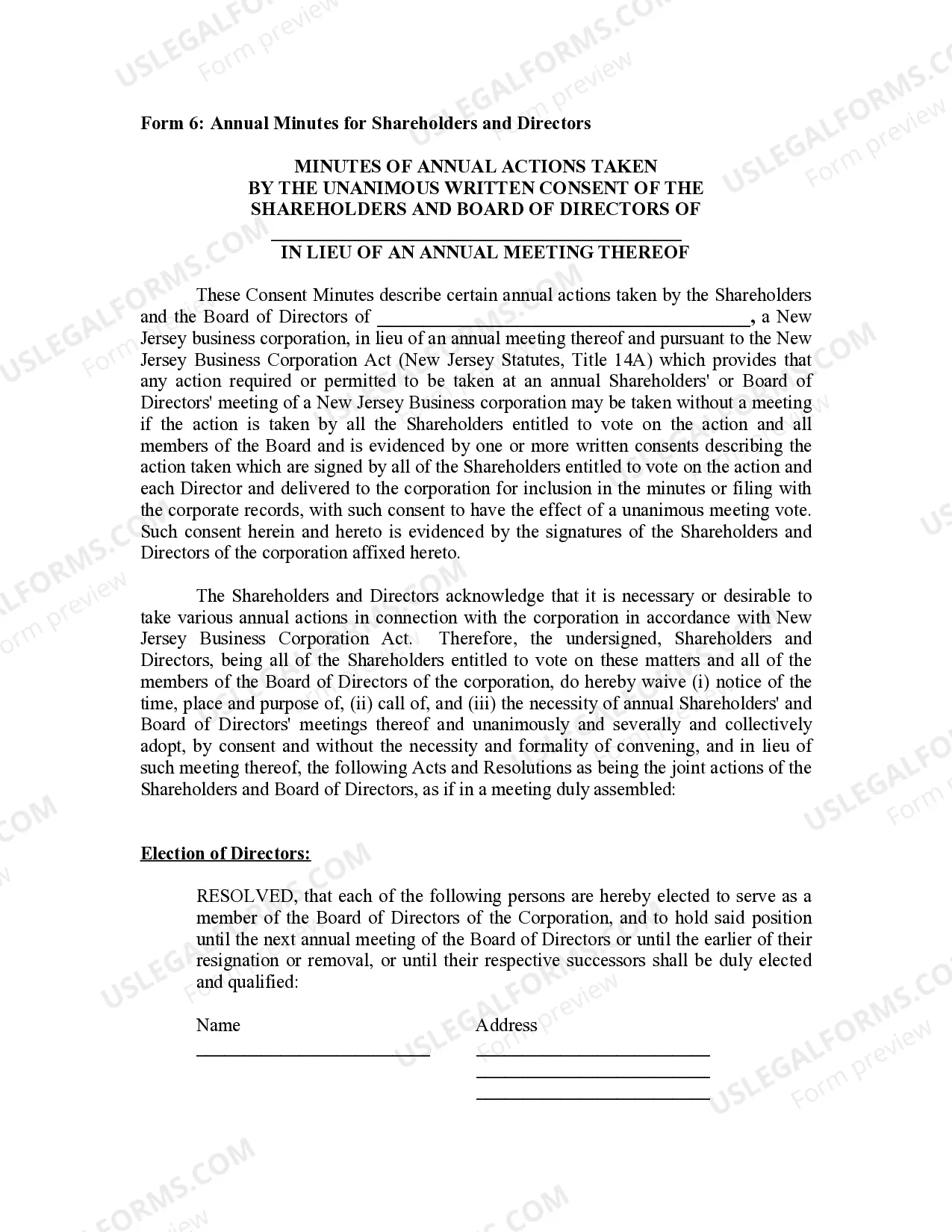

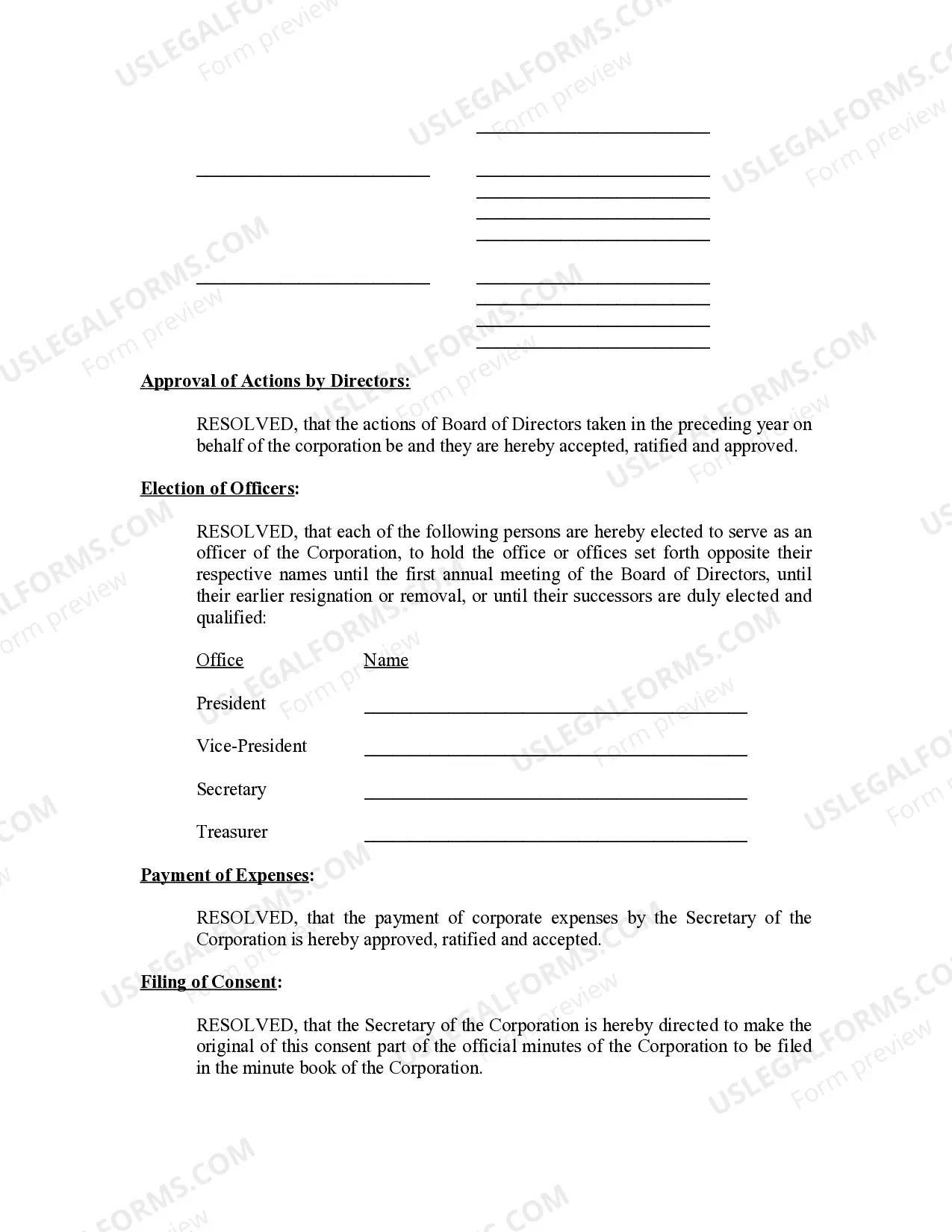

The Annual Minutes form is used to document any changes or other organizational activities of the Corporation during a given year.

New Jersey Annual Minutes

Description

How to fill out New Jersey Annual Minutes?

US Legal Forms is a special platform where you can find any legal or tax document for filling out, including Annual Minutes - New Jersey. If you’re tired of wasting time looking for appropriate examples and spending money on papers preparation/lawyer fees, then US Legal Forms is exactly what you’re seeking.

To experience all of the service’s benefits, you don't need to download any application but simply choose a subscription plan and create an account. If you already have one, just log in and look for the right sample, save it, and fill it out. Downloaded documents are stored in the My Forms folder.

If you don't have a subscription but need Annual Minutes - New Jersey, have a look at the guidelines below:

- make sure that the form you’re taking a look at applies in the state you want it in.

- Preview the form and read its description.

- Click on Buy Now button to get to the sign up page.

- Select a pricing plan and carry on registering by entering some info.

- Choose a payment method to complete the sign up.

- Save the file by choosing your preferred file format (.docx or .pdf)

Now, complete the document online or print out it. If you feel uncertain about your Annual Minutes - New Jersey sample, speak to a legal professional to examine it before you send or file it. Begin hassle-free!

Form popularity

FAQ

