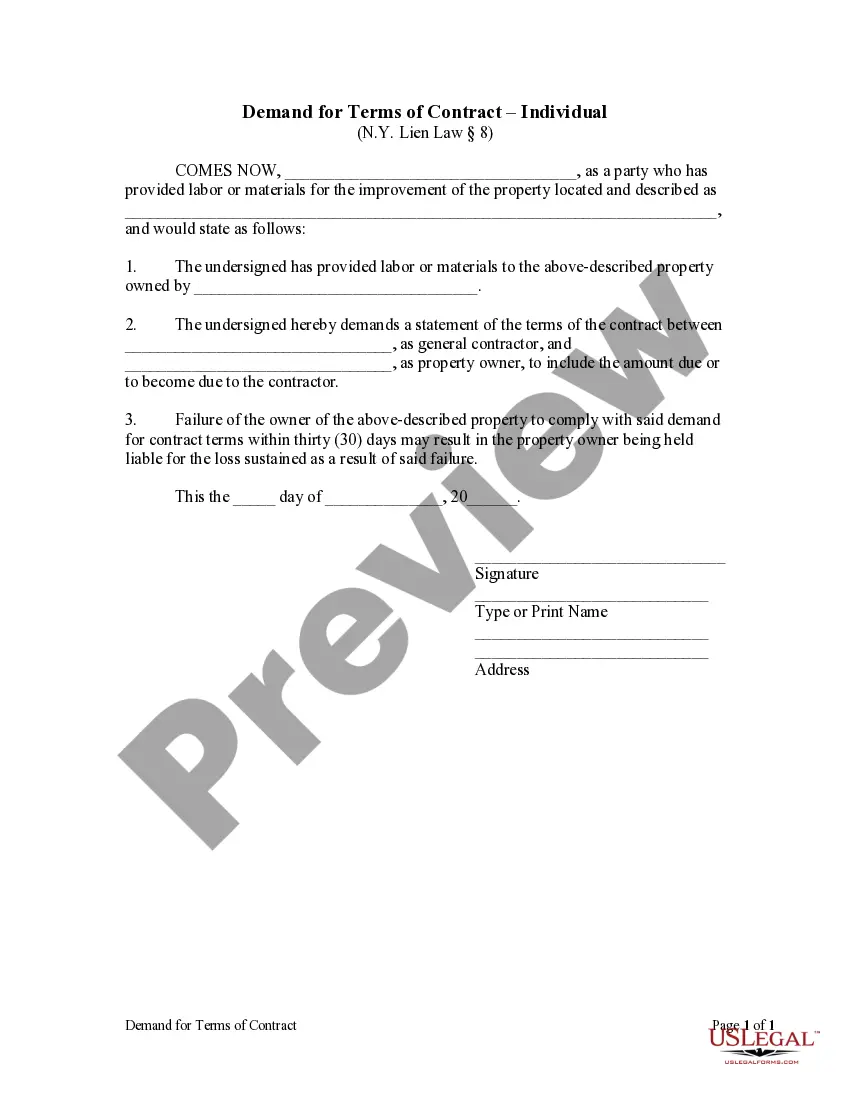

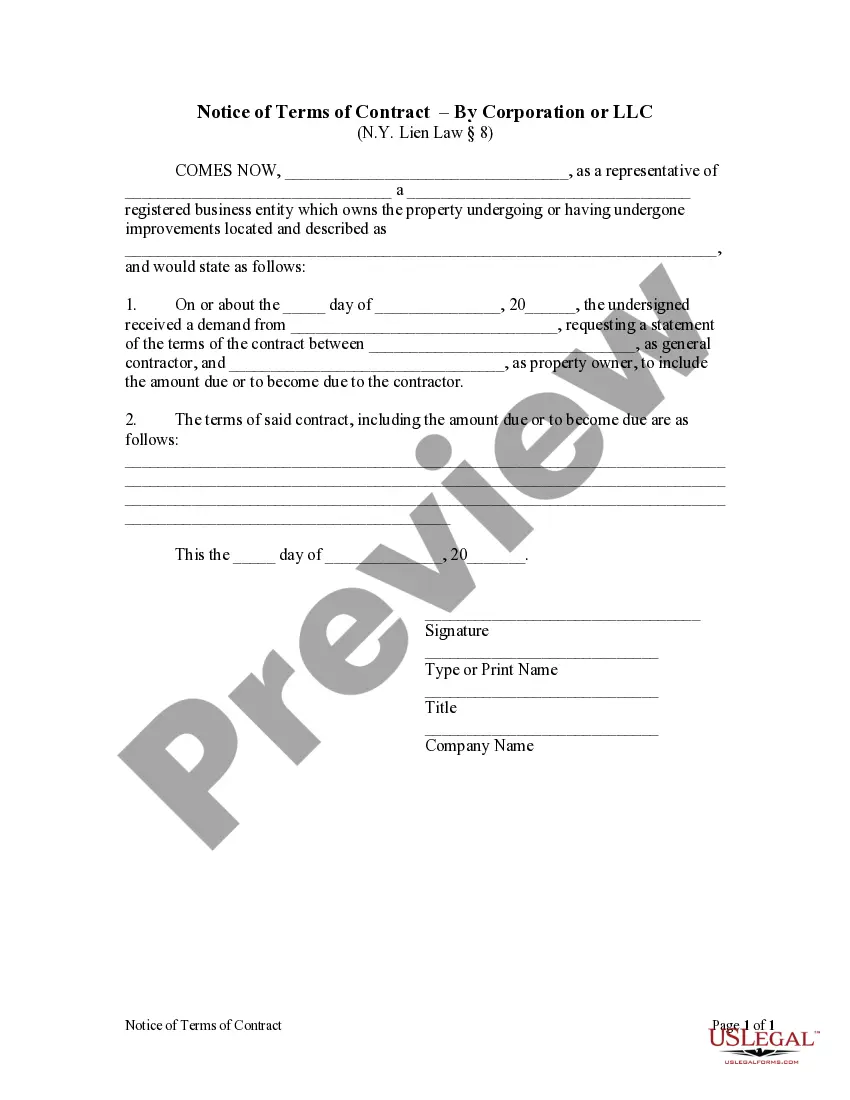

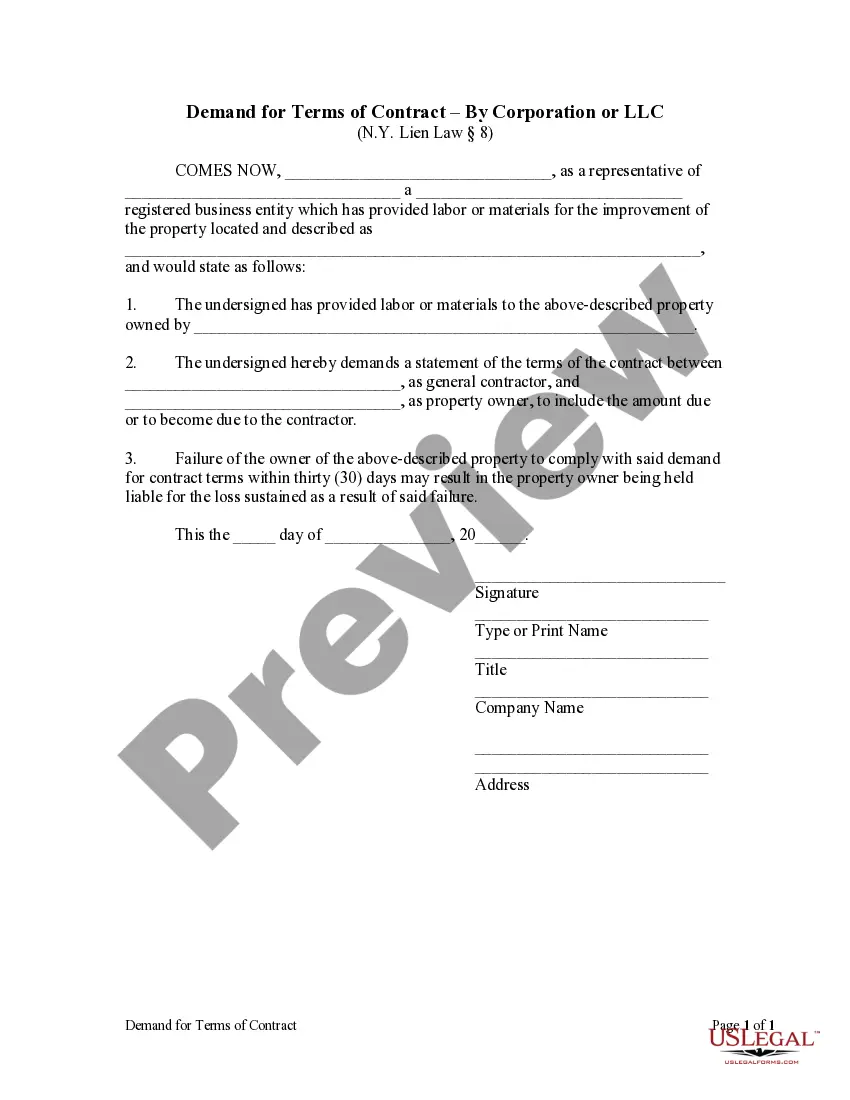

New York statutes provide that a subcontractor, laborer, or materialman providing labor or materials to a contractor or subcontractor may issue a written demand to the property owner for the terms of the contract between the contractor and the property owner. The owner is required to provide the terms of said contract within thirty (30) days or be held liable for any damages that result.

