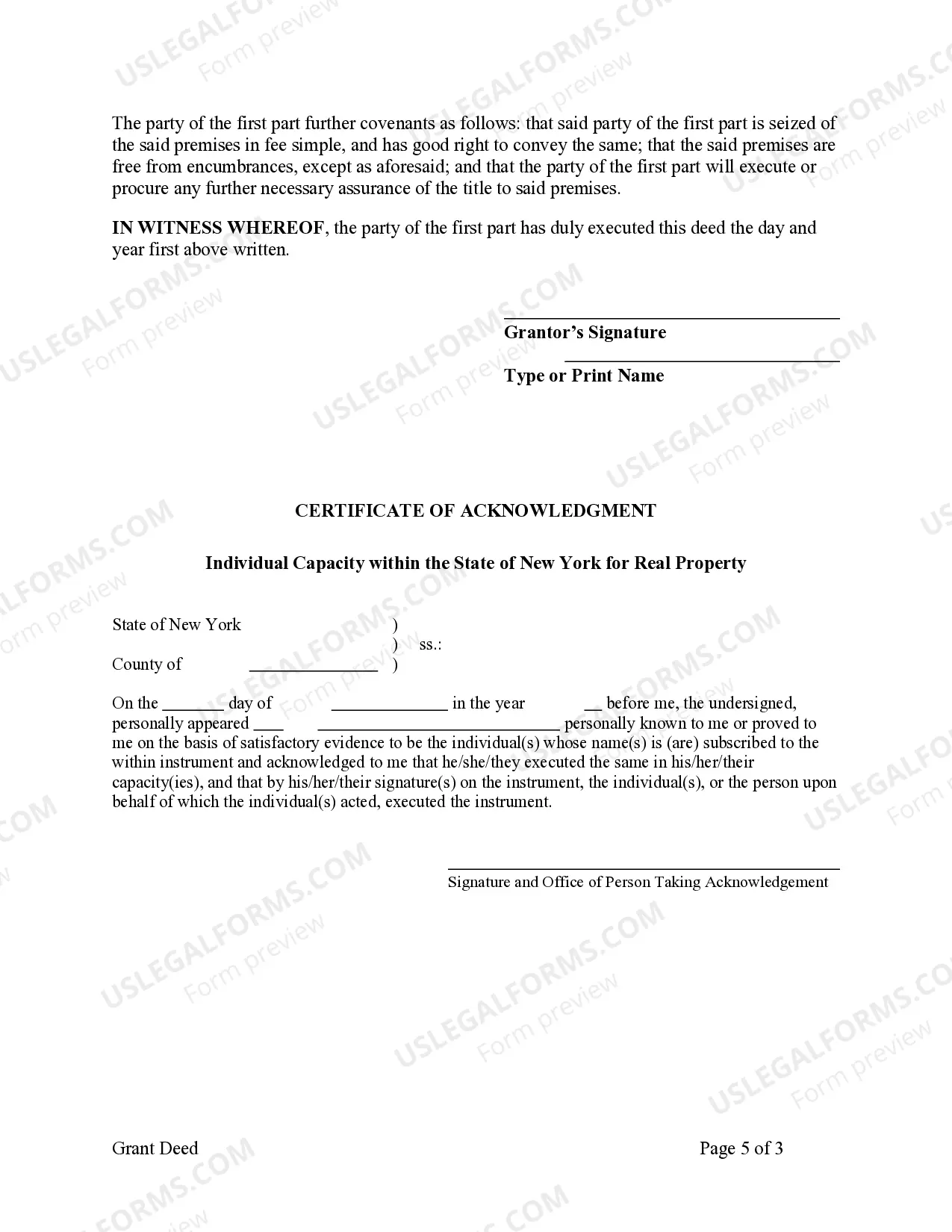

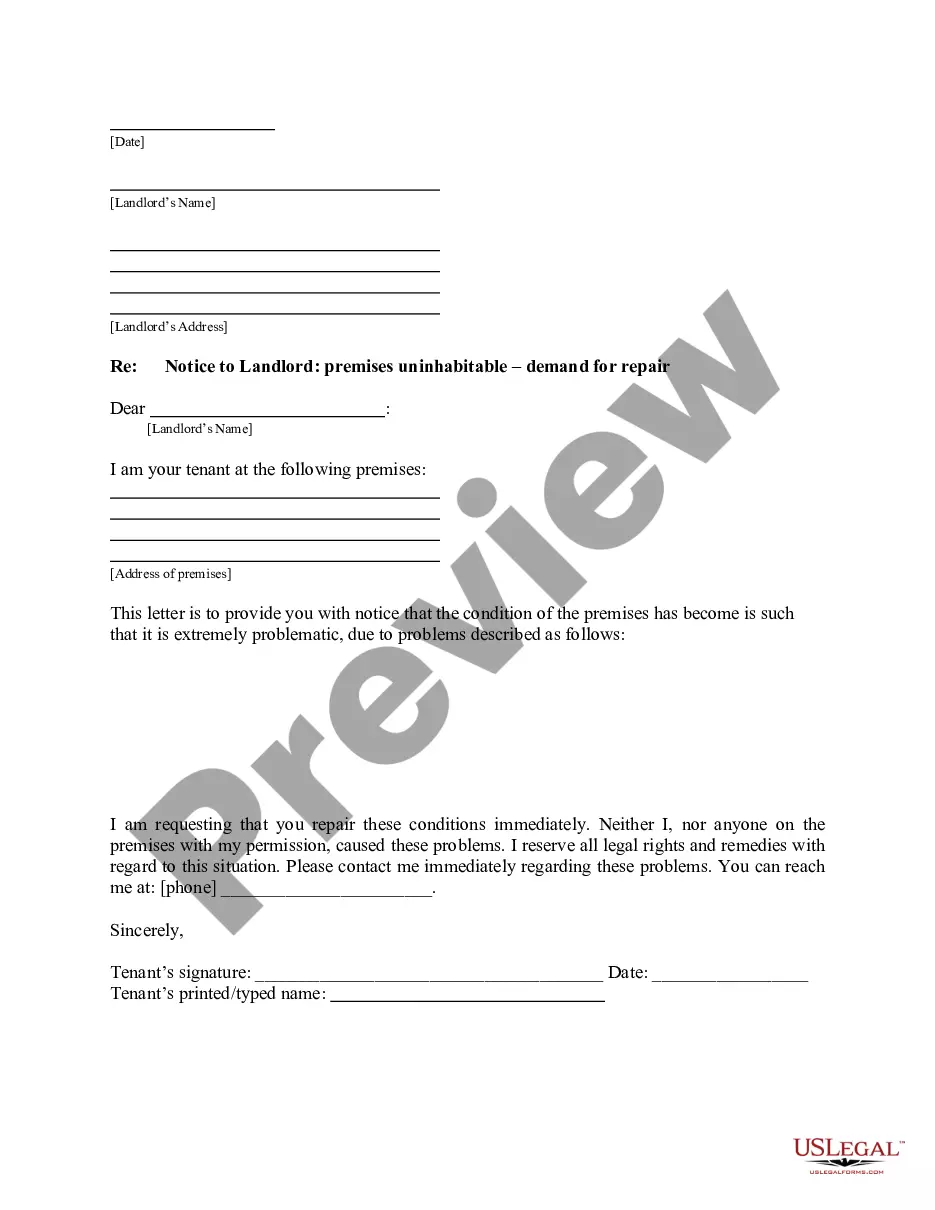

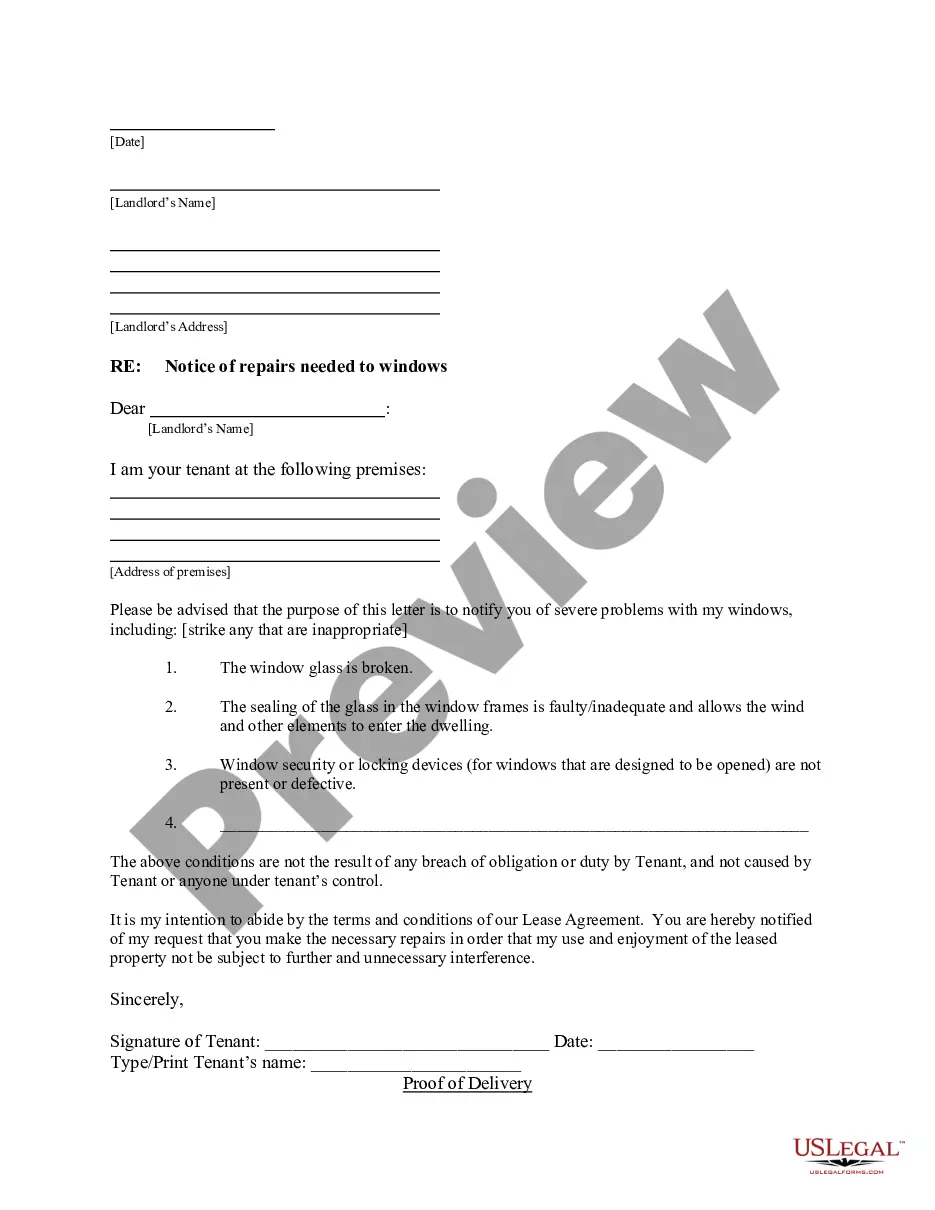

This form is a Grant Deed where the Grantor is an individual and the Grantees are two individuals or husband and wife. This deed complies with all state statutory laws.

Queens New York Grant Deed from an Individual to Two Individuals or Husband and Wife

Description

How to fill out New York Grant Deed From An Individual To Two Individuals Or Husband And Wife?

If you have previously made use of our service, sign in to your account and retrieve the Queens New York Grant Deed from an Individual to Two Individuals or Husband and Wife onto your device by clicking the Download button. Ensure your subscription is active. If it isn’t, renew it according to your payment plan.

If this is your initial encounter with our service, adhere to these straightforward steps to acquire your document.

You have everlasting access to each document you have purchased: you can find it in your profile within the My documents menu whenever you need to revisit it. Utilize the US Legal Forms service to conveniently discover and store any template for your personal or business requirements!

