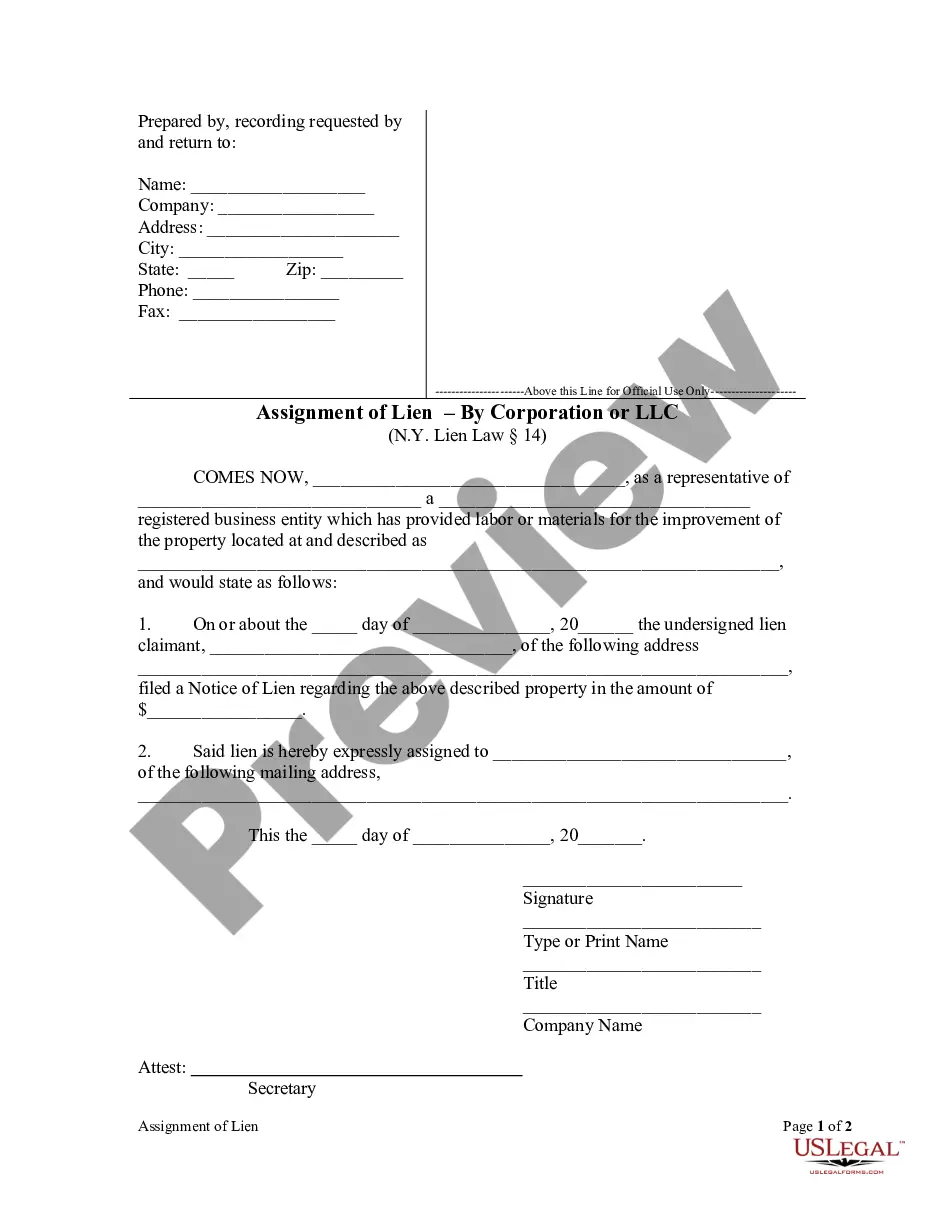

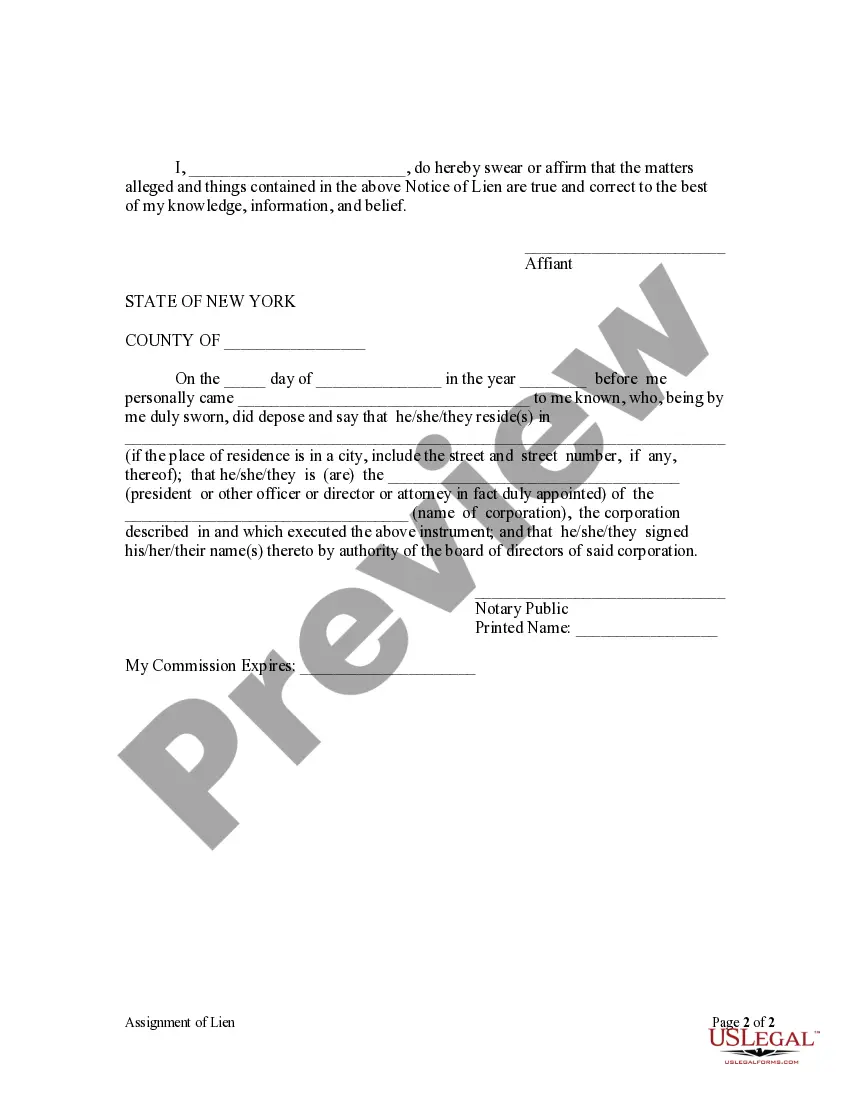

New York law permits a party to assign a lien using a written form signed and acknowledged by the lien holder.

Queens New York Assignment of Lien by Corporation

Description

How to fill out New York Assignment Of Lien By Corporation?

We consistently endeavor to minimize or avert legal complications when managing intricate legal or financial matters.

To achieve this, we seek expert legal solutions which are typically very expensive.

Nonetheless, not every legal issue is that complicated; many can be handled independently.

