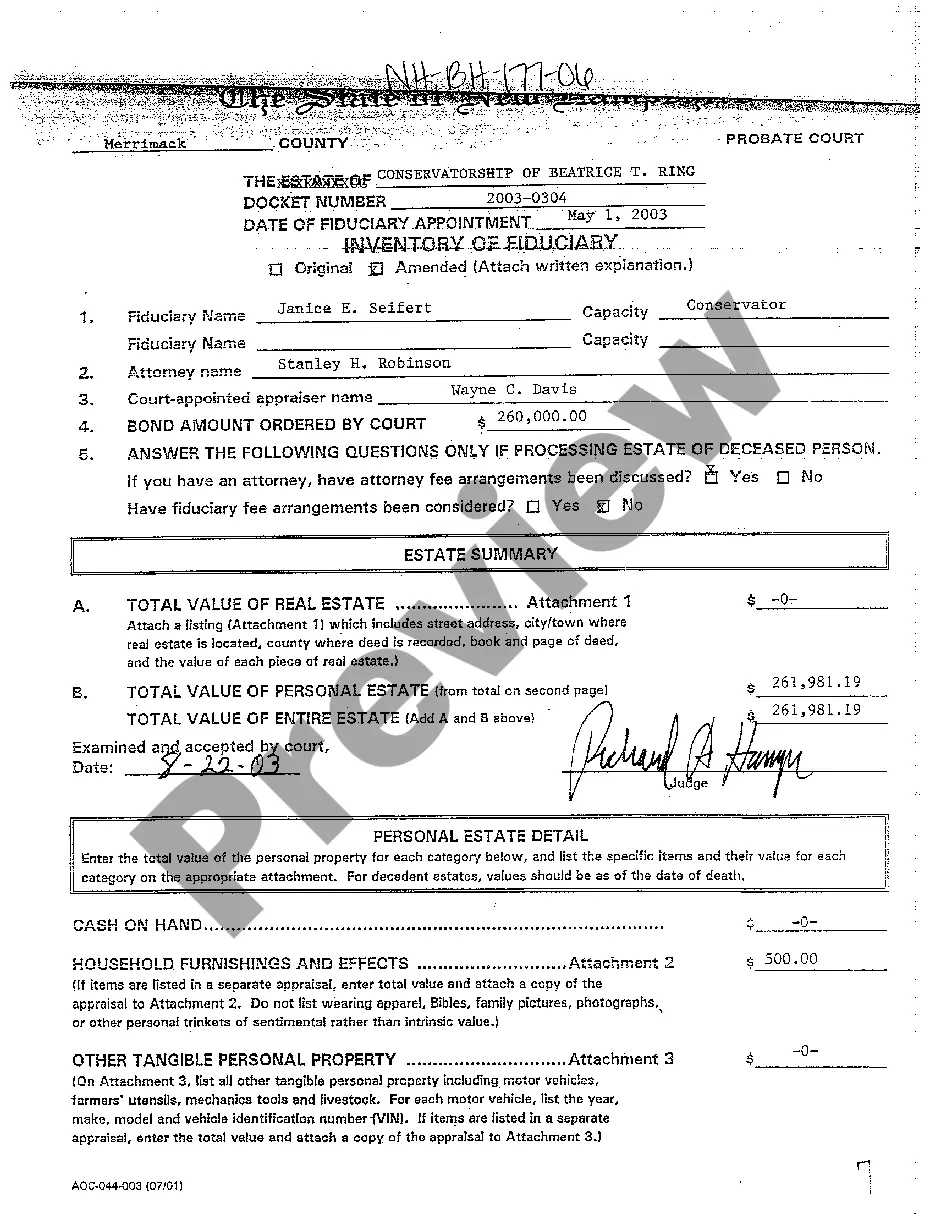

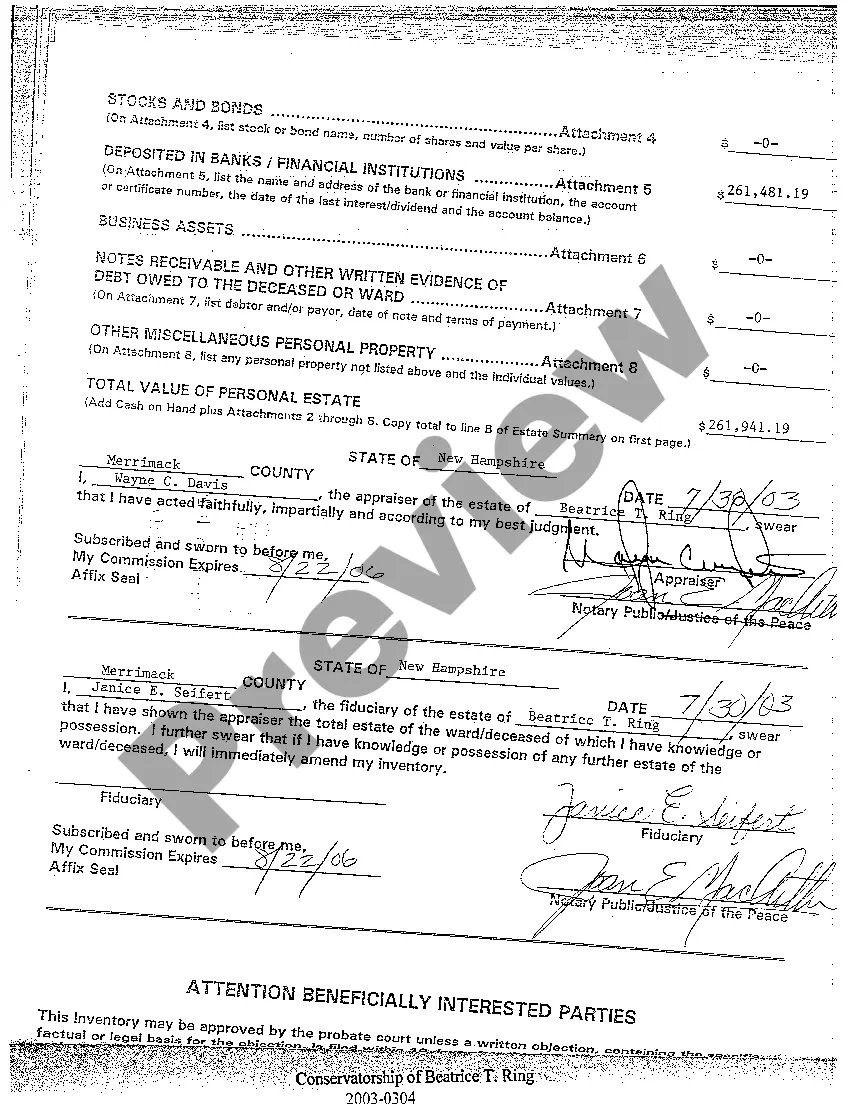

