Clark Nevada Renunciation And Disclaimer of Property from Will by Testate

Description

How to fill out Nevada Renunciation And Disclaimer Of Property From Will By Testate?

We consistently aspire to minimize or avert legal liabilities when engaging with intricate legal or financial matters.

To achieve this, we enlist legal services that are typically very expensive.

However, not all legal dilemmas are of the same intricacy.

Many of them can be managed independently.

Make use of US Legal Forms whenever you need to locate and download the Clark Nevada Renunciation And Disclaimer of Property from Will by Testate or any other document promptly and securely. Simply Log In to your account and click the Get button next to it. If you misplace the document, you can always re-download it from the My documents section. The procedure is equally simple if you are new to the platform! You can establish your account within a few moments. Ensure to verify if the Clark Nevada Renunciation And Disclaimer of Property from Will by Testate aligns with the laws and regulations of your state and locality. Moreover, it is essential to review the form's outline (if available), and if you observe any inconsistencies with your initial requirements, look for an alternative template. Once you confirm that the Clark Nevada Renunciation And Disclaimer of Property from Will by Testate is suitable for your needs, you can select the subscription choice and process your payment. Following that, you can download the document in any preferred format. Over the course of more than 24 years in the industry, we have assisted millions by providing ready-to-modify and current legal documents. Utilize US Legal Forms now to conserve time and resources!

- US Legal Forms is an online directory of current DIY legal documents covering a range of topics from wills and power of attorneys to incorporation articles and dissolution petitions.

- Our library empowers you to take control of your affairs without resorting to legal counsel.

- We provide access to legal document templates that are not always accessible to the general public.

- Our templates are tailored to specific states and regions, which greatly streamlines the search process.

