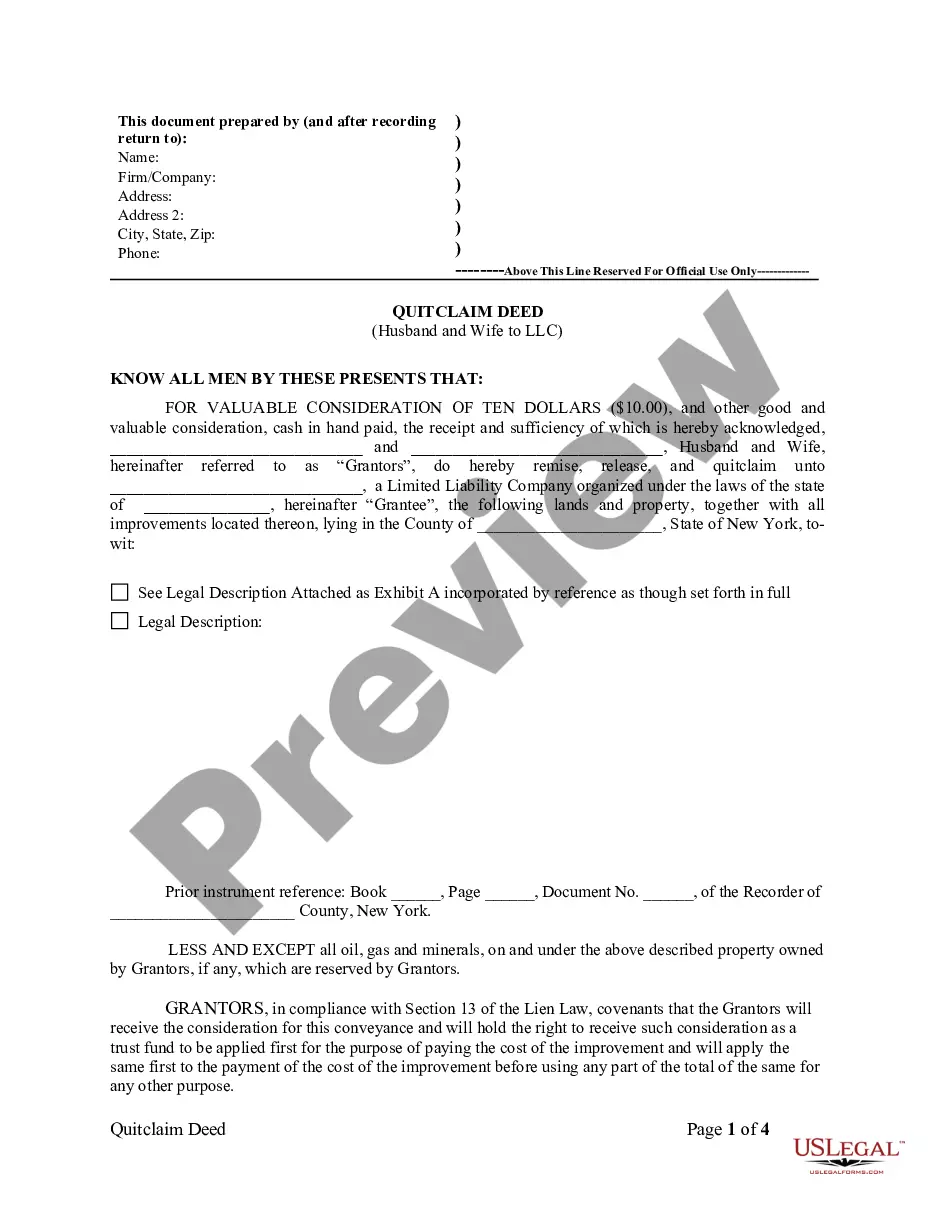

Kings New York Quitclaim Deed from Husband and Wife to LLC

Description

How to fill out New York Quitclaim Deed From Husband And Wife To LLC?

Regardless of one's social or occupational standing, finalizing legal documents is an unfortunate requirement in the current professional landscape.

Frequently, it’s nearly impossible for an individual without legal education to draft such paperwork from scratch, primarily due to the intricate terminology and legal subtleties involved.

