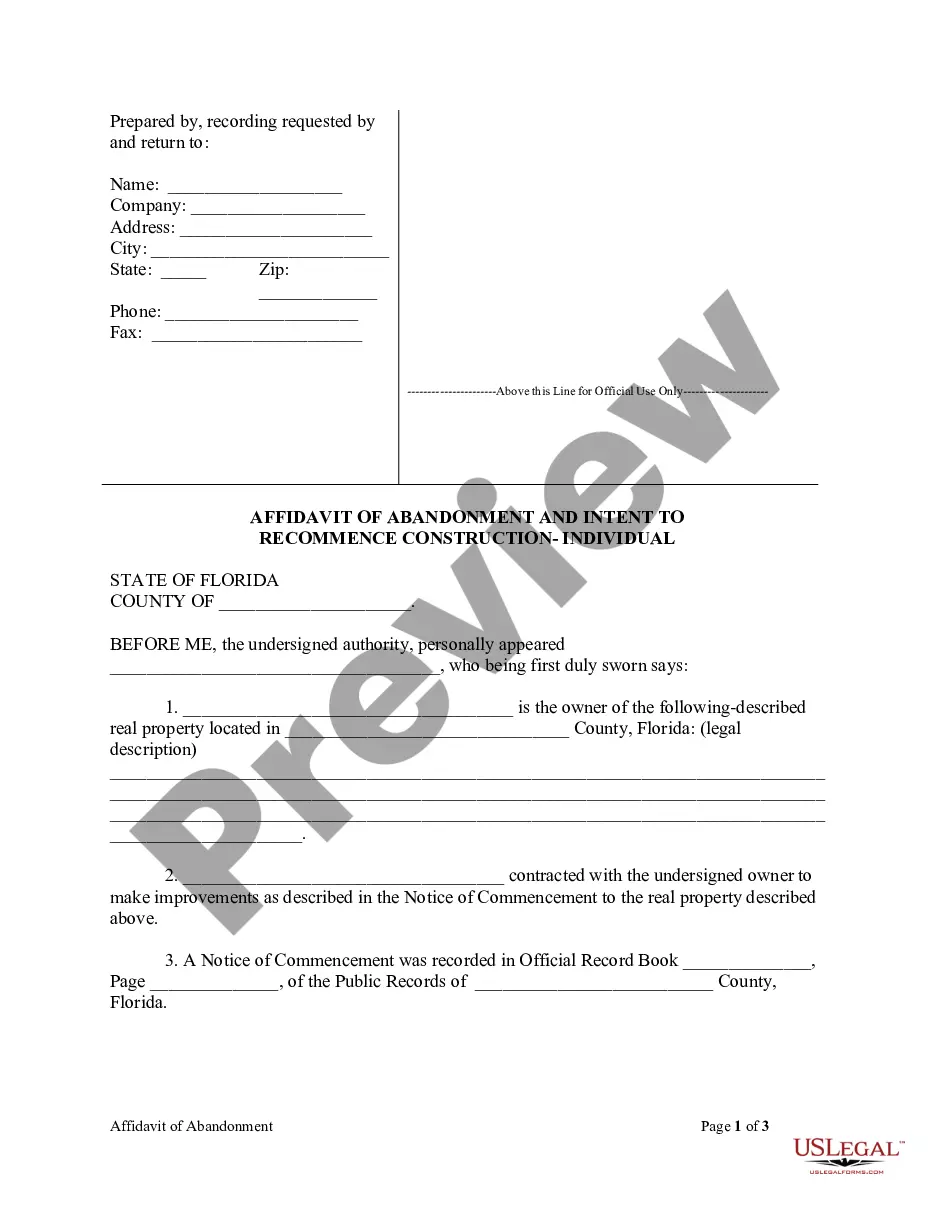

Clark Nevada Final Notice of Default for Past Due Payments in connection with Contract for Deed

Description

How to fill out Nevada Final Notice Of Default For Past Due Payments In Connection With Contract For Deed?

We consistently aim to mitigate or avert legal repercussions when handling intricate legal or financial issues.

To achieve this, we seek attorney solutions that, as a general rule, tend to be quite expensive.

Nevertheless, not all legal issues are necessarily complicated. Many of them can be managed independently.

US Legal Forms is an online repository of current DIY legal documents covering everything from testaments and powers of attorney to articles of incorporation and petitions for dissolution.

Simply Log In to your account and click the Get button next to it. If you misplace the document, you can always redownload it from the My documents tab. The process is equally straightforward if you’re new to the website! You can create your account in just a few minutes. Ensure that the Clark Nevada Final Notice of Default for Past Due Payments linked to Contract for Deed complies with the laws and regulations of your state and locality. Additionally, it’s crucial that you review the form’s description (if available), and if you spot any inconsistencies with what you were originally seeking, look for a different form. Once you're certain that the Clark Nevada Final Notice of Default for Past Due Payments regarding Contract for Deed meets your needs, you can select a subscription option and proceed with payment. Afterward, you can download the document in any suitable file format. With over 24 years of experience in the market, we’ve assisted millions by providing customizable and up-to-date legal forms. Maximize your use of US Legal Forms now to conserve effort and resources!

- Our collection empowers you to manage your issues without resorting to legal counsel.

- We offer access to legal document templates that are not always readily available.

- Our templates are specific to states and regions, which greatly simplifies the search procedure.

- Leverage US Legal Forms when you need to quickly and securely obtain and download the Clark Nevada Final Notice of Default for Past Due Payments associated with Contract for Deed or any other document.

