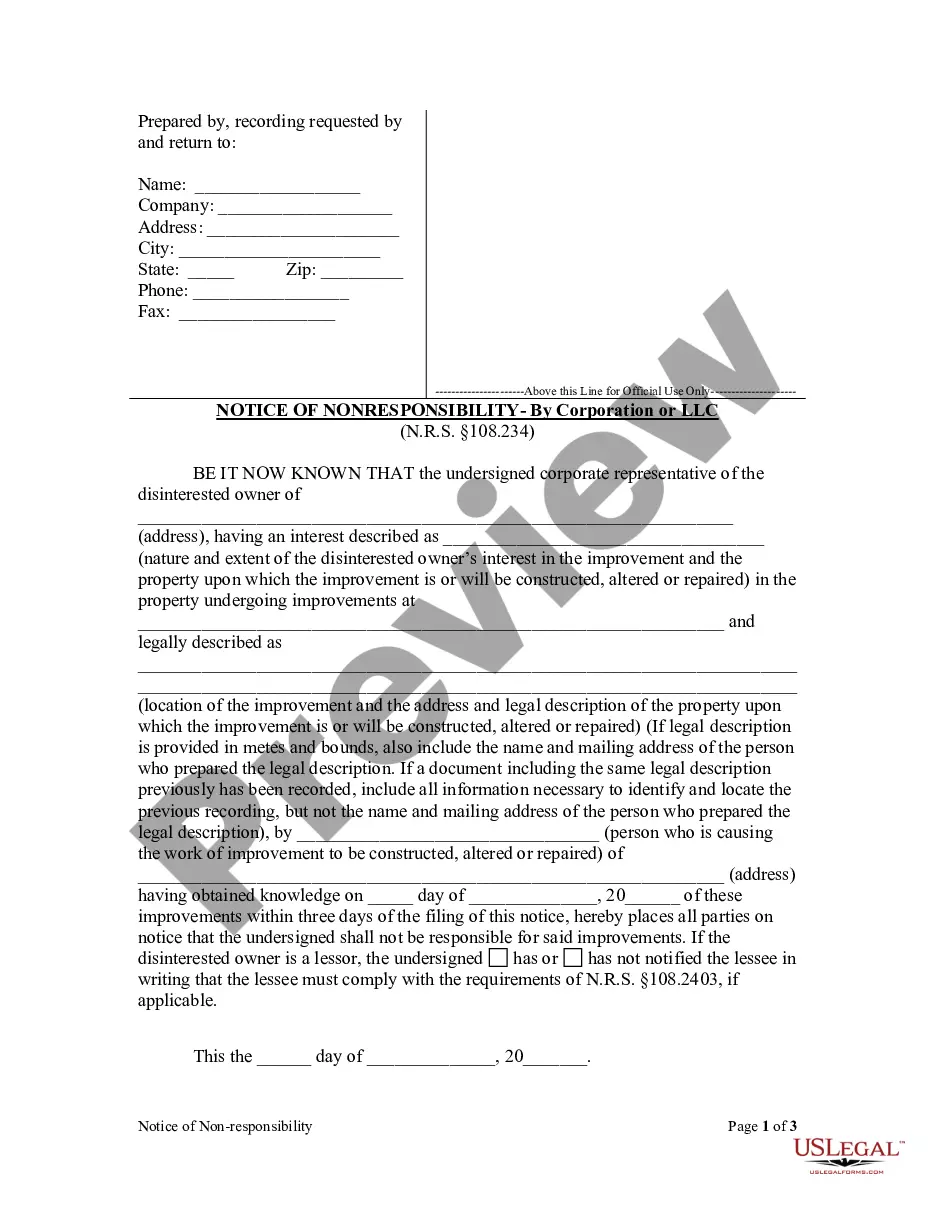

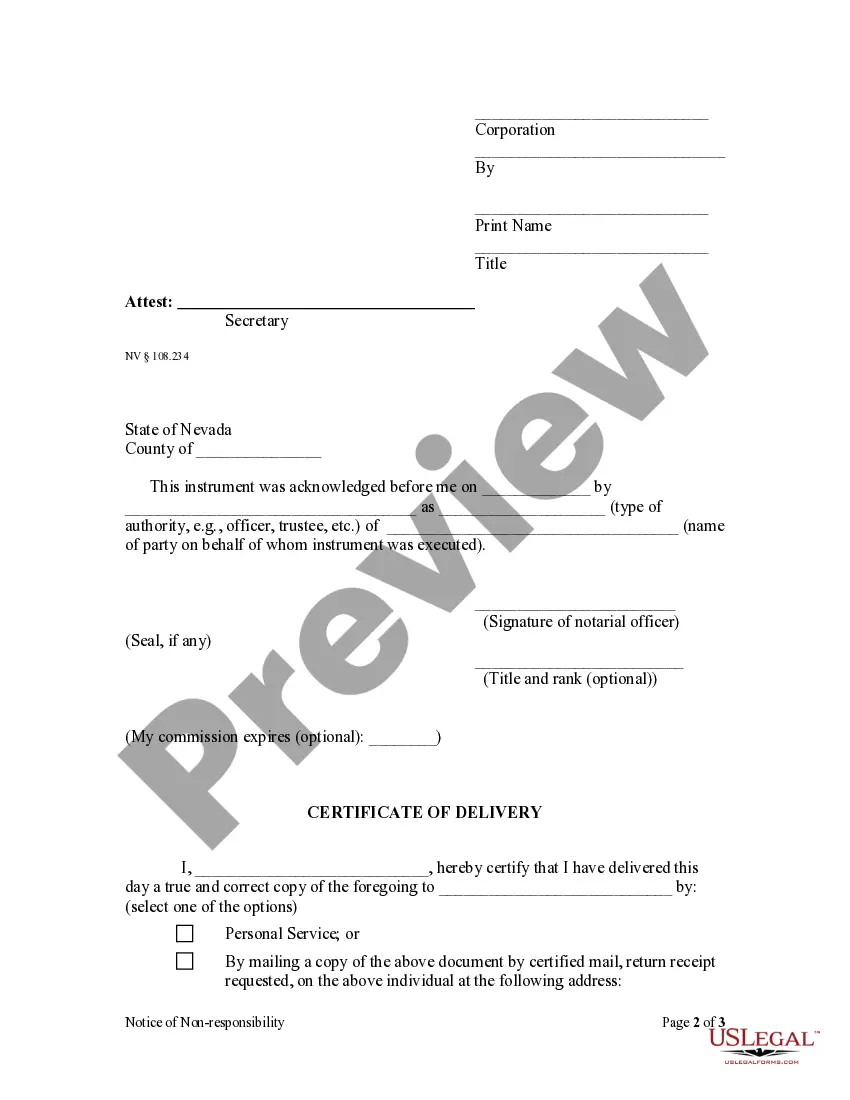

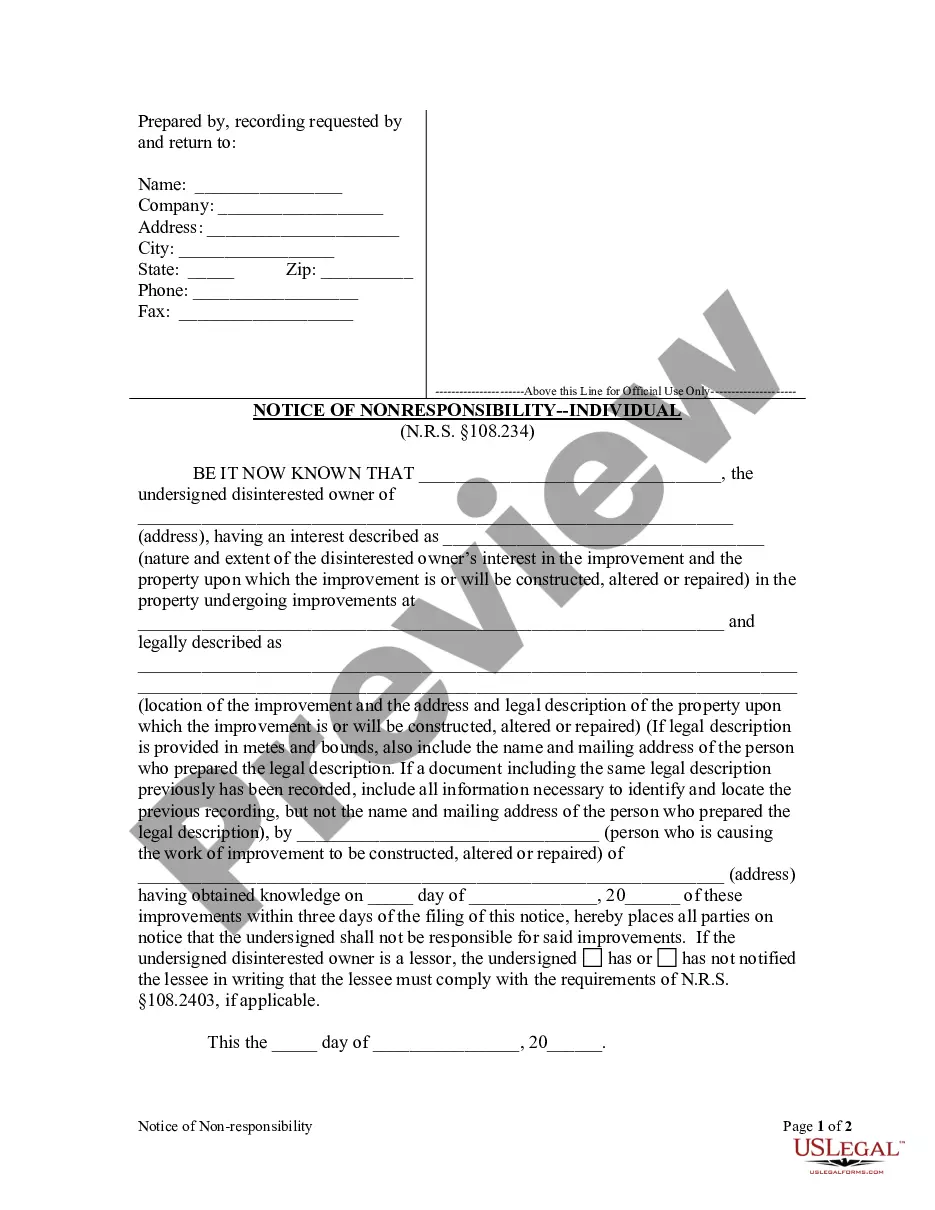

Nevada statutes presume that if individuals are furnishing labor or materials for the improvement of property they do so on behalf of the property owner and are entitled to a lien against the property for the value of the materials or labor provided. However, in the event that a person with an ownership interest in the property does not desire to be held responsible for the improvements, that party may file a notice of non-responsibility with the county recorder within three days of obtaining knowledge that improvements are being made.

