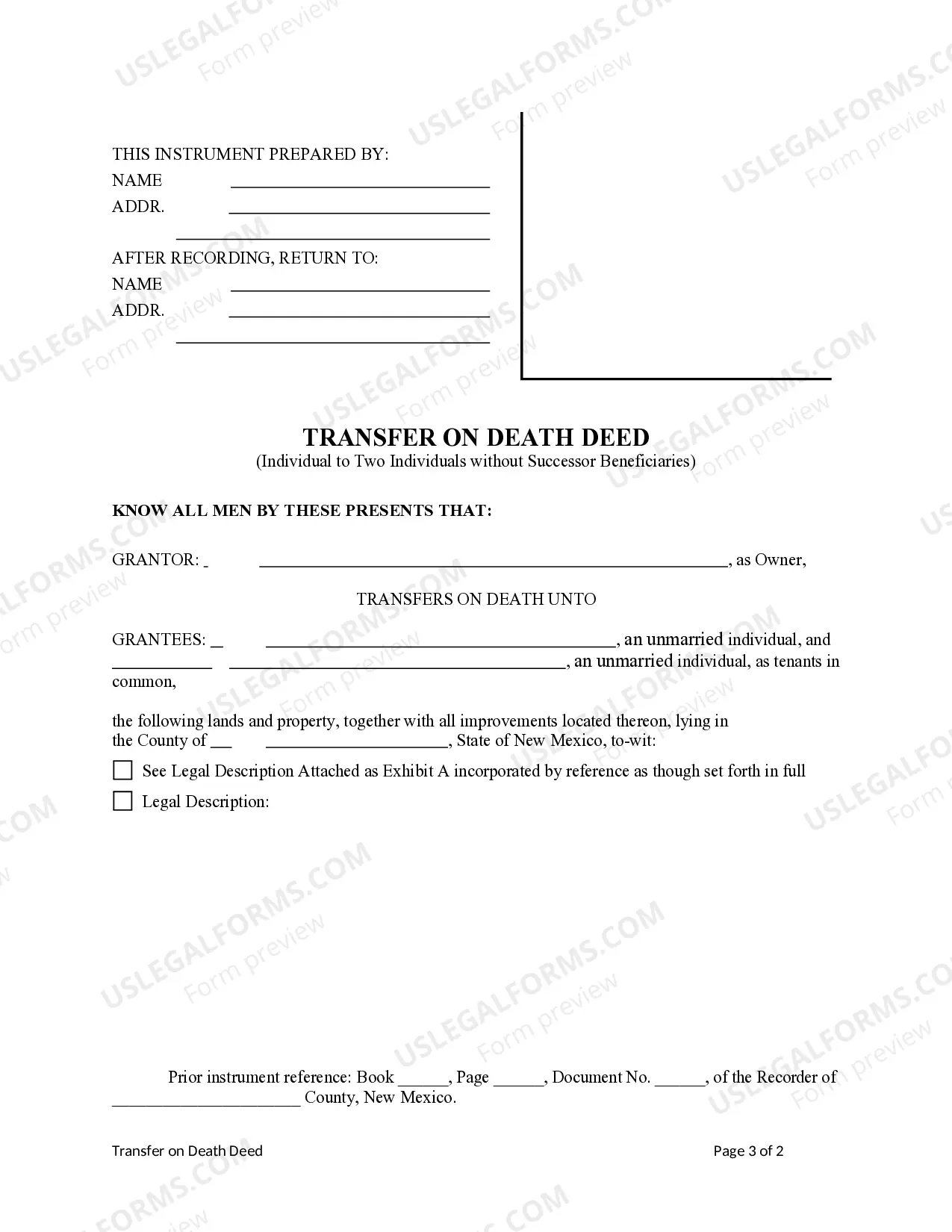

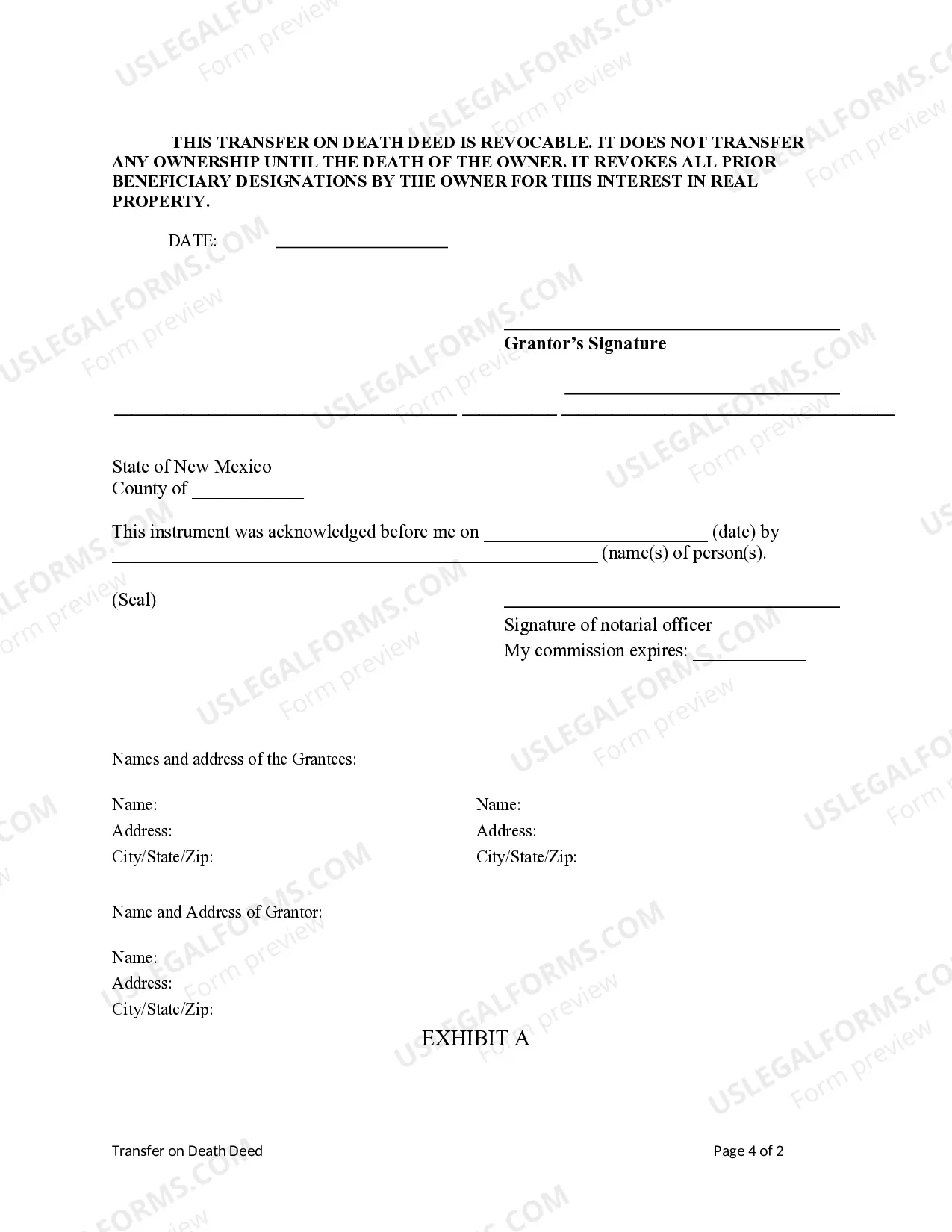

This form is a Beneficiary Deed where the Grantor is an individual and there are two Grantee Beneficiaries. There are NO named Successor Grantee Beneficiaries. Grantor conveys and transfers, upon Grantor's death, to the Grantee Beneficiaries as tenants in common. This Deed is not effective unless recorded prior to Grantor's death. This deed complies with all state statutory laws.

Albuquerque New Mexico Transfer on Death Deed - Individual to Two Individuals Without Successor Beneficiaries

Description

How to fill out New Mexico Transfer On Death Deed - Individual To Two Individuals Without Successor Beneficiaries?

If you are looking for a legitimate form, it’s incredibly difficult to discover a more suitable service than the US Legal Forms website – likely the most substantial online libraries.

With this collection, you can locate a vast array of templates for commercial and personal needs categorized by type and state, or through keywords.

Employing our premium search functionality, finding the latest Albuquerque New Mexico Transfer on Death Deed - Individual to Two Individuals Without Successor Beneficiaries is as simple as 1-2-3.

Obtain the form. Select the format and save it onto your device.

Edit. Complete, alter, print, and sign the acquired Albuquerque New Mexico Transfer on Death Deed - Individual to Two Individuals Without Successor Beneficiaries.

- If you are already aware of our platform and possess a registered account, to acquire the Albuquerque New Mexico Transfer on Death Deed - Individual to Two Individuals Without Successor Beneficiaries, simply Log In to your user profile and click the Download button.

- If you are using US Legal Forms for the first time, just adhere to the instructions outlined below.

- Ensure you have accessed the form you need. Review its description and utilize the Preview feature (if available) to examine its details. If it doesn’t fulfill your needs, use the Search box at the top of the page to locate the required document.

- Validate your choice. Click on the Buy now button. Next, select your desired subscription plan and enter the information to create an account.

- Complete the payment process. Use your credit card or PayPal account to finalize the registration process.

