Jersey City New Jersey Answering Statement to Motion for Workers' Compensation

Description

How to fill out New Jersey Answering Statement To Motion For Workers' Compensation?

If you are seeking a legitimate form template, it’s difficult to find a superior location than the US Legal Forms website – one of the most extensive online libraries.

Here you can obtain a vast number of document examples for business and personal needs categorized by areas and states, or keywords.

With our sophisticated search feature, locating the latest Jersey City New Jersey Response Statement to Motion for Workers' Compensation is as simple as 1-2-3.

Complete the transaction. Use your credit card or PayPal account to finalize the registration process.

Acquire the form. Select the file format and download it to your device.

- Furthermore, the significance of each document is ensured by a team of skilled attorneys who continually review the templates on our site and update them according to the most current state and county regulations.

- If you are already familiar with our system and possess an account, all you need to do to access the Jersey City New Jersey Response Statement to Motion for Workers' Compensation is to Log In to your profile and click the Download button.

- If you are using US Legal Forms for the first time, simply adhere to the instructions below.

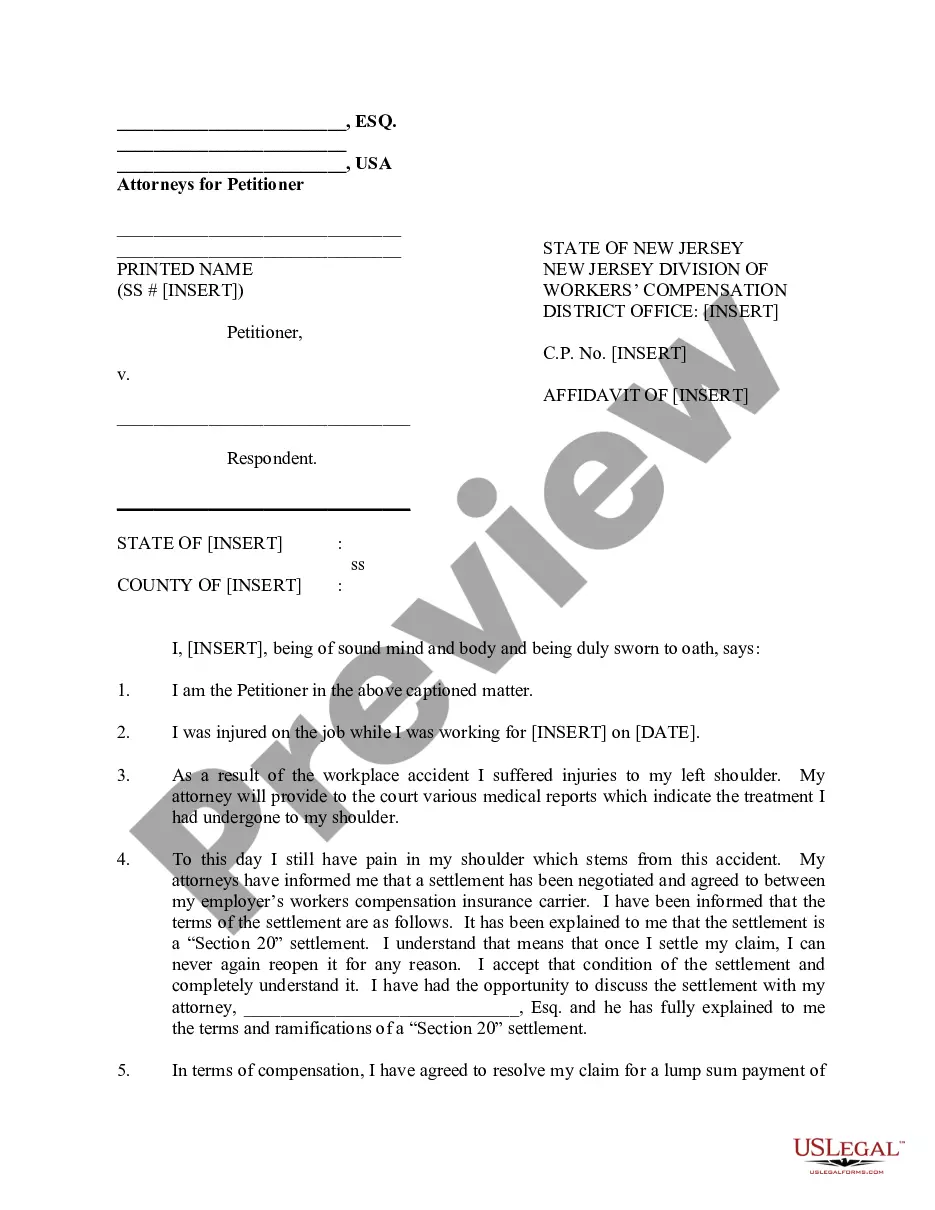

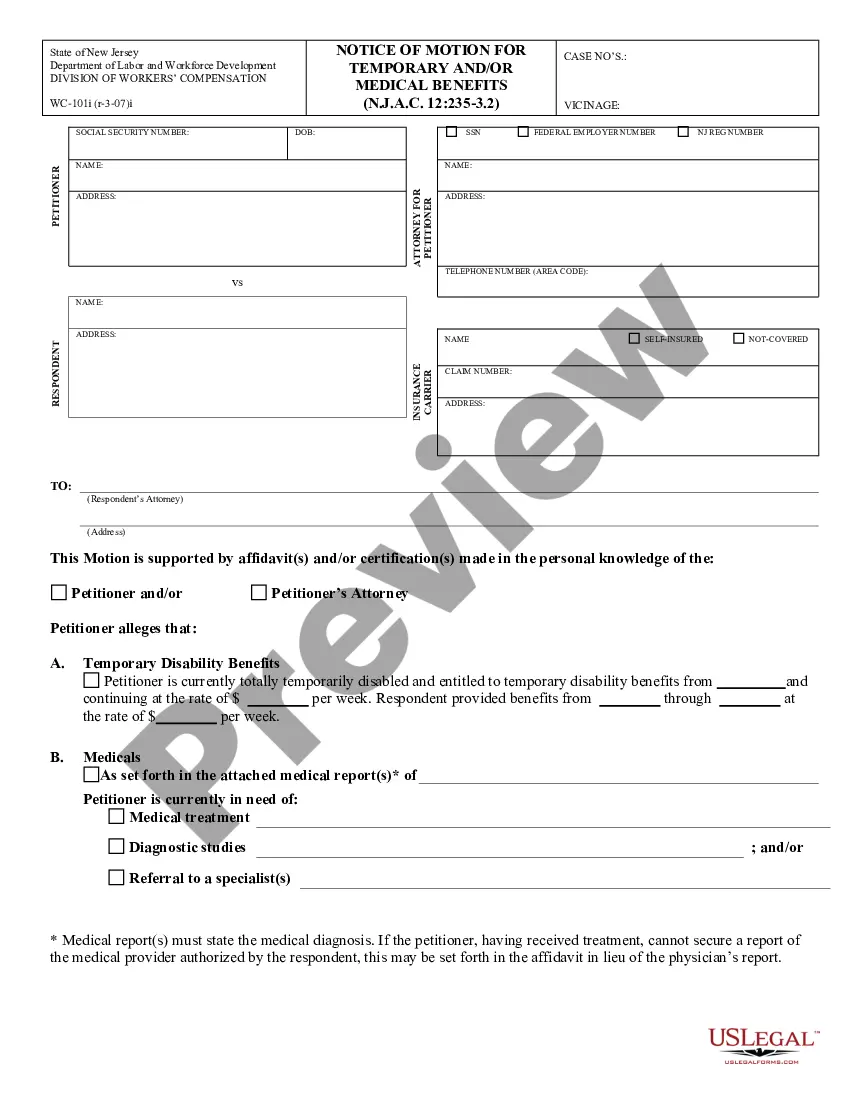

- Ensure you have located the template you need. Review its details and utilize the Preview function to examine its contents. If it doesn't fulfill your needs, use the Search feature at the top of the page to find the appropriate document.

- Validate your choice. Select the Buy now button. Next, choose your preferred payment plan and provide the necessary information to create an account.

Form popularity

FAQ

By law, workers' compensation insurance carriers have 60 days to process the payment. After 60 days, you may be entitled to receive simple interest for the delay. In most cases, you may expect to receive your initial benefit payment in 6-8 weeks following the judge's order.

