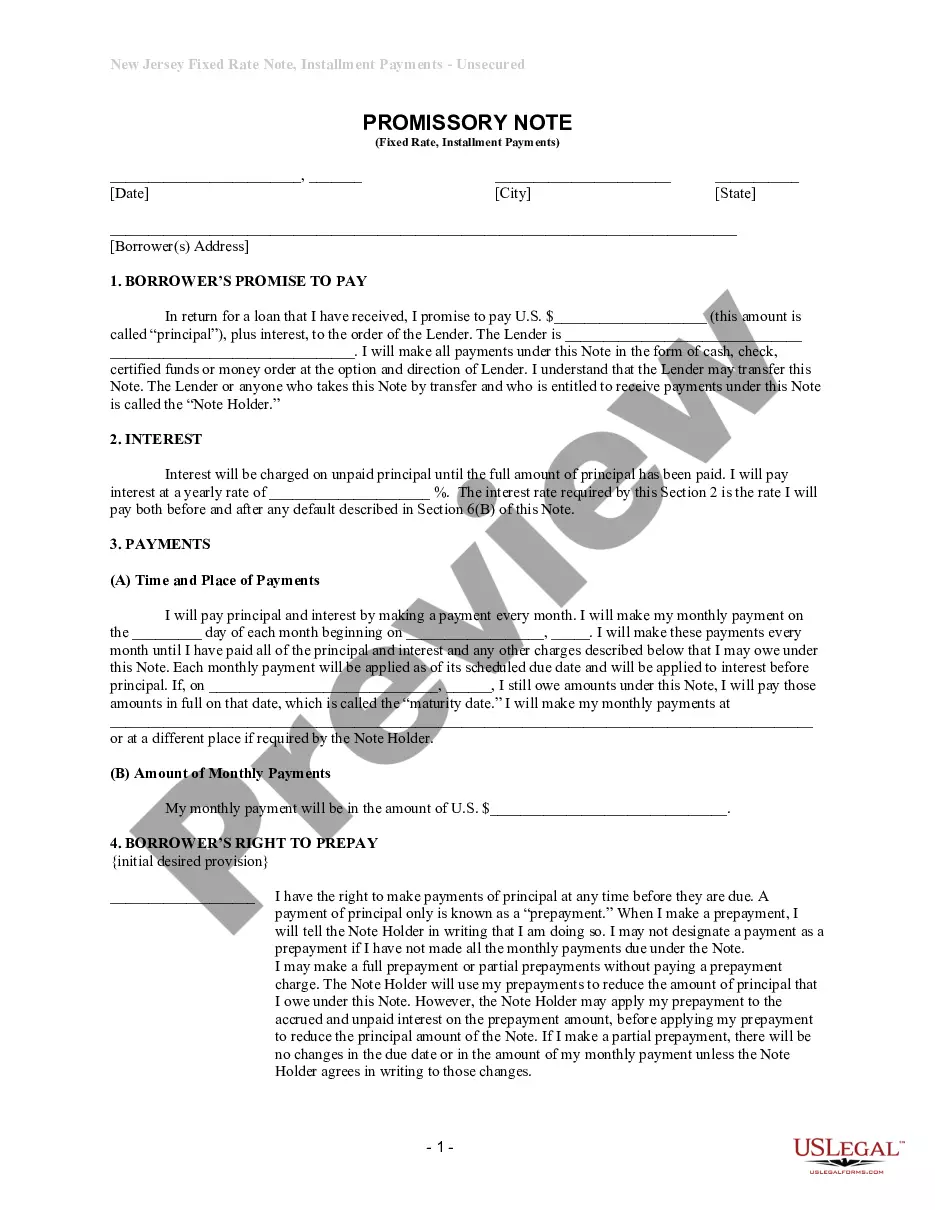

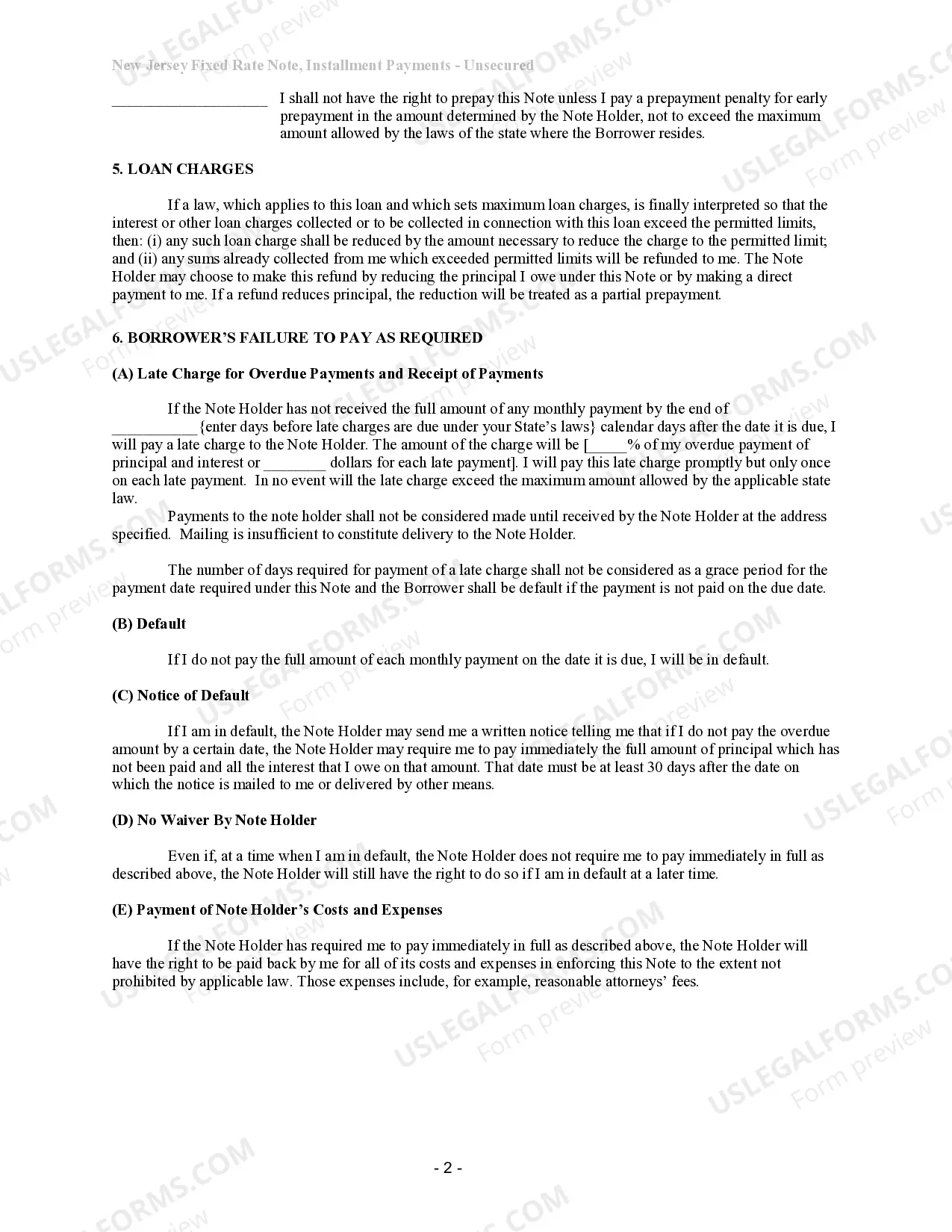

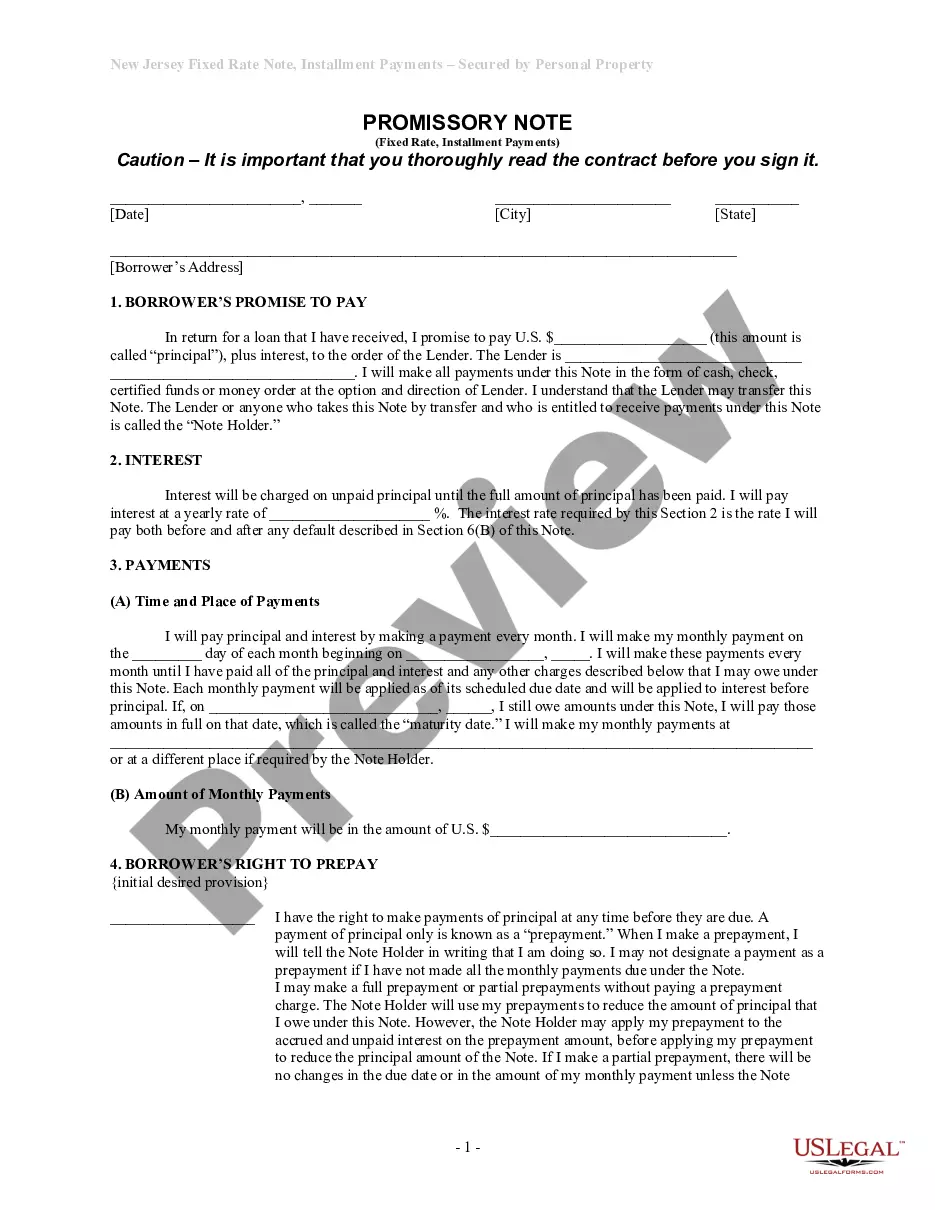

Elizabeth New Jersey Unsecured Installment Payment Promissory Note for Fixed Rate

Description

How to fill out New Jersey Unsecured Installment Payment Promissory Note For Fixed Rate?

If you are searching for a pertinent document, it’s impossible to select a superior service than the US Legal Forms website – likely the most comprehensive online collections.

With this collection, you can obtain a multitude of document samples for business and personal use by categories and regions, or keywords.

With the exceptional search functionality, finding the most current Elizabeth New Jersey Unsecured Installment Payment Promissory Note for Fixed Rate is as simple as 1-2-3.

