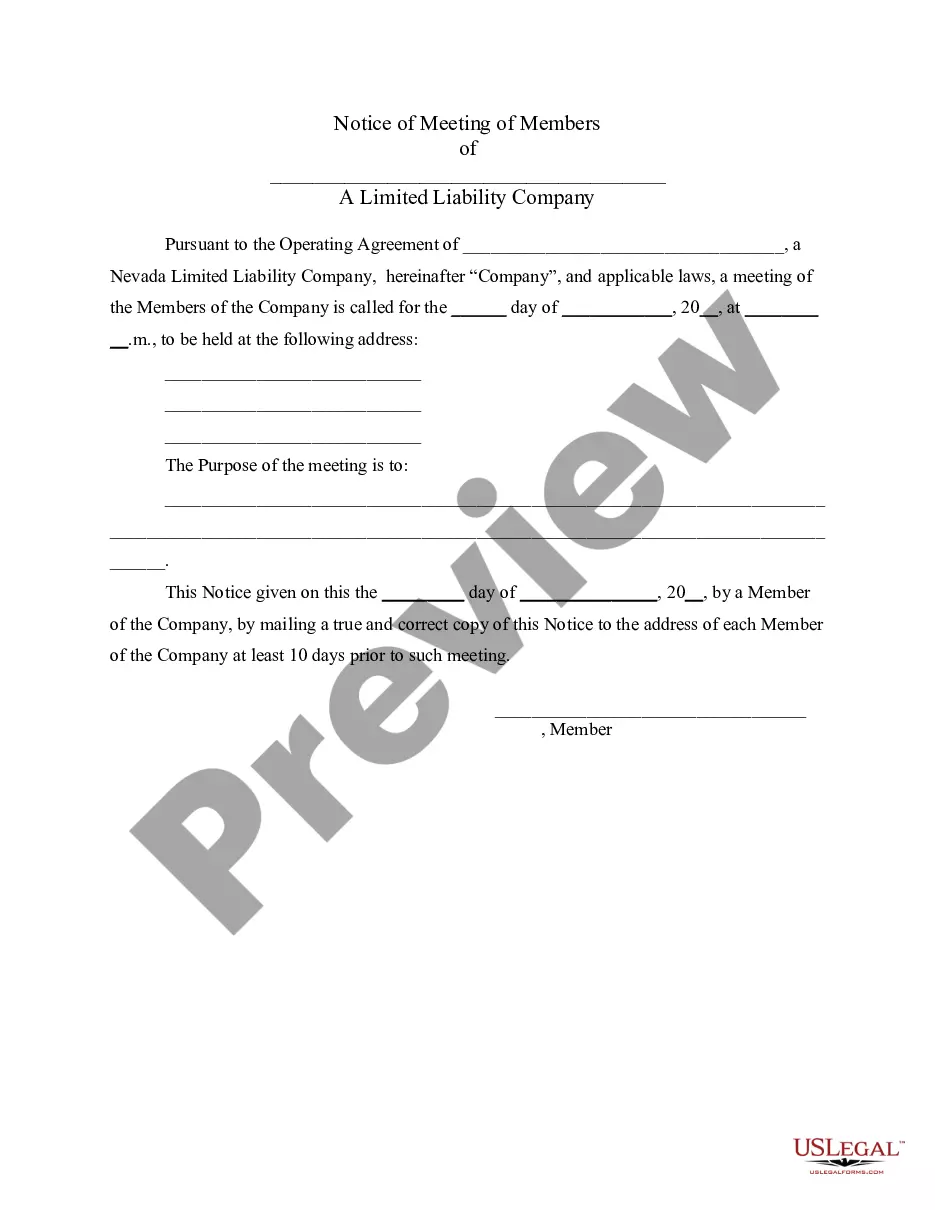

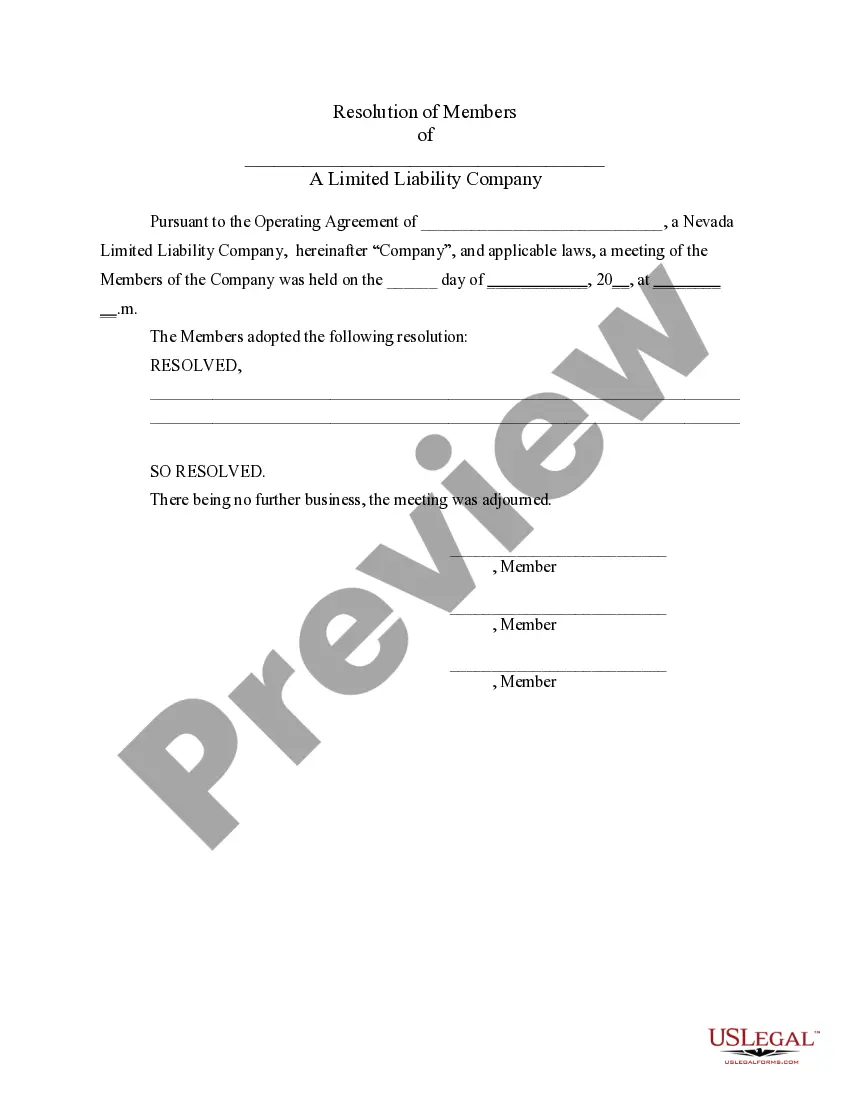

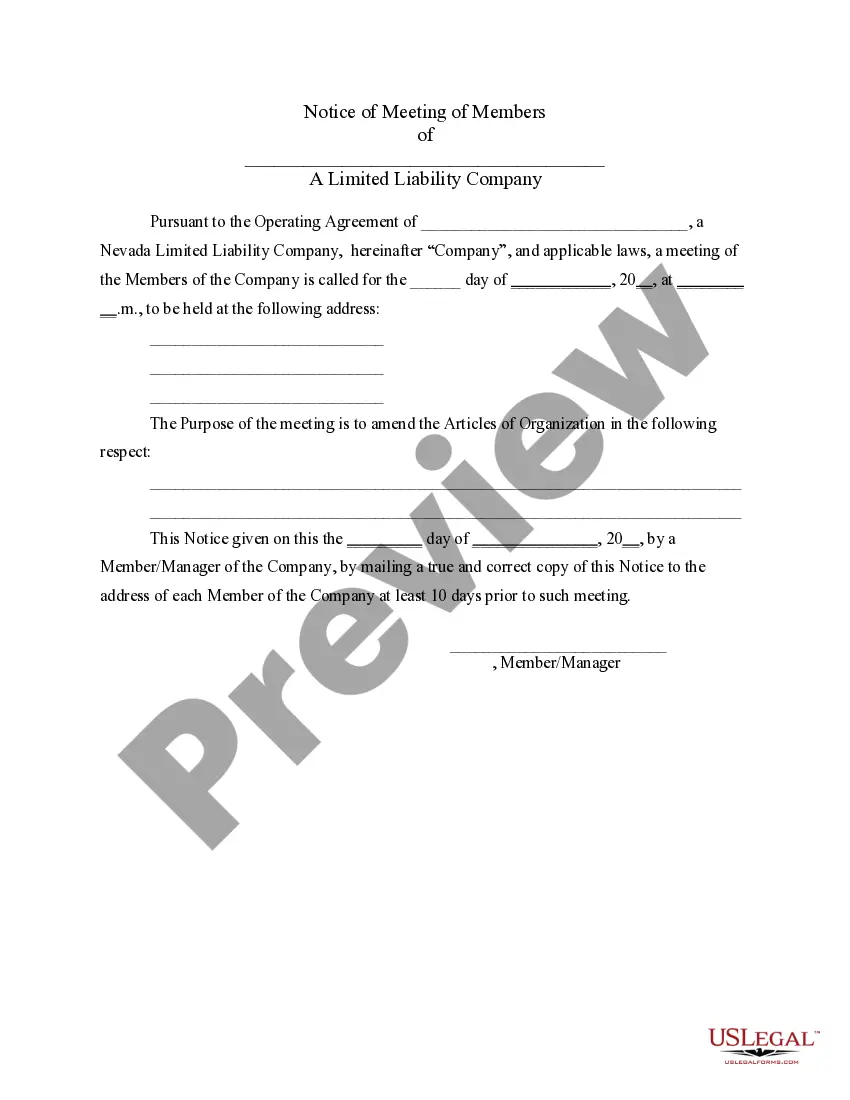

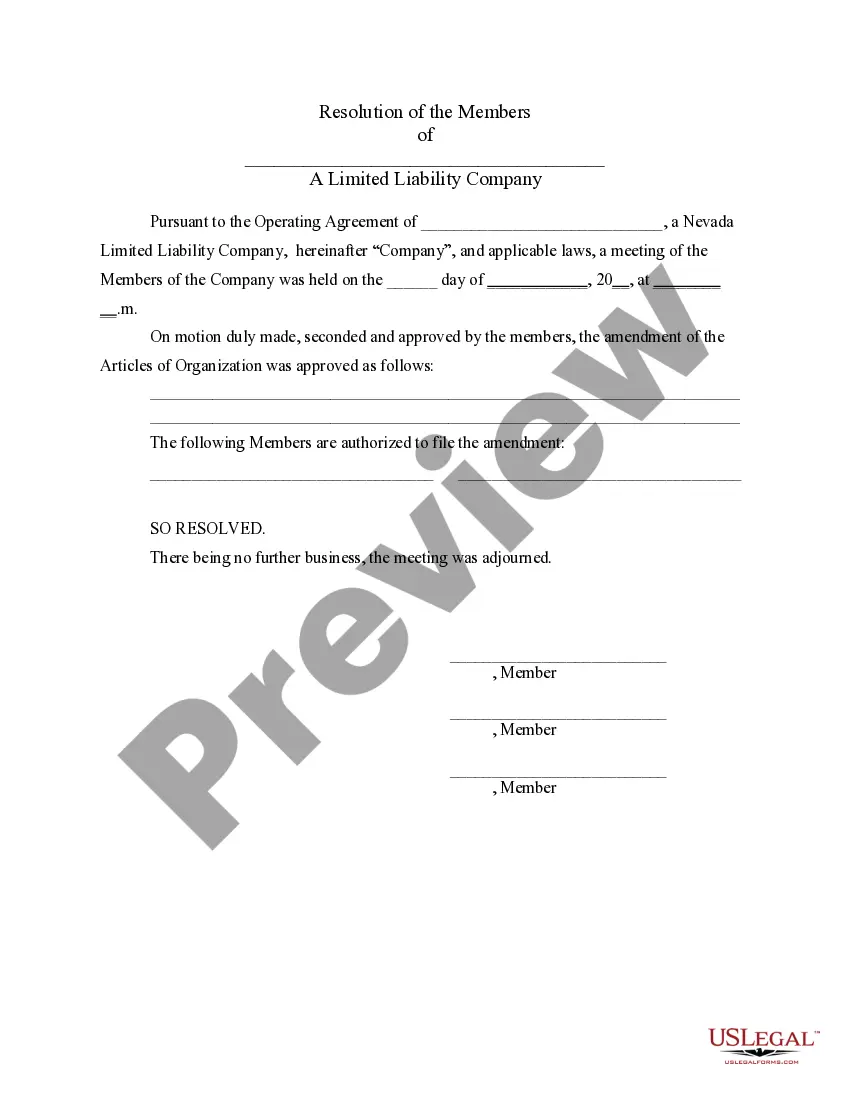

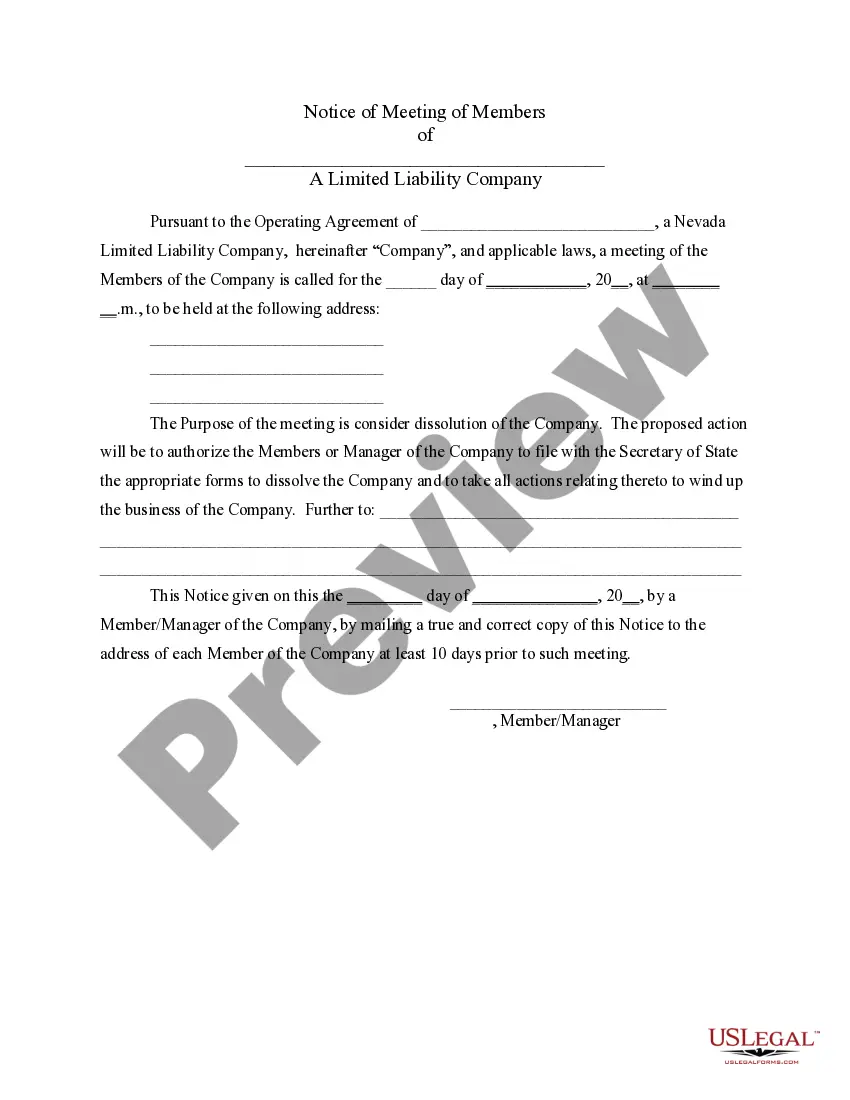

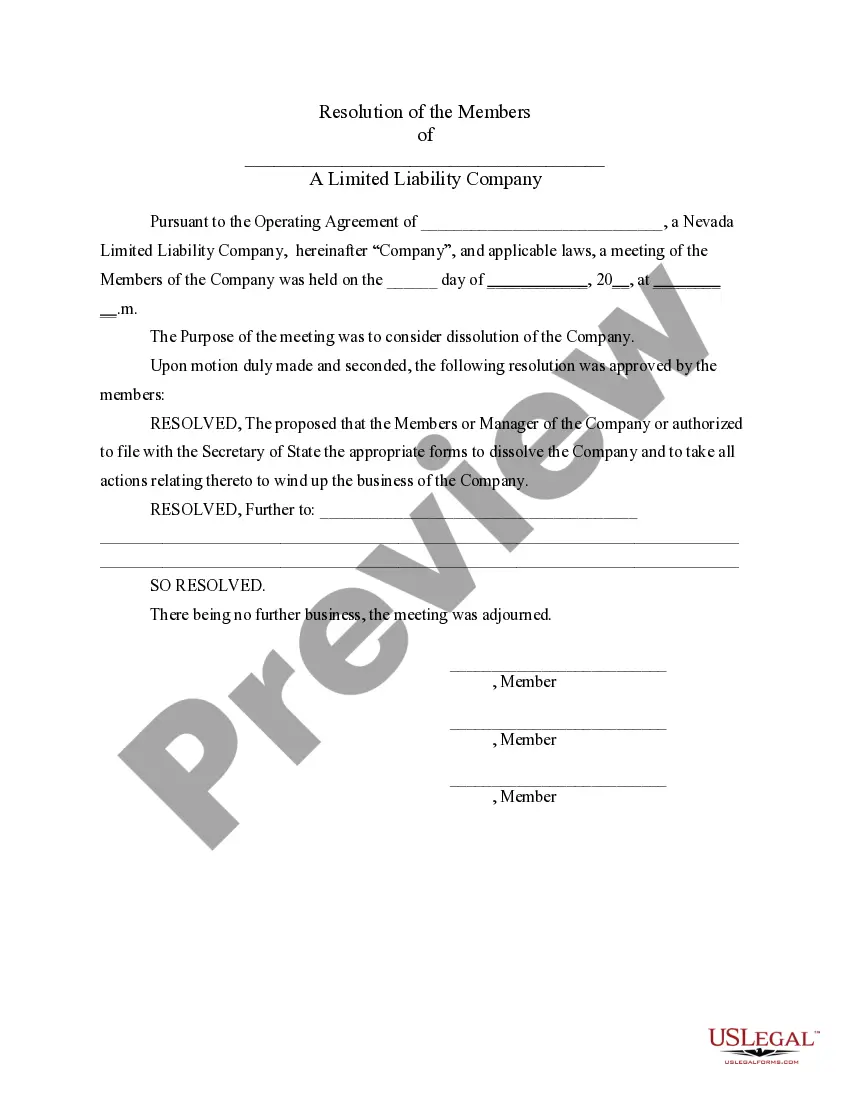

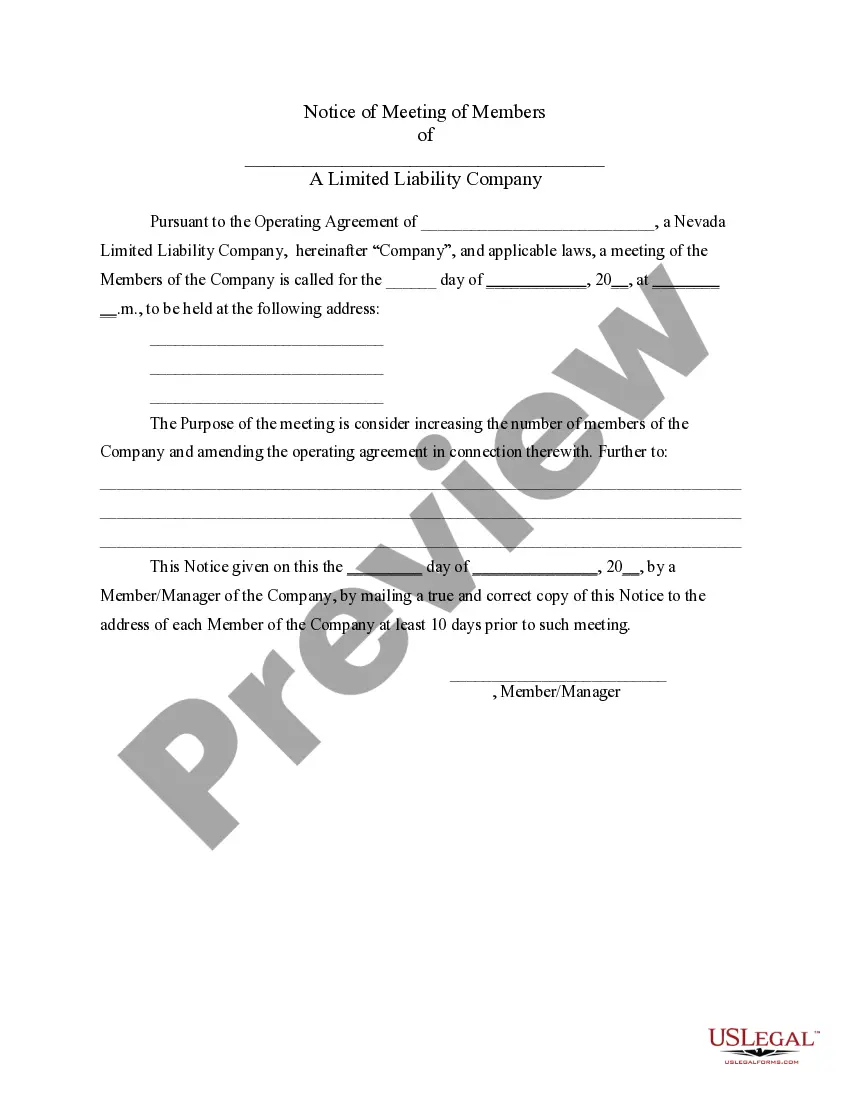

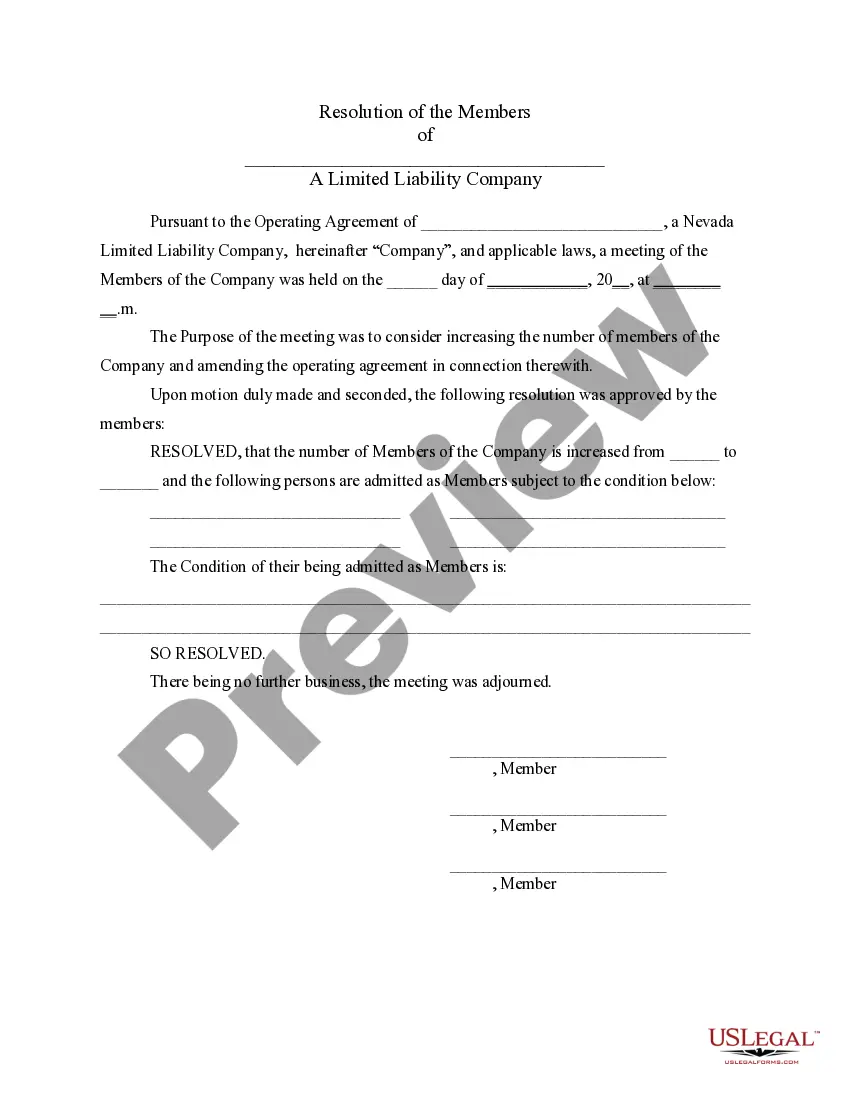

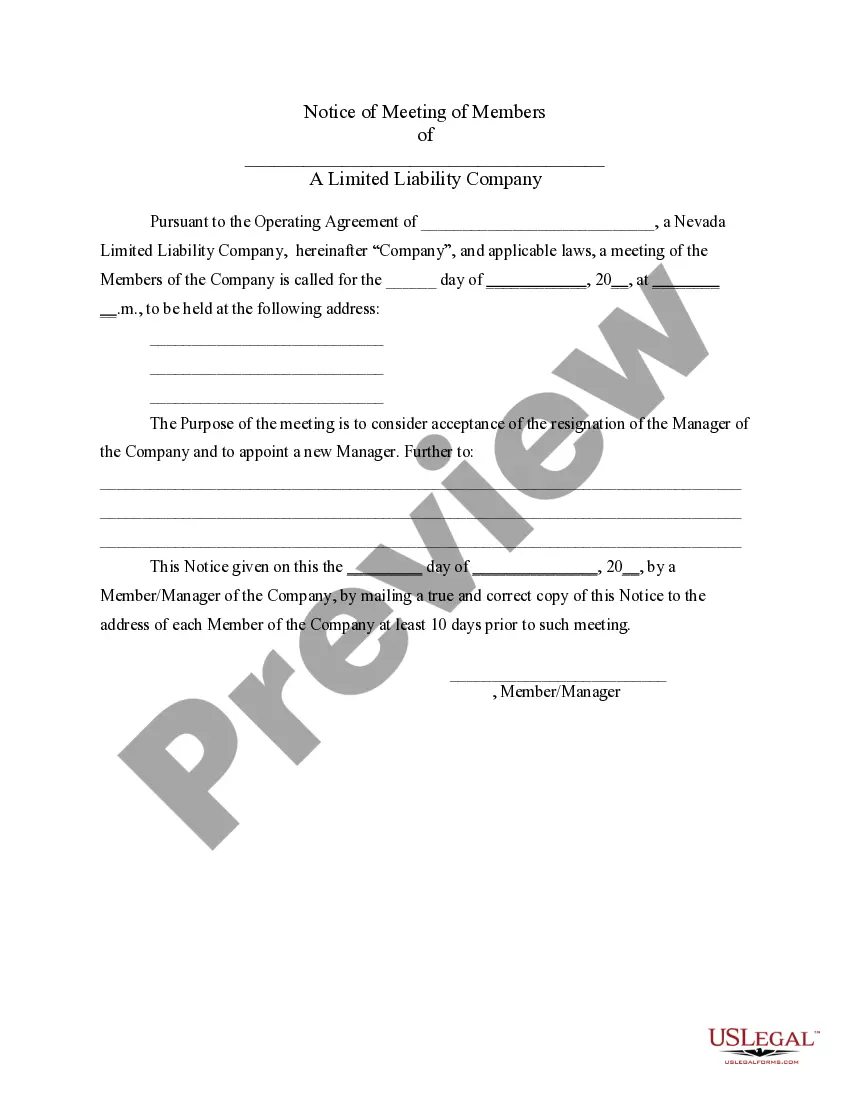

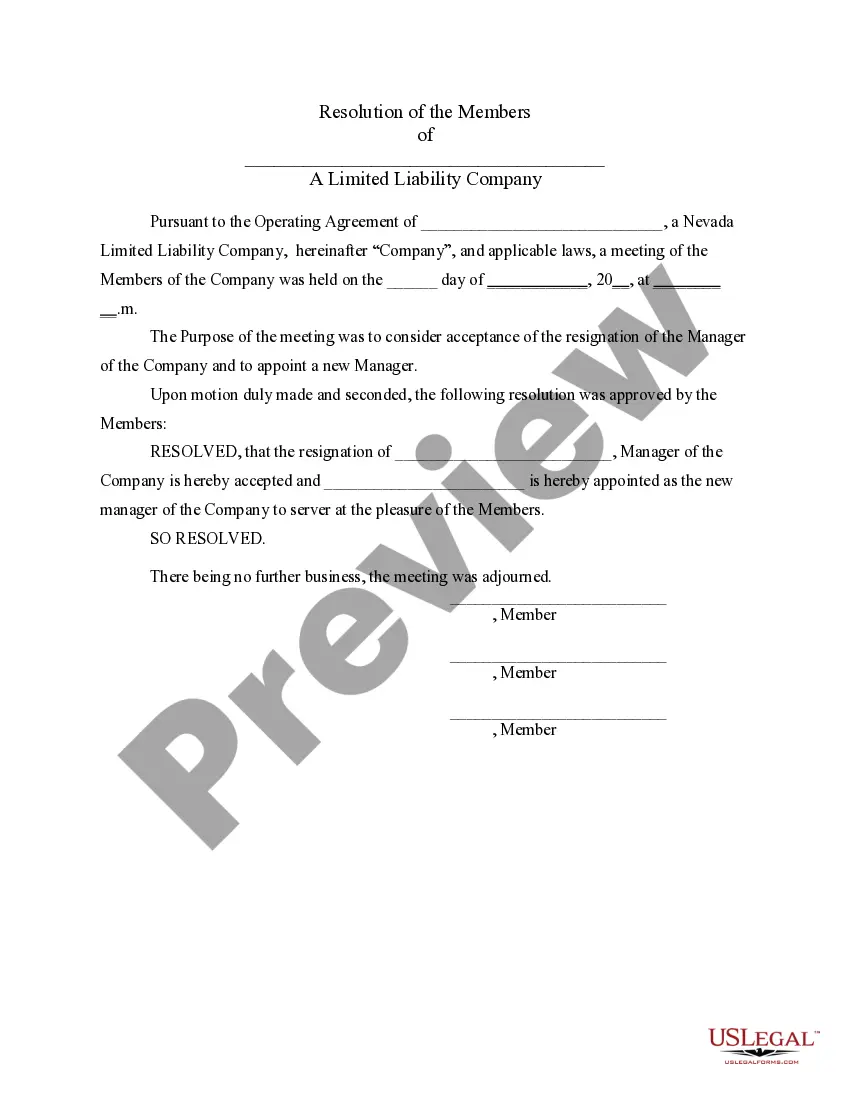

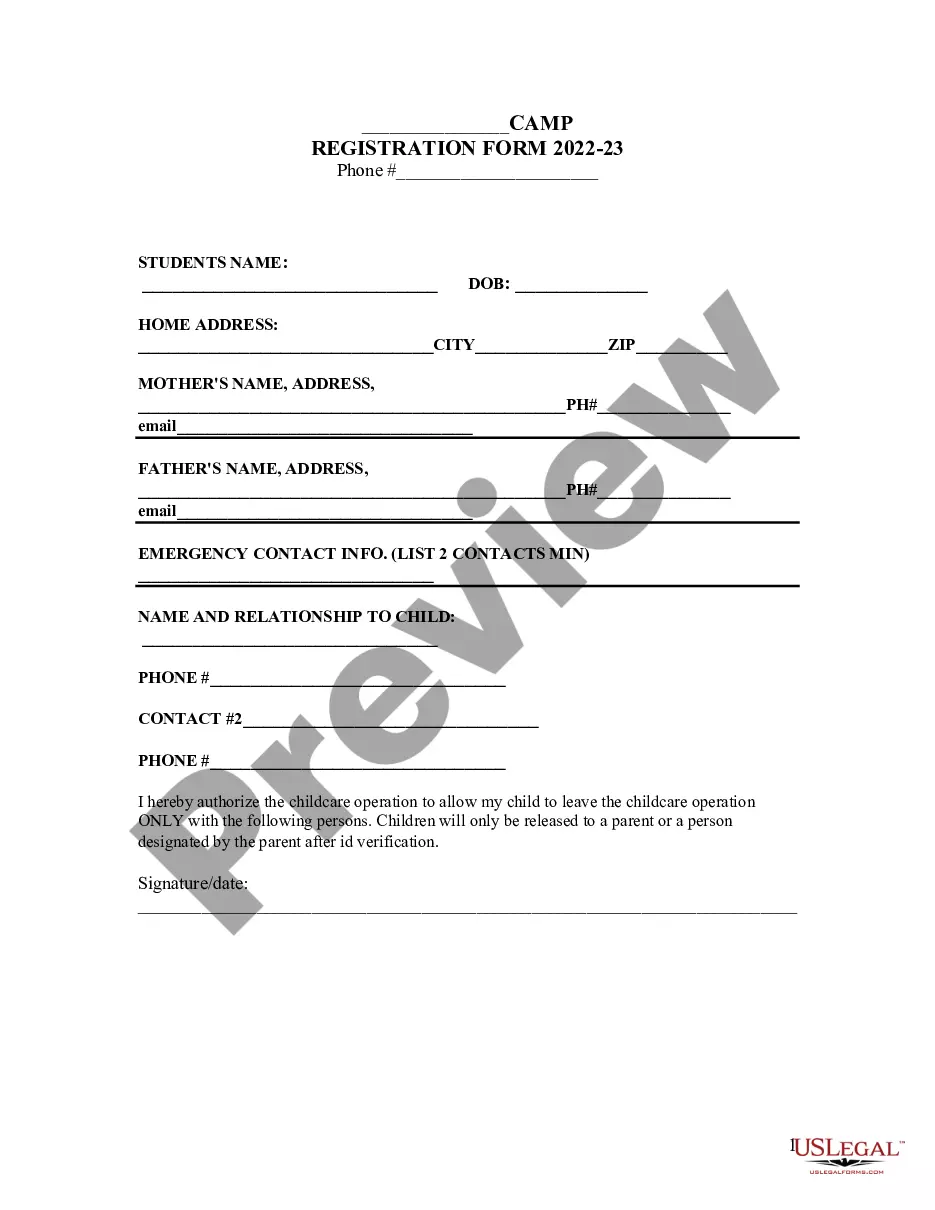

Las Vegas Nevada LLC Notices, Resolutions and other Operations Forms Package

Description

How to fill out Nevada LLC Notices, Resolutions And Other Operations Forms Package?

