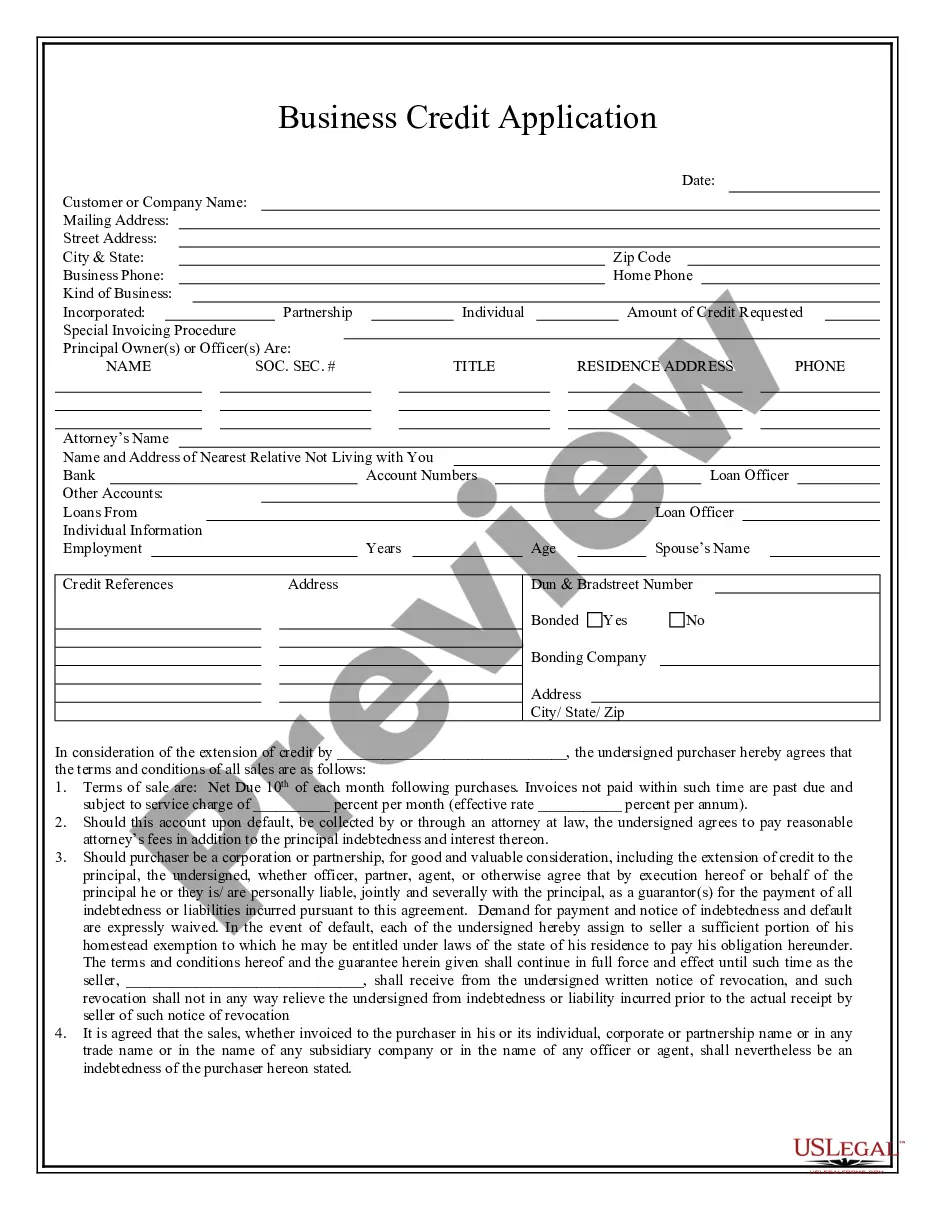

Queens New York Business Credit Application

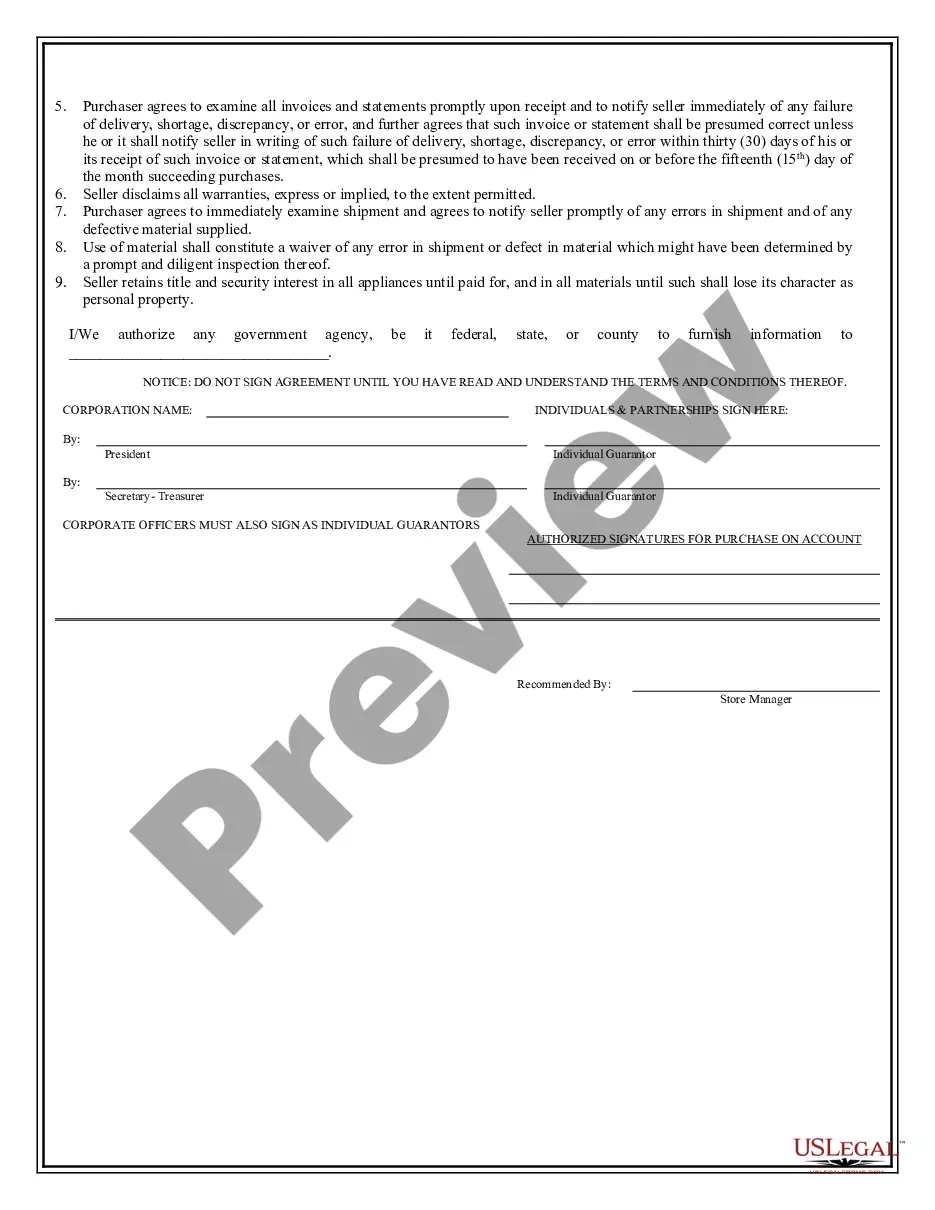

Description

How to fill out New York Business Credit Application?

If you are looking for a legitimate form, it’s impossible to discover a more suitable platform than the US Legal Forms website – likely the most extensive online collections.

With this collection, you can acquire a vast number of document samples for business and personal purposes categorized by subjects and locations, or keywords.

With our superior search function, locating the most recent Queens New York Business Credit Application is as simple as 1-2-3.

Acquire the template. Choose the format and save it on your device.

Make adjustments. Fill out, modify, print, and sign the acquired Queens New York Business Credit Application.

- If you are already familiar with our system and possess a registered account, all you need to do to obtain the Queens New York Business Credit Application is to Log In to your user profile and click the Download button.

- If you are utilizing US Legal Forms for the first time, just follow the instructions below.

- Ensure you have located the sample you require. Review its description and use the Preview feature (if available) to examine its content. If it doesn’t satisfy your needs, use the Search option located near the top of the screen to find the required file.

- Verify your selection. Click the Buy now button. After that, select your preferred subscription plan and provide the required information to sign up for an account.

- Complete the payment process. Utilize your bank card or PayPal account to finish the registration procedure.

Form popularity

FAQ

Typically, a credit score of 680 or higher is preferred for obtaining a business line of credit. However, each lender may have different criteria and some may consider your business's overall financial health. Your Queens New York Business Credit Application should detail your company's revenue, debts, and other financial metrics to show lenders your creditworthiness. Keep in mind that building a strong business credit profile will improve your chances of securing funding.

