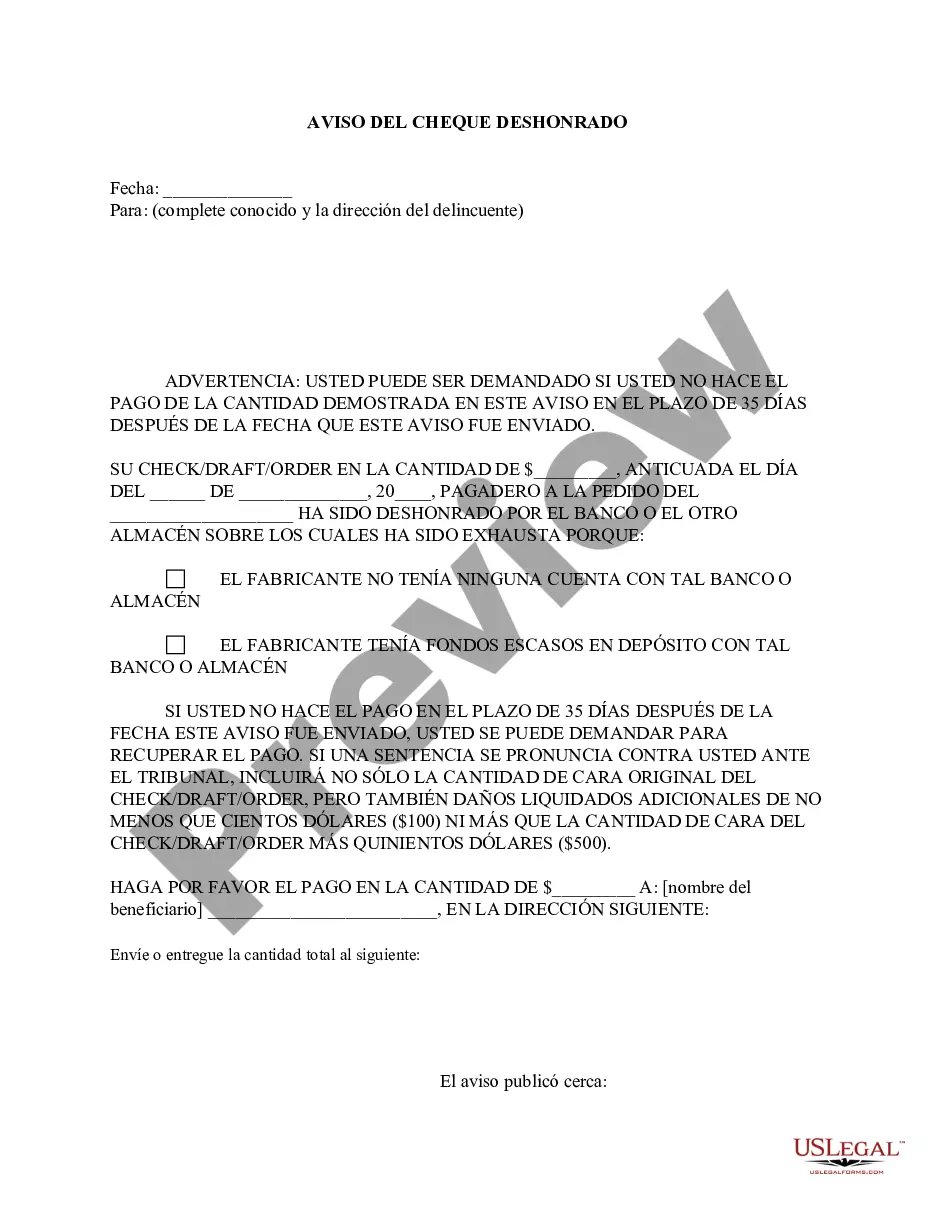

This is a Notice of Dishonored Check (Civil). A "dishonored check" (also known as a "bounced check" or "bad check") is a check which the bank will not pay because there is no such checking account, or there are insufficient funds in the account to pay the check. In order to attempt the greatest possible recovery on a dishonored check, the business owner, or any other person given a dishonored check, may be required by state law to notify the debtor that the check was dishonored.

Newark New Jersey Notice of Dishonored Check - Civil - Keywords: bad check, bounced check - Spanish

Description

How to fill out New Jersey Notice Of Dishonored Check - Civil - Keywords: Bad Check, Bounced Check - Spanish?

Irrespective of societal or occupational position, completing legal documents is an unfortunate obligation in the current professional landscape.

Frequently, it is nearly unfeasible for an individual without legal training to create such documents from the ground up, primarily due to the complicated terminology and legal subtleties they involve.

