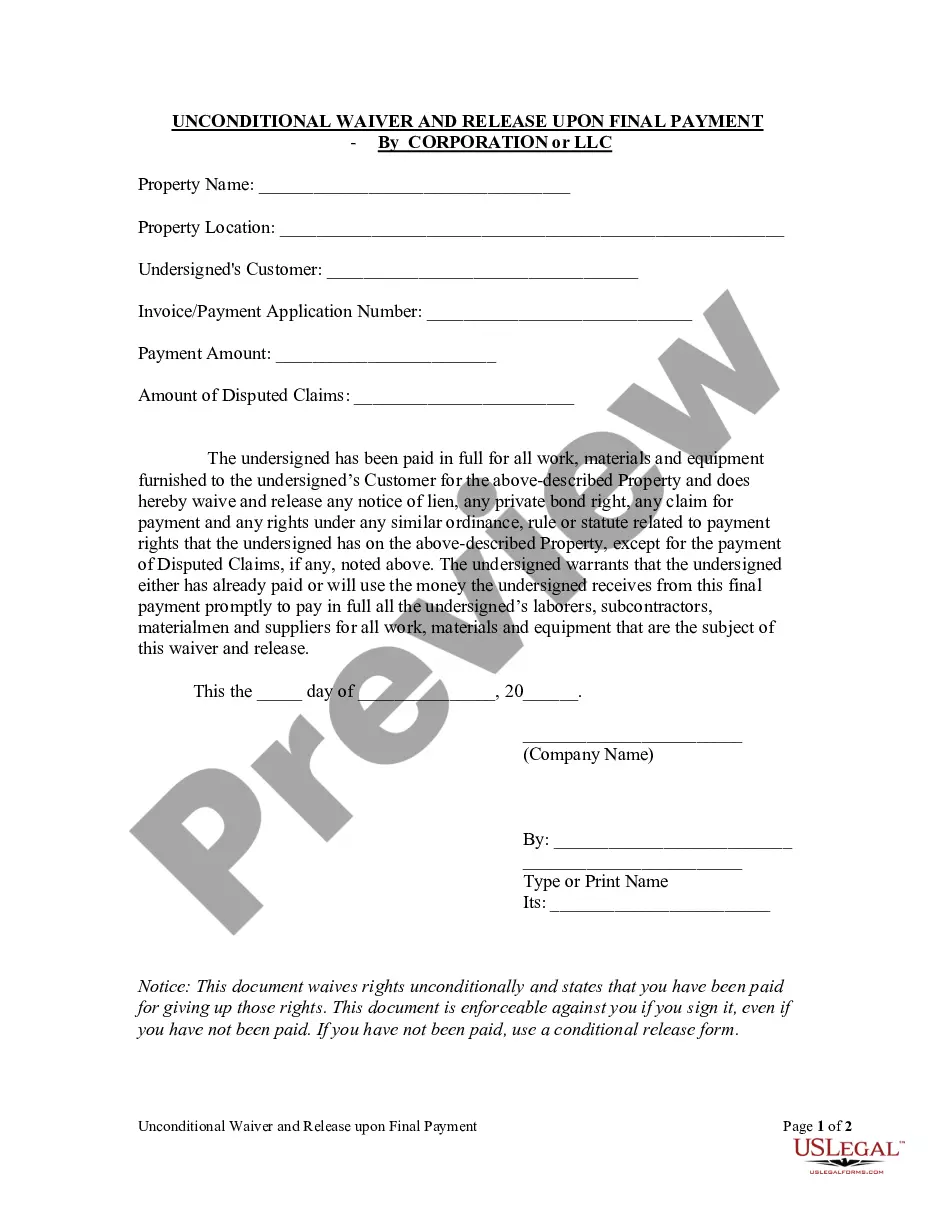

This Unconditional Waiver and Release Upon Final Payment is for use by a corporation or LLC who has been paid in full for all work, materials and equipment furnished to its customer for the described property to waive and release any notice of lien, any private bond right, any claim for payment and any rights under any similar ordinance, rule or statute related to payment rights that the corporation has on the property, except for the payment of disputed claims, if any. The lien claimant warrants that the lien claimant either has already paid or will use the money the lien claimant receives from this final payment promptly to pay in full all the laborers, subcontractors, materialmen and suppliers for all work, materials and equipment that are the subject of this waiver and release.

