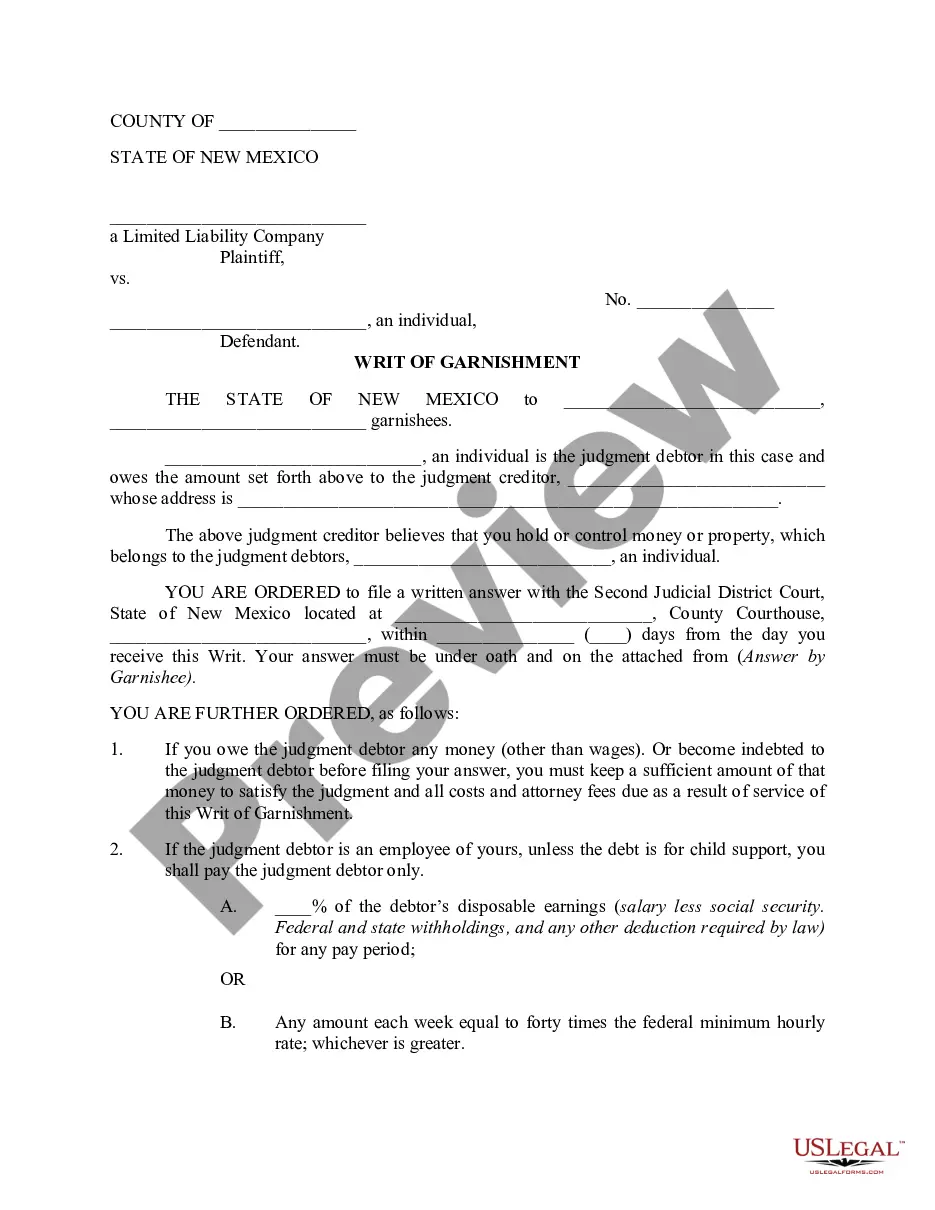

Las Cruces New Mexico Writ of Garnishment

Description

How to fill out New Mexico Writ Of Garnishment?

Utilize the US Legal Forms and gain immediate access to any form example you require.

Our convenient platform with a vast collection of templates simplifies the process of locating and acquiring nearly any document example you need.

You can save, complete, and endorse the Las Cruces New Mexico Writ of Garnishment in just a few moments rather than spending hours online searching for an appropriate template.

Employing our catalog is an excellent method to enhance the security of your document submissions.

If you don’t have an account yet, follow the steps outlined below.

Feel free to take advantage of our platform and make your document experience as effortless as possible!

- Our experienced attorneys routinely review all the forms to ensure that they are suitable for a specific state and adhere to the latest laws and regulations.

- How can you acquire the Las Cruces New Mexico Writ of Garnishment.

- If you hold a subscription, simply Log In to your account.

- The Download option will be available for all the documents you view.

- Additionally, you can access all your previously saved documents in the My documents section.

