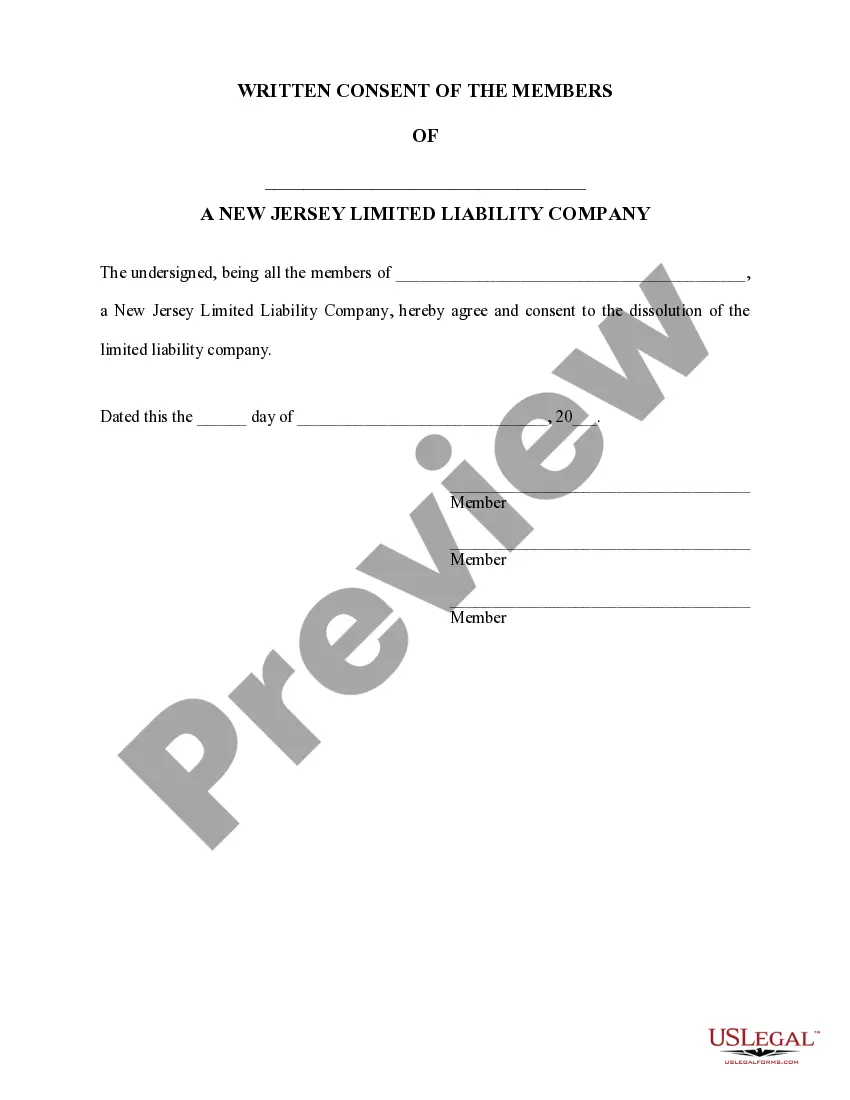

Newark New Jersey Dissolution Package to Dissolve Limited Liability Company LLC

Description

How to fill out New Jersey Dissolution Package To Dissolve Limited Liability Company LLC?

If you are looking for a pertinent form, it's impossible to discover a superior service than the US Legal Forms site – likely the most comprehensive databases on the web.

With this collection, you can obtain numerous templates for business and personal needs categorized by type and state, or keywords.

Utilizing our high-quality search feature, locating the latest Newark New Jersey Dissolution Package to Dissolve Limited Liability Company LLC is as simple as 1-2-3.

Complete the payment process. Use your credit card or PayPal account to finalize the registration procedure.

Obtain the form. Select the file format and download it to your device.

- Furthermore, the relevance of each document is validated by a team of professional attorneys who routinely review the templates on our platform and update them according to the most recent state and county regulations.