This is where US Legal Forms becomes beneficial.

Confirm that the form you have located is appropriate for your area, as the regulations of one state or county do not apply to another.

Review the form and read a brief synopsis (if available) of situations the document can be applicable for.

- Our platform offers a vast collection of over 85,000 ready-to-use state-specific documents that are applicable for nearly every legal situation.

- US Legal Forms also acts as an exceptional tool for associates or legal advisors wanting to efficiently use our DYI forms.

- Whether you require the Newark New Jersey Notice of Dishonored Check - Civil - Keywords: bad check, bounced check - Spanish or any other documentation valid in your state or county, with US Legal Forms, everything is readily accessible.

- Here’s how to acquire the Newark New Jersey Notice of Dishonored Check - Civil - Keywords: bad check, bounced check - Spanish in minutes using our reliable platform.

- If you are currently a subscriber, you may proceed to Log In to your account to obtain the required form.

- However, if you are new to our platform, make sure to follow these steps before securing the Newark New Jersey Notice of Dishonored Check - Civil - Keywords: bad check, bounced check - Spanish.

Form popularity

FAQ

If you receive a check that bounces, the first step is to contact the issuer to resolve the issue directly. Keep in mind that you may have legal recourse if the situation is not handled. The Newark New Jersey Notice of Dishonored Check - Civil can provide essential information on your rights and options. Additionally, utilizing services from uslegalforms can help you draft formal notices or pursue claims if necessary.

If you deposit a bad check, your bank will usually notify you that the check has bounced after a few days. This may result in fees for you, in addition to the original amount of the check being deducted from your account. It's essential to know your options, and understanding the Newark New Jersey Notice of Dishonored Check - Civil can guide you in addressing this issue effectively. You may also consider using a resource like uslegalforms to find the relevant legal documents to support your case.

Yes, writing a bounced check can lead to legal trouble in Newark, New Jersey. If the check is not honored, you may face criminal charges, depending on the amount. Moreover, victims of your bad check can file claims against you, resulting in potential lawsuits. It is crucial to take the necessary steps and seek information on the Newark New Jersey Notice of Dishonored Check - Civil to prevent any legal complications.

In Newark, New Jersey, the penalty for a bounced check often includes both criminal and civil repercussions. If you issue a bad check, you may face fines or even possible jail time. Additionally, the payee may attempt to recover their losses through legal action. Understanding the Newark New Jersey Notice of Dishonored Check - Civil process can help you navigate these consequences more effectively.

When you knowingly write a bad check, it is often referred to as writing a 'bounced check.' In Newark, New Jersey, this action can lead to various legal consequences under the Newark New Jersey Notice of Dishonored Check - Civil regulations. Writing checks without sufficient funds can result in criminal charges, making it important to understand the implications of your actions. If you find yourself facing issues with bad checks, consider utilizing the resources available through platforms like USLegalForms to navigate your situation effectively.

In New Jersey, writing a bad check can lead to serious consequences. Generally, if the amount of the bounced check exceeds $200, it could be classified as a felony. This means that if you are charged with a Newark New Jersey Notice of Dishonored Check - Civil - Keywords: bad check, bounced check - Spanish, it is crucial to understand the implications. To navigate this complex legal issue, consider using the US Legal Forms platform, which provides helpful resources and forms specifically tailored to address your needs regarding bad checks.

A check may be returned or dishonored when the account lacks sufficient funds, if there’s a discrepancy in the printed name or signature, or if it has been altered. Other triggers include account closure or requests for stop payments. Becoming familiar with the Newark New Jersey Notice of Dishonored Check - Civil can further prepare you for any potential issues concerning bounced checks.

A bank can dishonor a check when there are insufficient funds, when the check has not been validly signed, or if it does not comply with processing regulations. Additionally, if there is suspicion of fraud or if the account has been closed, the bank will also refuse the check. Staying informed about the conditions outlined in the Newark New Jersey Notice of Dishonored Check - Civil - can help clarify your options.

A check may be returned for multiple reasons, including insufficient funds, an endorsement issue, or a request for cancellation from the issuer. If the check is over a certain time frame or lacks proper information, banks may also return it. Understanding the reasons behind returned checks can help you mitigate issues related to the Newark New Jersey Notice of Dishonored Check - Civil.

A bounced check is a check that cannot be processed due to insufficient funds in the issuer's account. To avoid issuing a bad check, always maintain a clear record of your account balance, and consider using banking tools to track your transactions. Being aware of the Newark New Jersey Notice of Dishonored Check - Civil - can provide you with essential insights into what happens when a check bounces.