To create a business credit application form, start by identifying the essential information you need from applicants. Include fields for business name, address, ownership details, and financial information. Additionally, you can use platforms like USLegalForms to streamline this process, helping you build a comprehensive Queens New York Business Credit Application tailored to your specific requirements. Remember, clear and concise forms lead to better data collection and improved applicant experience.

To qualify for the New York City school tax credit, you must be a resident of the city and have a child in a public or private school. Income limits may apply, and you must file a tax return to claim the credit. It’s advisable to consult the official guidelines or use a straightforward platform like US Legal Forms to understand how this might intersect with your Queens New York Business Credit Application.

Claiming your New York State sales tax back requires filing a refund application with the New York State Department of Taxation and Finance. You will need documentation showing that you overpaid on sales tax. It's essential to keep thorough records and detailed receipts to support your claim as you navigate this process with your Queens New York Business Credit Application.

To start a new corporation in New York, you begin by choosing a unique name for your business and checking its availability. Next, you must file the Articles of Incorporation with the New York State Department. Additionally, consider seeking help from services like US Legal Forms to navigate the paperwork and ensure that your Queens New York Business Credit Application is properly prepared.

To secure funding for your LLC, start by preparing a comprehensive business plan that outlines your goals and financial needs. Next, consider submitting your Queens New York Business Credit Application to explore various funding options available. Platforms like uslegalforms can guide you through the process, ensuring you present your business in the best light to potential lenders.

The timeline to obtain a business line of credit can vary based on several factors, including your credit history and the lender’s requirements. Typically, you might see approval within a few days after submitting your Queens New York Business Credit Application. Once approved, funds may be accessible quickly, allowing you to seize business opportunities with ease.