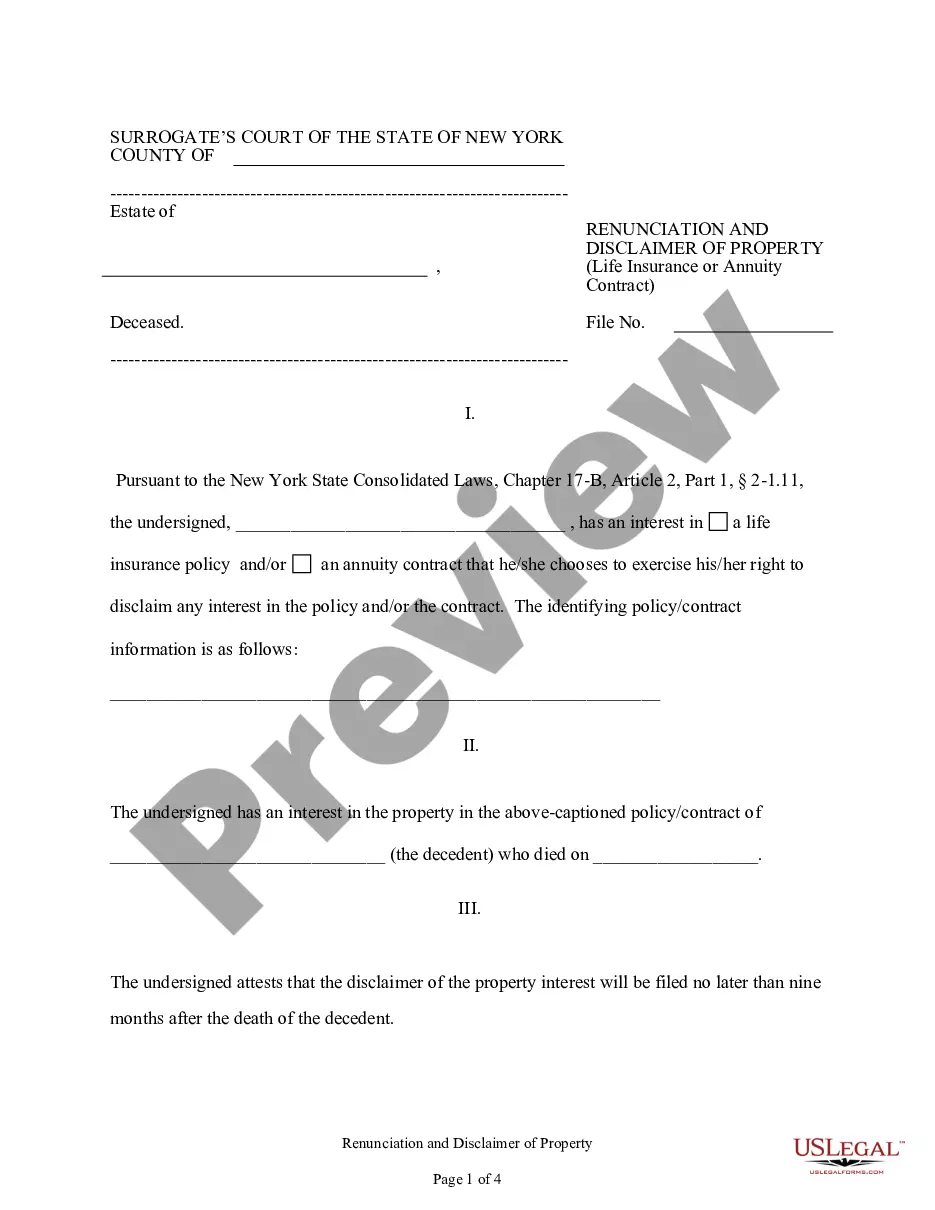

Suffolk New York Renunciation And Disclaimer of Property from Life Insurance or Annuity Contract