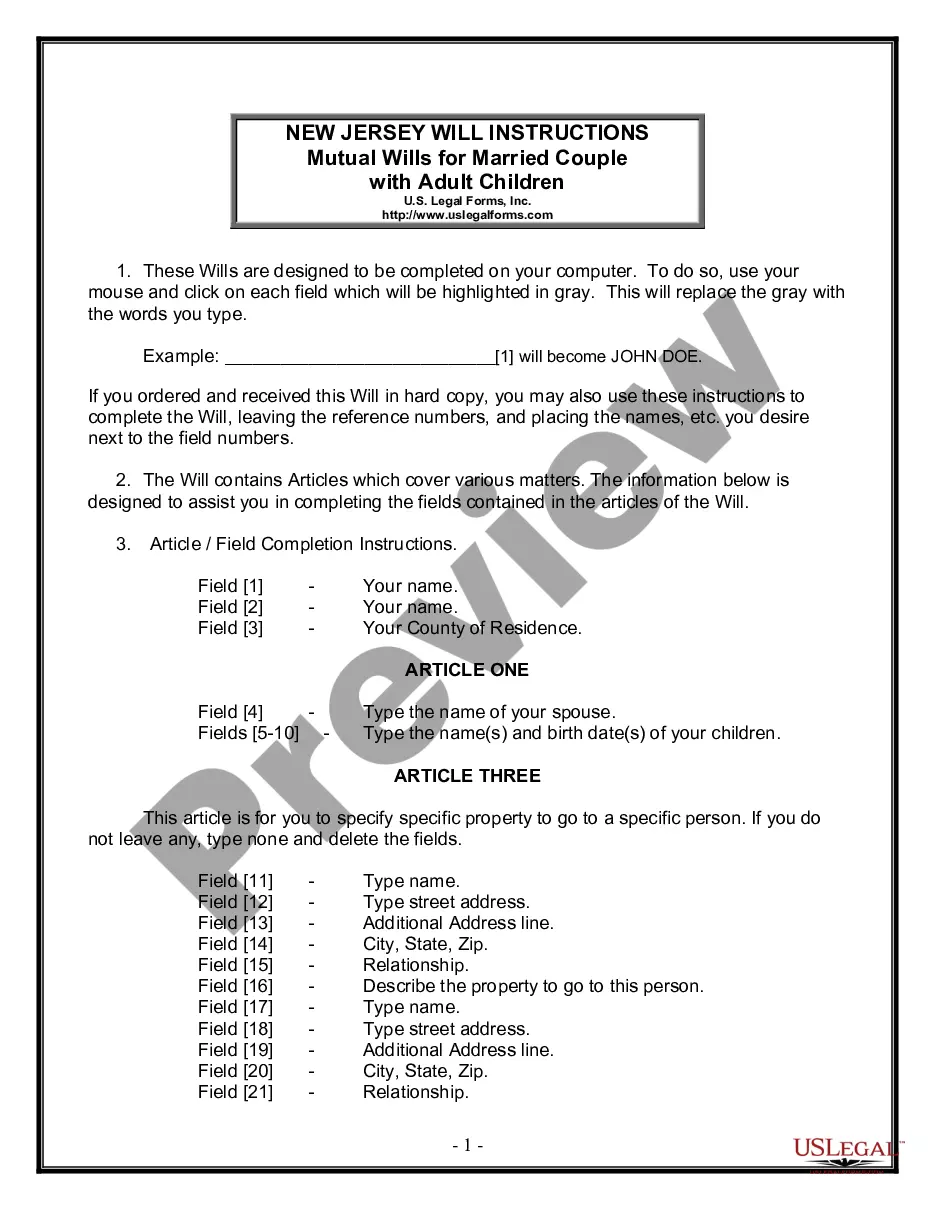

US Legal Forms is an online repository of current DIY legal documents that cover everything from wills and powers of attorney to articles of incorporation and dissolution petitions.

Simply Log In to your account and click the Get button beside it. If you misplace the document, you can always re-download it from the My documents tab. The process is equally simple even if you are not familiar with the site! You can create your account in just a few minutes. Be sure to confirm that the Queens New York Assignment of Lien by Corporation or LLC aligns with the laws and regulations of your locality. Furthermore, it is crucial to read through the description of the form (if provided), and if you notice any inconsistencies with what you originally sought, look for another template. After confirming that the Queens New York Assignment of Lien by Corporation or LLC meets your needs, you can select a subscription plan and proceed to payment. You can then download the document in any preferred file format. For over 24 years, we have assisted millions by providing customizable and up-to-date legal documents. Take advantage of US Legal Forms today to save time and resources!

- Our collection empowers you to manage your affairs without engaging an attorney.

- We provide access to legal form templates that are not always readily available.

- Our templates are tailored to specific states and regions, making the search process much easier.

- Utilize US Legal Forms whenever you need to obtain and download the Queens New York Assignment of Lien by Corporation or LLC or any other form swiftly and securely.

Form popularity

FAQ

To file a UCC in New York, you must complete the appropriate form and submit it to the New York Secretary of State. This process requires you to include specific details about the parties involved and the collateral. If you're looking to understand how your filing relates to a Queens New York Assignment of Lien by Corporation, consider utilizing the resources available on the US Legal Forms platform for a smooth filing experience.

Yes, the UCC applies to individuals when it comes to personal property transactions. It provides a standardized method of securing interests in these assets, which can be beneficial in various financial scenarios. In the context of a Queens New York Assignment of Lien by Corporation, understanding these principles can help you protect your interests more effectively. US Legal Forms can help you find the necessary information for your needs.

To put a lien on a corporation, you typically need to file a lien notice with the appropriate state authorities. It is crucial to follow the guidelines that apply to the specific type of lien you wish to place. If you're dealing with a Queens New York Assignment of Lien by Corporation, be sure to adhere to local laws and procedures. US Legal Forms offers detailed documents to assist you in this process.

