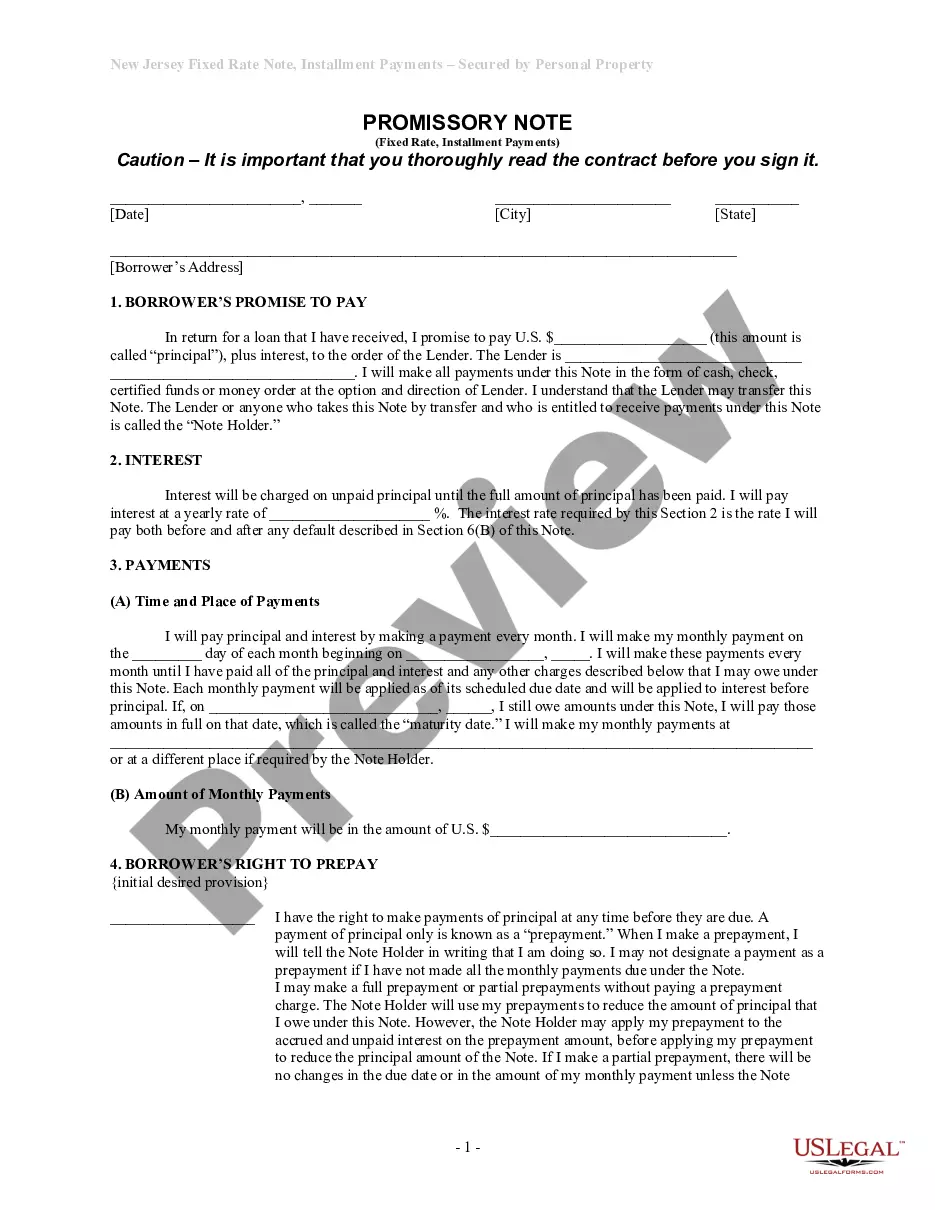

Elizabeth New Jersey Installments Fixed Rate Promissory Note Secured by Personal Property

Description

How to fill out New Jersey Installments Fixed Rate Promissory Note Secured By Personal Property?

Obtaining validated templates tailored to your local laws can be difficult unless you access the US Legal Forms resource.

This is an online collection of over 85,000 legal documents catering to both personal and professional requirements and various real-world scenarios.

All documents are systematically organized by usage area and jurisdiction, making it simple and straightforward to find the Elizabeth New Jersey Installments Fixed Rate Promissory Note Secured by Personal Property.

Provide your credit card information or utilize your PayPal account to cover the service fee.

- Examine the Preview mode and document description.

- Ensure you have selected the correct document that fulfills your needs and aligns with your local jurisdiction stipulations.

- Search for another template, if required.

- If you discover any discrepancies, use the Search tab above to locate the accurate one. If it meets your expectations, proceed to the following step.

- Complete the transaction.

Form popularity

FAQ

Yes, promissory notes can be secured by collateral, providing additional assurance to lenders. In the case of an Elizabeth New Jersey Installments Fixed Rate Promissory Note Secured by Personal Property, personal property acts as collateral, reducing the lender’s risk. This arrangement enhances the borrower’s credibility and facilitates smoother transactions, making it a beneficial option for both parties.

