Nevada LLC Notices, Resolutions and other Operations Forms Package

Understanding this form

The LLC Notices, Resolutions and other Operations Forms Package includes essential forms for managing the operations of a Limited Liability Company (LLC). This package consists of over 15 templates designed to facilitate meetings, amendments, resolutions, and notifications related to the LLC's management and membership. This differs from other forms by offering a comprehensive set specifically tailored for various operational scenarios within an LLC, ensuring legal compliance and organized structuring of meetings and decisions.

Key components of this form

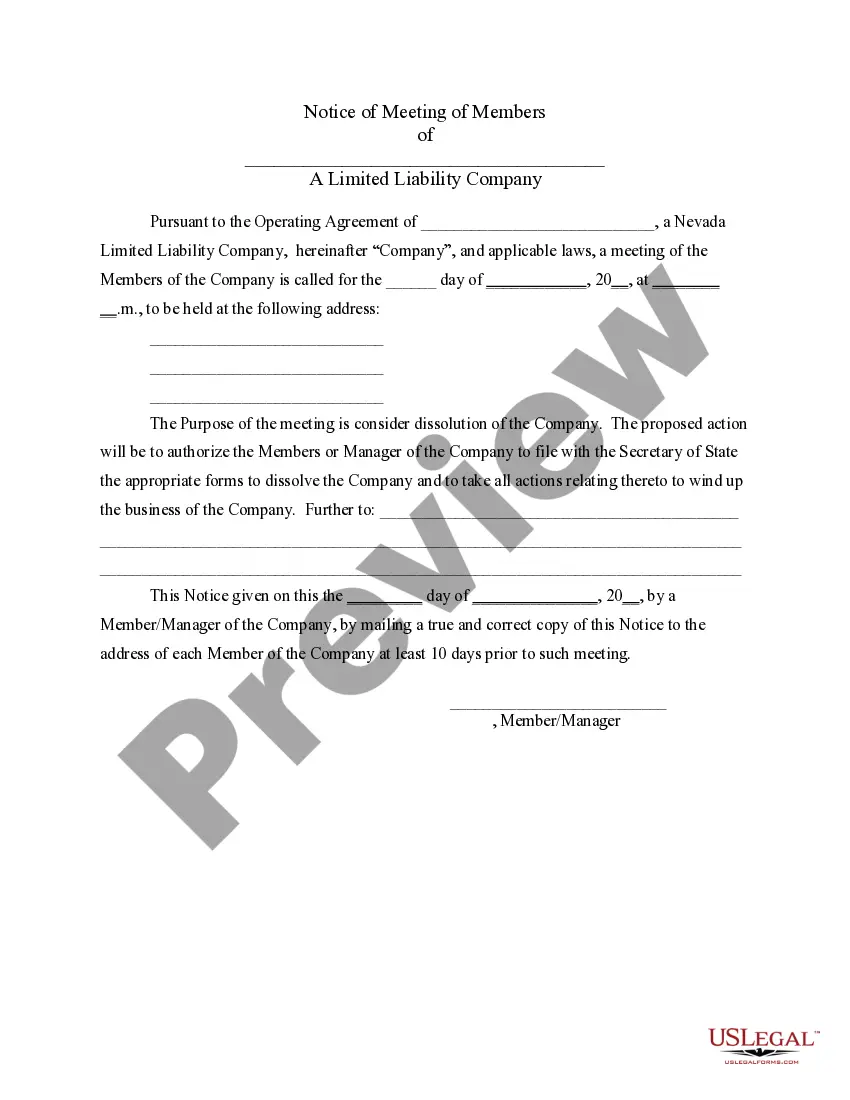

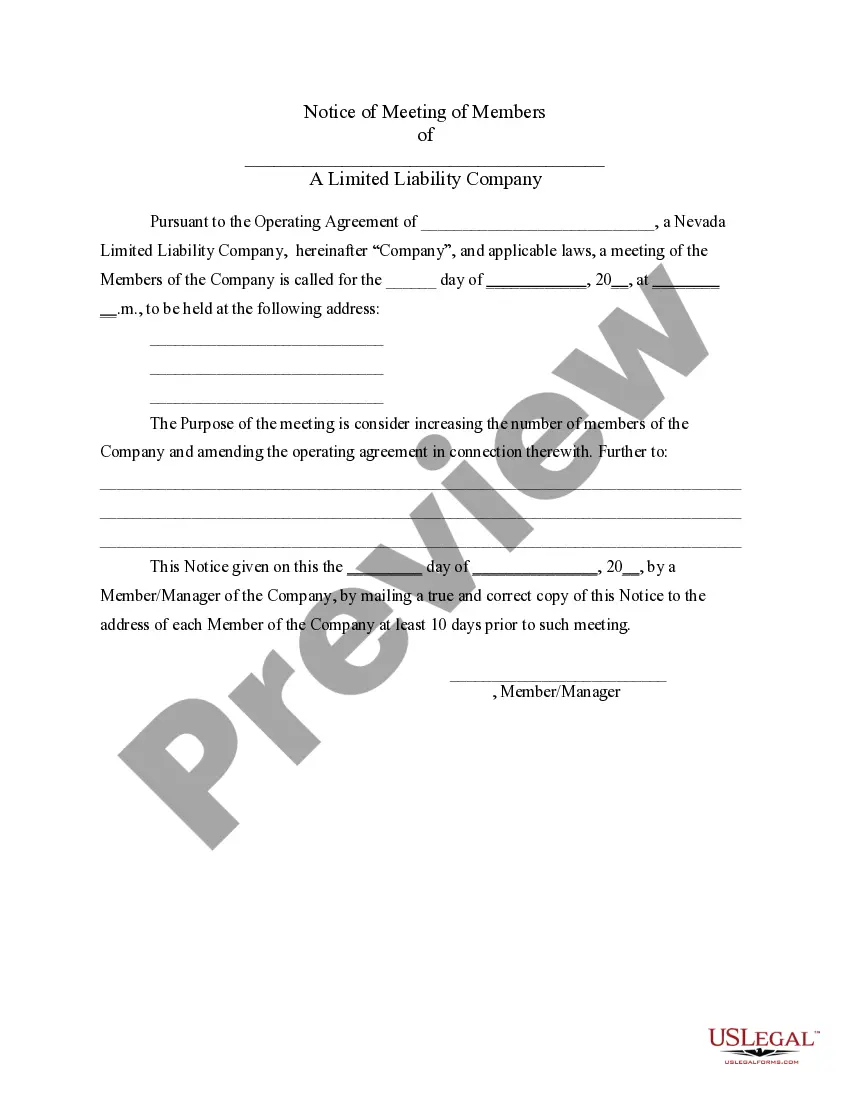

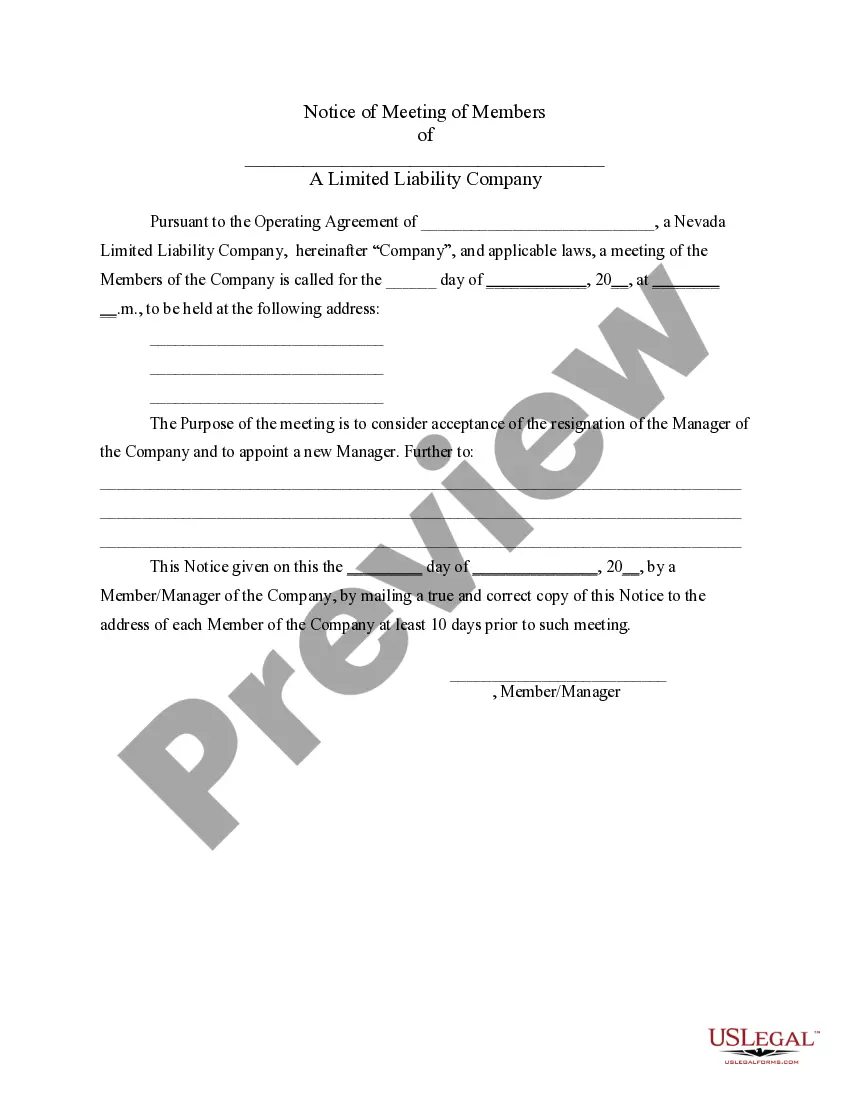

- Notice of Meeting templates for various purposes.