Form popularity

FAQ

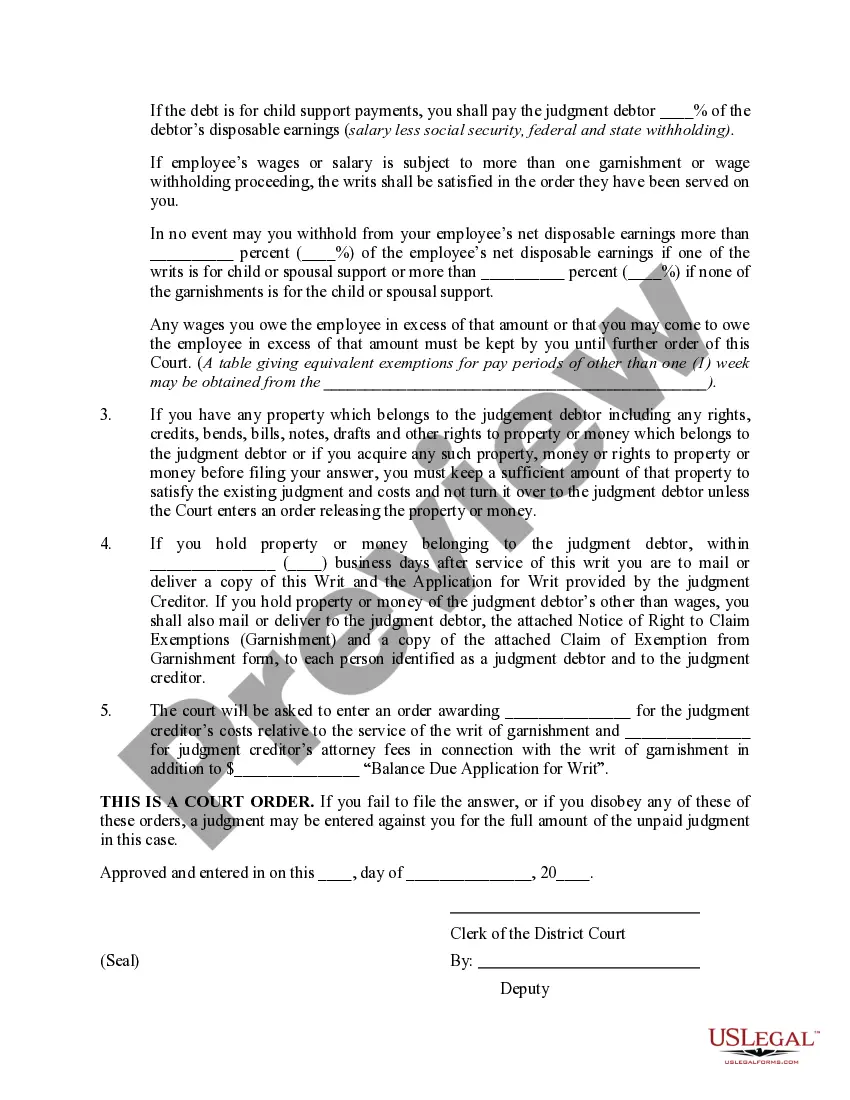

The most that can be garnished from your paycheck largely depends on the type of debt and your disposable income. For most debts, creditors can garnish amounts up to 25% of your disposable earnings. However, for certain types of debts, like those owed to the IRS, this might vary. Consulting legal resources can provide clarity on your specific circumstances in Las Cruces, New Mexico.

In general, the maximum amount that can be garnished from a paycheck is subjected to federal and state laws. Typically, the maximum is 25% of disposable income or the amount that exceeds 30 times the federal minimum wage. Understanding these details can help navigate potential garnishments effectively in Las Cruces, New Mexico.

The amount that can be garnished from a checking account typically depends on the type of debt. Standard practices allow creditors to access funds up to the total value of the debt owed, but certain exemptions may apply. For more tailored guidance, explore the U.S. Legal Forms platform to find specific details about your situation legal in Las Cruces, New Mexico.

To garnish wages in New Mexico, a creditor must obtain a court order, which is executed through a writ of garnishment. After securing the writ, it is served to the employer of the debtor in Las Cruces, New Mexico. Following this, the employer is legally required to withhold the specified amount from the debtor's paycheck.

The IRS can garnish a significant portion of your paycheck, often up to 25% of your disposable earnings. However, this amount may vary based on your financial situation and federal guidelines. If you find yourself in this situation in Las Cruces, New Mexico, it can be wise to consult with a legal expert regarding a writ of garnishment.

A writ of garnishment is typically served by a sheriff or a process server. In Las Cruces, New Mexico, once the court issues the writ, the server delivers it to the employer or the bank holding the debtor's funds. This action legally directs them to withhold a specified amount from the debtor's wages or bank account.

Indeed, New Mexico is a wage garnishment state, where part of your paycheck can be withheld to satisfy a debt. Creditors must follow legal procedures to initiate this process. Being informed about how the Las Cruces New Mexico Writ of Garnishment applies can offer further protection and help you manage any garnishment effectively.

In New Mexico, the amount that can be garnished from your paycheck generally depends on your disposable income. Typically, creditors can garnish up to 25% of your disposable earnings. However, knowing how a Las Cruces New Mexico Writ of Garnishment works can provide clearer insights into your specific situation.

Yes, New Mexico is a garnishment state, allowing creditors to collect on debts through wage garnishments and other methods. This process, governed by local laws, involves legal steps that vary depending on the specific circumstances. Familiarizing yourself with how a Las Cruces New Mexico Writ of Garnishment functions can assist you in navigating these laws.

In New Mexico, the statute of limitations for collecting most debts typically ranges from four to six years. Once this period has passed, debts may become uncollectible. Knowing the timeline can help you assess any outstanding obligations, especially in the context of a Las Cruces New Mexico Writ of Garnishment.