Form popularity

FAQ

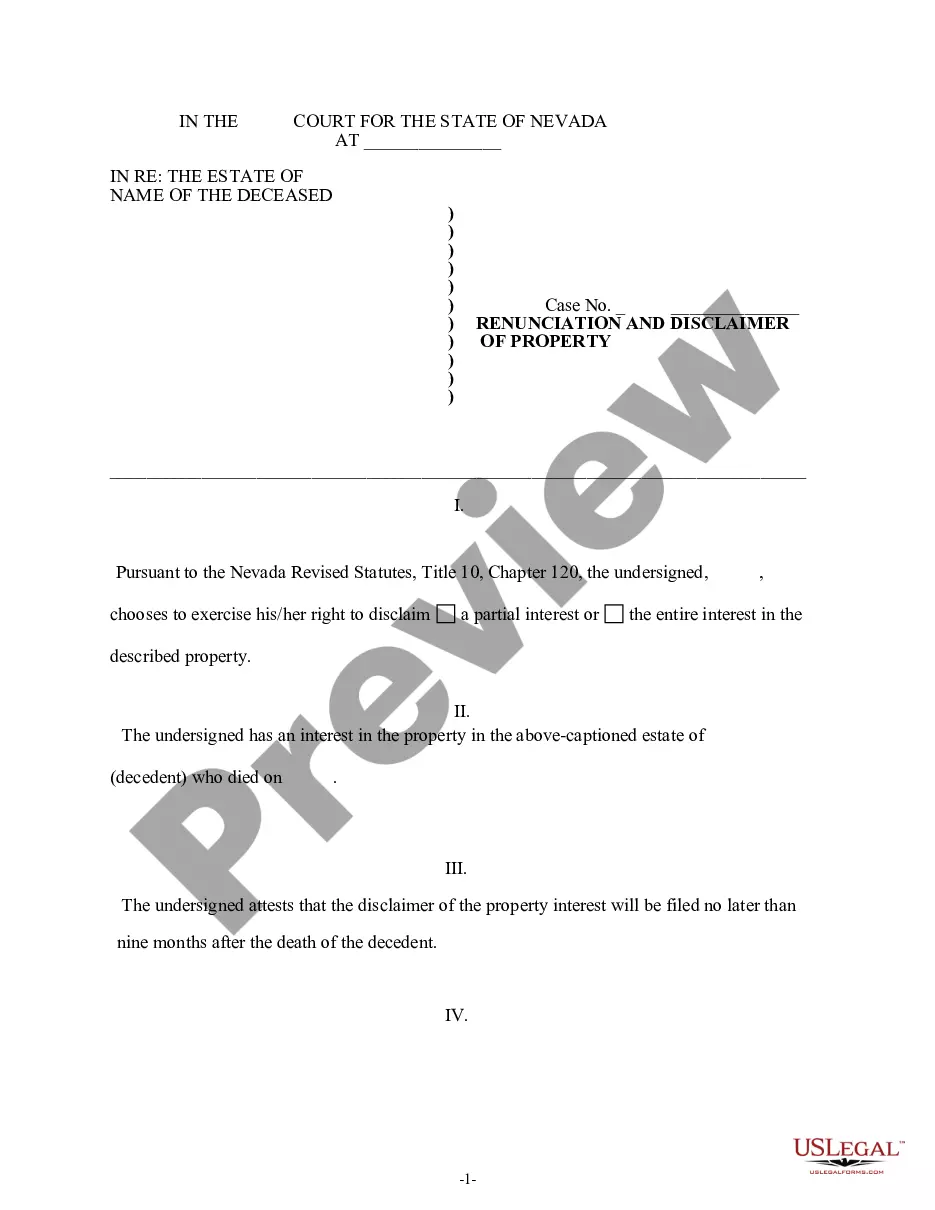

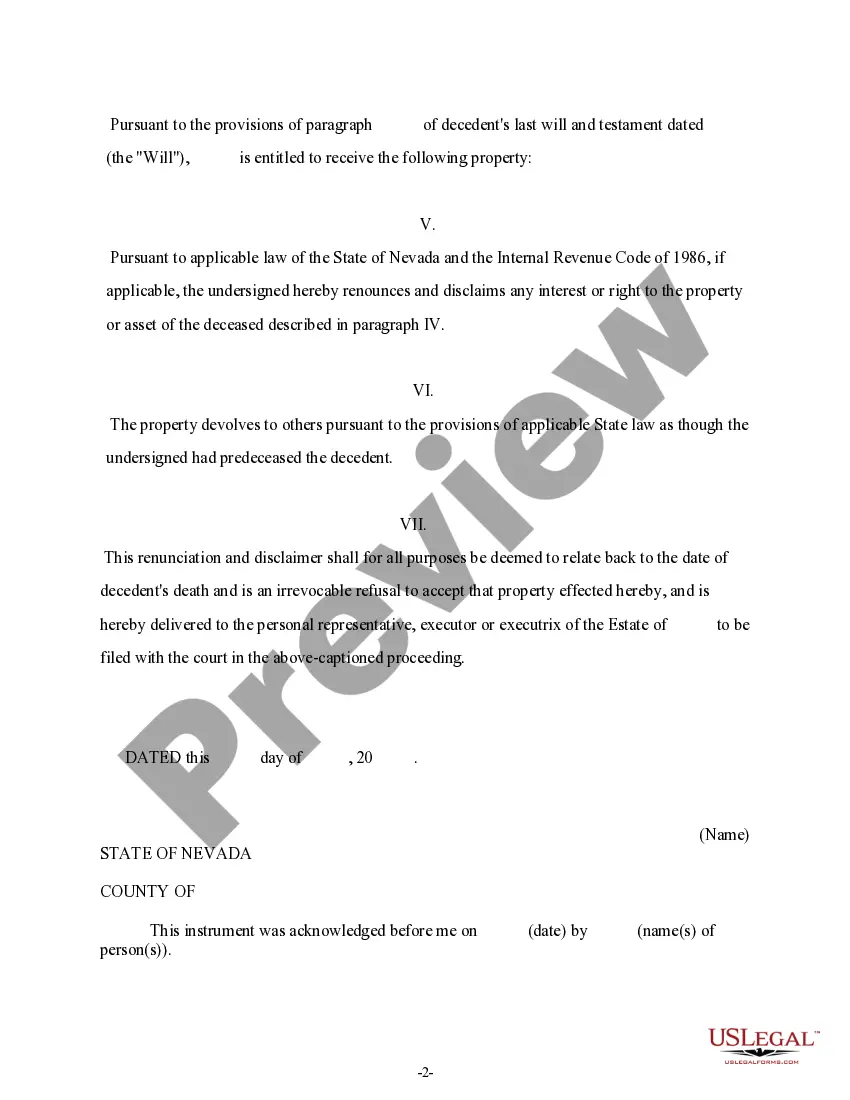

Writing a disclaimer of inheritance involves creating a formal document that states your intention to reject the inherited property. In Clark, Nevada, this usually means outlining your name, the deceased’s name, and specifying the property you are disclaiming in the Clark Nevada Renunciation And Disclaimer of Property from Will by Testate. It is essential to comply with state laws and maintain clarity in your language. Utilizing a platform like Uslegalforms can help you draft a legally sound disclaimer that meets all the necessary requirements.

An example of a disclaimer of estate occurs when an individual chooses to reject their inheritance under a will. For instance, if you receive property from a deceased relative in Clark, Nevada, you can file a Clark Nevada Renunciation And Disclaimer of Property from Will by Testate. This formal action allows you to decline the property, ensuring that it passes to another beneficiary without tax implications. It’s crucial to follow specific legal procedures to ensure the disclaimer is valid.

To execute a will in Nevada, you need to ensure it meets state legal requirements. A will should be in writing, signed by the testator, and witnessed by at least two individuals who are not beneficiaries. If you refer to the Clark Nevada Renunciation And Disclaimer of Property from Will by Testate, it is essential to understand how this process can affect the distribution of your assets. Using the USLegalForms platform can help you navigate these steps effectively, ensuring compliance with Nevada laws.

In Nevada, a disclaimer of inheritance typically does not need to be notarized, but it must be in writing and signed by the disclaimant. While notarization is not a requirement, having it notarized can add an extra layer of legal protection. For more precise guidance on the Clark Nevada Renunciation And Disclaimer of Property from Will by Testate, utilizing the resources at uslegalforms can provide clarity and assistance in this process.

A disclaimer of interest in Nevada allows an heir to refuse their share of an estate, preventing that asset from becoming part of their own estate. This process aligns with the principles of Clark Nevada Renunciation And Disclaimer of Property from Will by Testate, ensuring that the property can transfer seamlessly to other beneficiaries. By understanding this option, beneficiaries can make informed decisions about their inheritance.

