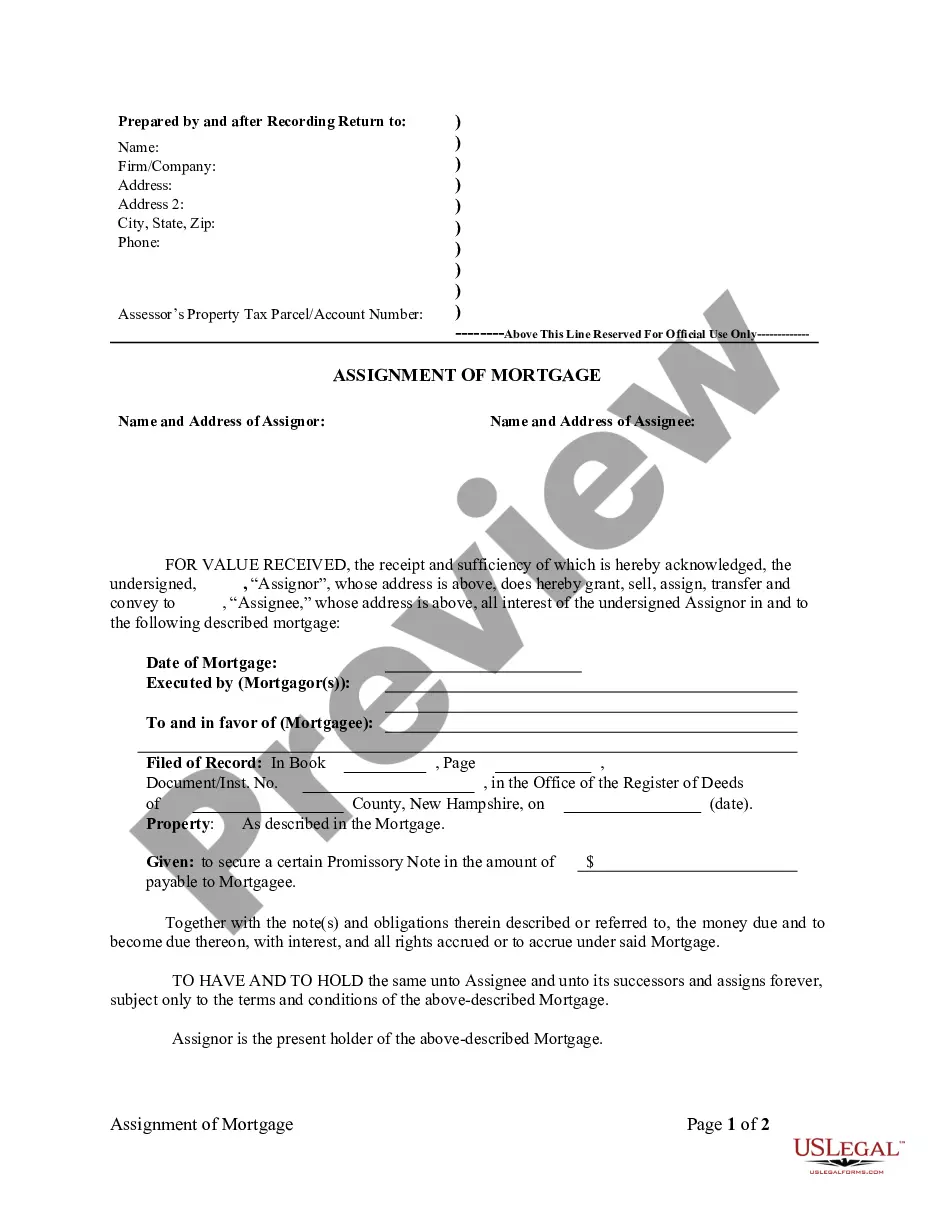

Manchester New Hampshire Assignment of Mortgage by Individual Mortgage Holder

Description

How to fill out New Hampshire Assignment Of Mortgage By Individual Mortgage Holder?

If you’ve previously utilized our service, Log In to your account and retrieve the Manchester New Hampshire Assignment of Mortgage by Individual Mortgage Holder onto your device by clicking the Download button. Confirm that your subscription is active. If not, renew it per your payment plan.

If this marks your initial engagement with our service, follow these straightforward steps to acquire your document.

You have continual access to every document you have acquired: you can find it in your profile under the My documents section whenever you need to use it again. Utilize the US Legal Forms service to easily search for and save any template for your personal or business requirements!

- Ensure you’ve found an appropriate document. Review the description and use the Preview option, if available, to determine if it aligns with your needs. If it doesn’t satisfy you, utilize the Search tab above to discover the correct one.

- Purchase the template. Click the Buy Now button and select either a monthly or annual subscription plan.

- Create an account and complete the payment. Enter your credit card information or choose the PayPal option to finish the purchase.

- Acquire your Manchester New Hampshire Assignment of Mortgage by Individual Mortgage Holder. Choose the file format for your document and store it on your device.

- Complete your document. Print it or use online editing tools to fill it out and sign it electronically.

Form popularity

FAQ

To complete an assignment of mortgage, you must draft an assignment document that outlines the terms between the original holder and the new holder. For those seeking assistance with the Manchester New Hampshire Assignment of Mortgage by Individual Mortgage Holder, using a reliable online platform can streamline this process, making the necessary legal documentation available. After both parties sign, file the assignment with the appropriate local office to formalize the transfer.

Yes, a mortgage can be assigned to another party, provided all legal requirements are met. When dealing with the Manchester New Hampshire Assignment of Mortgage by Individual Mortgage Holder, ensure that this transfer aligns with your mortgage agreement. Potentially, you may need permission from your lender before proceeding. Taking these steps can help protect your interests during the assignment.

Releasing an assignment of a mortgage requires specific documentation to indicate that the obligations have been fulfilled. You must file a release statement with the local registry, formalizing the end of the assignment. In the context of the Manchester New Hampshire Assignment of Mortgage by Individual Mortgage Holder, working with a legal professional can help you navigate the requirements effectively. Make sure to keep copies for your records.

Typically, the original mortgage holder signs the assignment of the mortgage. In cases involving the Manchester New Hampshire Assignment of Mortgage by Individual Mortgage Holder, both the assignor and the assignee may need to sign. This ensures that all parties acknowledge the transfer of rights and obligations. Always verify the local requirements to ensure compliance.

An assignment of a mortgage involves transferring the rights and obligations of a mortgage from one party to another. In the context of the Manchester New Hampshire Assignment of Mortgage by Individual Mortgage Holder, the original lender assigns the mortgage to a new lender or individual. This process keeps the mortgage intact while changing who receives the payments. You can simplify this process with the right legal documents and support.

In an assignment of mortgage, the grantor is the individual or entity that holds the original mortgage and is transferring it to another party. Essentially, the grantor effectively relinquishes their rights to the mortgage in the assignment. For those involved in a Manchester New Hampshire Assignment of Mortgage by Individual Mortgage Holder, understanding the role of the grantor can clarify the responsibilities and rights transferred in the process.

The assignment and transfer of lien is typically signed by the current mortgage holder, who is transferring their rights to the new holder. The new holder may also sign to indicate acceptance of the assignment. If you are navigating a Manchester New Hampshire Assignment of Mortgage by Individual Mortgage Holder, it is essential to ensure that all required signatures are correctly obtained to validate the transfer.