In New Jersey, these benefits are 70% of your average weekly wages before the injury, but there is a maximum and minimum that changes every year. For injuries that happen in 2021, the weekly maximum benefit is $969, and the minimum is $258. TTD benefits continue until you: are able to return to your job.

Under New Jersey workers' compensation law, employers cannot be sued for work injuries. However, the law does not bar workers from filing suit against non-employers who may have played a role in causing an accident at work.

How Long Do Workers' Comp Settlements Take in NJ? The short answer is, it depends. Claims that are not in dispute may be paid as soon as 30 to 60 days of filing, and in fact, where there is no dispute you may be entitled to interest if the payment is delayed beyond 60 days.

Regardless of when, how, or why your employer stops payments, workers comp cannot stop paying without notice. Your employer or their insurer cannot stop paying you workers' compensation benefits without telling you.

When you settle your workers' comp claim, you give up certain benefits in exchange for an agreed-upon sum of money. Settlements can be paid in a lump sum or in installments on a monthly, annual, or other basis.

Fortunately, workers' compensation benefits are not taxable. Neither the New Jersey Division of Taxation nor the Internal Revenue Service (IRS) taxes medical or disability benefits received through workers' comp.

Workers' compensation is a ?no fault? insurance program that provides medical treatment, wage replacement, and permanent disability compensation to employees who suffer job-related injuries or illnesses. It also provides death benefits to dependents of workers who have died as a result of their employment.

In Vitale v. Schering-Plough Corporation, 231 N.J. 234 (2017), the New Jersey Supreme Court held that section 39 of the New Jersey Worker's Compensation Act prohibits a waiver of an employee's claims against third-party tortfeasors.