Regardless of social or professional standing, completing legal paperwork is a regrettable requirement in the current professional landscape.

Frequently, it’s nearly impossible for someone without a legal background to create such documents from scratch, primarily due to the intricate language and legal nuances they entail.

This is where US Legal Forms steps in to assist.

Ensure the form you’ve found is appropriate for your area, as the regulations of one state or county may not apply to another.

If the form you chose doesn’t meet your requirements, you can start over and search for the desired document. Click 'Buy now' and select your preferred subscription plan. Log In with your account details or create a new account. Choose a payment method and proceed to download the Las Vegas Nevada LLC Notices, Resolutions, and other Operations Forms Package once the payment is completed. You’re all set! Now you can either print the form or fill it out online. If you have any trouble finding your purchased documents, you can easily locate them in the My documents section. Whatever issue you need to resolve, US Legal Forms has you covered. Give it a try today and experience it yourself.

- Our platform offers an extensive collection of over 85,000 ready-to-use legal documents tailored to specific states, suitable for nearly any legal circumstance.

- US Legal Forms also serves as an excellent tool for associates or legal advisors aiming to enhance their efficiency with our DIY forms.

- Whether you require the Las Vegas Nevada LLC Notices, Resolutions, and other Operations Forms Package or any other documentation valid in your state or county, US Legal Forms has it all accessible.

- Here’s how to swiftly obtain the Las Vegas Nevada LLC Notices, Resolutions, and other Operations Forms Package using our dependable service.

- If you are already a customer, you can go ahead and Log In to your account to access the required form.

- However, if you are new to our service, make sure to follow these instructions before acquiring the Las Vegas Nevada LLC Notices, Resolutions, and other Operations Forms Package.

