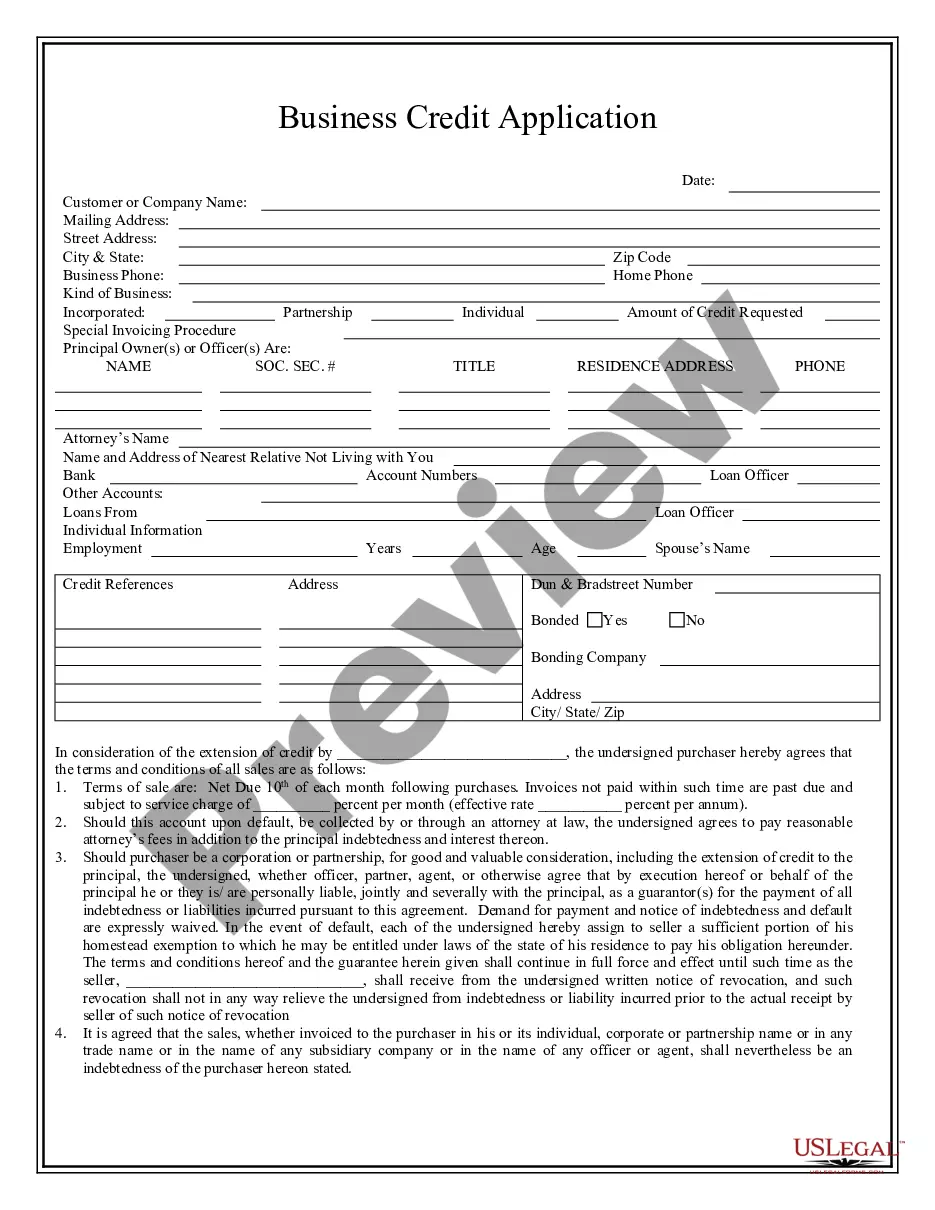

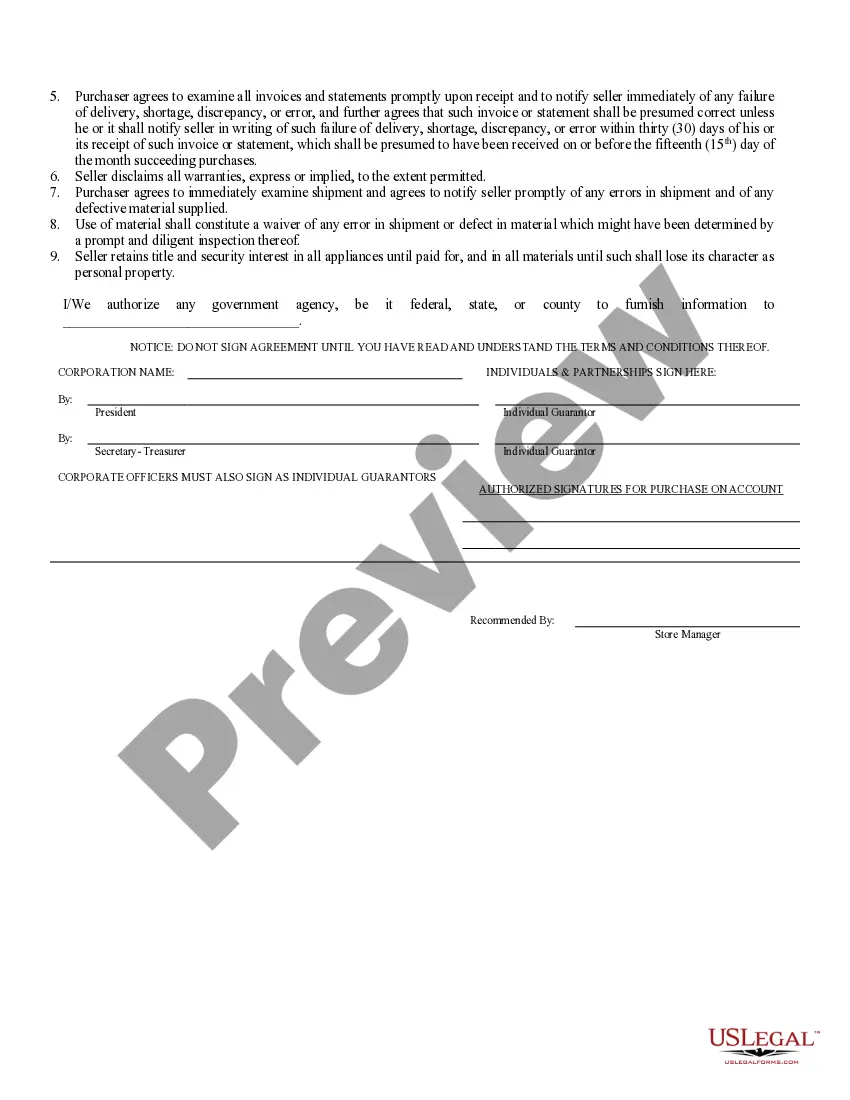

Jersey City New Jersey Business Credit Application

Description

How to fill out New Jersey Business Credit Application?

Irrespective of social or occupational rank, completing legal documents is an unfortunate requirement in contemporary society.

Frequently, it’s nearly unfeasible for an individual lacking any legal expertise to draft such paperwork from scratch, largely due to the intricate terminology and legal nuances involved.

This is where US Legal Forms can come to the rescue.

Verify that the form you have selected is appropriate for your area since the regulations of one state or region may not apply to another.

You’re all set! Now you can print the form or complete it online. Should you encounter any problems retrieving your purchased documents, you can easily locate them in the My documents section.

- Our service offers a vast collection of over 85,000 ready-to-use state-specific documents applicable to nearly any legal circumstance.

- US Legal Forms also acts as a valuable resource for associates or legal advisers desiring to save time with our DIY documents.

- Whether you need the Jersey City New Jersey Business Credit Application or any other documentation valid in your state or locality, with US Legal Forms, everything is accessible.

- Here’s how you can obtain the Jersey City New Jersey Business Credit Application in moments using our dependable service.

- If you are already a subscriber, you may proceed to Log In to your account to download the relevant form.

- However, if you are new to our platform, be sure to follow these steps before downloading the Jersey City New Jersey Business Credit Application.

Form popularity

FAQ

To open a small business in New Jersey, you need a clear business plan, necessary licenses, and permits. Additionally, consider applying for an EIN and registering your business entity. These steps are vital for a smooth Jersey City New Jersey Business Credit Application and will help establish credibility with lenders.

It's generally advisable to form your LLC before applying for an EIN. This order ensures that your EIN is linked directly to your business entity. When you're ready to apply for a Jersey City New Jersey Business Credit Application, having your LLC and EIN in place simplifies the process.

You will need to fill out Form SS-4 to get an EIN number in New Jersey. You can submit this form online, by fax, or through the mail. Getting your EIN is a crucial step when preparing your Jersey City New Jersey Business Credit Application, as it establishes your business's identity.