Clark Nevada Unconditional Waiver and Release Upon Final Payment - Corporation or LLC

Description

How to fill out Nevada Unconditional Waiver And Release Upon Final Payment - Corporation Or LLC?

We consistently aim to reduce or avert legal conflicts when engaging with subtle legal or financial matters.

To achieve this, we enroll in legal services that are generally quite costly.

Nevertheless, not every legal matter is as intricate as that. Many can be addressed independently.

US Legal Forms is an online repository of current DIY legal documents spanning various needs from wills and powers of attorney to incorporation articles and dissolution petitions. Our collection empowers you to manage your affairs independently without requiring a lawyer's assistance.

Ensure to verify if the Clark Nevada Unconditional Waiver and Release Upon Final Payment - Corporation or LLC adheres to the regulations and laws of your state and locality. Additionally, it is crucial to review the form's outline (if available), and if you identify any inconsistencies with your original expectations, look for an alternate template. Once you confirm that the Clark Nevada Unconditional Waiver and Release Upon Final Payment - Corporation or LLC is suitable for your needs, you can select a subscription plan and proceed with payment. Afterward, you can download the document in any provided file format. With more than 24 years in the market, we have assisted millions by offering customizable and contemporary legal documents. Take advantage of US Legal Forms today to save time and resources!

- Utilize US Legal Forms whenever you wish to obtain and download the Clark Nevada Unconditional Waiver and Release Upon Final Payment - Corporation or LLC or any other form effortlessly and securely.

- Simply Log In to your account and click the Get button adjacent to it.

- If you happen to misplace the document, you can always retrieve it again in the My documents section.

- The process remains just as simple if you are new to the platform!

