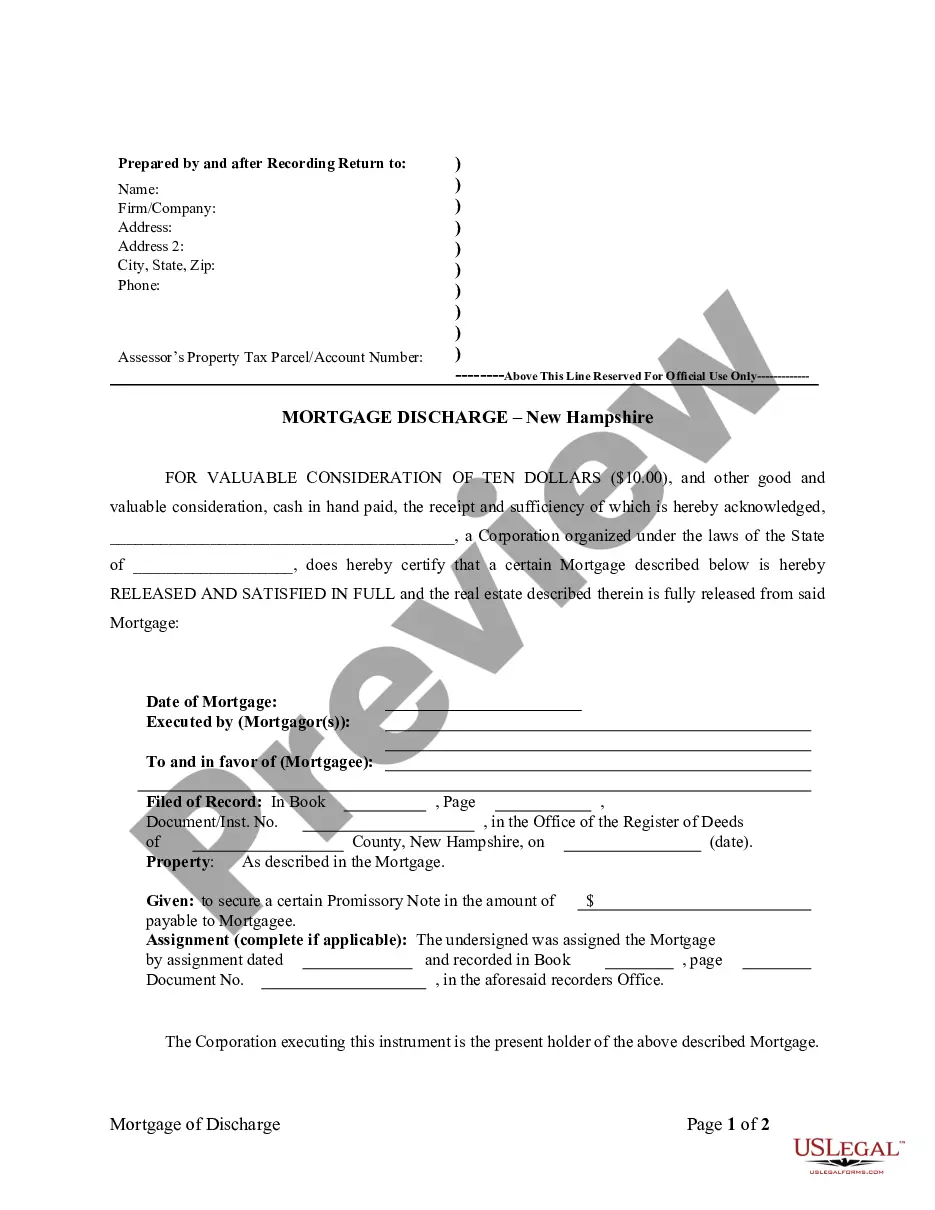

Manchester New Hampshire Satisfaction, Release or Cancellation of Mortgage by Corporation

Description

How to fill out New Hampshire Satisfaction, Release Or Cancellation Of Mortgage By Corporation?

If you have previously utilized our service, Log In to your account and obtain the Manchester New Hampshire Satisfaction, Release or Cancellation of Mortgage by Corporation on your device by selecting the Download button. Ensure your subscription is active. If not, renew it according to your payment plan.

If this is your initial interaction with our service, follow these straightforward steps to acquire your document.

You have ongoing access to every document you have purchased: you can find it in your profile within the My documents section whenever you need to use it again. Leverage the US Legal Forms service to effortlessly discover and save any template for your personal or business requirements!

- Make sure you have found the correct document. Review the description and use the Preview feature, if provided, to verify if it aligns with your requirements. If it is not suitable, employ the Search tab above to locate the appropriate one.

- Buy the template. Click the Buy Now button and select a monthly or yearly subscription option.

- Establish an account and process payment. Use your credit card information or the PayPal method to finalize the transaction.

- Acquire your Manchester New Hampshire Satisfaction, Release or Cancellation of Mortgage by Corporation. Choose the file format for your document and save it on your device.

