Miramar Florida Assumption Agreement of Mortgage and Release of Original Mortgagors

Description

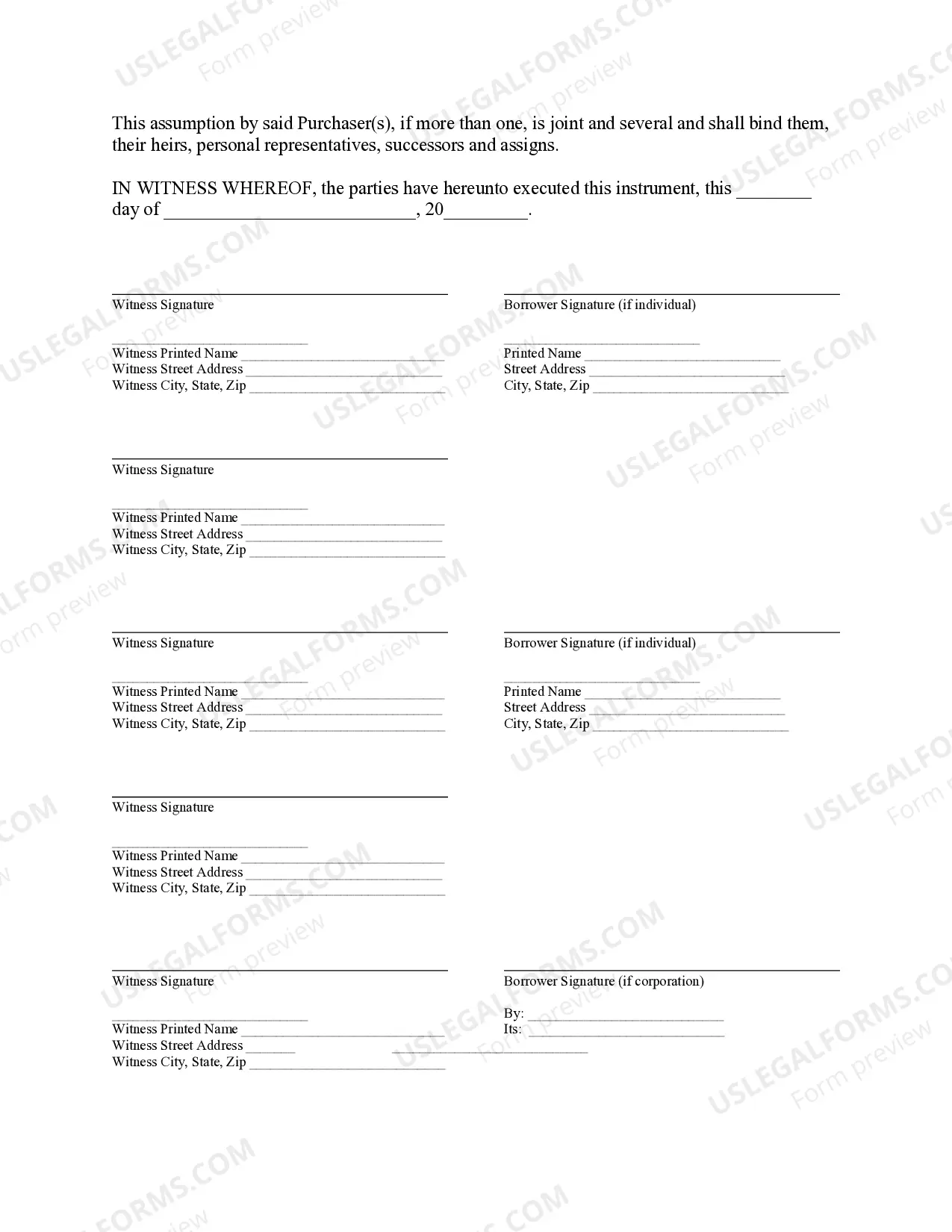

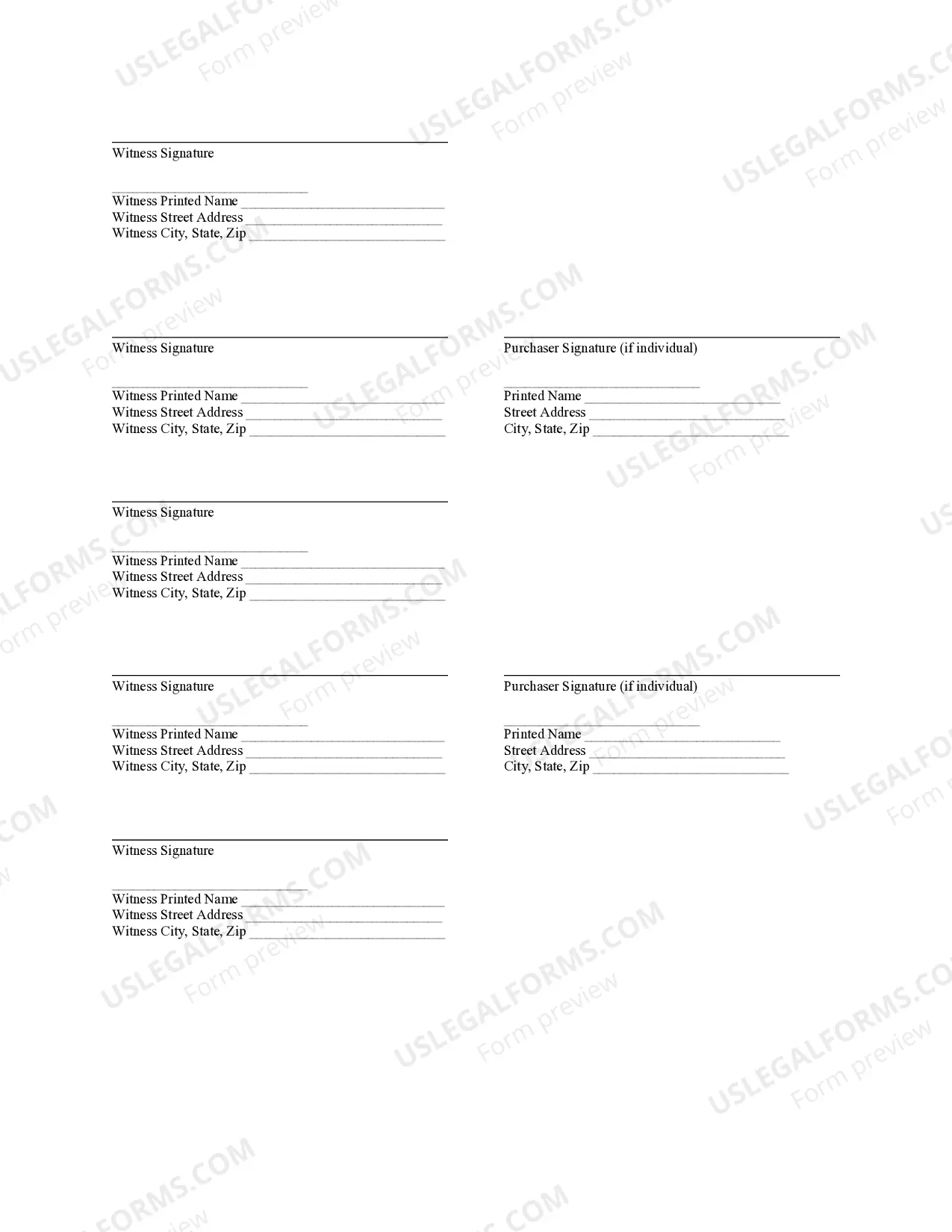

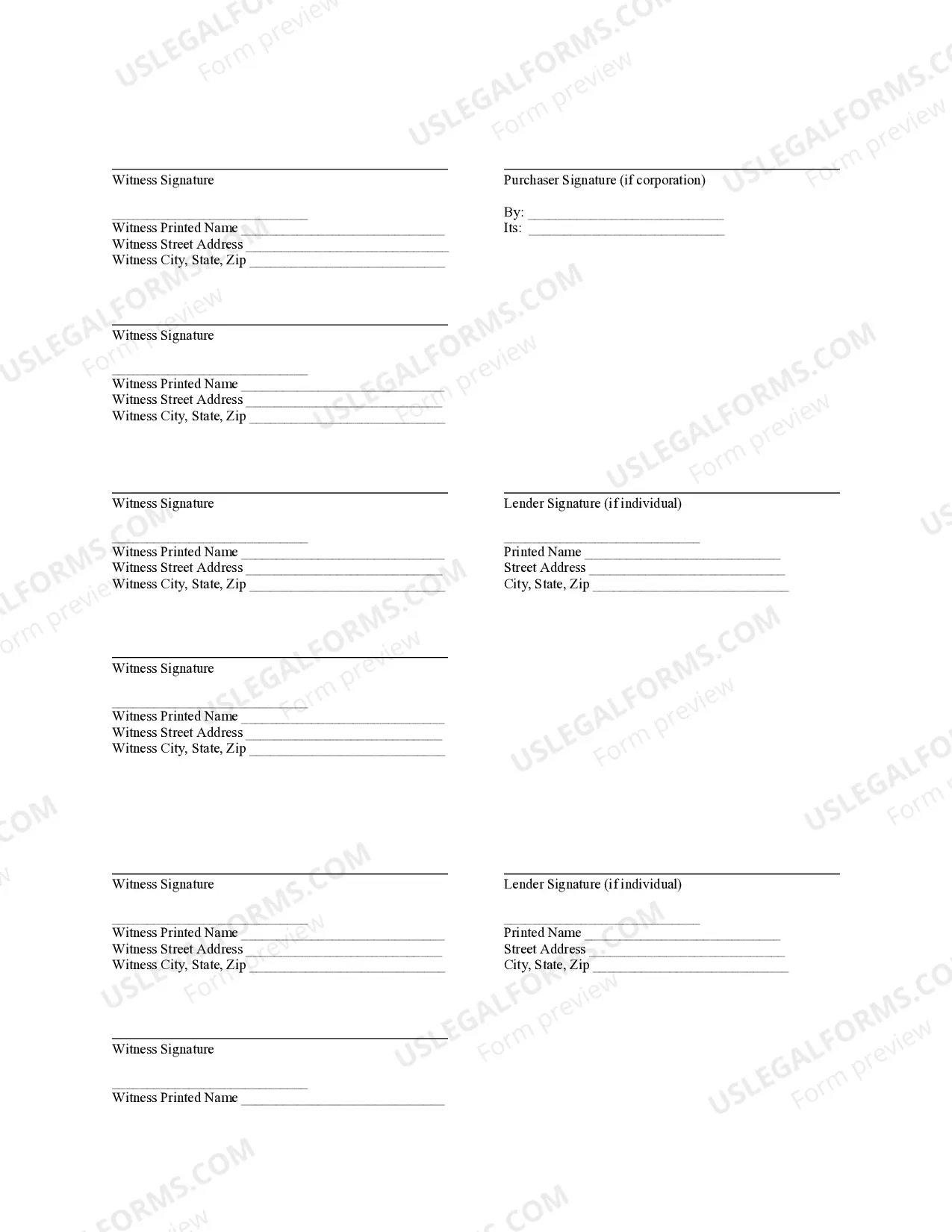

How to fill out Florida Assumption Agreement Of Mortgage And Release Of Original Mortgagors?

Utilize the US Legal Forms and gain immediate access to any form template you require.

Our user-friendly platform with numerous templates makes it easy to locate and obtain nearly any document example you will need.

You can download, complete, and validate the Miramar Florida Assumption Agreement of Mortgage and Release of Original Mortgagors in just a few minutes instead of spending hours online searching for the correct template.

Employing our catalog is an excellent way to enhance the security of your document filing.

Access the page with the required form. Ensure that it is the form you were seeking: confirm its title and description, and utilize the Preview function if available. If not, use the Search field to find the correct one.