To obtain an EIN number in New Jersey, you can apply directly online through the IRS website. This process is straightforward and typically completed within a few minutes. Having an EIN is essential for your Jersey City New Jersey Business Credit Application, as it helps you separate your personal and business finances.

Yes, obtaining business credit is often easier with an LLC. Lenders view LLCs as more stable and credible entities. By submitting a Jersey City New Jersey Business Credit Application under your LLC, you may benefit from better interest rates and repayment terms. This structure not only helps in borrowing but also safeguards personal assets.

Typically, a credit score of 650 or higher is beneficial when starting a small business. This score may vary depending on the lender's requirements. In many cases, when completing a Jersey City New Jersey Business Credit Application, a better credit score can lead to more favorable lending terms. Focus on building a strong credit profile to enhance your business's financial opportunities.

Yes, using your EIN, you can apply for a line of credit for your business. Your EIN acts as a unique identifier for your business, which is essential when filling out a Jersey City New Jersey Business Credit Application. However, lenders often assess additional factors like your credit history. Make sure you maintain good financial practices to improve your chances.

An LLC does not have an inherent credit score upon formation. Instead, it builds credit over time through financial activities. To apply for a Jersey City New Jersey Business Credit Application successfully, maintaining timely payments and responsible borrowing is crucial. Your new LLC can establish a solid credit history just like any other business.

While lenders often focus on business credit scores, a personal credit score of 680 or higher is generally preferred for securing business credit. Lenders may use your personal credit profile as a deciding factor, especially if your business is new or lacks an established credit history. So, a Jersey City New Jersey Business Credit Application may require your personal details to assess shared risk.

A business credit application is a document that businesses complete to request financing or credit from lenders. When you fill out a Jersey City New Jersey Business Credit Application, you provide vital information that helps creditors evaluate your ability to repay borrowed funds. This is key to securing the financial support necessary for your business growth.