Nevertheless, we make every effort to cite public sources deemed reliable and trustworthy.