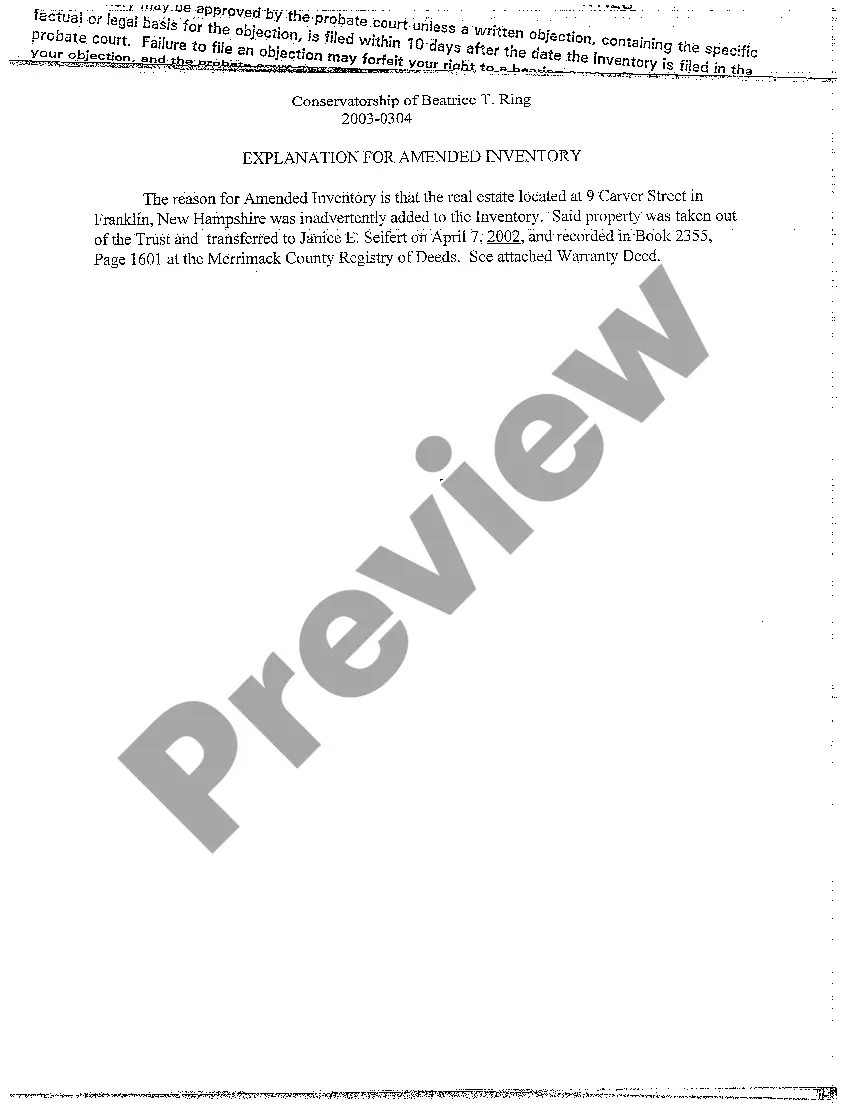

Manchester New Hampshire Inventory of Fiduciary