This is where US Legal Forms steps in to assist.

Ensure the template you located is appropriate for your area considering that the regulations of one state do not apply to another.

Preview the document and review a brief description (if available) of the situations for which the form can be utilized.

- Our platform offers an extensive collection of over 85,000 ready-made state-specific documents suited for nearly any legal circumstance.

- US Legal Forms also serves as a valuable asset for associates or legal advisors looking to save time with our DIY papers.

- Whether you require the Kings New York Quitclaim Deed from Husband and Wife to LLC or any other forms relevant to your state or locality, everything is easily accessible with US Legal Forms.

- Here’s a quick guide on how to obtain the Kings New York Quitclaim Deed from Husband and Wife to LLC using our reliable platform.

- If you are already a current customer, you can simply Log In to your account to access the desired document.

- However, if you are new to our platform, please make sure to follow these steps before acquiring the Kings New York Quitclaim Deed from Husband and Wife to LLC.

Form popularity

FAQ

One potential disadvantage of placing a property in an LLC is the initial setup and ongoing maintenance costs. While an LLC can provide asset protection, it may require additional fees and compliance with state regulations. It's important to weigh these costs against the benefits of the Kings New York Quitclaim Deed from Husband and Wife to LLC to determine the right choice for your property and financial situation.

Transferring a deed to an LLC can be done through a simple process of drafting a quitclaim deed. You will need to complete the Kings New York Quitclaim Deed from Husband and Wife to LLC, ensuring all necessary info is accurate and relevant. Afterward, you must record the deed with your local county clerk to officially transfer ownership and protect your interests.

Many individuals choose to place their property in an LLC to protect their personal assets from liabilities related to the property. By doing this, they can separate their personal finances from their business investments. Additionally, utilizing the Kings New York Quitclaim Deed from Husband and Wife to LLC streamlines the process of transferring ownership, making it easier to manage and sell property when needed.

A quitclaim deed can be voided for several reasons, including a lack of legal capacity of the granter or if it was signed under duress. Additionally, if there are issues related to the execution or notarization of the deed, it may not hold up in court. When experiencing concerns, utilizing a reliable platform like uslegalforms can help ensure that your Kings New York Quitclaim Deed from Husband and Wife to LLC is executed properly to prevent any future disputes.

The main disadvantage of a quitclaim deed lies in the lack of warranties regarding the property title. This means that the recipient may not have full assurance of ownership rights. In the context of a Kings New York Quitclaim Deed from Husband and Wife to LLC, if any title issues arise, the LLC might face challenges regarding their ownership status.

A quitclaim deed from a husband to his wife transfers any interest he has in a property to her without making promises about the quality of the title. This type of deed is often used in marriage or when couples wish to consolidate property ownership. In a Kings New York Quitclaim Deed from Husband and Wife to LLC scenario, this transfer can help establish clear ownership before the property is transitioned to the LLC.

People use quitclaim deeds to simplify the transfer of property rights. This document is convenient in various situations, including divorce, estate transfers, or when property is being gifted. When a Kings New York Quitclaim Deed from Husband and Wife to LLC is executed, it can help streamline the process of moving ownership into a business structure, making it easier to manage the property.

A quitclaim deed is most commonly used for transferring property ownership without any guarantees about the title's validity. It allows one party to transfer their interest in a property to another party, which is particularly useful in situations like divorce settlements or property gifts. For instance, in a Kings New York Quitclaim Deed from Husband and Wife to LLC, the spouses can seamlessly transfer property to their newly formed company.

Filling out a quitclaim deed in New York involves several steps. Begin by downloading the appropriate form, ensuring it includes the names of the grantor and grantee, along with the property description. Carefully complete all sections of the form, then have it notarized. Finally, file the deed with the local county clerk's office to finalize the transfer. For assistance, the uslegalforms platform offers easily accessible resources to guide you through the process.

A quit claim from husband to wife is a legal document used to transfer ownership rights of property between spouses. This deed effectively removes one spouse's interest in the property and places it entirely under the other's name. It can come into play during marriage, divorce, or estate planning. This type of transaction can also facilitate future moves to an LLC as part of broader financial strategies.