Form popularity

FAQ

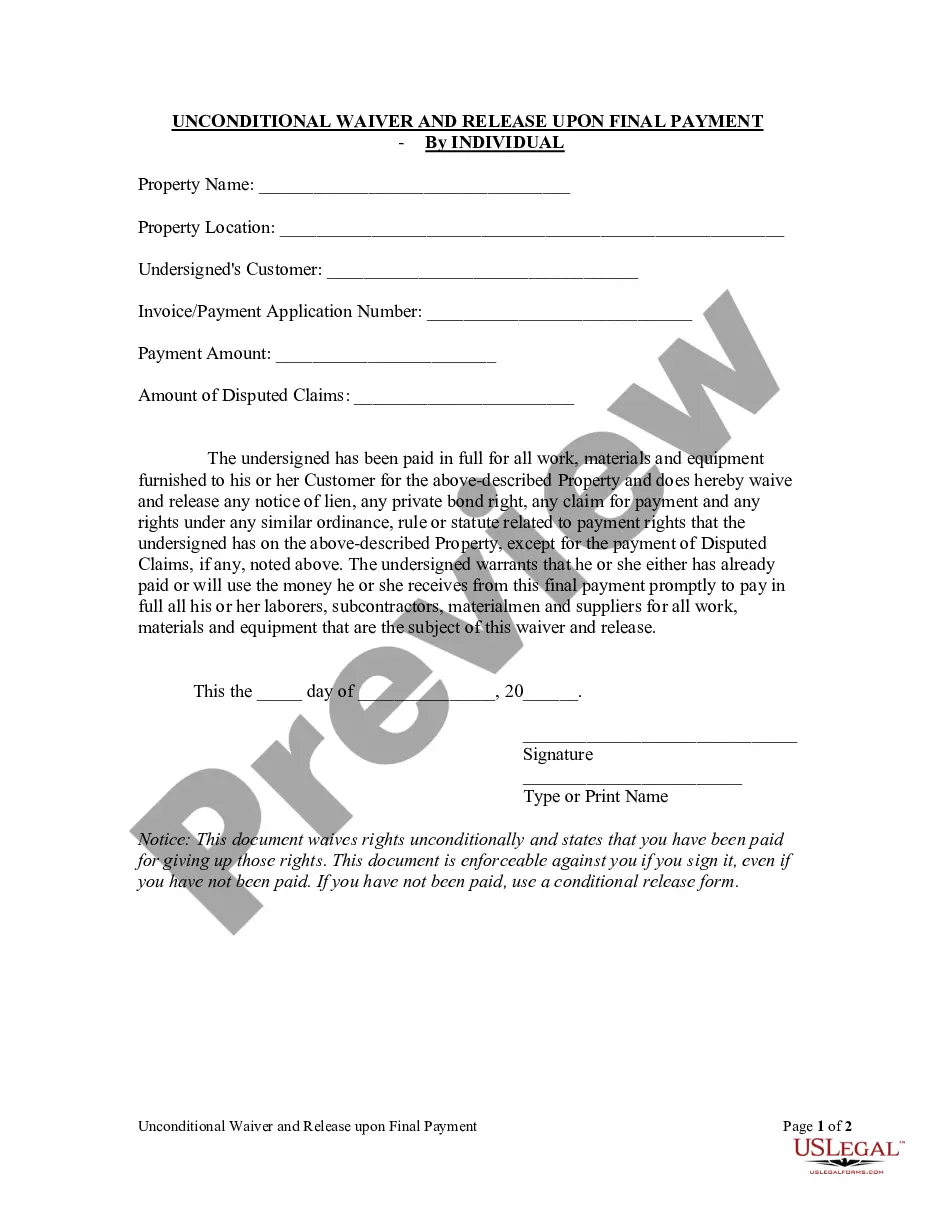

To fill out an unconditional waiver and release, start by providing your name and the payment details, ensuring it reflects the final payment amount. Include details about the project and parties involved to ensure clarity. Doing so effectively protects all parties in Clark Nevada and simplifies the process for corporations or LLCs working on construction-related transactions.

An unconditional release waiver is a legal document that confirms a contractor or supplier has received full payment for their work or materials. It means that they waive their right to claim any further payments related to the project. If you are dealing with payments in Clark Nevada, understanding how this waiver works for corporations or LLCs is essential for smooth transactions.

