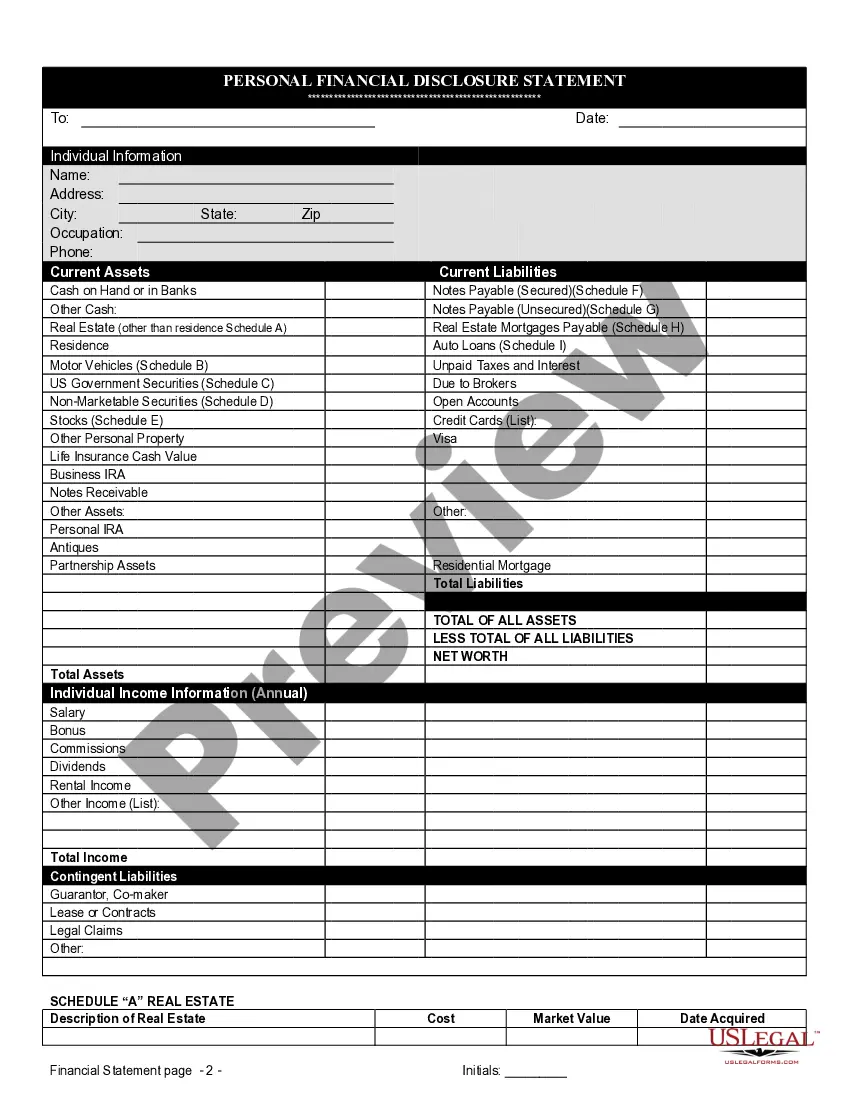

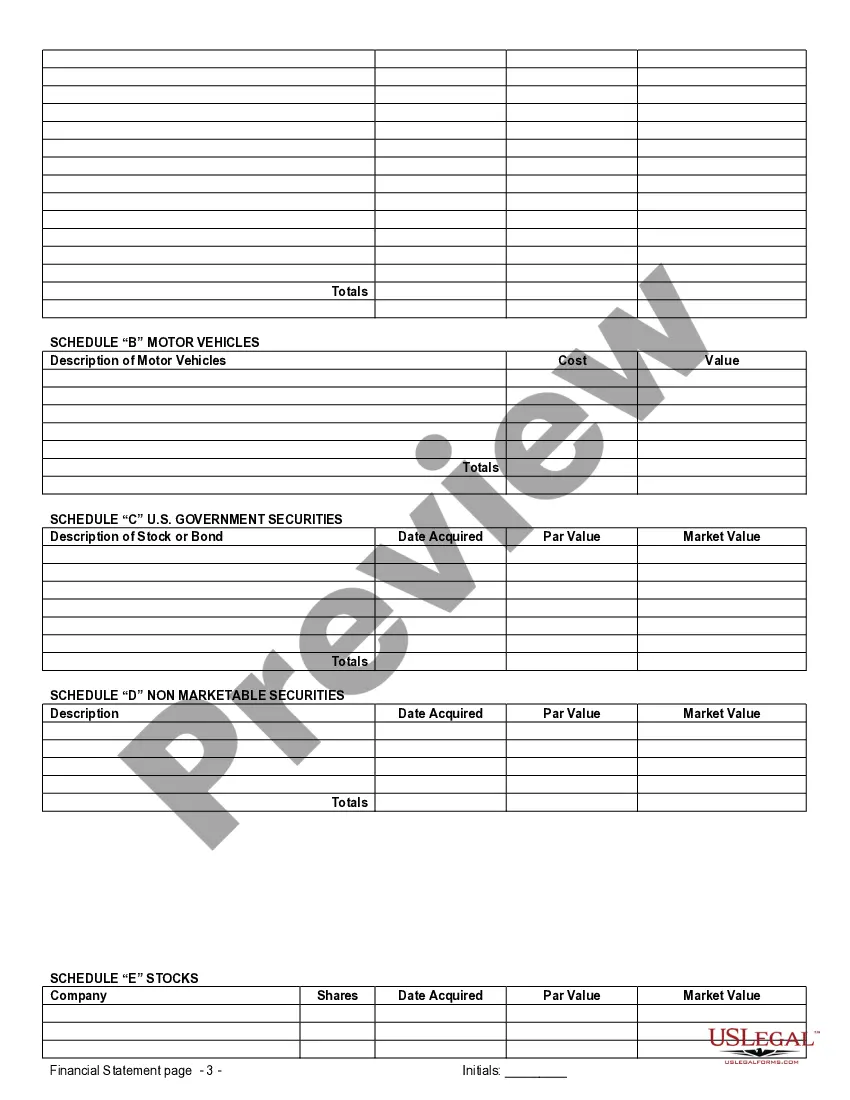

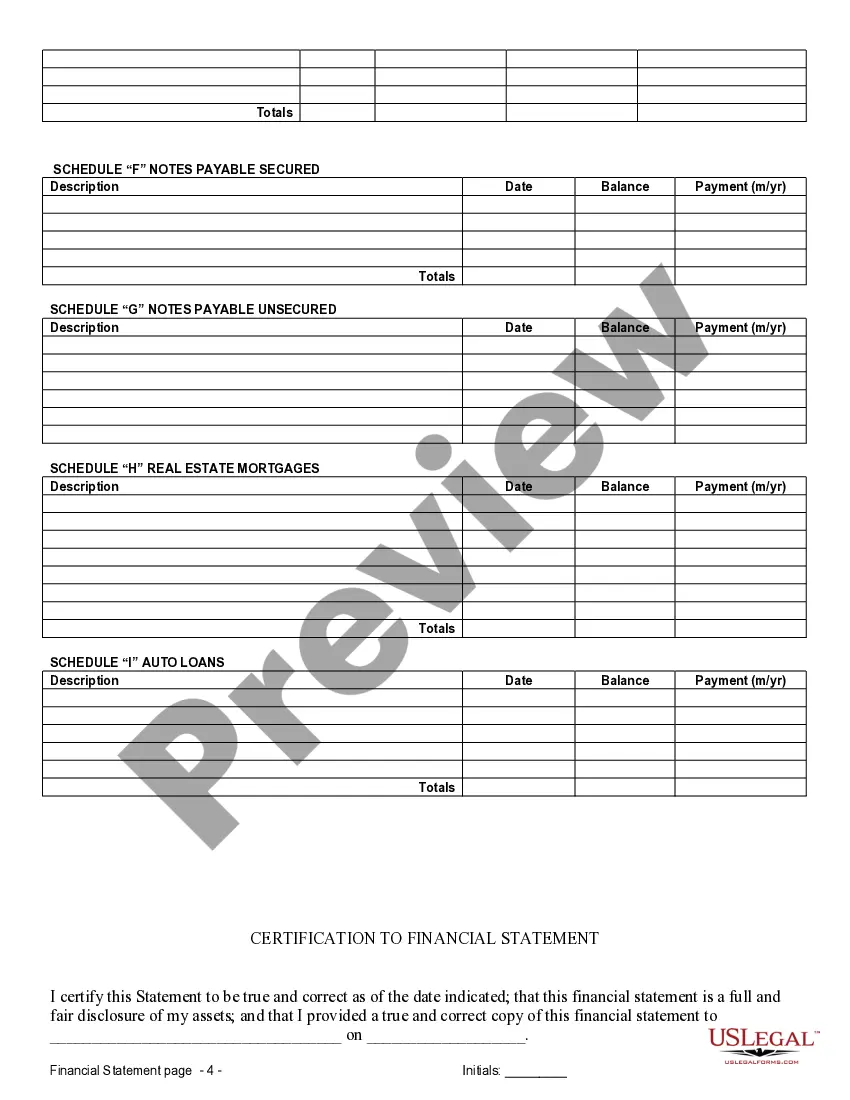

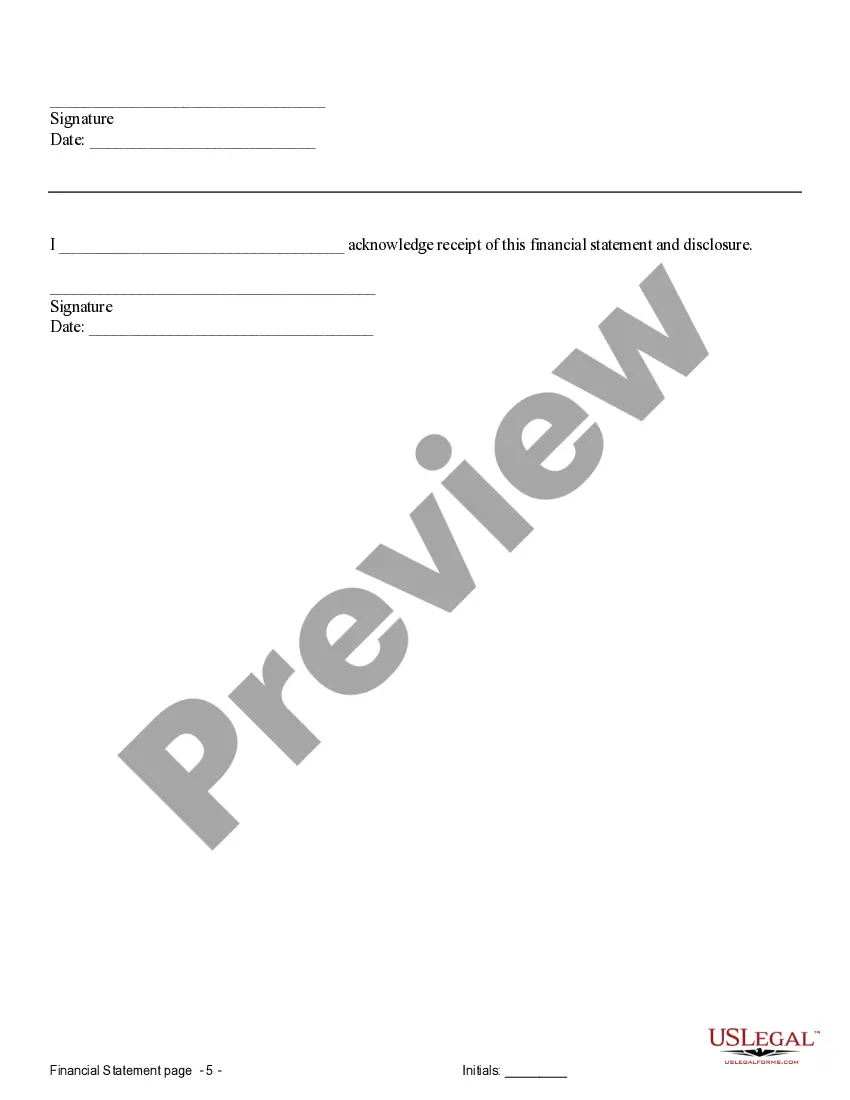

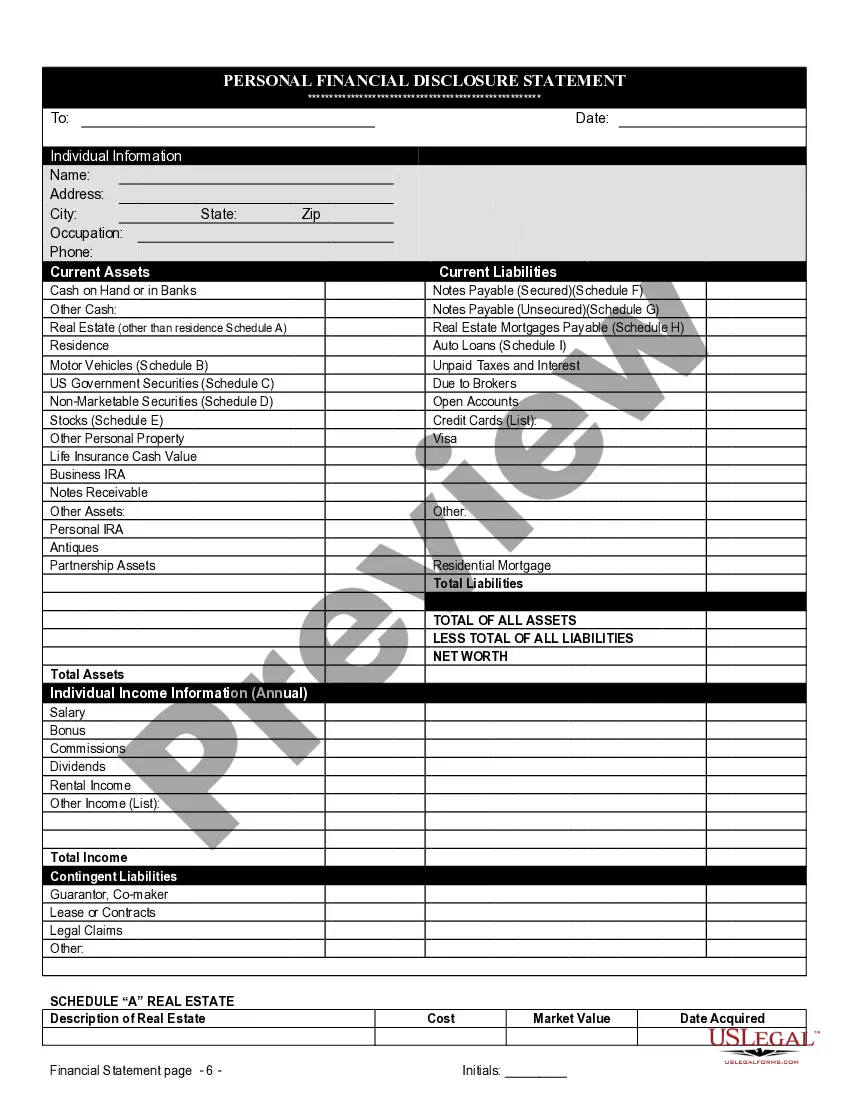

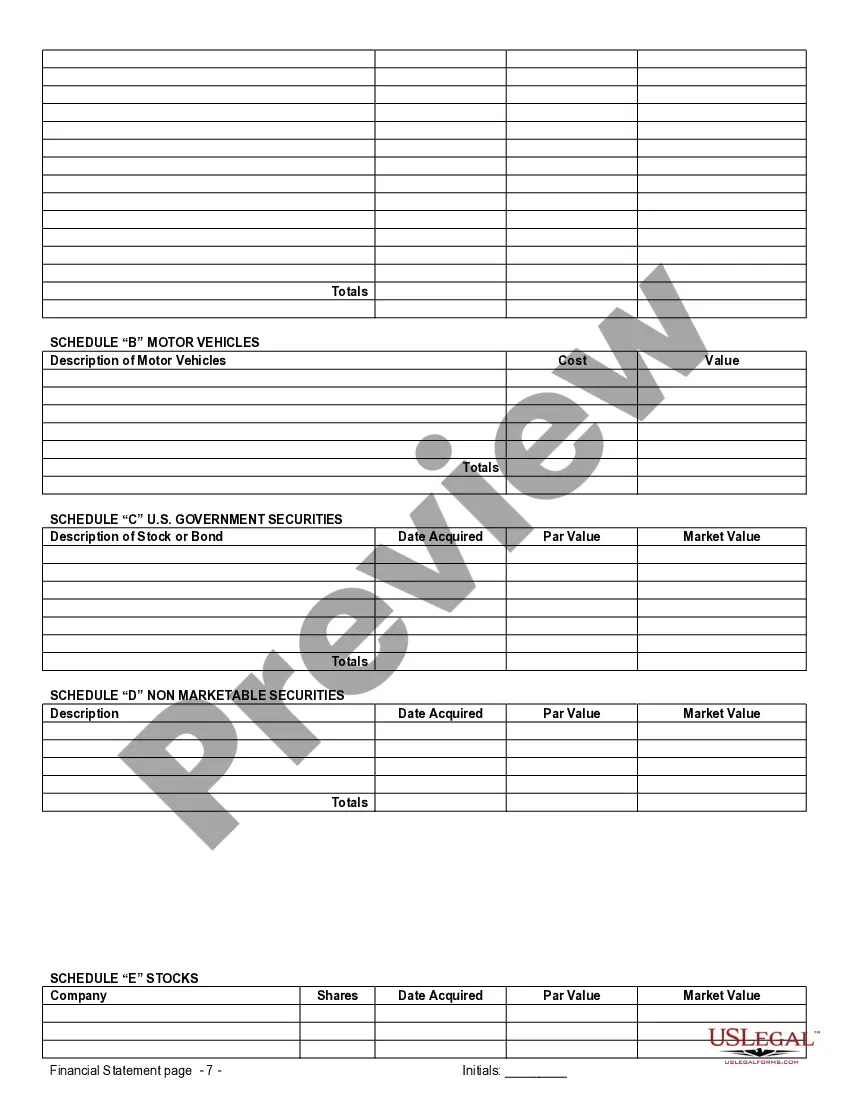

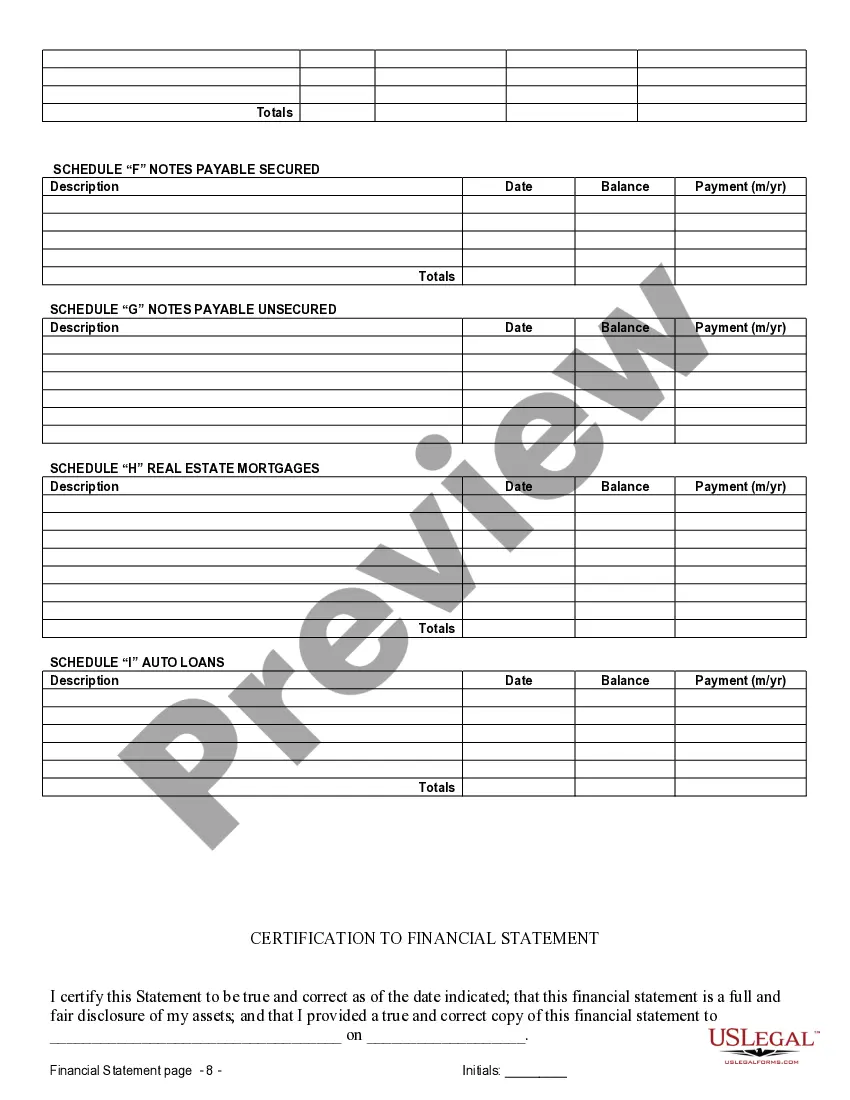

The financial statement disclosure form is for use in connection with the premarital agreement and must be completed accurately and completely. Both parties are required to complete a separate financial statement and provide a copy of the statement to the other party.

Omaha Nebraska Financial Statements only in Connection with Prenuptial Premarital Agreement

Description

How to fill out Nebraska Financial Statements Only In Connection With Prenuptial Premarital Agreement?