Form popularity

FAQ

The Nevada annual report filing fee is a $150 minimum charge that corporations must pay when filing annual reports under NRS 78.150. This can be paid by mail or online. The annual and biannual reports are the information that must be updated with the Nevada Secretary of State's office by the corporate entity.

How to File Your Nevada Annual Report Figure out your filing due date and fees. Download a paper form OR submit your report online. File your report with the Nevada Secretary of State and pay all necessary fees.

Nevada requires LLCs to file an Annual List of Members/Managers and Business License. It is due by the last day of the month marking the LLC's incorporation anniversary. The filing fee is $150 for the Annual List and $200 for the business license registration. Taxes.

Corporations and LLCs must file Articles of Incorporation or Articles of Organization with the Nevada Secretary of State and maintain all records, minutes, etc., as required by law. You may go to their website and download the appropriate forms.

The State Business License must be renewed annually. For entities that are formed under NRS Title 7, the business license fee is due at the time an Initial List of Officers or Annual List of Officers is due. The State Business License Fee is in addition to the fees for the initial or annual list.

In Nevada, an annual list (also known as an annual report) is a regular filing that your LLC must complete every year to update your business information, including: Names and addresses of LLC members or managing members.

What are ?articles of organization?? The ?articles of organization? is the basic document required to set up a limited-liability company in Nevada. It is the only formation document required to be filed with the Secretary of State's office to establish the existence of an LLC in Nevada.

The State of Nevada requires you to file an annual report, or what the state more technically calls an annual list, for your LLC. Only a few pieces of information?mainly the names and addresses of the LLC's managers or managing members?are required to complete the list.

To form a corporation in Nevada, you must file articles of incorporation with the Nevada Secretary of State. The form is customizable. The articles of incorporation must include the following information: Name of the corporation.

To make amendments your limited liability company in Nevada, you must provide the completed Amendment to Articles of Organization form to the Secretary of State by mail, fax, email or in person, along with the filing fee.