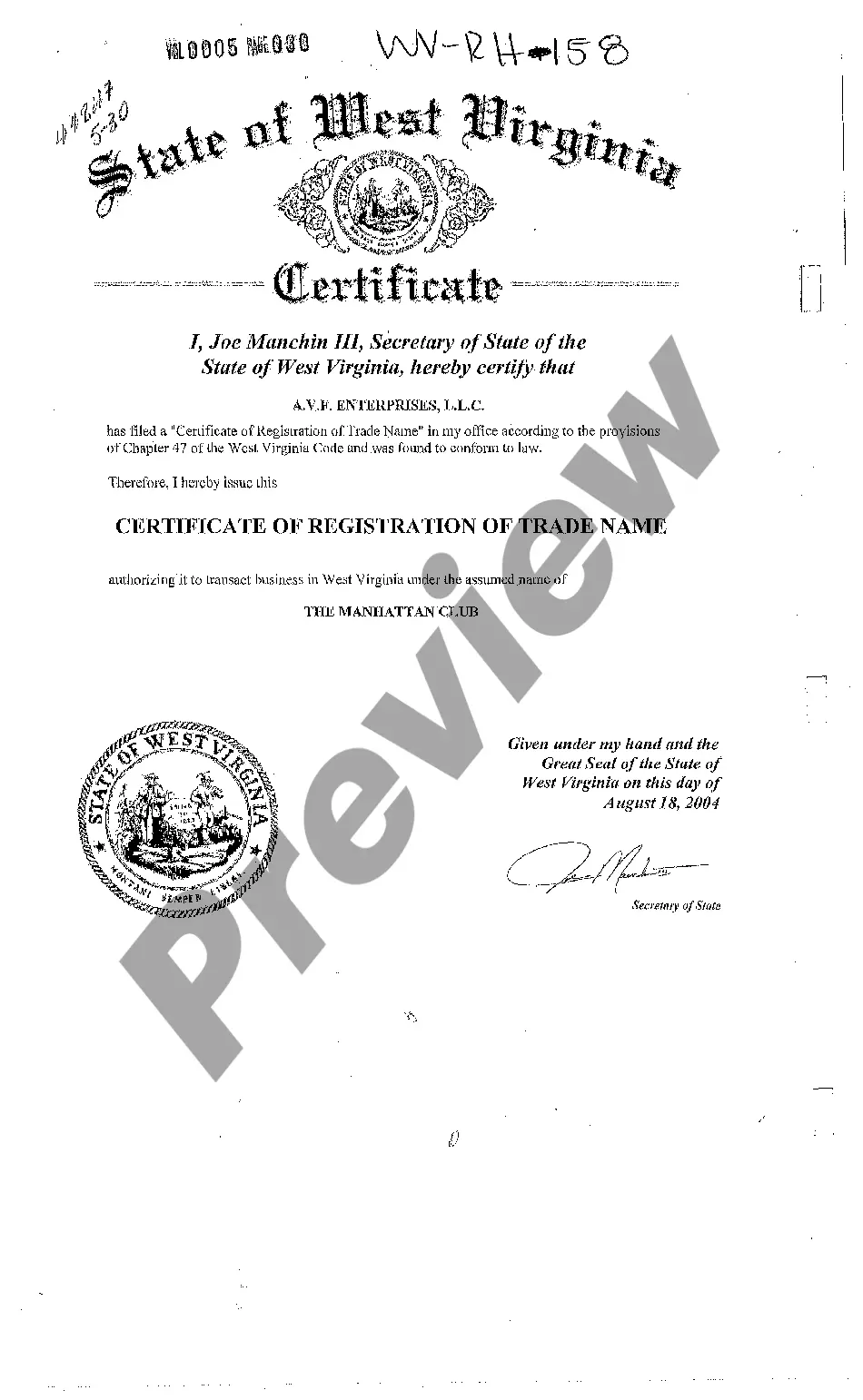

Las Vegas Nevada Notice of Non Responsibility - Corporation

Description

How to fill out Nevada Notice Of Non Responsibility - Corporation?

We consistently endeavor to minimize or avert legal complications when engaging with intricate law-related or financial matters.

To achieve this, we enlist attorney services that are generally quite costly.

Nevertheless, not all legal issues are equally intricate.

Many can be managed by ourselves.