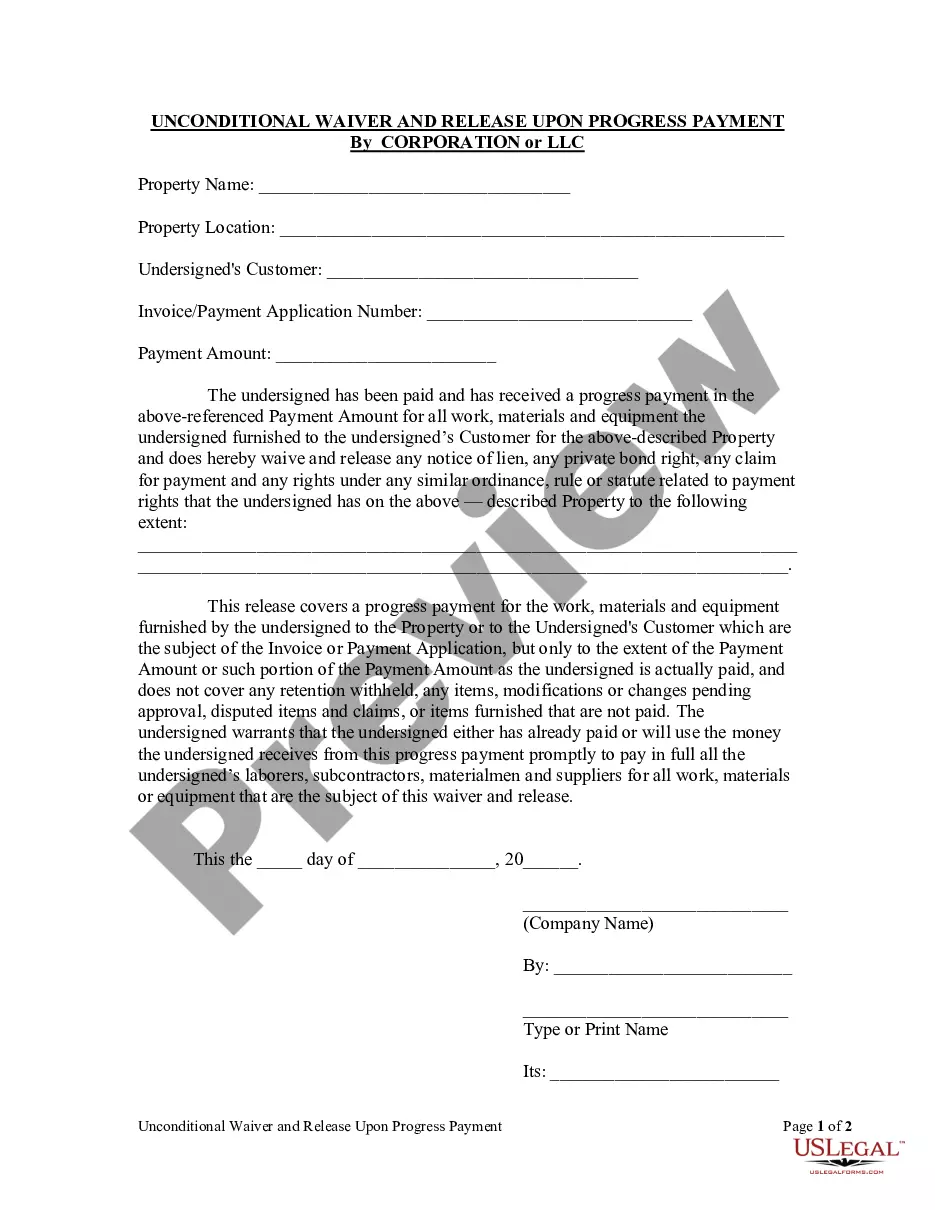

The primary difference between a final lien waiver and a conditional lien waiver lies in the timing of payment and release of claims. A final lien waiver is effective once the payment is delivered, while a conditional lien waiver becomes effective only when payment goes through, which means if the check bounces, the waiver is void. Understanding these distinctions is vital, and using the Clark Nevada Unconditional Waiver and Release Upon Final Payment - Corporation or LLC helps contractors and clients navigate these intricacies with confidence.

Unconditional release waivers are documents that signify the release of a party from any claims for payment once funds are received. They are crucial in construction and contracting environments, as they help protect against potential legal disputes over payments. With the Clark Nevada Unconditional Waiver and Release Upon Final Payment - Corporation or LLC, you ensure that all parties fully understand their rights and responsibilities, leading to smoother transactions and clearer communication.

In Nevada, an unconditional waiver and release upon final payment serves the same purpose as elsewhere, providing assurance that the contractor or supplier cannot demand further payment once the final payment is received. This document eliminates any potential disputes about payment and helps maintain trust between parties. Using the Clark Nevada Unconditional Waiver and Release Upon Final Payment - Corporation or LLC gives all involved peace of mind and protection from future claims.

In Nevada, lien waivers are not required to be notarized; however, this practice can provide added reassurance for all parties involved. Electronic signature options also exist as convenient alternatives, making the process even smoother. When dealing with the Clark Nevada Unconditional Waiver and Release Upon Final Payment - Corporation or LLC, always consider the best practices that suit your specific scenario to ensure compliance and peace of mind.

In Nevada, the statute of limitations for waiving a lien is generally set at six months from the date of last work or service provided. This timeline emphasizes the importance of addressing any liens promptly to avoid complications. Knowing the timeframe regarding the Clark Nevada Unconditional Waiver and Release Upon Final Payment - Corporation or LLC is essential for parties looking to protect their rights and interests in construction-related transactions.

Waivers in Nevada generally do not need to be notarized to remain valid. However, having a waiver notarized can add an extra layer of security and validation for all parties involved. It's advisable to understand the specifics of your situation concerning the Clark Nevada Unconditional Waiver and Release Upon Final Payment - Corporation or LLC to determine if notarization is beneficial for your peace of mind.

Filling out a conditional waiver and release on final payment involves accurately providing details about the payment and the parties involved. You must clearly state the amount received and ensure that your information aligns with the terms agreed upon. For effective use of the Clark Nevada Unconditional Waiver and Release Upon Final Payment - Corporation or LLC, consider using reliable resources like uslegalforms to access templates and precise instructions to avoid errors.

Yes, lien waivers can be signed electronically in Nevada. This modern method facilitates quicker transactions and adds efficiency to the paperwork involved in the construction industry. Utilizing electronic signatures for the Clark Nevada Unconditional Waiver and Release Upon Final Payment - Corporation or LLC can streamline your processes and reduce delays, making it a practical choice for many professionals in the field.