- Ensure you’ve located the appropriate document. Review the description and use the Preview option, if available, to verify if it aligns with your requirements. If it doesn’t fulfill your criteria, utilize the Search tab above to locate the suitable one.

- Purchase the template. Hit the Buy Now button and choose a monthly or yearly subscription plan.

- Establish an account and process a payment. Use your credit card information or the PayPal option to finalize the transaction.

- Acquire your Queens New York Grant Deed from an Individual to Two Individuals or Husband and Wife. Select the file format for your document and download it to your device.

- Finalize your sample. Print it out or utilize professional online editors to complete it and sign it electronically.

Form popularity

FAQ

To add your spouse to a deed in New York, you will need to execute a new Queens New York Grant Deed from an Individual to Two Individuals or Husband and Wife. Start by obtaining the correct form and listing both names appropriately. Then, you must sign the deed in front of a notary and file it with the local county clerk. This process ensures that both of you share ownership and protect your rights.

When creating a Queens New York Grant Deed from an Individual to Two Individuals or Husband and Wife, you can include multiple names on the deed. Typically, there is no strict limit on the number of names; however, it is wise to keep it manageable. Having more than two names can complicate ownership rights and responsibilities. Ensure that all parties understand the implications of shared ownership.

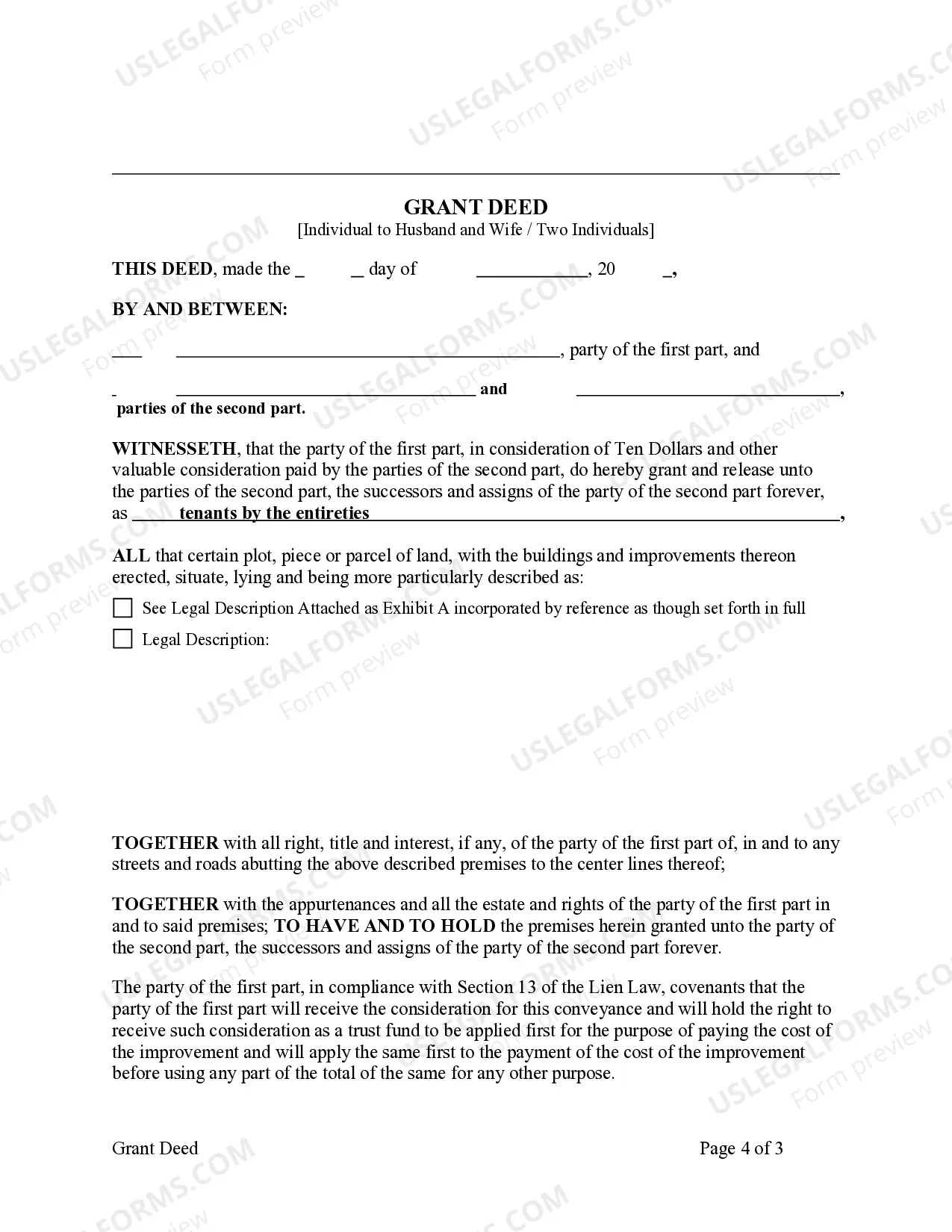

Transferring ownership of a house in New York involves preparing a grant deed that outlines the transfer details. The deed should clearly list the current owner and the new owners, which could be two individuals or a husband and wife. After signing the deed, you must file it with the county clerk’s office to complete the transfer. This process creates a Queens New York Grant Deed from an Individual to Two Individuals or Husband and Wife, officially updating the ownership records.

To add someone to your deed in New York, you need to prepare a new grant deed that reflects the change. This deed must include the names of both the current owner and the new person you are adding, whether they are two individuals or a husband and wife. It’s also important to have the deed notarized and filed with the county clerk where the property is located. By doing this, you will create a Queens New York Grant Deed from an Individual to Two Individuals or Husband and Wife, ensuring the new ownership is legally recognized.