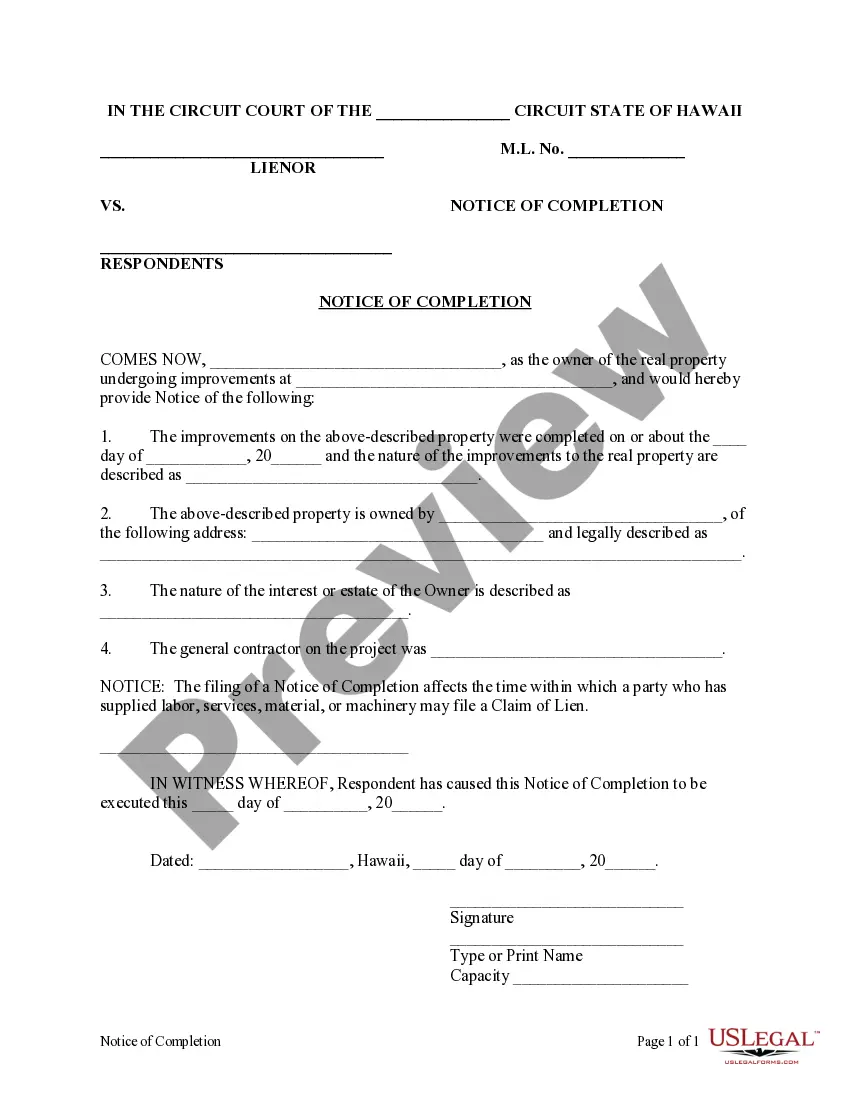

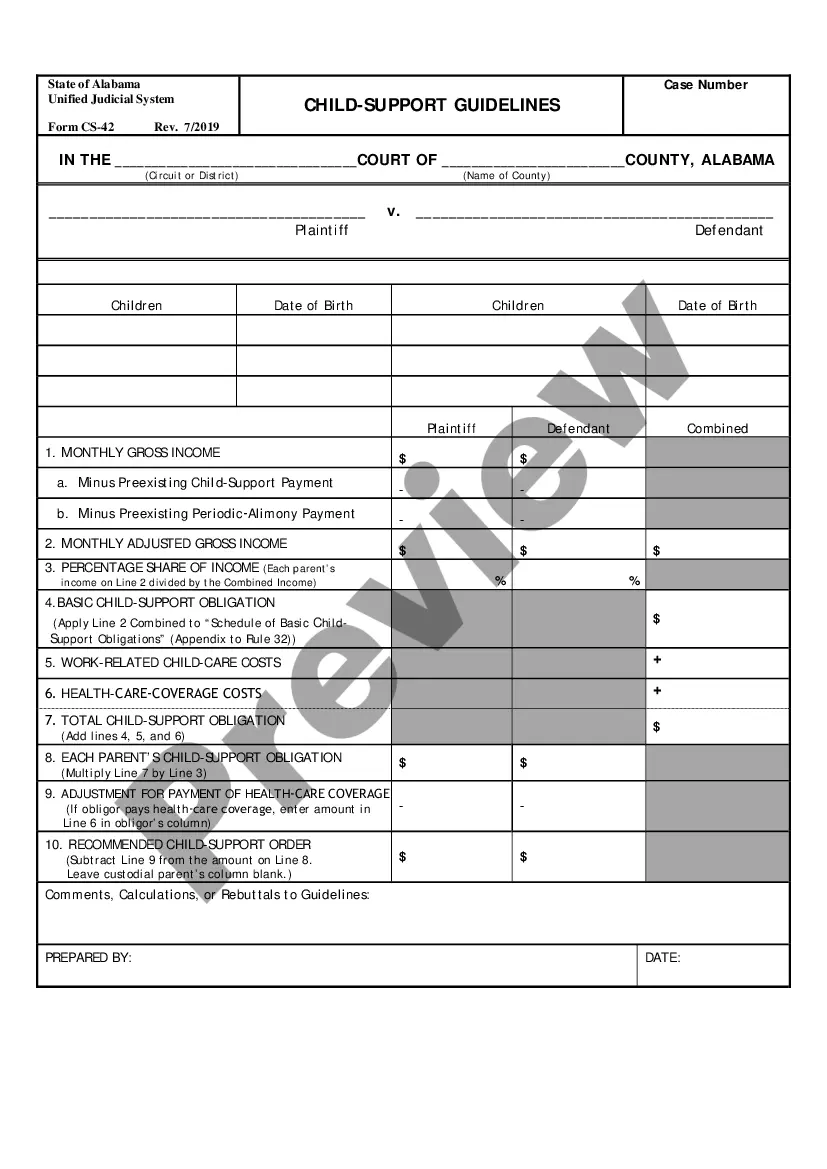

Utilize US Legal Forms whenever you wish to locate and download the Las Vegas Nevada Notice of Non Responsibility - Corporation or LLC or any other document effortlessly and securely. Simply Log In to your account and click the Get button beside it. If you happen to misplace the document, you can always re-download it from the My documents tab. The procedure is just as straightforward if you’re new to the platform! You can register for your account in just a few minutes. Ensure you verify whether the Las Vegas Nevada Notice of Non Responsibility - Corporation or LLC complies with the laws and regulations of your state and locality. Additionally, it’s essential to review the form’s outline (if available), and if you notice any differences from what you were originally looking for, search for an alternative template. Once you’re certain that the Las Vegas Nevada Notice of Non Responsibility - Corporation or LLC is suitable for your situation, you can select the subscription option and proceed with payment. Then, you can download the document in any available file format. For over 24 years, we’ve assisted millions of individuals by offering ready-to-customize and current legal documents. Take advantage of US Legal Forms now to conserve time and resources!

- US Legal Forms is an online repository of current DIY legal documents covering everything from wills and powers of attorney to articles of incorporation and petitions for dissolution.

- Our platform empowers you to handle your matters independently without needing attorney services.

- We provide access to legal document templates that are not always readily available.

- Our templates are specific to states and regions, which significantly eases the search process.

Form popularity

FAQ

How to Form a Corporation in Nevada Choose a Corporate Name.File Articles of Incorporation.File Initial List of Officers and State Business License Application.Appoint a Registered Agent.Prepare Corporate Bylaws.Appoint Directors and Hold First Board Meeting.