Description

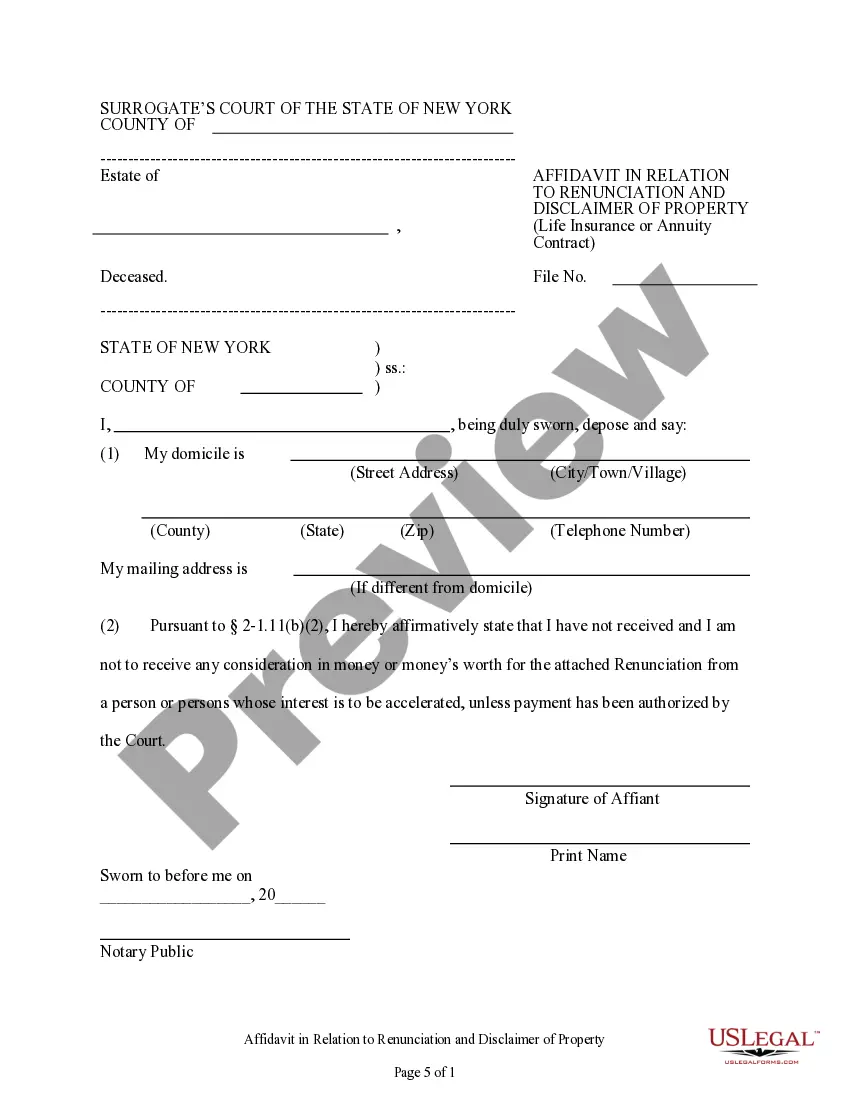

How to fill out New York Renunciation And Disclaimer Of Property From Life Insurance Or Annuity Contract?

If you are searching for a legitimate form, it’s extremely challenging to select a more suitable service than the US Legal Forms website – likely the most comprehensive collections on the web.

With this collection, you can discover thousands of document examples for business and personal needs by categories and states, or keywords.

With our enhanced search feature, obtaining the latest Suffolk New York Renunciation And Disclaimer of Property from Life Insurance or Annuity Contract is as simple as 1-2-3.

Complete the payment process. Use your credit card or PayPal account to finalize the registration process.

Obtain the form. Choose the format and download it to your device.

- Additionally, the accuracy of every record is validated by a group of proficient lawyers who consistently review the templates on our platform and refresh them according to the most recent state and county regulations.

- If you are already familiar with our platform and possess a registered account, all you need to do to access the Suffolk New York Renunciation And Disclaimer of Property from Life Insurance or Annuity Contract is to Log In to your account and click the Download option.

- If you are using US Legal Forms for the first time, simply adhere to the instructions below.

- Ensure you have located the template you require. Review its description and utilize the Preview feature (if available) to examine its content. If it doesn’t fulfill your needs, employ the Search option at the top of the page to find the necessary document.

- Confirm your selection. Click the Buy now button. After that, select your preferred pricing plan and provide details to register an account.

Form popularity

FAQ

The holder of a life estate does not have the right to sell or otherwise transfer the property without the approval of the reversion holder. This means that while they can enjoy the property, they cannot pass it on or leverage it financially. Understanding this limitation is helpful when considering the Suffolk New York Renunciation And Disclaimer of Property from Life Insurance or Annuity Contract and planning your estate.

A life estate allows an individual to use and enjoy a property during their lifetime, while a reversion indicates that the property returns to the original owner or their heirs after the life tenant passes away. This distinction is important for estate planning and understanding property rights. If you are navigating issues related to the Suffolk New York Renunciation And Disclaimer of Property from Life Insurance or Annuity Contract, knowing these differences can assist your decisions.