A disclaimer is considered qualified if it meets the legal criteria set forth in state laws, such as being made voluntarily and in writing, and within a specified time frame. In the context of Clark Nevada Renunciation And Disclaimer of Property from Will by Testate, it's crucial that the disclaimer does not benefit the disclaimant in any way. Ensuring these conditions are met protects the integrity of the estate and directs the property to the intended recipient.

A disclaimer of property interest is a legal statement that allows an individual to refuse benefits they would otherwise receive from an estate. This acts as a protective measure, keeping the property from becoming part of the disclaimant's estate or subject to their debts. Understanding the specifics of Clark Nevada Renunciation And Disclaimer of Property from Will by Testate can ensure that this process is performed correctly, securing your interests.

To file a will in Nevada, you must submit the original will to the appropriate district court in the county where the deceased lived. This process typically includes the completion of a petition for probate to initiate the estate administration. If you need guidance on the Clark Nevada Renunciation And Disclaimer of Property from Will by Testate, consider exploring resources available on uslegalforms, which can help streamline the filing process.

An example of an estate disclaimer is when an heir, who has been left a house in a will, chooses to refuse the inheritance. Instead of accepting the house, the heir may sign a disclaimer, which allows the property to pass directly to the next beneficiary named in the will. This is relevant in scenarios involving the Clark Nevada Renunciation And Disclaimer of Property from Will by Testate, as it can preserve family harmony and financial interests.

A disclaimer works by allowing beneficiaries to refuse their share of an estate, which effectively redirects that share according to the terms of the will or state laws. In Clark Nevada Renunciation And Disclaimer of Property from Will by Testate, this process can simplify the distribution of assets and prevent potential conflicts among heirs. This legal tool can also help ensure that the property goes to other heirs or is used for the original intent of the testator.