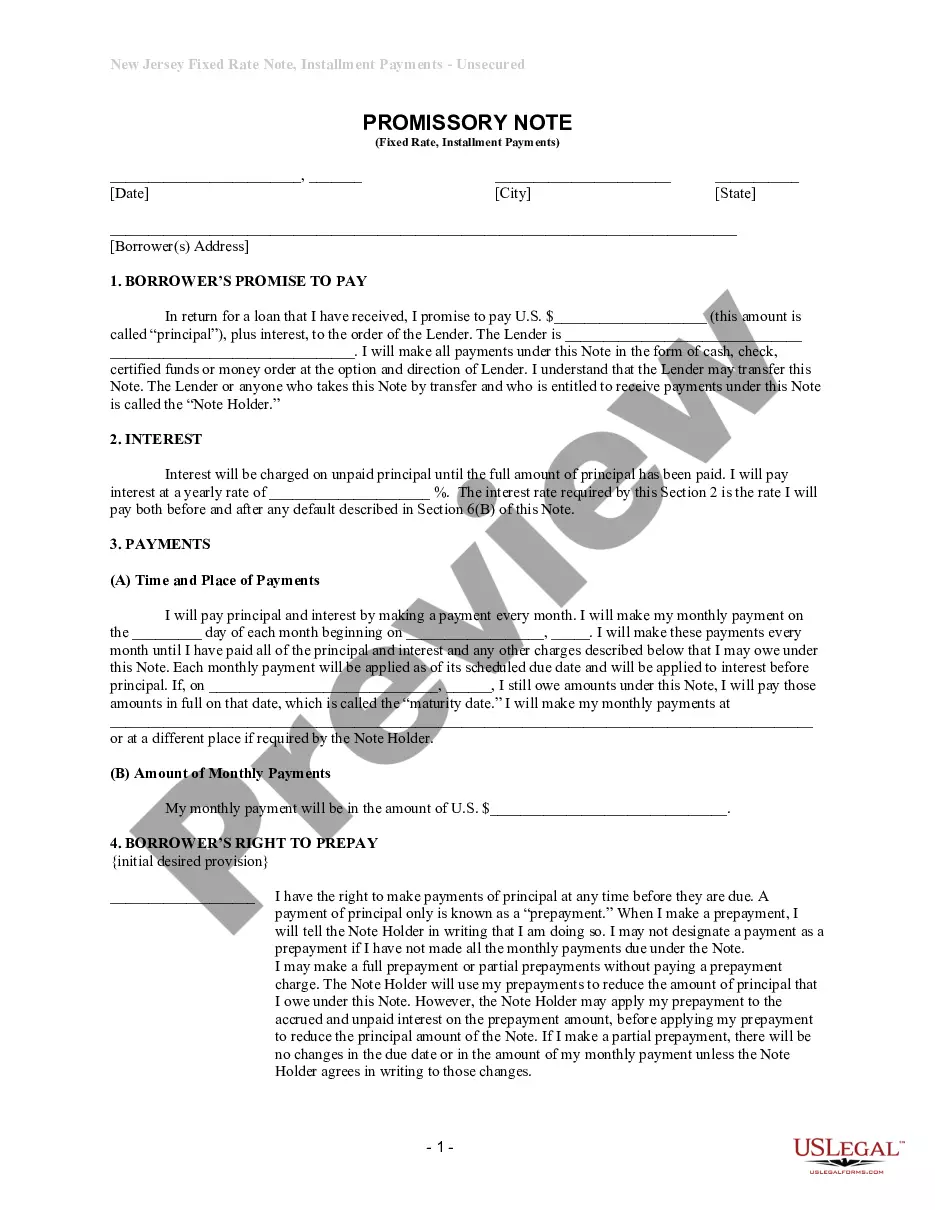

An installment note typically involves a series of payments scheduled over time, making it easier for borrowers to manage their finances. In contrast, a promissory note can be a one-time payment or may have different terms for repayment. For ones looking to understand Elizabeth New Jersey Installments Fixed Rate Promissory Note Secured by Personal Property, knowing these distinctions helps in making informed decisions about borrowing and lending.