When a life estate is created alongside a retained reversion, the rights for certain actions such as selling or transferring the property do not apply to the life tenant. The life tenant cannot alter the property without the grantor’s permission. Understanding these limitations is essential, especially in the context of Suffolk New York Renunciation And Disclaimer of Property from Life Insurance or Annuity Contract.

Reversion refers to the return of property ownership to the original owner after the termination of a life estate. In simpler terms, when a life estate ends, the rights revert back to the grantor or their heirs. This concept is crucial when dealing with the Suffolk New York Renunciation And Disclaimer of Property from Life Insurance or Annuity Contract, as it helps clarify who will ultimately control the property.

The statute of renunciation in New York State provides a legal framework for individuals to renounce their rights to property, including interests from life insurance or annuity contracts. This statute allows individuals to disclaim their rights formally, which is important for estate planning. If you are considering the Suffolk New York Renunciation And Disclaimer of Property from Life Insurance or Annuity Contract, understanding this law can guide your decisions.

Reversing a life estate deed involves a legal process, often requiring documentation that reflects the change in property ownership. You typically need to file a formal request and may need to consult with a legal expert familiar with Suffolk New York Renunciation And Disclaimer of Property from Life Insurance or Annuity Contract. This process can help ensure that your intentions regarding property rights are followed accurately.

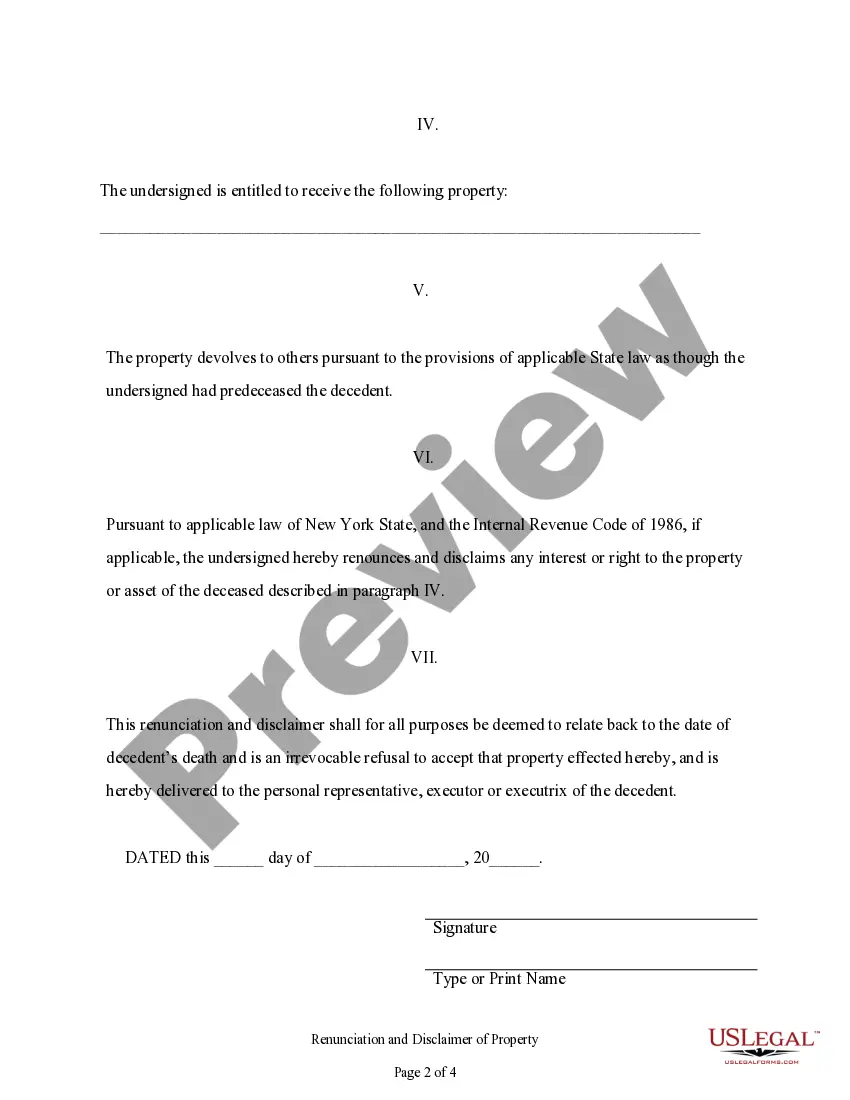

Renouncing and disclaiming inheritance essentially refer to the same act of refusing property. However, the terms may vary based on context and legal specifications. In the context of the Suffolk New York Renunciation And Disclaimer of Property from Life Insurance or Annuity Contract, to renounce may be more about the act itself, while to disclaim involves the formal/legal procedures. Understanding this distinction can guide your decision-making process.