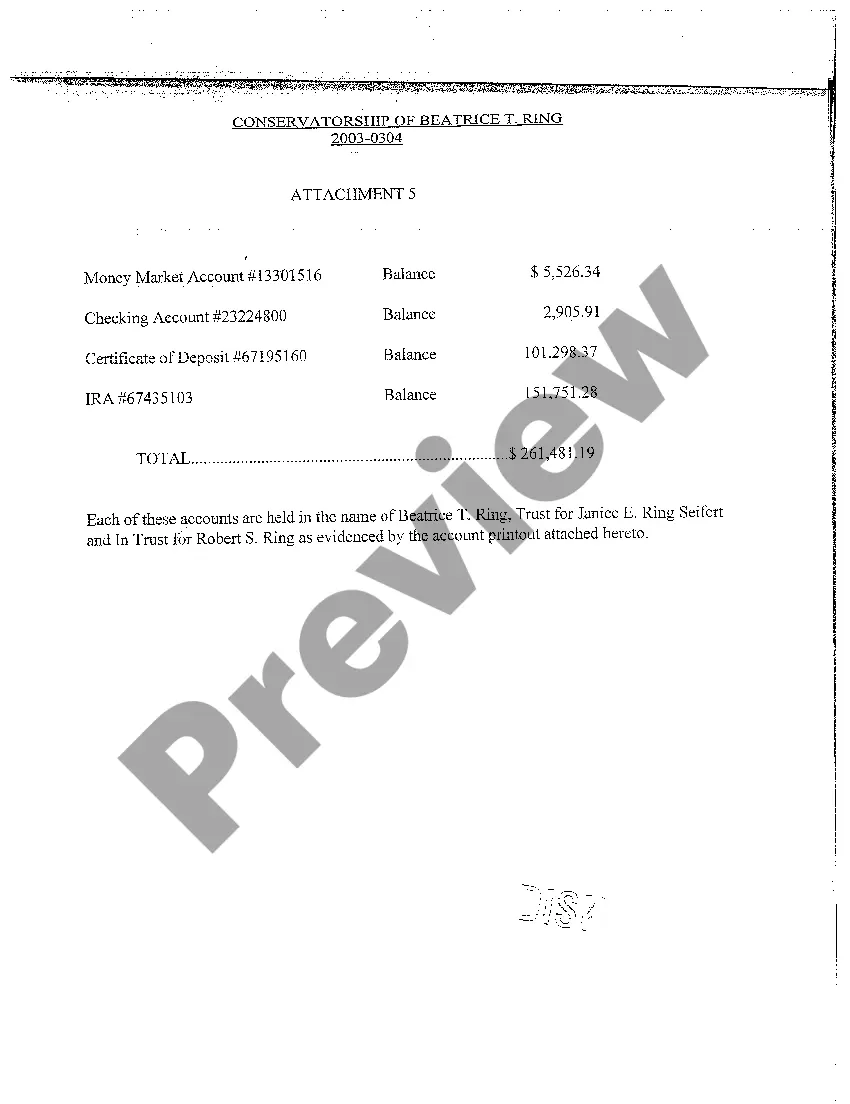

Description

How to fill out New Hampshire Inventory Of Fiduciary?

