Nassau New York Renunciation And Disclaimer of Property from Life Insurance or Annuity Contract

Description

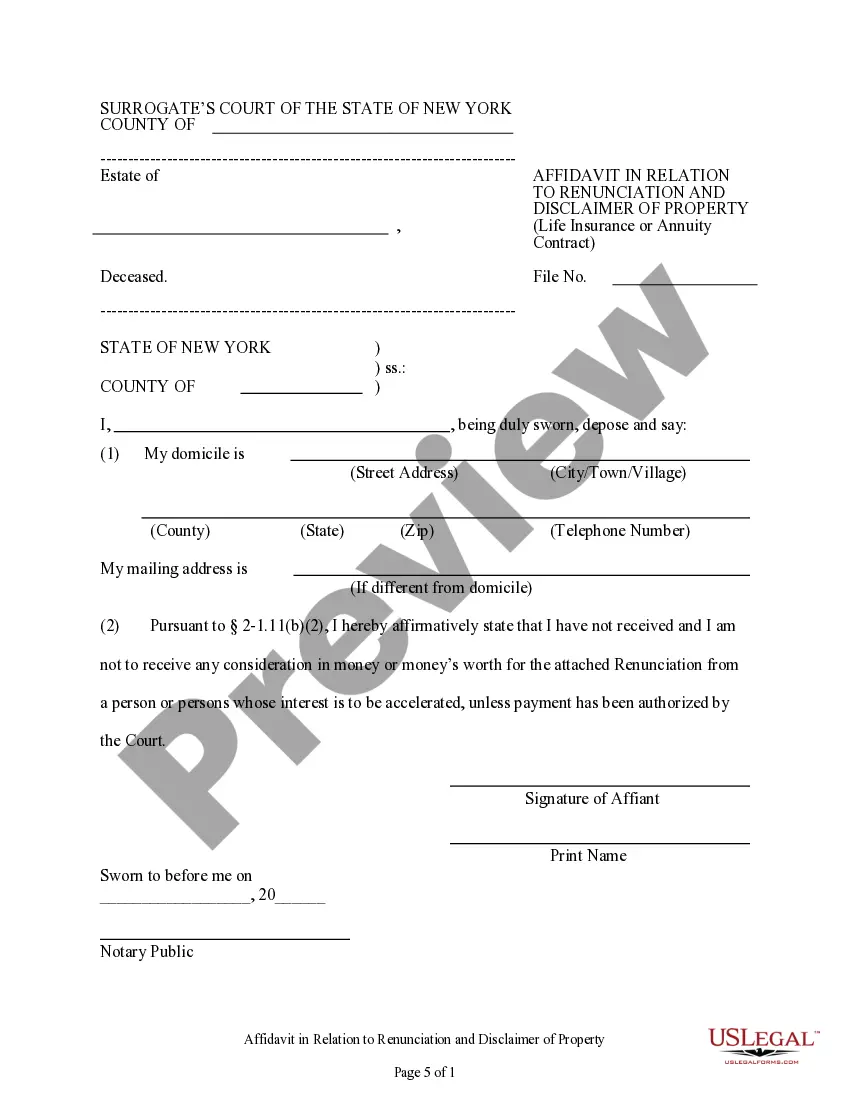

How to fill out New York Renunciation And Disclaimer Of Property From Life Insurance Or Annuity Contract?

Locating validated templates tailored to your local regulations can be difficult unless you utilize the US Legal Forms repository.

It’s an online compilation of over 85,000 legal documents catering to both personal and professional requirements and various real-world situations.

All the files are appropriately categorized by area of application and jurisdiction, making it as quick and effortless as ABC to search for the Nassau New York Renunciation And Disclaimer of Property from Life Insurance or Annuity Contract.

Maintaining paperwork organized and compliant with legal standards is of utmost importance. Take advantage of the US Legal Forms library to always have crucial document templates at your fingertips!

- Look at the Preview mode and form description.

- Ensure you’ve chosen the accurate one that fulfills your requirements and aligns with your local jurisdiction criteria.

- Search for another template, if needed.

- If you notice any discrepancy, use the Search tab above to find the correct one. If it meets your needs, proceed to the subsequent step.