Initiate the downloading process. Click Buy Now and choose the pricing plan you prefer. Then, create an account and complete your order via credit card or PayPal.

- Our knowledgeable attorneys frequently review all the documents to ensure that the forms are suitable for a specific state and compliant with current laws and regulations.

- How do you secure the Miramar Florida Assumption Agreement of Mortgage and Release of Original Mortgagors.

- If you possess an account, simply Log In to your account. The Download option will be activated on all the samples you view.

- Additionally, you can access all your previously saved documents in the My documents section.

- If you do not yet have an account, follow the steps below.

Form popularity

FAQ

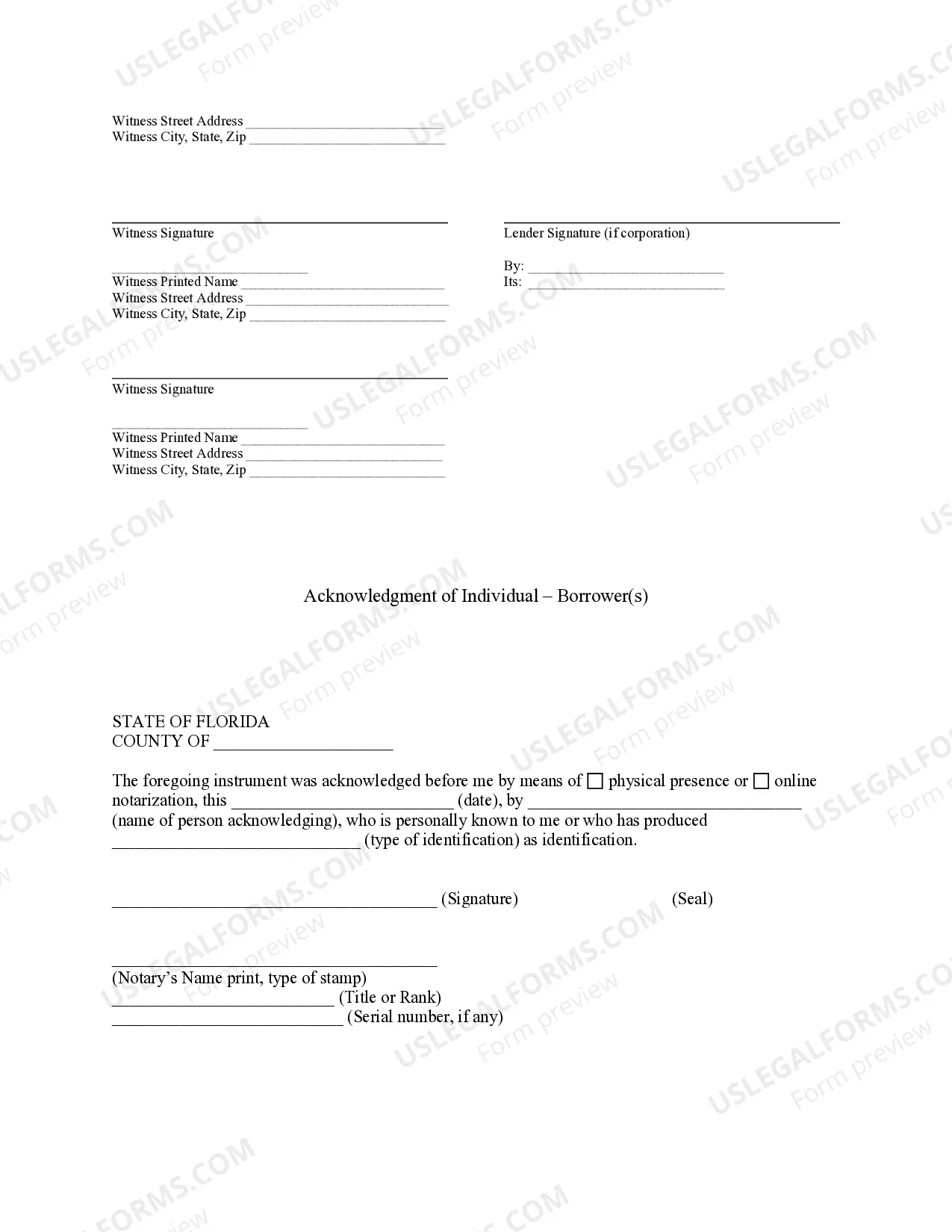

Yes, assumption agreements usually get recorded to document the transfer of obligations associated with a mortgage. Recording these agreements is vital for legal clarity and for protecting the interests of the new homeowner in Miramar, Florida. This step ensures that the terms of the Miramar Florida Assumption Agreement of Mortgage and Release of Original Mortgagors are recognized by third parties. For assistance with recording your agreement, consider uslegalforms to guide you in the process.

Typically, an assumption agreement is recorded in the property records to establish its legal standing. This recording provides a clear history of the mortgage obligation and protects the rights of the new borrower. In the context of a Miramar Florida Assumption Agreement of Mortgage and Release of Original Mortgagors, recording the agreement ensures that all parties' interests are safeguarded.

An assumption agreement is a legal document that allows a buyer to take over the seller's mortgage payments. In Miramar, Florida, this type of agreement helps transfer the responsibility of the mortgage from the original borrower to the new homeowner. This can make the home-buying process smoother, as it might offer more favorable terms than a new mortgage. Consider using platforms like uslegalforms to ensure your Miramar Florida Assumption Agreement of Mortgage and Release of Original Mortgagors is properly structured.

Assuming a mortgage in Miramar, Florida can present several challenges. First, the original mortgage terms may not be as favorable as current market rates. Additionally, if the property value declines, the financial burden may increase for the person assuming the mortgage. Therefore, it's essential to carefully consider these aspects before proceeding with a Miramar Florida Assumption Agreement of Mortgage and Release of Original Mortgagors.

