Omaha Nebraska Transfer on Death Deed or TOD - Beneficiary Deed for Husband and Wife / Two Individuals to Individual

Description

How to fill out Nebraska Transfer On Death Deed Or TOD - Beneficiary Deed For Husband And Wife / Two Individuals To Individual?

Regardless of social or professional standing, filling out legal documents is a regrettable requirement in the modern world.

Frequently, it’s nearly impossible for individuals lacking a legal background to generate this kind of documentation from the ground up, primarily because of the complex terminology and legal subtleties they entail.

This is where US Legal Forms proves to be useful.

You’re all set! Now you can either print the document or fill it out online.

If you experience any difficulties finding your purchased documents, you can easily access them in the My documents section.

- Be sure the document you have selected is tailored to your locality since the laws of one region do not apply to another.

- Examine the document and read a brief overview (if available) of situations the form can be applicable to.

- If the one you selected does not fulfill your requirements, you may start over and search for the necessary form.

- Click Purchase now and select the subscription plan that best fits your needs.

- Use your Log In details or register for a new account from scratch.

- Select the payment method and proceed to download the Omaha Nebraska Transfer on Death Deed or TOD - Beneficiary Deed for Husband and Wife / Two Individuals to Individual as soon as the payment has been confirmed.

Form popularity

FAQ

A transfer on death deed can be a very helpful planning tool when designing an estate plan. Indiana is one of many states that allows the transfer of real property by a transfer on death deed.

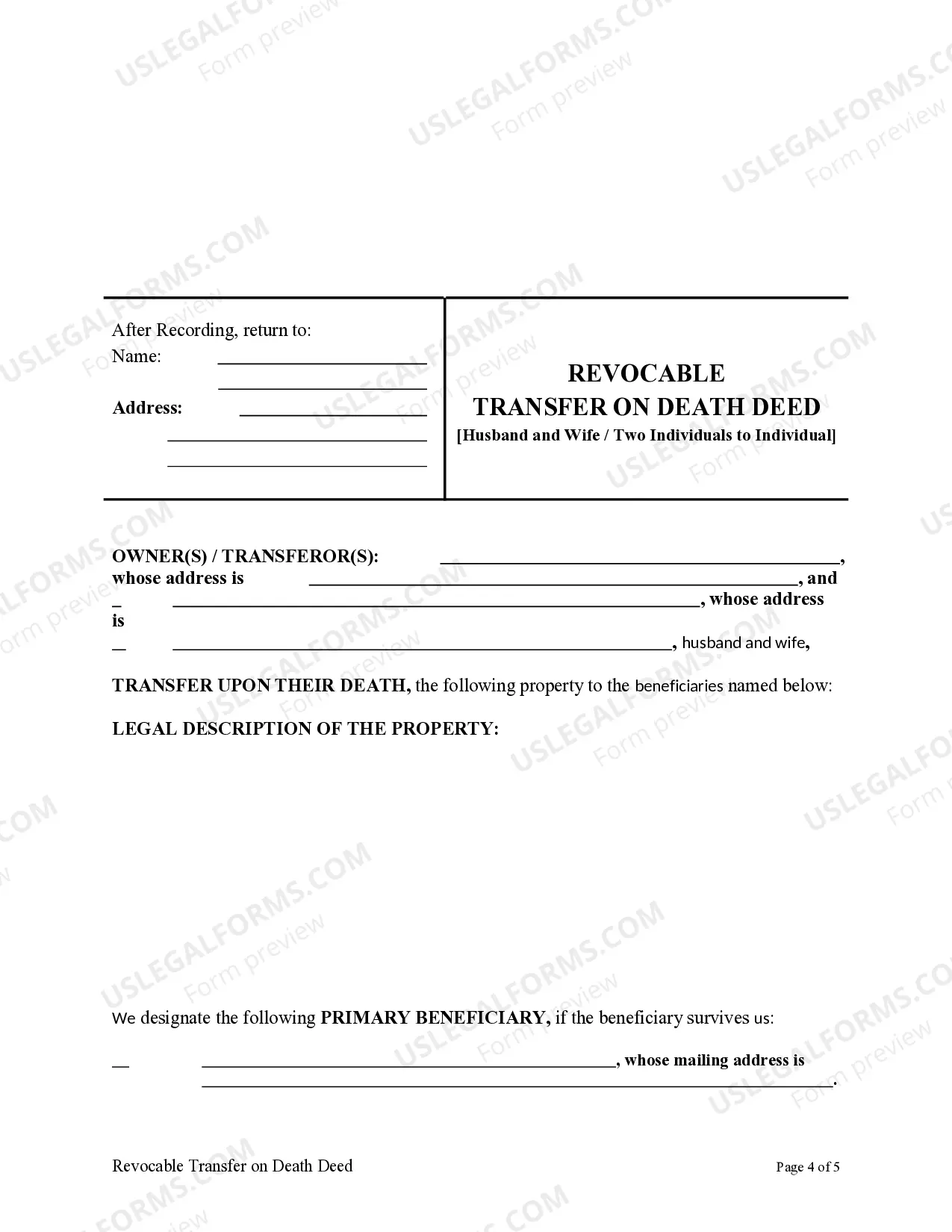

The Act allows an individual to transfer property located in Nebraska to one or more beneficiaries effective at the transferor's death through the use of a special deed referred to as a ?Transfer on Death Deed.?

In addition to using the proper form, the TOD deed has certain requirements that must be met: (1) the TOD deed must be signed by two independent witnesses; (2) the independent witnesses and you (the property owner) must all appear before a notary public and have it acknowledged before the notary public or other

A transfer on death (TOD) account automatically transfers its assets to a named beneficiary when the holder dies For example, if you have a savings account with $100,000 in it and name your son as its beneficiary, that account would transfer to him upon your death.

Transfer-on-Death Deeds for Real Estate North Carolina does not allow real estate to be transferred with transfer-on-death deeds.

A transfer on death deed, or a TOD Deed, allows for individuals to pass real property to a beneficiary upon their death.

A beneficiary form states who will directly inherit the asset at your death. Under a TOD arrangement, you keep full control of the asset during your lifetime and pay taxes on any income the asset generates as you own it outright. TOD arrangements require minimal paperwork to establish.

(b)(1) A transfer on death deed shall contain the following warnings: WARNING: The property transferred remains subject to inheritance taxation in Nebraska to the same extent as if owned by the transferor at death. Failure to timely pay inheritance taxes is subject to interest and penalties as provided by law.