This form is a Personal Representative's Deed of Distribution where the Grantor is the Personal Representative of an estate and the Grantees are the beneficiaries of the estate. Grantor conveys the described property to the Grantees. This deed complies with all state statutory laws.

Las Cruces New Mexico Deed of Distribution - Personal Representative to Two Individuals

Description

How to fill out New Mexico Deed Of Distribution - Personal Representative To Two Individuals?

Take advantage of the US Legal Forms and gain immediate access to any template sample you require.

Our user-friendly platform, featuring thousands of document templates, lets you locate and obtain virtually any document sample you need.

You can save, complete, and sign the Las Cruces New Mexico Deed of Distribution Personal Representative to Two Individuals in just minutes instead of spending countless hours online searching for the correct template.

Utilizing our collection is an excellent method to enhance the security of your form submissions.

If you haven’t created an account yet, follow the steps below.

Access the page with the template you need. Ensure it is the form you intended to find: check its title and description, and utilize the Preview function when available. Otherwise, use the Search field to look for the necessary one.

- Our skilled attorneys regularly examine all the documents to ensure that the forms are suitable for a specific state and adhere to new laws and regulations.

- How can you acquire the Las Cruces New Mexico Deed of Distribution Personal Representative to Two Individuals.

- If you have a subscription, simply Log In to your account.

- The Download button will be activated on all documents you view.

- Additionally, you can find all previously saved forms in the My documents section.

Form popularity

FAQ

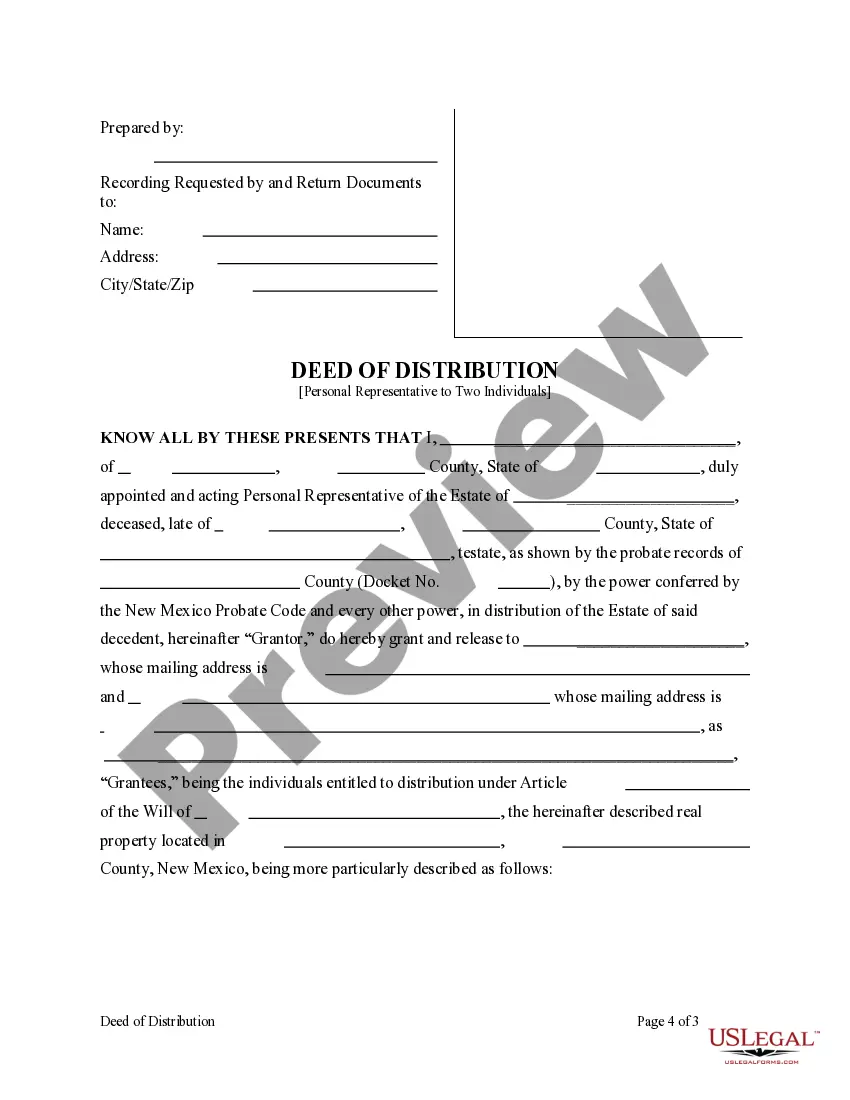

A personal representative deed in New Mexico serves as a legal document that transfers property ownership from a deceased person's estate to designated individuals. Specifically, the Las Cruces New Mexico Deed of Distribution—Personal Representative to Two Individuals allows the personal representative to distribute assets as outlined in the will. This deed is crucial for properly managing and distributing the estate according to the deceased's wishes.

In Las Cruces, New Mexico, you do not necessarily need a lawyer to obtain a personal representative deed, but having legal assistance can be beneficial. A lawyer can help you navigate the nuances of estate law and ensure the Las Cruces New Mexico Deed of Distribution—Personal Representative to Two Individuals is executed correctly. However, if you are familiar with the process, you can use resources like US Legal Forms to complete the deed without a lawyer.

To obtain a personal representative deed in Las Cruces, New Mexico, you must first identify the estate's personal representative, who is often named in the will. This individual must prepare the required documents, including the Las Cruces New Mexico Deed of Distribution—Personal Representative to Two Individuals. You can simplify the process by using platforms like US Legal Forms, which provide templates and guidance to ensure you complete everything correctly.

To obtain a personal representative deed in Las Cruces, New Mexico, you can start by gathering relevant documents such as the will and proof of your position as the personal representative. You may also consult legal platforms like USLegalForms for templates and guidance tailored to your needs. This will streamline the process and ensure compliance with local regulations.

A personal representative's deed conveys various types of property, which may include real estate, personal belongings, and financial assets. This document formalizes the distribution specified in the deceased's will or dictated by state laws in Las Cruces, New Mexico. It ensures that all parties involved understand the transfer of ownership.

The term 'deed conveyed' refers to the legal act of transferring ownership from one party to another. In the context of the Las Cruces New Mexico Deed of Distribution, it describes how property ownership shifts from the deceased's estate to their beneficiaries. This process is vital for establishing clear rights of ownership.

A personal representative's deed conveys the title of property belonging to a deceased individual to their beneficiaries. This deed acts as a formal acknowledgment of the transfer, effectively changing the ownership from the estate to the designated individuals. Such a document is essential for ensuring the rightful heirs receive their inheritance.

A personal representative deed typically outlines the transfer of specific properties from the estate to designated beneficiaries. It provides legal proof that the personal representative has fulfilled their duty of distribution under the laws of Las Cruces, New Mexico. This ensures transparency and protects the rights of the beneficiaries.

A personal representative's deed of distribution is a legal document used in Las Cruces, New Mexico, to transfer property from the estate of a deceased individual to beneficiaries. This deed is crucial when distributing assets, as it officially conveys the rights of ownership. By using this document, a personal representative ensures that the distribution is executed according to the deceased's wishes.

To fill out a personal representative deed, start with the complete details of the estate, including any legal identifiers. Clearly outline the beneficiaries and the property being distributed. Make sure to review the specific requirements of the Las Cruces New Mexico Deed of Distribution to ensure full compliance and proper execution.