Yes, you can file a UCC on an individual, particularly if you have a valid claim against their personal property. This filing serves to secure the right to specific assets in case of a default. Understanding how the Queens New York Assignment of Lien by Corporation works can clarify how this affects your rights and claims. For further clarity, exploring US Legal Forms can provide helpful templates and guidance.

You can file a UCC for an individual at the local or state level, depending on your jurisdiction. In many cases, the Secretary of State’s office is the appropriate location for this filing. To ensure a smooth process related to the Queens New York Assignment of Lien by Corporation, you may want to consult reliable resources, such as those offered on the US Legal Forms platform.

Filing a UCC-1 on yourself allows you to officially declare an interest in your own personal assets. This can provide you with legal protections, especially in financial transactions. Understanding the implications of a Queens New York Assignment of Lien by Corporation can also assist you in making informed decisions. If you want to manage this effectively, US Legal Forms can help you navigate the process.

To perform a lien search in New York, you can start at the New York Department of State's website, where you can access business entity records. This lets you see any filed liens against a corporation or individual. Leveraging resources like the US Legal Forms website will also provide you with a guide on the process of executing a Queens New York Assignment of Lien by Corporation, making your search more efficient.

In Rhode Island, a lien typically lasts for a period of 10 years from the date it is filed. However, it’s essential to know that this period can be extended under certain circumstances. For those interested in the specifics of a Queens New York Assignment of Lien by Corporation, it’s beneficial to consult legal professionals or resources available on the US Legal Forms platform.

To conduct a lien search on a company, start by visiting your state’s Secretary of State website or the local county clerk's office where the business is registered. You can search their online databases by entering the company's name. Additionally, consider using the US Legal Forms platform to access tailored resources for conducting a Queens New York Assignment of Lien by Corporation search, ensuring you get the most accurate and up-to-date information.

Lien Law 75 in New York specifically addresses the requirements for filing certain types of liens related to private projects. It details obligations of property owners, contractors, and subcontractors in the lien process. For those dealing with matters concerning Queens New York Assignment of Lien by Corporation, familiarizing yourself with these legal specifications can be beneficial.