To transfer ownership of a property in New York, you will need to fill out a Queens New York Grant Deed from an Individual to Two Individuals or Husband and Wife. This involves providing the details of the current owner and the new owners, along with a legal description of the property. After completing the deed, you must file it with your local county clerk's office to make it official. Utilizing platforms like USLegalForms can streamline this paperwork and ensure accuracy, making your transfer process easier.

No, you do not necessarily need a lawyer to obtain a Queens New York Grant Deed from an Individual to Two Individuals or Husband and Wife. Many individuals successfully complete this process on their own by using online resources. However, having a legal expert can help ensure that the deed is properly formatted and complies with local regulations. If you prefer guidance, considering platforms like USLegalForms can simplify the process for you.

In New York, a husband and wife are not automatically joint tenants unless this arrangement is explicitly stated in the deed. This means that if you own property together, both parties must agree on and document their ownership status. To avoid ambiguity, it's beneficial to create a Queens New York Grant Deed from an Individual to Two Individuals or Husband and Wife, which can clearly outline the intended ownership structure. Consulting with legal professionals can help ensure your property is set up according to your wishes.

Many married couples choose to own property as joint tenants due to the advantages of shared ownership and the right of survivorship. This arrangement simplifies the transfer of property upon the death of one spouse, allowing the surviving spouse to retain full ownership. However, it is not mandatory for married couples to be joint tenants, as they can also opt for tenants in common or other arrangements. A well-drafted Queens New York Grant Deed from an Individual to Two Individuals or Husband and Wife can reflect their specific preferences.

Yes, New York allows for joint tenancy among property owners. This means individuals can hold title to a property together with the right of survivorship. It is important for co-owners to explicitly establish their ownership structure, especially when creating legal documents such as a Queens New York Grant Deed from an Individual to Two Individuals or Husband and Wife. This ensures clarity on what happens to the property if one owner passes away.

Joint tenancy and tenants in common are two distinct forms of property ownership in New York. Joint tenancy allows co-owners to have equal shares, with the right of survivorship, meaning if one owner dies, the other automatically inherits their share. In contrast, tenants in common can own different shares of the property, and if one owner passes, their share goes to their estate rather than the surviving owners. When creating a Queens New York Grant Deed from an Individual to Two Individuals or Husband and Wife, it’s essential to consider which arrangement suits your needs.