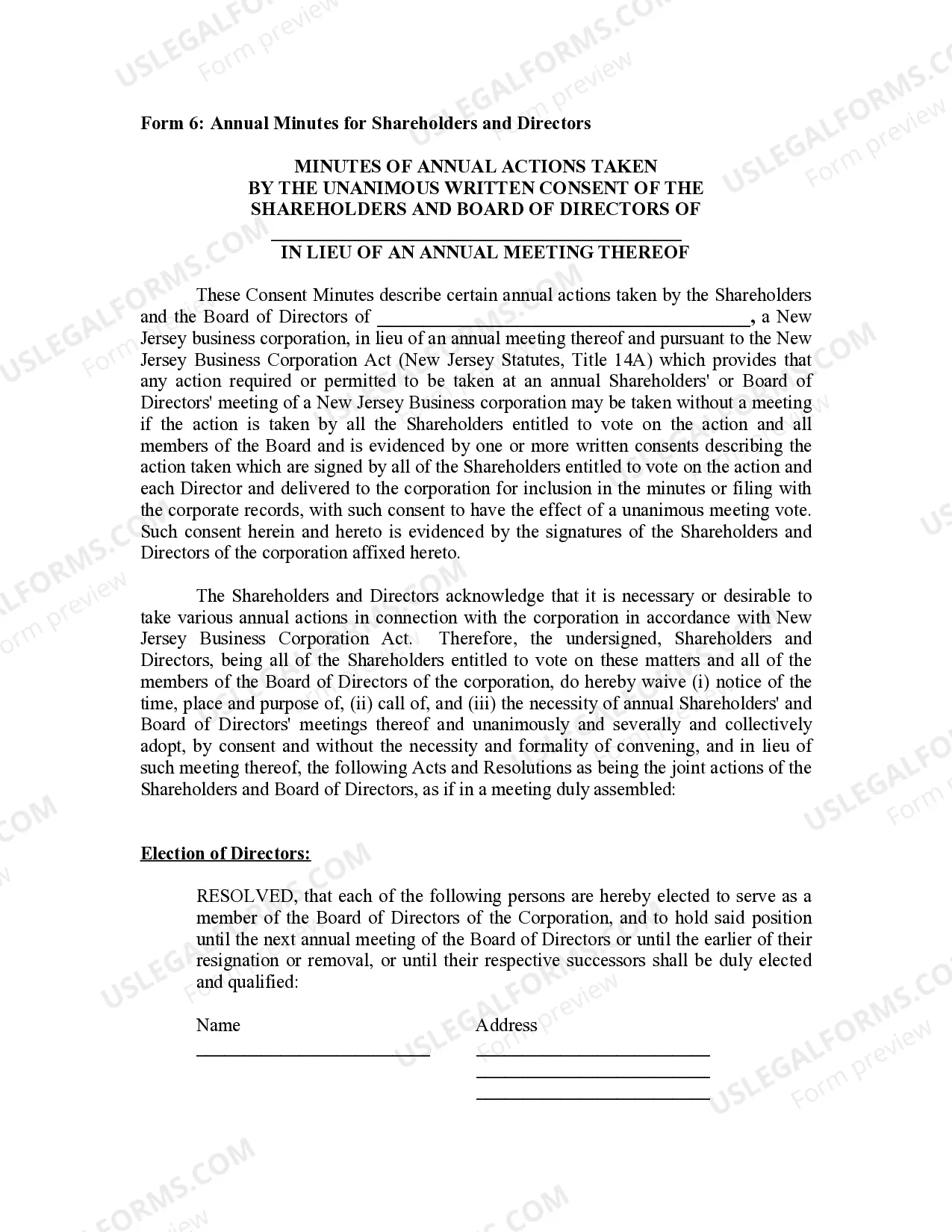

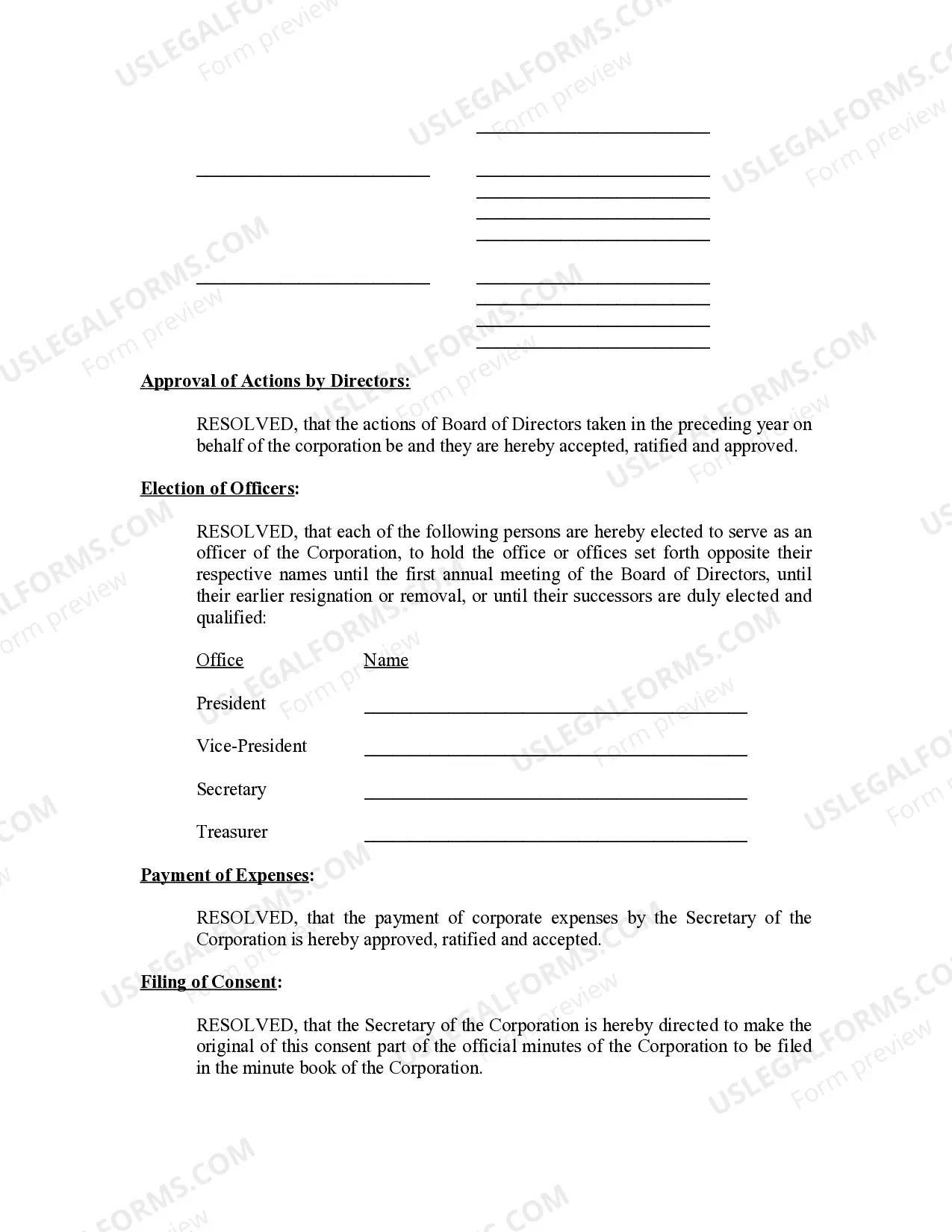

The Annual Minutes form is used to document any changes or other organizational activities of the Corporation during a given year.

Newark New Jersey Annual Minutes

Description

How to fill out New Jersey Annual Minutes?

If you have previously utilized our service, Log In to your account and store the Newark Annual Minutes - New Jersey on your device by clicking the Download button. Ensure your subscription is active. If it isn't, renew it based on your payment plan.

