Las Vegas Nevada Notice of Assignment to Living Trust

Description

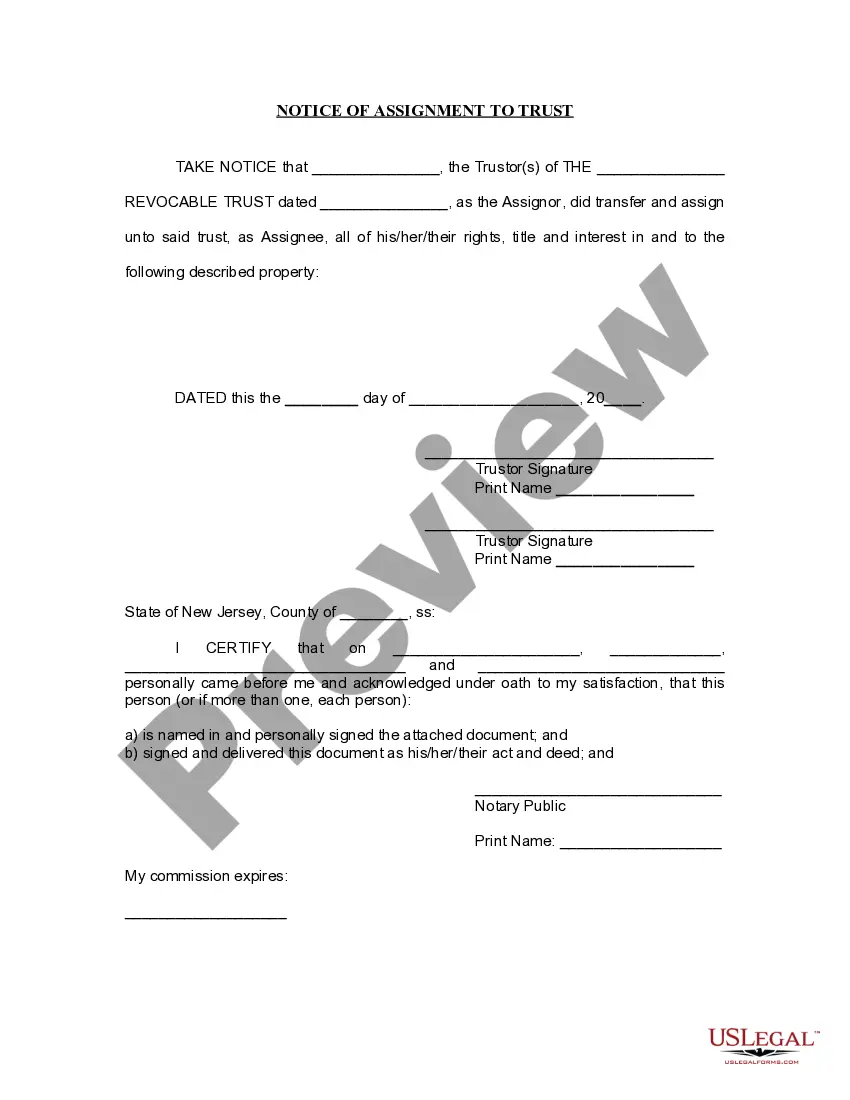

trustor(s) of the revocable trust transferred and assigned his or her or their rights, title and interest in and to certain described property to the trust.

How to fill out Nevada Notice Of Assignment To Living Trust?

If you have previously utilized our service, sign in to your account and download the Las Vegas Nevada Notice of Assignment to Living Trust onto your device by clicking the Download button. Ensure your subscription is active. If it isn’t, renew it according to your payment plan.

If this is your initial encounter with our service, follow these straightforward steps to acquire your document.

You have indefinite access to every document you have purchased: you can locate it in your profile within the My documents menu whenever you need to access it again. Utilize the US Legal Forms service to swiftly find and download any template for your personal or professional purposes!

- Ensure you’ve found the correct document. Review the description and use the Preview feature, if accessible, to verify if it satisfies your requirements. If it doesn’t fulfill your needs, utilize the Search tab above to find the suitable one.

- Acquire the template. Hit the Buy Now button and select a monthly or yearly subscription plan.

- Create an account and process a payment. Use your credit card information or the PayPal option to finalize the purchase.

- Obtain your Las Vegas Nevada Notice of Assignment to Living Trust. Choose the file format for your document and save it to your device.

- Fill out your template. Print it or utilize professional online editors to complete it and sign it digitally.

Form popularity

FAQ

Should I Record My Trust? The Clark County, Nevada, Recorder's Office (which serves Las Vegas, Henderson, Boulder City, North Las Vegas, Mesquite among other towns) will accept your trust for filing if you want. It's your choice whether to record the trust or not.

The short answer is no. One of the great benefits of a living trust in this era ? where is it difficult to keep anything private and out of the public domain ? is that a living trust is confidential. It does not need to be recorded, filed, or registered except in certain circumstances discussed below.

To transfer real property into your Trust, a new deed reflecting the name of the Trust must be executed, notarized and recorded with the County Recorder in the County where the property is located. Care must be taken that the exact legal description in the existing deed appears on the new deed.

A living trust in Nevada can cost significantly different amounts depending on how you go about setting it up. If you decide to go at it alone ? for instance, with the help of a book or an online guide ? it may run you $200 or less.

To make a living trust in Nevada, you: Choose whether to make an individual or shared trust. Decide what property to include in the trust. Choose a successor trustee. Decide who will be the trust's beneficiaries?that is, who will get the trust property. Create the trust document.

A Nevada Revocable Living Trust prevents your estate from having to be submitted to the probate process primarily because the Revocable Living Trust is a separate legal entity created during your life to hold your estate assets. However, you still control everything (unless you become incapacitated/pass away).

Privacy is one of the key benefits of a living trust Nevada. A will becomes public record when it goes through probate. A trust does not become public record. Your assets, beneficiaries, and the terms of the trust remain private.