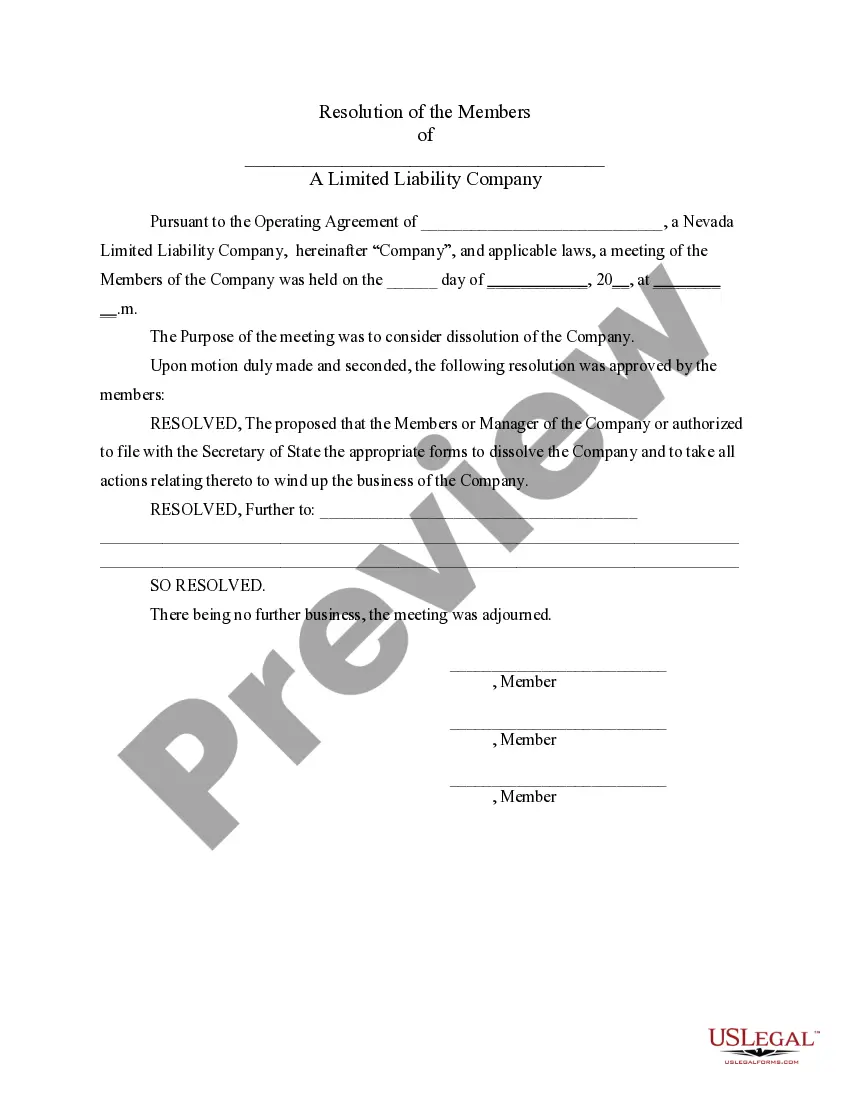

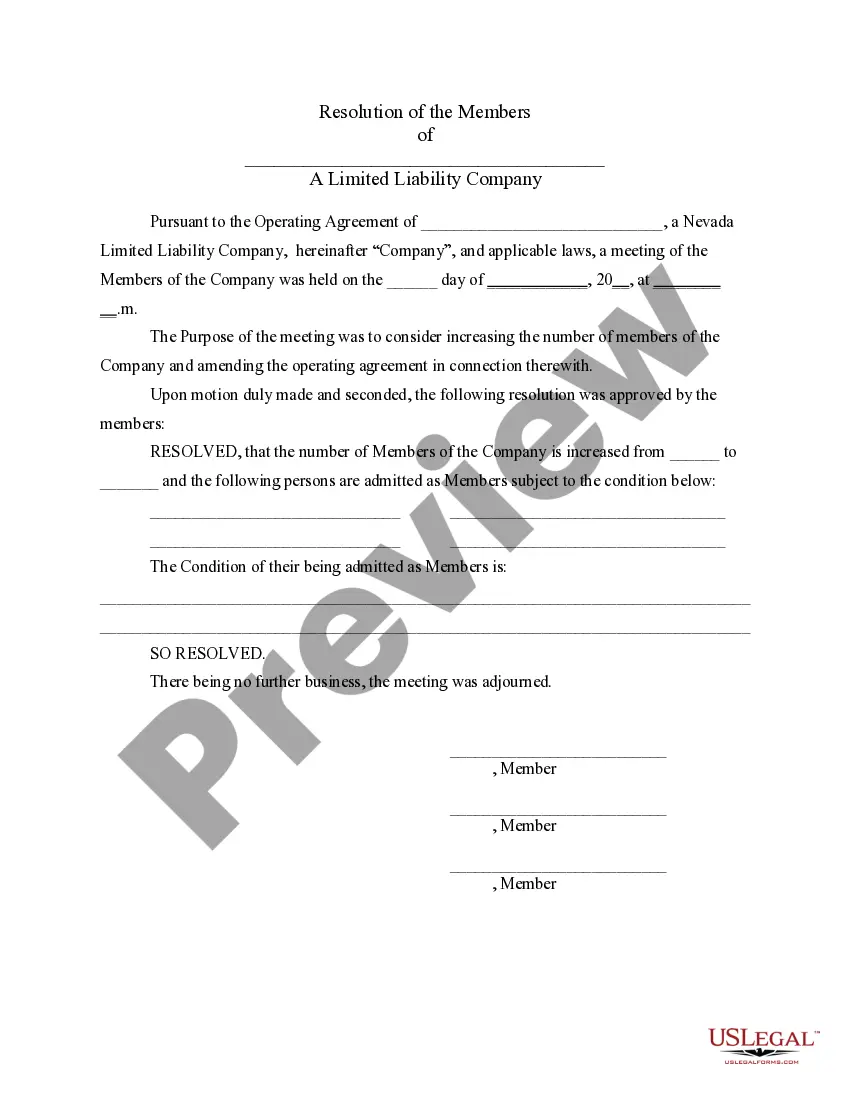

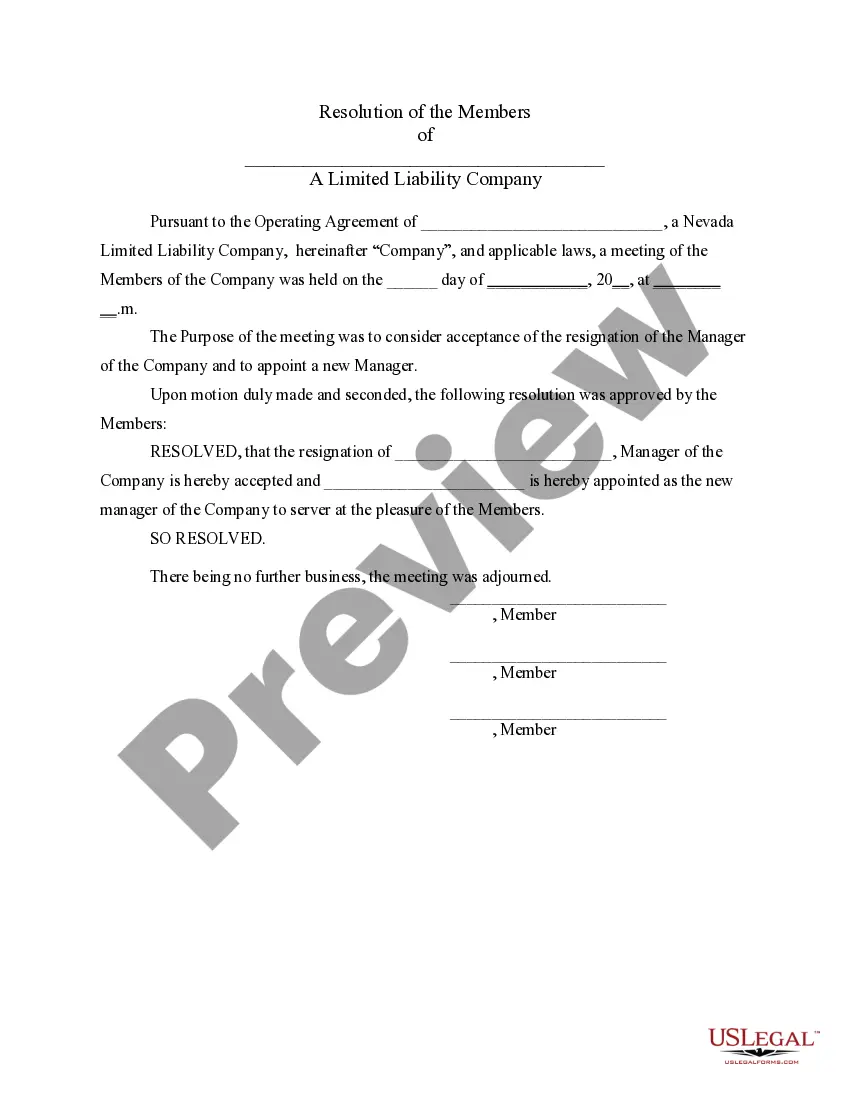

- Resolutions for meetings, including amendments and disbursements.

- Procedures for admitting new members and accepting resignations.

- Forms for dissolution of the LLC and related decisions.

- Assignment of Member Interest documentation.

- Demand for Indemnity by Member/Manager.

- Application for Tax Identification Number.

When to use this document

This forms package is essential when you need to conduct formal meetings within your LLC, document critical decisions, or amend operating agreements. Common scenarios include changes in membership, accepting or removing managers, dissolution discussions, and financial disbursements. Using these forms helps maintain clear records of all significant actions and decisions taken by the LLC members.

Who can use this document

These forms are intended for:

- LLC members seeking to formalize meeting notices and resolutions.

- Managers of LLCs who need to document changes in management or membership.

- Individuals responsible for maintaining corporate records.

- Anyone involved in the operational management of an LLC.

Completing this form step by step

- Identify the members of the LLC and their roles.

- Specify the date, time, and location of the meeting.

- Outline the purpose of the meeting clearly, reflecting the decision to be made.