Form popularity

FAQ

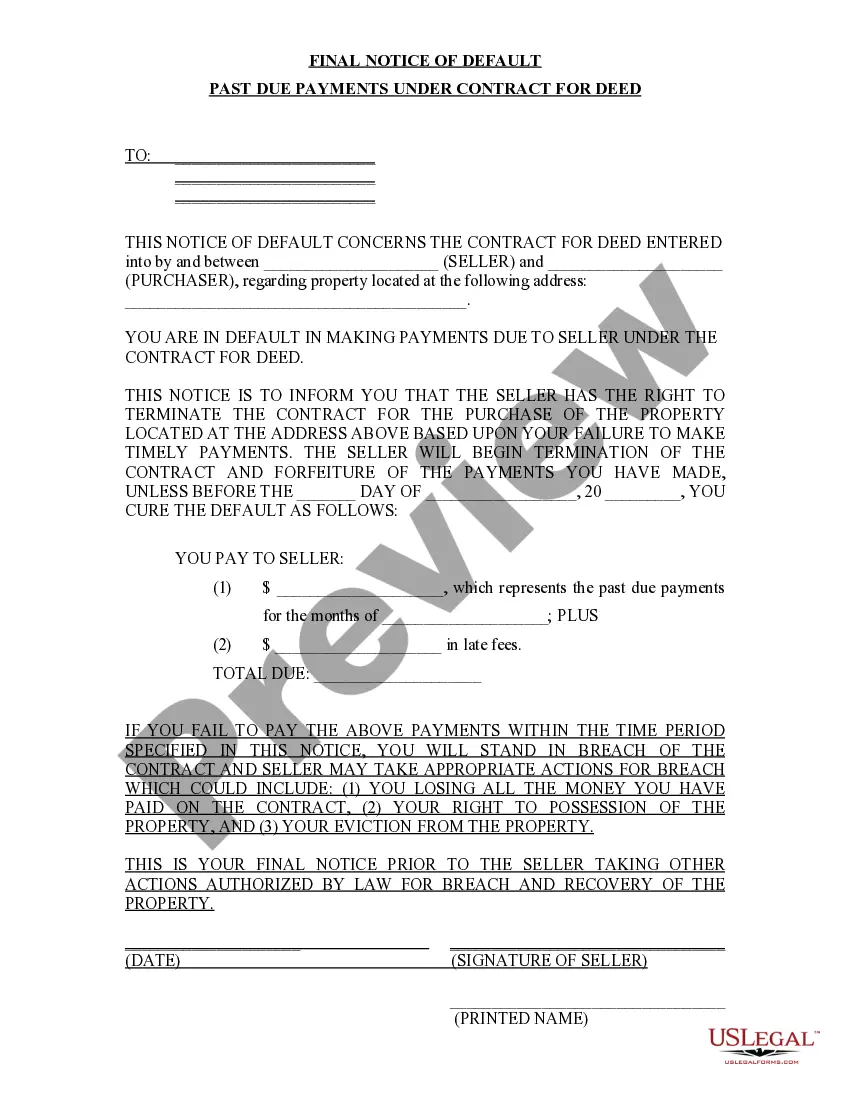

When a contract for deed enters default, the seller must follow specific steps to regain possession of the property. First, a Clark Nevada Final Notice of Default for Past Due Payments in connection with Contract for Deed must be issued to the buyer. This notice informs the buyer of the default and allows them an opportunity to rectify the situation. If the default remains unaddressed, the seller may then pursue legal action, which can include foreclosure, to reclaim ownership and rights to the property.

In Nevada, the statute of limitations on a deed of trust is typically six years for the lender to enforce the agreement. This means that if payments are missed, the lender has a limited window to act. If you are facing issues related to a Clark Nevada Final Notice of Default for Past Due Payments in connection with Contract for Deed, it is important to understand these timeframes. Consulting with a legal expert can provide clarity and help you navigate your situation.

A notice of intent to default in Nevada is a preliminary warning issued to the borrower regarding overdue payments, often preceding a formal notice of default. This document alerts borrowers to their financial obligations and encourages them to take corrective action. Utilizing resources like the Clark Nevada Final Notice of Default for Past Due Payments in connection with Contract for Deed can help borrowers understand their options and the urgency of addressing payment issues.

The foreclosure process in Nevada can take several months, often ranging from three to six months, depending on specific circumstances. Once a notice of default is filed, the borrower typically has a chance to resolve the debt before foreclosure proceedings begin. The Clark Nevada Final Notice of Default for Past Due Payments in connection with Contract for Deed provides borrowers with crucial timeframes and options to potentially avoid losing their home.

Default status in Nevada refers to the legal classification assigned to a borrower who has missed multiple mortgage payments. This status adversely impacts the borrower's credit and financial standing. Understanding the implications of default status is crucial, especially with the Clark Nevada Final Notice of Default for Past Due Payments in connection with Contract for Deed, which serves as a formal warning and outlines the next steps for resolution.

Receiving a notice of default in Nevada clearly indicates the urgency of your financial situation. It typically prompts the borrower to address their payment issues immediately, allowing a chance to rectify the default before facing foreclosure. The Clark Nevada Final Notice of Default for Past Due Payments in connection with Contract for Deed often outlines the necessary steps to avoid further penalties, providing essential information for those in distress.

A notice of default in Nevada is a formal document issued when a borrower fails to make mortgage payments on time. This signifies that the lender has declared the borrower in default, initiating the process that may lead to foreclosure. The Clark Nevada Final Notice of Default for Past Due Payments in connection with Contract for Deed specifies the amount owed and any actions the borrower must take to avoid further legal steps.