Kings New York Demand for Terms of Contract by Corporation

Description

How to fill out New York Demand For Terms Of Contract By Corporation?

If you have previously engaged our service, Log In to your profile and download the Kings New York Demand for Terms of Contract by Corporation or LLC onto your device by clicking the Download button. Ensure your subscription is active. If it isn't, renew it based on your payment plan.

If this is your initial experience with our service, adhere to these straightforward steps to acquire your document.

You have continuous access to every document you have purchased: you can find it in your profile under the My documents section whenever you need to use it again. Utilize the US Legal Forms service to easily locate and save any template for your personal or business needs!

- Confirm you’ve found a suitable document. Review the details and utilize the Preview feature, if accessible, to determine if it fulfills your requirements. If it doesn't suit you, employ the Search tab above to find the correct one.

- Purchase the template. Hit the Buy Now button and select either a monthly or yearly subscription option.

- Create an account and process a payment. Provide your credit card information or choose the PayPal option to finalize the payment.

- Acquire your Kings New York Demand for Terms of Contract by Corporation or LLC. Select the file format for your document and store it on your device.

- Fill out your sample. Print it or utilize professional online editors to complete it and sign it digitally.

Form popularity

FAQ

The commercial rent tax threshold in New York is established for businesses renting commercial space exceeding $250,000 annually. This tax applies to businesses accordingly, influencing their financial planning. Understanding how the Kings New York Demand for Terms of Contract by Corporation interacts with these financial obligations is essential for corporations. Proper legal guidance can help navigate the complexities of commercial rent agreements.

A commercial vehicle in New York is typically defined as any vehicle used for business purposes, including transport of goods or services. The classification includes trucks, vans, and vehicles over a certain weight or size. Knowing how this relates to the Kings New York Demand for Terms of Contract by Corporation can help businesses establish compliance in their operations. Awareness of these regulations helps avoid legal complications.

A note of issue is a document filed to indicate that a case is ready for trial. It marks the transition from pre-trial procedures to trial preparation. Understanding the implications of the Kings New York Demand for Terms of Contract by Corporation helps in managing this phase effectively. Businesses should ensure all necessary documentation is in order before filing a note of issue.

To file a notice of appearance in New York, you must complete the appropriate form and submit it to the court where the case is pending. This form notifies the court and other parties of your representation. By understanding the Kings New York Demand for Terms of Contract by Corporation, you can better navigate this process. Legal assistance may streamline this filing for corporations involved in contractual agreements.

Threshold law in New York refers to specific monetary values that determine the jurisdiction and type of court handling a case. Generally, certain thresholds must be met for cases to proceed in the specialized divisions, such as the Commercial Division. The Kings New York Demand for Terms of Contract by Corporation provides clear insight into handling contractual disputes under these laws. Ensuring awareness of these thresholds can significantly impact legal strategies.

The commercial division in New York typically operates with a threshold of $500,000 in controversy. This threshold distinguishes the complex commercial cases that require specialized handling from standard cases. Familiarity with the Kings New York Demand for Terms of Contract by Corporation can enhance your understanding of this threshold. Proper preparation ensures businesses can effectively engage with the legal process.

A summons with notice is a legal document that informs a party of a lawsuit and provides a brief description of the claims. It allows the plaintiff to initiate legal proceedings without providing a detailed complaint upfront. Companies must know how the Kings New York Demand for Terms of Contract by Corporation applies to this process to ensure compliance. This knowledge helps avoid potential issues during litigation.

The threshold for the New York Commercial Division involves cases with a monetary value exceeding $500,000. This division provides a unique environment tailored for complex commercial disputes. Understanding the Kings New York Demand for Terms of Contract by Corporation is crucial for effectively navigating these cases. Thus, businesses should be well-versed in these thresholds to manage their legal strategies.

An example of unconscionable conduct is when a lender imposes exceedingly high interest rates on a borrower, who has no alternative options due to their financial situation. This scenario illustrates a stark imbalance in power and fairness within the contractual relationship. For businesses, it’s crucial to avoid such practices while adhering to the Kings New York Demand for Terms of Contract by Corporation.

Procedural unconscionability pertains to the circumstances in which a contract was formed, such as lack of negotiation or information asymmetry. Substantive unconscionability, however, refers to the terms themselves and whether they are unreasonably favorable to one party. Both types are important to consider in the context of the Kings New York Demand for Terms of Contract by Corporation to avoid legal pitfalls.