- Record the resolutions discussed and any votes tallied during the meeting.

- Ensure all relevant members sign the documents to maintain legal integrity.

Does this document require notarization?

Notarization is not commonly needed for this form. However, certain documents or local rules may make it necessary. Our notarization service, powered by Notarize, allows you to finalize it securely online anytime, day or night.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Common mistakes

- Failing to provide sufficient notice to all members prior to meetings.

- Omitting critical details in the resolutions or notices.

- Not recording the outcomes of meetings effectively.

- Allowing non-members to participate in decisions without proper consent.

Why use this form online

- Convenience: Download and complete forms at your own pace.

- Editability: Modify documents as needed to suit specific needs.

- Reliability: Access templates drafted by licensed attorneys to ensure legal compliance.

- Time-saving: Quickly obtain the necessary forms without needing to consult legal counsel for every document.

Looking for another form?

Form popularity

FAQ

Forming an LLC in Nevada is easy. To form an LLC in Nevada you will need to file the Articles of Organization with the Nevada Secretary of State, which costs $75. You can apply online or by mail. The Articles of Organization is the legal document that officially creates your Nevada Limited Liability Company.

STEP 1: Name your Nevada LLC. STEP 2: Choose a Registered Agent in Nevada. STEP 3: File the Nevada LLC Articles of Organization. STEP 4: Create a Nevada LLC Operating Agreement. STEP 5: Get a Nevada LLC EIN.

There is a Nevada LLC forming fees of $75 (state fee). In order to form an LLC, you will be required to file the Articles of Organization and the state fee with the Secretary of State at 202 North Carson Street, Carson City, NV 89701-4201.

Member/Manager Information of LLCs Unlike some states, Nevada does not require members or managers to live in the state itself. In order to successfully form an LLC, you must be 18+ years old and file your articles of organization.

No state income, corporate or franchise taxes. No taxes on corporate shares or profits. Privacy protection for owners choosing to be anonymous. No operating agreements or annual meetings requirements. Low business registration fees and quick turnarounds.

No, you do not need an attorney to form an LLC. You can prepare the legal paperwork and file it yourself, or use a professional business formation service, such as .In all states, only one person is needed to form an LLC.

There is a Nevada LLC forming fees of $75 (state fee). In order to form an LLC, you will be required to file the Articles of Organization and the state fee with the Secretary of State at 202 North Carson Street, Carson City, NV 89701-4201.