Acquiring verified templates tailored to your local regulations can be difficult unless you utilize the US Legal Forms library.

This is an online repository of over 85,000 legal documents catering to both personal and professional requirements and various real-world scenarios.

All documents are appropriately categorized by their area of application and jurisdiction, making it as simple and quick as ABC to find the Manchester New Hampshire Inventory of Fiduciary.

Ensure your paperwork remains organized and adheres to legal stipulations is greatly essential. Make use of the US Legal Forms library to have crucial document templates readily available for all your needs!

- Examine the Preview mode and document description.

- Ensure you've selected the correct one that fulfills your needs and aligns with your local jurisdictional criteria.

- Search for another template if necessary.

- Should you identify any discrepancies, use the Search tab above to find the appropriate one.

- If it meets your criteria, proceed to the next step.

Form popularity

FAQ

In New Hampshire, an estate generally triggers probate if its total value equals or exceeds $25,000. This threshold pertains to the collective value of assets owned solely by the deceased. Consulting the Manchester New Hampshire Inventory of Fiduciary can clarify how various asset types factor into this valuation. Awareness of this trigger point allows you to make informed decisions about estate planning.

In New Hampshire, an executor typically has up to one year to settle an estate, although this timeframe can vary based on specific circumstances. This period includes settling debts, distributing assets, and completing all necessary filings. Understanding the processes outlined in the Manchester New Hampshire Inventory of Fiduciary is critical for the executor's effective navigation through this timeline. Legal resources can assist in maintaining compliance with these timeframes.

The minimum value for probate in New Hampshire is generally $25,000 in total estate value. If the estate's value exceeds this amount, probate proceedings will likely be necessary. By consulting the Manchester New Hampshire Inventory of Fiduciary, you can familiarize yourself with what assets count towards this valuation. This recognition can guide better estate management.

There are several strategies to avoid probate in New Hampshire. Establishing a living trust is a common approach, as assets placed in a trust can bypass the probate process. Additionally, naming beneficiaries on accounts and properties can also help. Exploring the Manchester New Hampshire Inventory of Fiduciary can provide further insights into effective estate planning to minimize probate.

Not all wills in New Hampshire necessarily go through probate. For example, if an estate is small and falls below the probate limit, it may not require probate proceedings. If you are clear about the Manchester New Hampshire Inventory of Fiduciary, you can assess whether your specific situation mandates this legal pathway. Understanding these distinctions can help in proper estate planning.

In New Hampshire, wills are generally filed with the probate court in the county where the deceased lived. If you are searching for a will, locating the correct probate court is crucial. Utilizing the Manchester New Hampshire Inventory of Fiduciary can help you understand how to effectively submit or retrieve a will in this court system. For additional support, consider platforms like uslegalforms to assist you in this process.

In New Hampshire, an estate typically must be worth over $25,000 in order for it to go through probate. This figure includes the total value of assets, excluding certain types of property such as joint assets. If you are dealing with an estate of this value or more, understanding the Manchester New Hampshire Inventory of Fiduciary process is essential. You may need legal support to navigate this complex journey.

To close an estate in New Hampshire, you must complete all necessary tasks, including settling debts, distributing assets, and filing final tax returns. Once all obligations are met, you will file a petition with the probate court for estate closure. Utilizing the Manchester New Hampshire Inventory of Fiduciary can guide you through this process and help finalize the estate efficiently.

Certain assets do not go through probate, such as life insurance policies with designated beneficiaries, retirement accounts, and property held in joint tenancy. These assets transfer directly to the beneficiaries upon death, bypassing the probate process. Understanding this distinction is crucial when preparing the Manchester New Hampshire Inventory of Fiduciary to ensure proper asset management.

In New Hampshire, not all wills require probate, but generally, a will must be probated to settle the estate. The probate process validates the will and supervises the distribution of assets according to the decedent's wishes. If the estate is small or if it falls under certain categories, it may not need to go through probate. Understanding the role of the Manchester New Hampshire Inventory of Fiduciary can clarify what is needed in your situation.