- Purchase the document.

Form popularity

FAQ

The statute of renunciation in New York State allows individuals to formally refuse the inheritance or benefits from an estate, including property from life insurance or annuity contracts. This legal process enables beneficiaries to disclaim their rights willingly, ensuring that the property passes to other rightful heirs or beneficiaries without incurring tax liabilities. When considering the Nassau New York Renunciation and Disclaimer of Property from Life Insurance or Annuity Contract, it's crucial to follow specific guidelines to ensure compliance with state laws. For personalized assistance in navigating this complex process, consider using the US Legal Forms platform, which provides essential resources and forms tailored to your needs.

An example of a disclaimer of interest is when a beneficiary receives a life insurance policy but chooses to disclaim it, allowing the proceeds to pass to another designated beneficiary. This can occur in situations where someone prefers not to take on the tax implications associated with the inheritance. In the context of Nassau, New York, the Renunciation And Disclaimer of Property from Life Insurance or Annuity Contract provides a structured way to execute this decision. Utilizing this process helps ensure that the deceased's wishes are respected while benefiting the estate's overall management.

A disclaimer of interest allows a person to refuse an inheritance from a deceased person's estate. This option can be beneficial if accepting the inheritance may lead to unintended tax consequences or legal complications. In Nassau, New York, individuals may utilize the Renunciation And Disclaimer of Property from Life Insurance or Annuity Contract to formally decline such inheritances. It's a strategic decision to simplify your estate planning and ensure that assets go to other beneficiaries.

To renounce an inheritance, begin by reviewing the laws specific to your state, such as those governing the Nassau New York Renunciation And Disclaimer of Property from Life Insurance or Annuity Contract. Prepare a written renunciation that clearly states your decision, specifying the property involved. Submitting this renunciation to the estate's executor or administrator is crucial for it to be legally recognized. If you need assistance with the documentation, consider using USLegalForms for a streamlined solution.

A letter of instruction for heirs and beneficiaries should provide clear guidance about your wishes regarding your estate. Begin with a warm introduction, then outline specific instructions related to various assets, including any life insurance or annuity contracts. By citing the Nassau New York Renunciation And Disclaimer of Property from Life Insurance or Annuity Contract, you can clarify how you wish certain properties to be handled. This letter is a valuable resource for your loved ones during a challenging time.

To give up an inheritance, you will need to prepare a formal renunciation document. This document should specify the property you are renouncing, and it must adhere to the requirements of the Nassau New York Renunciation And Disclaimer of Property from Life Insurance or Annuity Contract. You may also need to file this document with the probate court, so using a service like USLegalForms can ensure that you have the correct paperwork to facilitate the process smoothly.

To write a letter declining an inheritance, start by clearly stating your intention to renounce the property. Include your full name, address, and the details of the estate involved, showing that you understand the context. It’s important to mention the specific asset, such as life insurance or annuity contracts, as part of the Nassau New York Renunciation And Disclaimer of Property from Life Insurance or Annuity Contract process. Finally, sign your letter and send it to the executor or administrator of the estate.

The choice between the terms renounce and disclaim often depends on the legal context. In terms of accepting or rejecting an inheritance or entitlement, disclaiming is the more commonly used term, while renouncing may refer to broader obligations or rights. To navigate the specifics of Nassau New York Renunciation And Disclaimer of Property from Life Insurance or Annuity Contract, one should be aware of these distinctions.

Renunciation and disclaimer of interests in an estate allows individuals to voluntarily give up their rights to inherit a portion or all of an estate. This can include assets like life insurance or annuities, and typically occurs when a beneficiary does not wish to accept the inheritance due to financial obligations or personal reasons. Understanding these concepts within Nassau New York Renunciation And Disclaimer of Property from Life Insurance or Annuity Contract is vital for effective estate planning.

Renouncing and rejecting may seem interchangeable, but they have different connotations in legal terms. Renouncing usually indicates a voluntary choice to relinquish a right, while rejecting often implies a refusal of what has been offered. In the context of Nassau New York Renunciation And Disclaimer of Property from Life Insurance or Annuity Contract, understanding these nuances helps in making informed decisions.