- If you are already familiar with our platform and have an account, all you need to access the Newark New Jersey Dissolution Package to Dissolve Limited Liability Company LLC is to Log In to your account and click the Download button.

- If you are using US Legal Forms for the first time, simply follow the instructions listed below.

- Ensure you have selected the form you desire. Read its description and utilize the Preview option (if available) to examine its content. If it doesn’t satisfy your needs, use the Search option at the top of the page to find the appropriate document.

- Verify your choice. Click the Buy now button. After that, choose your desired pricing plan and enter your details to create an account.

Form popularity

FAQ

If you do not dissolve your LLC in New Jersey, you may continue to incur annual fees and penalties. Additionally, your business may remain legally responsible for any tax obligations. Following the correct procedures through the Newark New Jersey Dissolution Package to Dissolve Limited Liability Company LLC can help you avoid these complications and ensure a clean closure for your business.

To obtain a tax clearance certificate in New Jersey, you should first ensure that all your tax filings are up to date. You can then request the certificate through the New Jersey Division of Taxation’s online system or by mailing a request directly to them. This step is vital for completing the Newark New Jersey Dissolution Package to Dissolve Limited Liability Company LLC properly.

In New Jersey, the Division of Taxation provides the tax clearance certificate. This official certificate confirms that your business has no outstanding tax liabilities. For those using the Newark New Jersey Dissolution Package to Dissolve Limited Liability Company LLC, obtaining this certificate is a crucial step in ensuring a smooth dissolution process.

To obtain an IRS tax clearance certificate, you need to submit Form 8821, which is the Tax Information Authorization form. This form allows you to authorize the IRS to send your tax information to another individual or business. It is essential to ensure that you have settled all tax accounts before applying for the certificate as part of the Newark New Jersey Dissolution Package to Dissolve Limited Liability Company LLC.

Dissolution and termination refer to the process of closing an LLC, but they have distinct meanings in New Jersey. Dissolution is the formal process of legally dissolving your LLC, while termination generally describes the end of business operations. After dissolution, you must file the appropriate documents to officially terminate your LLC with state authorities. Our Newark New Jersey Dissolution Package to Dissolve Limited Liability Company LLC can help clarify these differences and guide you through each step.

To dissolve your LLC in New Jersey, you must first file a Certificate of Dissolution with the New Jersey Division of Revenue and Enterprise Services. This document requires essential information about your LLC, such as its name and address. After submitting the form, ensure you handle any outstanding debts and obligations your LLC may have. You can utilize the Newark New Jersey Dissolution Package to Dissolve Limited Liability Company LLC to streamline this process.

To dissolve an LLC in New Jersey, you must file the appropriate paperwork with the Division of Revenue and Enterprise Services. This involves submitting a Certificate of Dissolution and settling any outstanding debts or obligations. The Newark New Jersey Dissolution Package to Dissolve Limited Liability Company LLC can streamline this process, ensuring that you complete all necessary steps efficiently and accurately.

Deciding whether to dissolve your LLC or leave it inactive depends on your future plans. If you do not intend to use your LLC, dissolving it can save you from unnecessary fees and legal obligations. The Newark New Jersey Dissolution Package to Dissolve Limited Liability Company LLC can assist you in making this decision by providing the necessary tools for a seamless dissolution process.

Letting your LLC expire can result in various complications, such as tax liabilities or the risk of losing personal liability protection. Your business may still be held accountable for any obligations incurred during its active period. To avoid these concerns, you should consider the Newark New Jersey Dissolution Package to Dissolve Limited Liability Company LLC. This package provides clear instructions to properly dissolve your LLC and protect your interests.

If you create an LLC but do not use it, it will remain inactive, potentially leading to ongoing fees or even administrative dissolution. Keeping an unused LLC can complicate your finances and legal obligations. If you find yourself in this situation, consider using the Newark New Jersey Dissolution Package to Dissolve Limited Liability Company LLC to simplify the process of dissolving your entity while avoiding unnecessary costs.