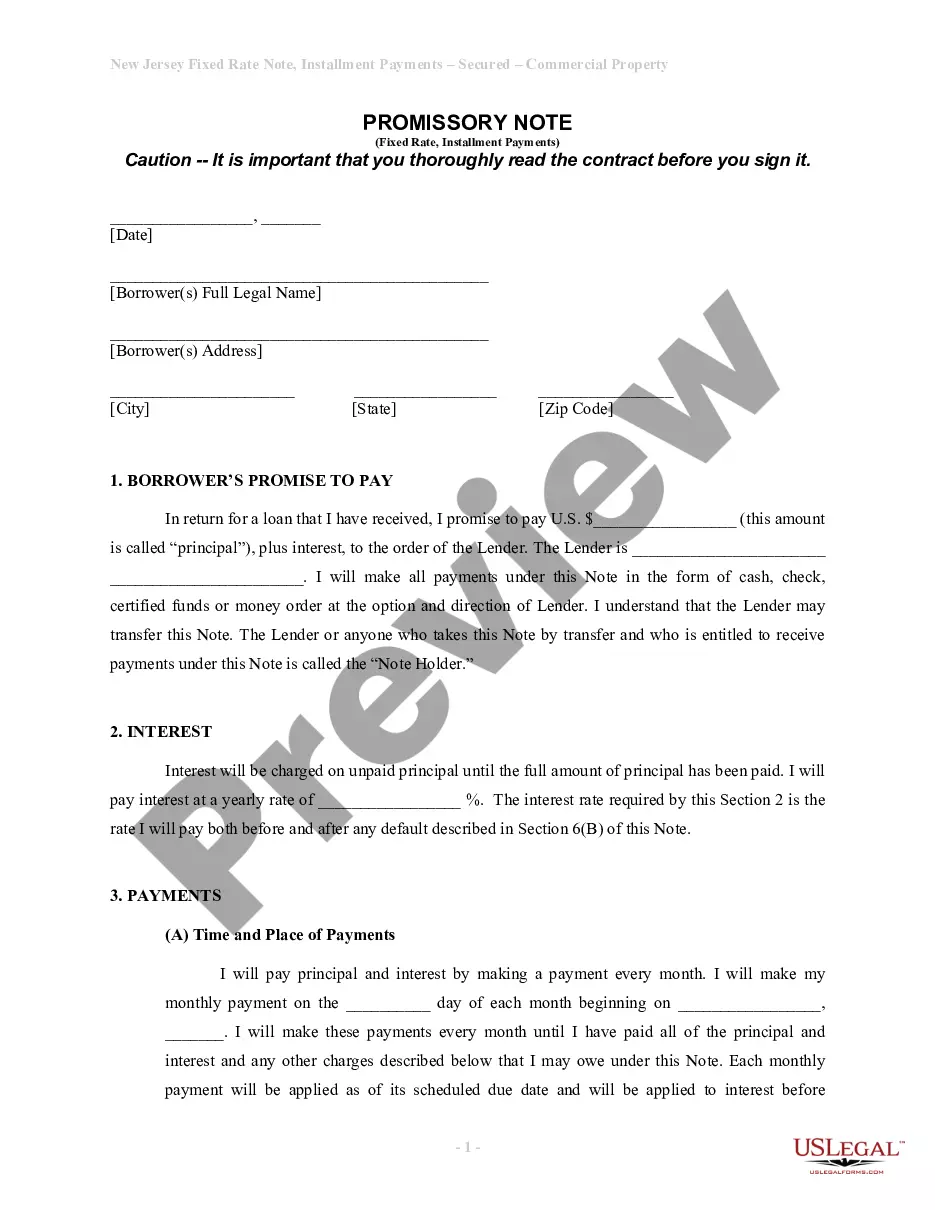

In New Jersey, you can file your UCC (Uniform Commercial Code) financing statement with the New Jersey Division of Revenue and Enterprise Services. For an Elizabeth New Jersey Installments Fixed Rate Promissory Note Secured by Personal Property, this step is essential to establish your security interest in the collateral. Filing your UCC ensures that your claim takes priority over other creditors. Uslegalforms offers comprehensive services to guide you through this filing process effectively.

You typically file a promissory note with the county clerk's office in the jurisdiction where the borrower resides. For an Elizabeth New Jersey Installments Fixed Rate Promissory Note Secured by Personal Property, you would secure your filing in the Union County Clerk's Office. This filing helps establish your legal rights and protections surrounding the note. Investing in legal forms through Uslegalforms can simplify this process for you.

Yes, promissory notes are legal in New Jersey and are widely used in various financial transactions. When structured correctly, an Elizabeth New Jersey Installments Fixed Rate Promissory Note Secured by Personal Property provides legal protection for both the lender and the borrower. This legal document must adhere to the state's regulations to ensure its enforceability in court. If you're considering creating one, platforms like US Legal Forms can offer you templates and guidance to simplify the process.

Filling out a promissory note involves several key steps. Start by entering the date of the agreement, followed by the names of the parties involved. Next, detail the amount borrowed, the repayment terms, and indicate that it is an Elizabeth New Jersey Installments Fixed Rate Promissory Note Secured by Personal Property if applicable. Finally, both parties should sign and date the document to make it legally binding. For assistance with templates and legal language, explore UsLegalForms for user-friendly solutions.

To write a secured promissory note, start by clearly identifying the borrower, the lender, and the terms, including the principal amount and interest rate. Specify that the note is an Elizabeth New Jersey Installments Fixed Rate Promissory Note Secured by Personal Property, listing the property used as collateral. Use straightforward language and structure your document methodically to avoid confusion. If you need a template or further assistance, UsLegalForms offers reliable resources to help you draft your note correctly.

Yes, a promissory note can be secured by real property. However, in the context of an Elizabeth New Jersey Installments Fixed Rate Promissory Note Secured by Personal Property, you will find that personal property is more commonly used as collateral. This distinction is crucial, as securing a note with personal property typically involves different documentation and procedures. For detailed templates and guides, consider using UsLegalForms to navigate the specifics of your situation.