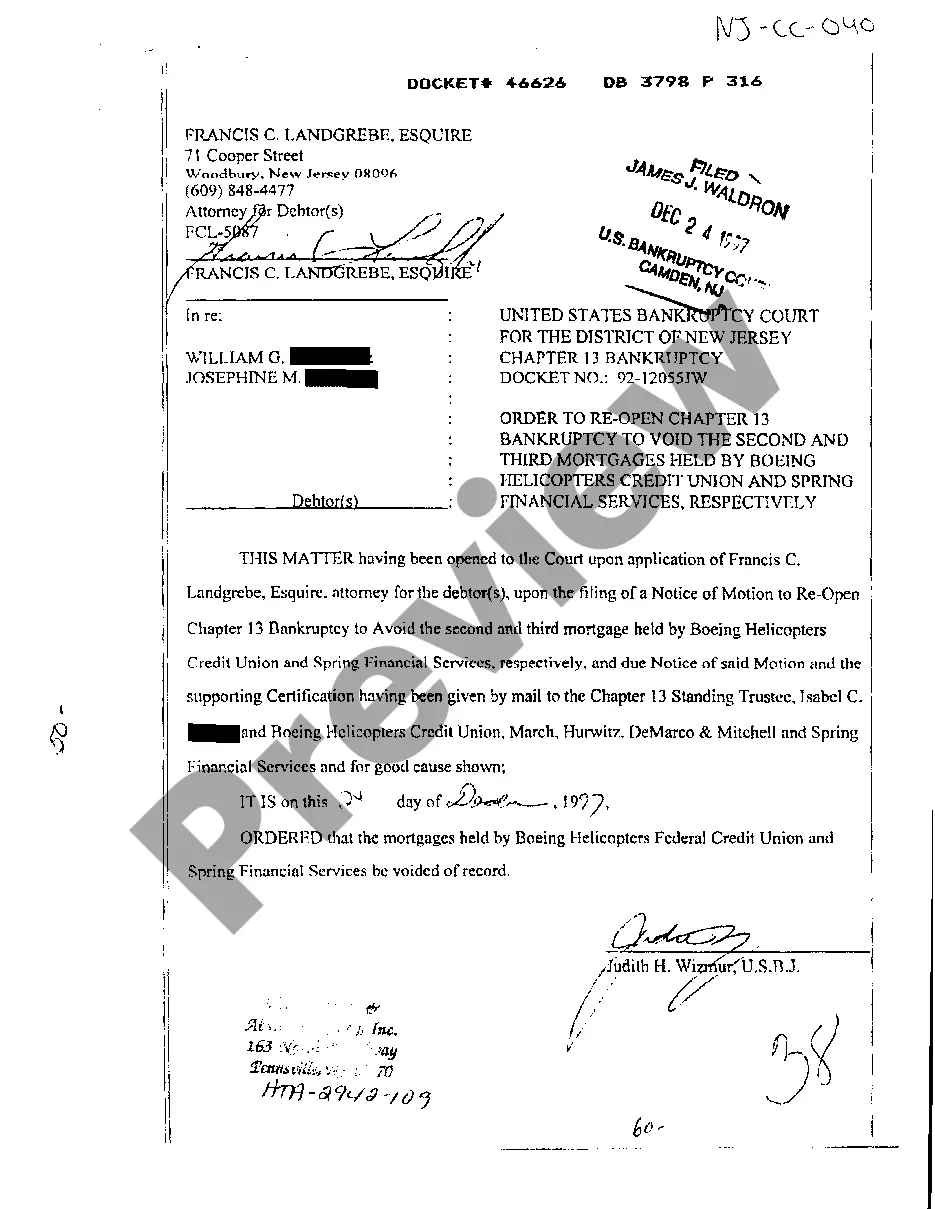

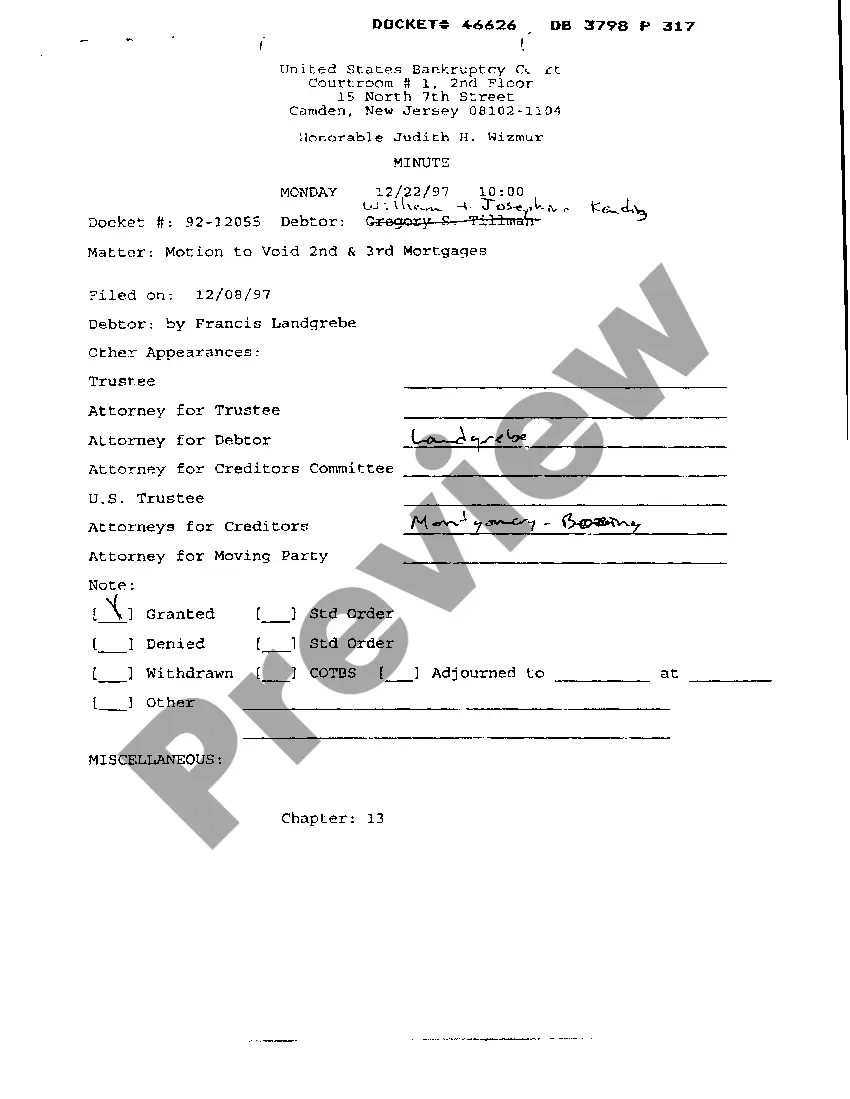

Paterson New Jersey Order to Reopen Chapter 13 to avoid Second and Third Mortgages

Description

How to fill out New Jersey Order To Reopen Chapter 13 To Avoid Second And Third Mortgages?

If you’ve previously utilized our service, Log In to your account and store the Paterson New Jersey Order to Reopen Chapter 13 to prevent Second and Third Mortgages on your device by clicking the Download button. Ensure your subscription is active. Otherwise, renew it based on your payment plan.

If this is your inaugural experience with our service, adhere to these straightforward steps to acquire your document.

You have lifetime access to every document you have purchased: you can find it in your profile within the My documents section whenever you need to access it again. Utilize the US Legal Forms service to quickly search for and save any template for your personal or business needs!

- Confirm you’ve located a suitable document. Browse the description and use the Preview option, if it’s available, to verify if it satisfies your needs. If it’s not suitable for you, employ the Search tab above to find the correct one.