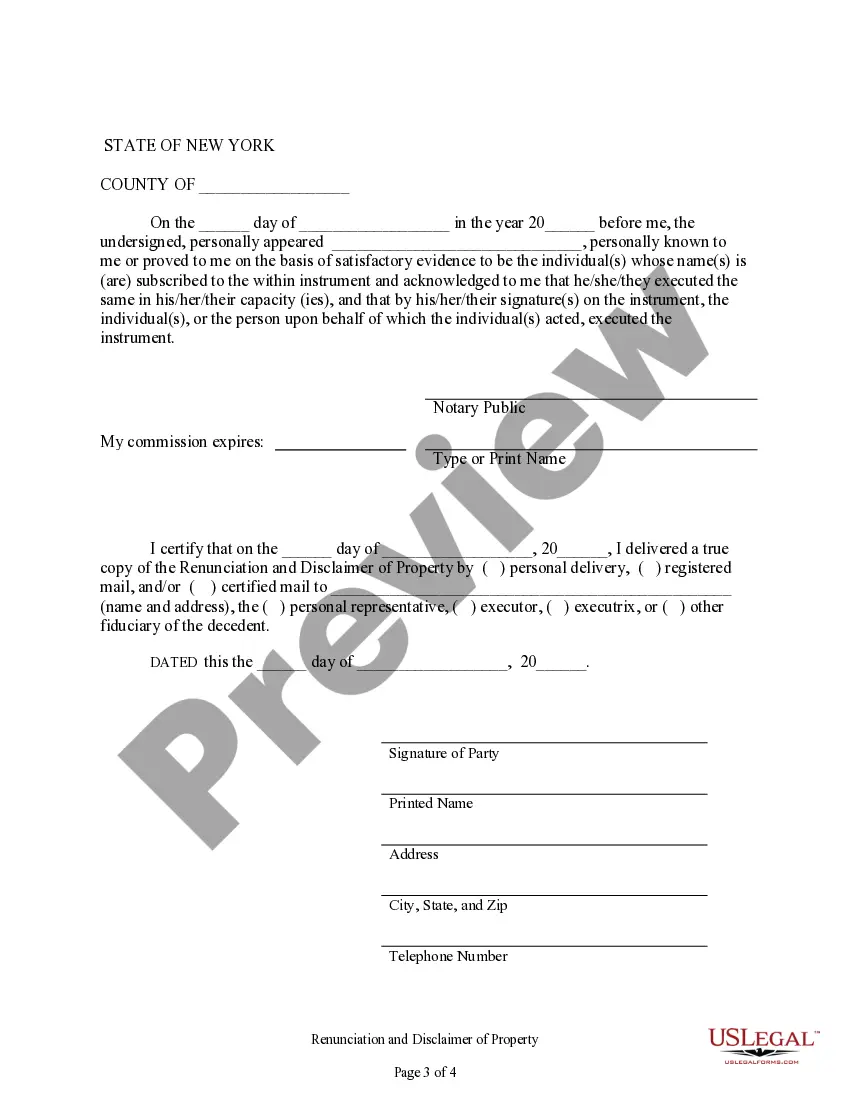

To disclaim an inheritance in New York state, you must formally acknowledge your decision through a written document. This relates closely to the Suffolk New York Renunciation And Disclaimer of Property from Life Insurance or Annuity Contract, which specifies how to proceed. Be certain to detail your relationship to the estate and file the disclaimer according to legal requirements. Timeliness is critical to ensure your disclaimer is valid.

Writing a disclaimer of inheritance involves creating a document that clearly outlines your decision to renounce the property. Begin with your information, followed by the decedent's details, and reference the Suffolk New York Renunciation And Disclaimer of Property from Life Insurance or Annuity Contract. Make sure to include a clear statement of your intent to disclaim and sign the document before submitting it to the appropriate entity.

The process to disclaim an inheritance typically involves understanding your rights and filing a disclaimer document. First, you need to obtain the legal forms required for the Suffolk New York Renunciation And Disclaimer of Property from Life Insurance or Annuity Contract. Next, clearly state your intention to refuse the inheritance and submit the signed documents to the relevant authorities. Ensure this is completed within the legally allowed timeframe for disclaiming property.