Form popularity

FAQ

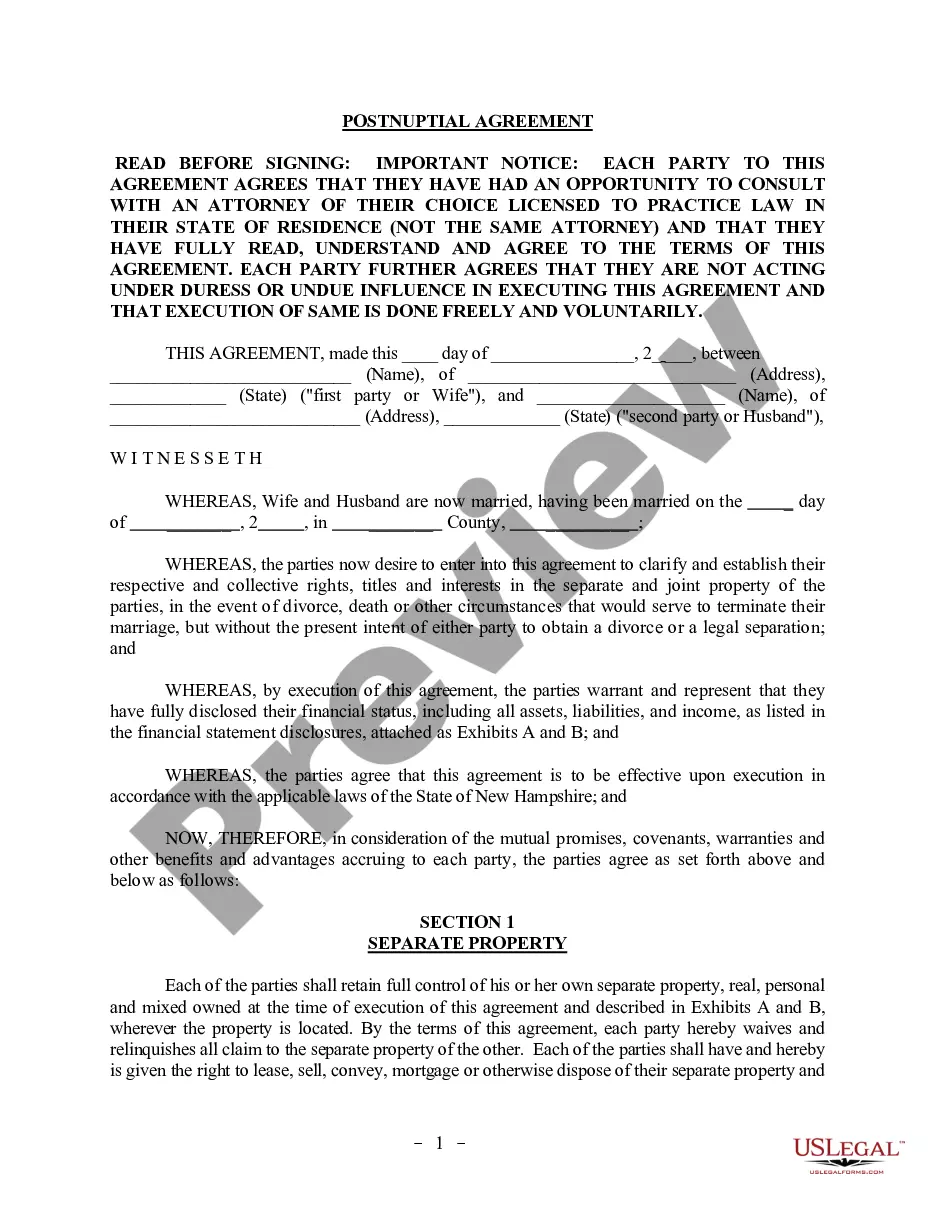

If you don't have a will or a Transfer on Death Deed, your real estate must go through the probate court and your property will pass to your heirs according to Texas law. Probate can be lengthy and expensive, with attorney fees and court costs paid from your estate.

Texas law allows multiple owners to name someone else to receive the property after both of them die. For example, a husband and wife may own property jointly with right of survivorship during life and create a TOD deed that transfers the property to named beneficiaries on the death of the last of them to die.

Transfer-on-death (TOD) refers to named beneficiaries that receive assets at the death of the property owner without the need for probate, facilitating the executor's disposition of the property owner's assets after their death.

TOD account holders can name multiple beneficiaries and divide assets any way they like. If your TOD investment account is set up to be split evenly between your children, each will receive an even part when you die.

While naming a TOD beneficiary can help your heirs avoid the probate process, it doesn't confer any tax benefit. It doesn't help you to avoid estate taxes, and your heirs will still have to pay income tax on the earnings of a certificate of deposit (CD) after you pass away.

The primary advantage of a transfer on death deed is to avoid the probate process. If a property owner has executed a transfer on death deed, then as soon as the property owner dies, that property passes to the person named. The beneficiary does not have to go to court.

Because TOD accounts are still part of the decedent's estate (although not the probate estate that the Last Will establishes), they may be subject to income, estate and/or inheritance tax. TOD accounts are also not out of reach for the decedent's creditors or other relatives.

A beneficiary form states who will directly inherit the asset at your death. Under a TOD arrangement, you keep full control of the asset during your lifetime and pay taxes on any income the asset generates as you own it outright. TOD arrangements require minimal paperwork to establish.

The law in New Mexico allows an owner of real property (land or house) to transfer that property to another person (grantee beneficiary) through the use of a Transfer on Death Deed (TODD).

Two documents are recommended for the transfer of property after death without a Will. An Affidavit of Heirship. The Affidavit of Heirship is a sworn statement that identifies the heirs. It is signed in front of a notary by an heir and two witnesses knowledgeable about the family history of the deceased.