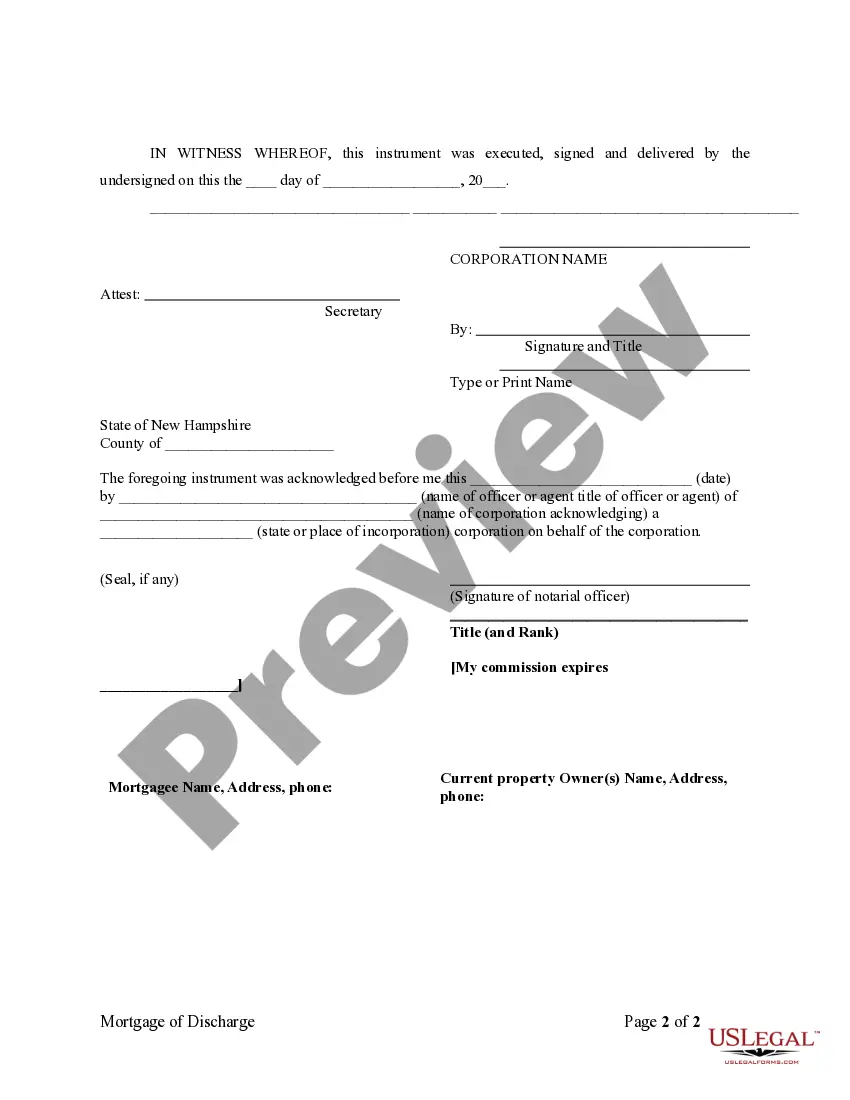

- Complete your template. Print it out or utilize professional online editors to fill it in and sign it electronically.

Form popularity

FAQ

Obtaining a mortgage lien release generally takes about 30 to 60 days in Manchester, New Hampshire. After you make your last payment, your lender must prepare the release document. To expedite this process, remain in contact with your lender and verify all required information is submitted without delay.

The time it takes to receive a satisfaction of a mortgage can vary. Typically, it may take a few weeks after your final payment is processed. It's wise to follow up with your lender regularly to ensure they are completing the necessary paperwork promptly. In Manchester, New Hampshire, expect a smoother process if you provide all required information upfront.

If the mortgagee does not acknowledge the satisfaction of the mortgage within sixty days, the borrower may have legal recourse. This includes the potential to file a petition in court to compel the mortgagee to act. Leveraging the services offered by US Legal Forms can help you navigate these situations under Manchester New Hampshire Satisfaction, Release or Cancellation of Mortgage by Corporation effectively.

To record a release of your mortgage, you must complete the necessary documentation and submit it to the registry of deeds. This process includes providing proof of payment and any required signatures. Using a platform like US Legal Forms can simplify your experience in navigating the Manchester New Hampshire Satisfaction, Release or Cancellation of Mortgage by Corporation.

An unsatisfied mortgage indicates that the borrower has not fulfilled their repayment obligations, and the lien is still active. This situation can hinder the owner's financial freedom, making it difficult to sell or refinance the property. It is crucial to understand this concept within the framework of Manchester New Hampshire Satisfaction, Release or Cancellation of Mortgage by Corporation to ensure your mortgage is properly resolved.

When a satisfaction of a mortgage is not recorded, creditors can still claim the debt remains outstanding. This situation can create legal and financial complications for homebuyers or sellers. Thus, maintaining proper records through the Manchester New Hampshire Satisfaction, Release or Cancellation of Mortgage by Corporation process is essential for protecting property interests.

Yes, a satisfaction of a mortgage typically requires notarization to ensure its validity. This step is crucial as notarization provides a layer of protection against fraud. Consequently, when processing a satisfaction or release in Manchester New Hampshire, make sure to seek notarization to guarantee compliance with local requirements.

If a mortgage does not get recorded, the lien may not be enforceable against third parties. This can lead to complications in establishing ownership and prioritization of debts. Thus, it is vital to follow the necessary steps for recording mortgages, particularly in the context of Manchester New Hampshire Satisfaction, Release or Cancellation of Mortgage by Corporation.

When no satisfaction of the mortgage is recorded, the property owner may continue to be burdened by the mortgage. This means the mortgage lien remains against the property, potentially complicating any future sales or refinances. To avoid these issues, it is essential to ensure that satisfaction of the mortgage is properly recorded in accordance with Manchester New Hampshire Satisfaction, Release or Cancellation of Mortgage by Corporation.

To obtain a copy of your satisfaction of a mortgage, you can start by requesting it from your lender directly. Many lenders retain copies of these documents after they have been issued. Additionally, you can check with the local registry of deeds in Manchester, New Hampshire, where such records are typically kept, helping you confirm your property’s clear title.