In Florida, an assumption of mortgage involves a new borrower taking over the existing mortgage from the original borrower. This process requires lender approval, as they will assess the new borrower's creditworthiness. A Miramar Florida Assumption Agreement of Mortgage and Release of Original Mortgagors can facilitate this transaction, ensuring all parties are protected and liabilities are clearly defined.

An assumption agreement for a mortgage is a legal contract that allows a buyer to take over the mortgage obligations from the seller. This agreement typically means the buyer will make the existing mortgage payments, thus relieving the seller of future responsibility. Such arrangements are often detailed in a Miramar Florida Assumption Agreement of Mortgage and Release of Original Mortgagors, which clarifies the roles and responsibilities of each party involved.

When a property is sold subject to a mortgage, mortgagees and unreleased mortgagors face various dangers. For instance, the mortgage may remain unpaid even after the sale, which could lead to foreclosure. Additionally, the original mortgagors may still have liability for the debt, causing financial strain. Understanding the implications of a Miramar Florida Assumption Agreement of Mortgage and Release of Original Mortgagors can mitigate these risks effectively.

The assumption agreement allows a buyer to take over the existing mortgage from the seller. This document protects both parties by clearly defining the terms under which the mortgage is transferred. Essentially, it facilitates a smooth transition, ensuring that obligations are honored. In the context of Miramar Florida Assumption Agreement of Mortgage and Release of Original Mortgagors, this agreement helps streamline the process of transferring property ownership.

While assumable mortgages can be a great option, there are a few considerations you should be aware of. The lender may require you to meet specific financial criteria to assume the mortgage. Additionally, not all mortgages are assumable, so it's crucial to review your situation. Overall, understanding the details of the Miramar Florida Assumption Agreement of Mortgage and Release of Original Mortgagors can help you navigate the process successfully.

To assume a mortgage, several key documents are typically required, including the current mortgage statement, an assumption agreement, and financial verification forms. In the context of the Miramar Florida Assumption Agreement of Mortgage and Release of Original Mortgagors, lenders may also require a credit report and income verification. Gathering these documents ahead of time can simplify the assumption process. Leveraging uslegalforms can help you compile the necessary paperwork efficiently.