- Purchase the document. Click the Buy Now button and select a monthly or yearly subscription plan.

- Create an account and process a payment. Use your credit card information or the PayPal method to finalize the transaction.

- Acquire your Paterson New Jersey Order to Reopen Chapter 13 to prevent Second and Third Mortgages. Choose the file format for your document and save it to your device.

- Fill out your document. Print it or utilize professional online editors to complete and sign it electronically.

Form popularity

FAQ

In a Chapter 13 bankruptcy, certain debts are not dischargeable, including most taxes, student loans, and child support obligations. This means you will need to keep these debts current throughout the repayment period. Utilize a Paterson New Jersey Order to Reopen Chapter 13 to understand which debts you can address and how to manage those that remain.

While in Chapter 13, you cannot simply walk away from your house without addressing your mortgage debts. However, if you pursue a Paterson New Jersey Order to Reopen Chapter 13, you may seek to modify how you handle your mortgage payments. It is essential to understand your options in order to make informed decisions about your housing situation.

Yes, utilizing a Paterson New Jersey Order to Reopen Chapter 13 can help eliminate your second mortgage. When you file for Chapter 13 bankruptcy, you may have the opportunity to challenge the secured status of your second mortgage. This process allows you to reduce or even remove this debt, leading to more manageable monthly payments.

In Chapter 13, your mortgage can be reorganized to fit your financial situation. The Paterson New Jersey Order to Reopen Chapter 13 to avoid Second and Third Mortgages allows for this reorganization, enabling you to catch up on arrears over a repayment plan. If everything is managed properly, you can keep your home while addressing your debts effectively. Legal assistance is paramount to navigate this process smoothly.

A reaffirmation agreement is not necessary, but it can be beneficial under certain conditions. If you want to keep your home and be responsible for the mortgage, the Paterson New Jersey Order to Reopen Chapter 13 to avoid Second and Third Mortgages can set the stage. Without reaffirmation, your obligation to the lender remains but does not attach to your bankruptcy discharge. Therefore, evaluate your situation carefully.

Yes, a borrower can keep their home and its existing mortgage in a Chapter 7 bankruptcy, provided certain criteria are met. The Paterson New Jersey Order to Reopen Chapter 13 to avoid Second and Third Mortgages focuses on Chapter 13, but understandingChapter 7 is valuable as well. You will need to maintain regular payments on the mortgage during and after the bankruptcy process. Seeking guidance from professionals is advisable for best outcomes.

If your mortgage is not reaffirmed in Chapter 13, it remains a debt but does not affect your ownership of the home. This aligns with the Paterson New Jersey Order to Reopen Chapter 13 to avoid Second and Third Mortgages, allowing you to keep your house. Your lender cannot pursue you for the balance after bankruptcy as long as you continue making payments. Therefore, staying current is vital.

A second mortgage can be forgiven under certain circumstances in Chapter 13 bankruptcy. If you file a Paterson New Jersey Order to Reopen Chapter 13 to avoid Second and Third Mortgages, you may have the chance to eliminate this type of debt. It's crucial to meet specific requirements, so speaking with a bankruptcy attorney can guide you through your options. They will help assess your situation effectively.

No, you are not required to reaffirm a mortgage in Chapter 13 bankruptcy. The Paterson New Jersey Order to Reopen Chapter 13 to avoid Second and Third Mortgages gives you options to keep your home without reaffirmation. You can maintain your current mortgage payment structure while addressing other debts. Consulting a legal expert can clarify your choices.

Yes, a second mortgage can potentially be discharged in Chapter 13 bankruptcy. Under the Paterson New Jersey Order to Reopen Chapter 13 to avoid Second and Third Mortgages, homeowners can restructure their debts. This process sometimes allows for the elimination of junior liens. Ensuring you work with a knowledgeable attorney will help you navigate the specifics.