All corporations, whether domestic or foreign, must also submit an annual report and the associated filing fee electronically with the Division of Revenue and Enterprise Services (DORES). The formation or registration date is the annual report filing due date. For more information, visit DORES' website.

For many businesses, filing annual reports is among them. If you operate your business as an LLC or corporation (depending on the state in which your company is registered), you may need to publish an annual report to keep in good standing with the state.

In New Jersey, an annual report is a regular filing that your LLC must complete every year. The report is essentially updating your registered agent address and paying a $50 fee. All LLCs are required to file their annual report with the New Jersey Secretary of State.

What Is an Annual Report? In New Jersey, an annual report is a regular filing that your LLC must complete every year. The report is essentially updating your registered agent address and paying a $50 fee. All LLCs are required to file their annual report with the New Jersey Secretary of State.

Legal name of the entity. Business address. Contact information for the Registered Agent. Name and address of the officers, directors, members and/or managers.

After you form an LLC in New Jersey, you must file an Annual Report every year. You need to file an Annual Report in order to keep your New Jersey LLC in compliance and in good standing with the state.

All corporations, whether domestic or foreign, must also submit an annual report and the associated filing fee electronically with the Division of Revenue and Enterprise Services (DORES). The formation or registration date is the annual report filing due date. For more information, visit DORES' website.