If this is your initial experience with our service, follow these straightforward steps to acquire your document.

You have continuous access to all documents you've purchased: you can find them in your profile under the My documents menu whenever you need to retrieve them. Leverage the US Legal Forms service to swiftly locate and download any template for your personal or business needs!

- Confirm you’ve found the correct document. Review the description and make use of the Preview option, if available, to verify if it meets your requirements. If it’s not suitable, utilize the Search tab above to find the right one.

- Buy the template. Click the Buy Now button and choose a monthly or yearly subscription plan.

- Create an account and proceed with payment. Use your credit card information or the PayPal option to finalize the transaction.

- Obtain your Newark Annual Minutes - New Jersey. Choose the file format for your document and download it to your device.

- Complete your sample. Print it out or use professional online editors to fill it in and sign it digitally.

Form popularity

FAQ

A good salary in Newark, NJ, is often considered to be around $50,000 annually. This amount allows individuals and families to comfortably manage living expenses while enjoying a reasonable standard of living. If you are planning financial commitments or business strategies, it’s helpful to use this figure as a reference, especially in the context of Newark New Jersey Annual Minutes.

In New Jersey, the average middle class income ranges between $75,000 and $100,000. This income bracket encompasses many families and influences purchasing power, lifestyle choices, and community engagement. When navigating business operations or reporting requirements, it is essential to align with these income levels, particularly if you are reviewing Newark New Jersey Annual Minutes.

The median household income in Newark, NJ, stands at about $35,500. This figure provides a better understanding of the earnings of typical families in the area. It plays a significant role in determining the affordability of services and the overall quality of life. For startups or businesses, recognizing this income bracket is crucial when planning for Newark New Jersey Annual Minutes.

The average household income in Newark, New Jersey, is an important metric for understanding the local economy. On average, households earn around $38,000 per year. This figure reflects the financial landscape that influences various aspects of life, including how businesses operate and the services available. For those considering a venture, knowing the income statistics can help inform decisions related to Newark New Jersey Annual Minutes.

In New Jersey, a public meeting notice must include the time, date, location, and agenda of the meeting. Additionally, you must post this notice in designated public places and the newspaper. Failure to adhere to these requirements can invalidate the meetings and affect your Newark New Jersey Annual Minutes. Ensuring proper notice is essential for transparency and compliance in your public meetings.

If you fail to file your annual report with New Jersey, your business may be administratively dissolved. This means you will no longer be able to legally operate your LLC, and you will lose the protections that come with your business status. Timely filing of your Newark New Jersey Annual Minutes is vital to maintain compliance and protect your interests. Consider utilizing services like uslegalforms to avoid these pitfalls.

The municipal code for Newark, NJ, covers regulations and ordinances specific to the city. You can find this information on the official city website or through local government offices. Understanding the municipal code is crucial for compliance with city rules that may affect your Newark New Jersey Annual Minutes. Being informed about these regulations can benefit your business operations significantly.

You can obtain a copy of your annual report in New Jersey through the Division of Revenue and Enterprise Services. Visit their website to access online services where you can request your report. It's a straightforward process that allows you to keep accurate records of your Newark New Jersey Annual Minutes. If you need assistance, platforms like uslegalforms can guide you through obtaining the necessary documents.

Failing to file an annual report for your LLC in New Jersey can lead to significant consequences. The state may suspend your business’s status, impacting your ability to conduct operations legally. Additionally, you might face penalties and late fees, which can add up over time. To avoid these issues, ensure you stay updated on your Newark New Jersey Annual Minutes.

Obtaining a tax clearance certificate in New Jersey typically takes about 10 to 15 business days. This certificate is vital for maintaining compliance and confirming that your taxes are up to date. Keeping your Newark New Jersey Annual Minutes organized can expedite this process and ensure you have all necessary documentation ready. US Legal Forms provides resources that can assist in tracking your filings and obtaining required certificates smoothly.