Complete the payment process. Use your credit card or PayPal account to finalize the registration procedure.

Obtain the document. Choose the format and download it onto your device. Make adjustments. Fill out, modify, print, and sign the obtained Elizabeth New Jersey Unsecured Installment Payment Promissory Note for Fixed Rate.

- Moreover, the validity of every single record is verified by a team of expert attorneys that routinely examine the templates on our platform and refresh them in accordance with the latest state and county regulations.

- If you are already familiar with our platform and possess an account, all you need to do to obtain the Elizabeth New Jersey Unsecured Installment Payment Promissory Note for Fixed Rate is to Log In to your profile and press the Download button.

- If you are utilizing US Legal Forms for the first time, just adhere to the instructions below.

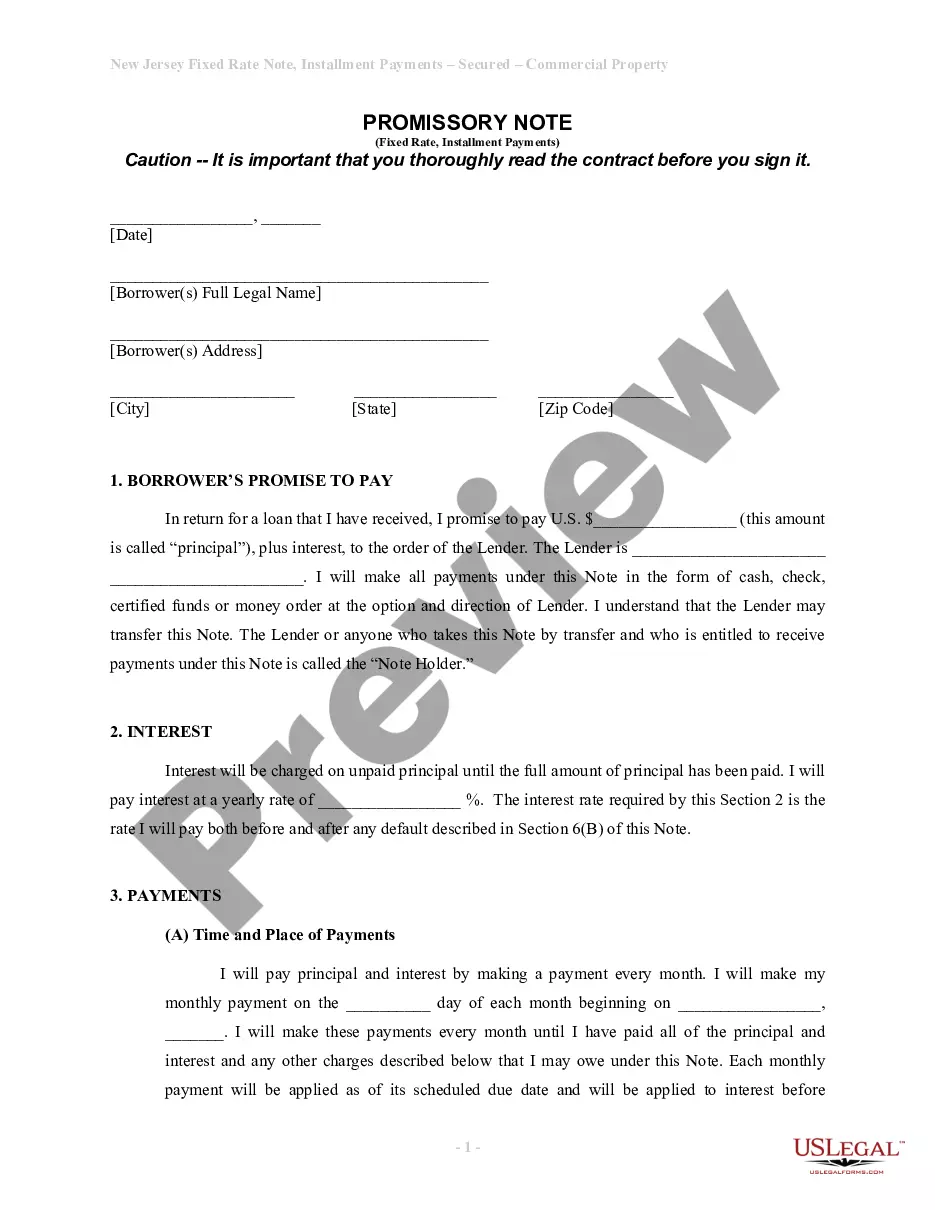

- Ensure you have selected the template you need. Review its description and use the Preview feature to examine its content. If it doesn’t fulfill your requirements, utilize the Search option at the top of the screen to locate the correct file.

- Confirm your choice. Click the Buy now button. Then, select your favored pricing plan and provide details to create an account.

Form popularity

FAQ

Yes, you can create your own promissory note, provided it includes all necessary components such as the amount, interest rate, and repayment terms. For simplicity and legal compliance, consider using templates from UsLegalForms to design your Elizabeth New Jersey Unsecured Installment Payment Promissory Note for Fixed Rate. This approach helps ensure accuracy and clarity in your agreement.

To obtain your promissory note, ensure that you keep a copy after it has been signed by both parties. If you are the lender, securely store the signed document in a safe place. You can also create or retrieve an Elizabeth New Jersey Unsecured Installment Payment Promissory Note for Fixed Rate through UsLegalForms if you need to draft a new one.

To create a promissory note for payment, you need to outline the key terms of the agreement, such as the principal amount, interest rate, and payment schedule. You can use templates available on UsLegalForms to create an Elizabeth New Jersey Unsecured Installment Payment Promissory Note for Fixed Rate quickly and efficiently. Ensure both parties understand and agree to the terms before signing.

