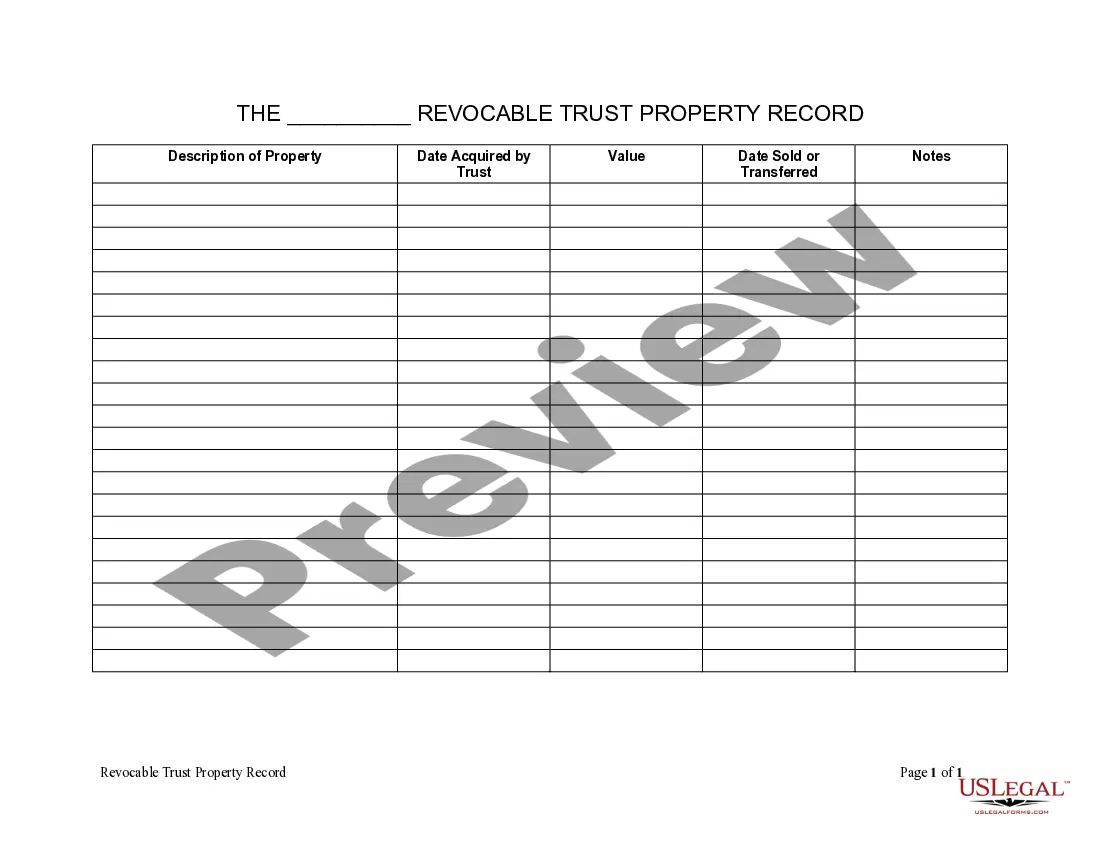

This is a Living Trust Property Inventory form. A living trust is a trust established during a person's lifetime in which a person's assets and property are placed within the trust, usually for the purpose of estate planning. This form allows the Trustee to record a Description of Property, Date Acquired by Trust, Value, Date Sold or Transferred so that all property held by the trust can be accounted for including the real, personal or intellectual property.

Jersey City New Jersey Living Trust Property Record

Description

How to fill out New Jersey Living Trust Property Record?

Obtaining validated templates tailored to your local statutes can be difficult unless you utilize the US Legal Forms repository.

It’s a digital compilation of over 85,000 legal documents for both personal and business requirements and various real-world scenarios.

All the forms are appropriately organized by category of use and jurisdiction, making the search for the Jersey City New Jersey Living Trust Property Record as straightforward as possible.

Keeping documentation organized and compliant with legal standards is crucial. Leverage the US Legal Forms library to have essential document templates readily accessible for any needs!

- Review the Preview mode and form description.

- Ensure you’ve chosen the correct one that aligns with your needs and fully adheres to your local jurisdiction standards.

- Search for an alternative template, if necessary.

- If you detect any discrepancies, use the Search tab above to find the correct one.

- If it meets your criteria, proceed to the following step.

Form popularity

FAQ

To find out the assessed value of a property, access your local tax assessor's office or their website for public records. Online tools often provide quick access to Jersey City New Jersey Living Trust Property Record data, allowing for easy searches by property address. Reviewing this information can help you make informed financial decisions regarding property ownership.

In New Jersey, property owners aged 65 or older may qualify for property tax relief programs, potentially lowering their tax burden. However, there is no automatic exemption that completely exempts seniors from paying property taxes. It is advisable to check with local tax offices and consider how Jersey City New Jersey Living Trust Property Record might affect tax rates and eligibility.

To find property ownership information in Jersey City, NJ, visit the local municipality's property records department or search their online database. Many counties provide their Jersey City New Jersey Living Trust Property Record services through accessible online platforms. This allows you to search by address or owner's name and get accurate ownership details quickly.

In Illinois, assessed value is often calculated as a percentage of the market value of the property, typically around one-third. Local officials evaluate various factors, including property type and location. For those interested in Jersey City New Jersey Living Trust Property Record, understanding assessed values is critical, as these figures directly impact property taxes.

To determine the land value of a property, you can review property tax records or recent sales of similar parcels in the area. Local assessors often provide detailed reports, including land value breakdowns. Utilizing Jersey City New Jersey Living Trust Property Record information can also enhance your understanding of both land and property values in your desired location.

You can find the assessed value of a property by checking with the local tax assessor's office or utilizing online search tools. Many websites provide Jersey City New Jersey Living Trust Property Record information that includes public assessment data. This process typically requires you to enter the property's details, such as the address or parcel number.

The assessed value is the value determined by the local tax assessor for tax purposes, while the appraised value is an independent evaluation of the property's market value. Understanding these distinctions is essential, especially when consulting Jersey City New Jersey Living Trust Property Record data. This knowledge can help you make informed decisions regarding property investments and taxes.

To find your property tax records in New Jersey, visit your local tax assessor's office or their website. You can also check online platforms that offer Jersey City New Jersey Living Trust Property Record services. These resources often allow you to search by property address or owner's name, making the process straightforward.

To list property in a trust, first, you must execute a transfer deed that officially moves the property from your name to the name of the trust. You should then file the deed with the appropriate county office to update the public record. This ensures that your ownership is clearly documented in your Jersey City New Jersey Living Trust Property Record.

The NJ 1041 is a tax return for estates and trusts in New Jersey, and it must be filed if your trust earns income. Generally, you need to complete this form if the trust has gross income exceeding $100. It's essential to maintain accurate records of income and distributions for your Jersey City New Jersey Living Trust Property Record to ensure compliance.