Utilize the US Legal Forms to gain immediate access to any document you need.

Our helpful website featuring a vast array of templates simplifies the process of locating and obtaining nearly any sample document you may need.

You can save, complete, and endorse the Omaha Nebraska Financial Statements solely related to Prenuptial Premarital Agreement in just a few minutes instead of spending hours searching online for a suitable template.

Using our database is a fantastic method to enhance the security of your form submissions.

If you haven't yet registered an account, follow the instructions below.

Access the page with the form you require. Ensure that it is the specific form you were searching for by verifying its title and description, and use the Preview feature if it is accessible. If not, utilize the Search function to find the necessary form.

- Our skilled attorneys frequently examine all documents to ensure that the templates are appropriate for specific states and adhere to current laws and regulations.

- How can you acquire the Omaha Nebraska Financial Statements solely concerning Prenuptial Premarital Agreement.

- If you possess an account, simply Log In to your profile.

- The Download option will be visible for all the files you review.

- Additionally, you can retrieve all previously saved documents from the My documents section.

Form popularity

FAQ

A prenuptial agreement does not cover the following: Child custody or visitation matters. Child support. Alimony in the event of a divorce. Day-to-day household matters. Anything prohibited by the law.

If a will contradicts the terms of a prenup, the heirs may have grounds to legally contest the validity of the will, and the courts will determine which document is enforceable when the terms contradict each other. The terms of a prenup are still enforceable in the event one spouse dies.

The law does not allow a couple to include any terms regarding child custody, visitation or support in a prenuptial or postnuptial agreement. This is because a judge will make these decisions in a divorce case based on the child's best interests.

Unconscionability Invalidates a Prenuptial Agreement One party signed the agreement involuntarily or not by choice. One party demonstrates that the other party did not divulge all relevant information. One party can prove he/she was not allowed access to an attorney before signing the prenup.

A premarital agreement, also known as a prenuptial or antenuptial agreement, is a contract between parties getting married.

When it comes to monetary assets, a prenup can also protect the future earnings of one or both parties so they are not up for grabs during a divorce.

The signing party must have full knowledge of the other spouse's property, assets and debts. If it is alleged that the party hid assets from the signing spouse at the time that the prenuptial agreement was created, or that the contract contains falsified financial information, this will void the agreement.

Be a written contract?no verbal agreements. Have lawful terms within the prenup. Include the signatures from both parties. Must be signed voluntarily (can't involve coercion, duress, intimidation, or deceit)

The agreement was procured by fraud ? a prenup is valid only if it is entered into after full disclosure by both parties as to their income, assets, and liabilities. If one spouse provides the other with information that is not accurate or truthful, the agreement is invalid.

Prenuptial agreements can be invalidated if the terms are so unfair and one-sided that the court would question why the spouse would agree to the agreement in the first place.