While notarization is not always required for a promissory note to be valid, having it notarized can add an extra layer of security. In Elizabeth, New Jersey, notarizing your unsecured installment payment promissory note for fixed rate can help prove the authenticity of the signatures involved. Therefore, it's wise to check local regulations for specific requirements.

Yes, you can write your own promissory note, and doing so allows you to tailor it to your specific needs. When it comes to an Elizabeth New Jersey Unsecured Installment Payment Promissory Note for Fixed Rate, consider including key details such as repayment terms, interest rate, and any agreed-upon payment schedule. However, it is wise to consult with a legal expert to ensure your note is legally compliant. Our platform, USLegalForms, provides easy-to-use templates that help you create a valid homemade promissory note.

Yes, promissory notes are legal in New Jersey and can serve various financial arrangements. They must meet specific legal criteria to be enforceable, ensuring that the terms are clear and both parties understand their obligations. The Elizabeth New Jersey Unsecured Installment Payment Promissory Note for Fixed Rate complies with regulations, providing a secure option for personal and commercial loans.

To record promissory notes payable, you should set up an account in your accounting system specifically for notes payable. When you incur such liabilities, debit the appropriate expense account and credit the notes payable account. Documenting the Elizabeth New Jersey Unsecured Installment Payment Promissory Note for Fixed Rate accurately supports successful financial tracking.

To report income from a promissory note, you will typically recognize this income as interest received. You should include the interest income on your tax returns as taxable income. The Elizabeth New Jersey Unsecured Installment Payment Promissory Note for Fixed Rate generates interest, making it essential for you to keep accurate financial records.

Yes, a promissory note can be unsecured, meaning it does not require collateral. This type of note relies solely on the borrower's promise to repay the specified amount. The Elizabeth New Jersey Unsecured Installment Payment Promissory Note for Fixed Rate serves as a common example of an unsecured agreement, offering flexibility for individuals and businesses.

Yes, a promissory note typically appears on your financial records as either an asset or a liability. If you issued the note, it will be a liability; if you received it, it becomes an asset. Understanding how the Elizabeth New Jersey Unsecured Installment Payment Promissory Note for Fixed Rate impacts your financial standing is crucial.