It costs $425 to form an LLC in Nevada. Filing the Articles of Organization costs $75. The state business license costs $200, and the list of managers and members costs $150. Your LLC is not official and open for business until you complete the filings and pay the required fees.

To dissolve an LLC in Nevada, simply follow these three steps: Follow the Operating Agreement. Close Your Business Tax Accounts.... Step 1: Follow Your Nevada LLC Operating Agreement.Step 2: Close Your Business Tax Accounts.Step 3: File Articles of Dissolution.

Annual Report (Annual List) The State of Nevada requires you to file an annual report, or what the state more technically calls an annual list, for your LLC. Only a few pieces of information?mainly the names and addresses of the LLC's managers or managing members?are required to complete the list.

The Nevada annual report filing fee is a $150 minimum charge that corporations must pay when filing annual reports under NRS 78.150. This can be paid by mail or online. The annual and biannual reports are the information that must be updated with the Nevada Secretary of State's office by the corporate entity.

To file your Articles of Incorporation, the Nevada Secretary of State charges a minimum filing fee of $75. You must also file the initial list of officers, which costs $150. All corporations doing business in Nevada must also file an annual business license fee, which is $500.

The annual renewal fee is $500 for Corporations, and $200 for all other business entity types. The fee and renewal form are due on the last day of the anniversary month in which the license was originally filed.

In Nevada, an annual list (also known as an annual report) is a regular filing that your LLC must complete every year to update your business information, including: Names and addresses of LLC members or managing members.

Nevada requires LLCs to file an Initial List of Members/Managers and Business License at the time of filing its Articles of Organization. The filing fee is $150 for the Initial List and $200 for the business license registration.

To file your Articles of Incorporation, the Nevada Secretary of State charges a minimum filing fee of $75. You must also file the initial list of officers, which costs $150. All corporations doing business in Nevada must also file an annual business license fee, which is $500.