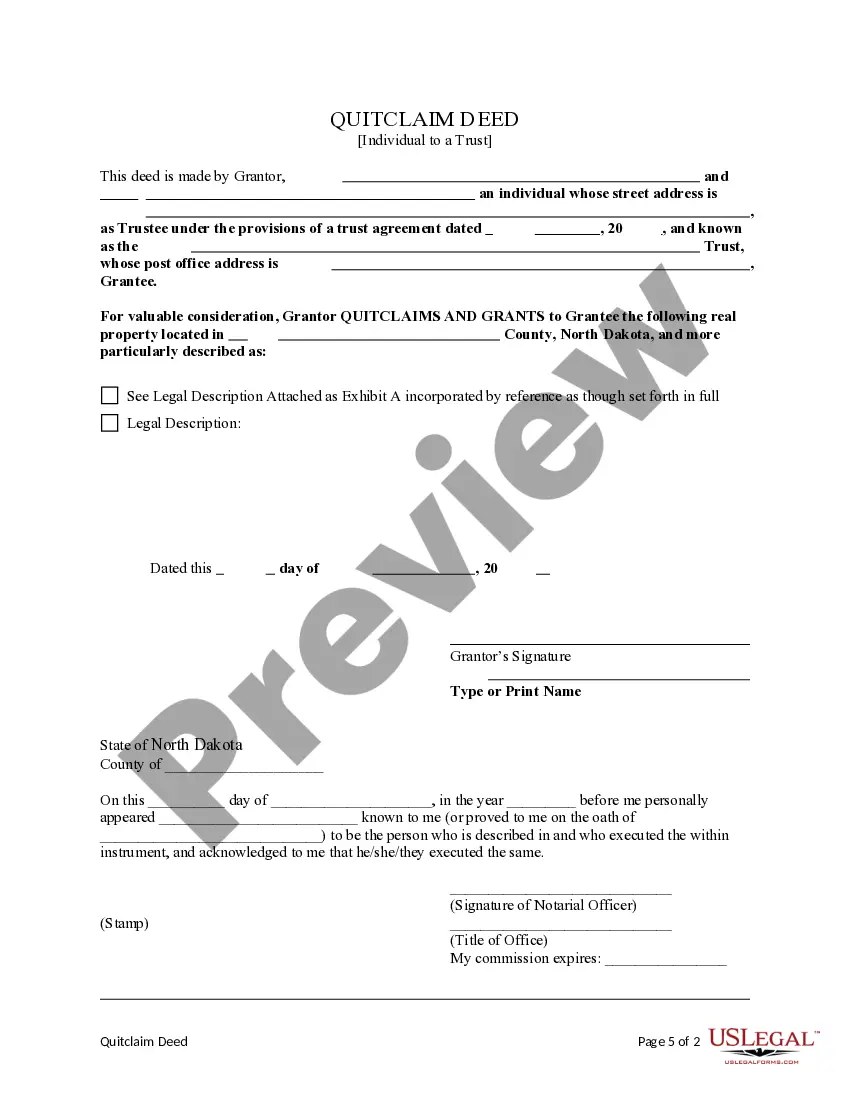

This form is a Quitclaim Deed where the Grantor is an individual and the Grantee is a trust. Grantor conveys and quitclaims the described property to Grantee. This deed complies with all state statutory laws.

Fargo North Dakota Quitclaim Deed from an Individual to a Trust

Description

How to fill out North Dakota Quitclaim Deed From An Individual To A Trust?

We consistently aim to reduce or avert legal repercussions when navigating intricate legal or financial situations. To achieve this, we seek legal solutions that are often highly expensive. However, not all legal issues are similarly intricate. The majority of them can be managed independently.

US Legal Forms is an online repository of current DIY legal documents encompassing everything from wills and power of attorney to articles of incorporation and petitions for dissolution. Our platform empowers you to take control of your legal affairs without the necessity of employing legal counsel. We provide access to legal form templates that are not always readily available. Our templates are tailored to specific states and regions, greatly simplifying the search process.

Utilize US Legal Forms whenever you need to obtain and download the Fargo North Dakota Quitclaim Deed from an Individual to a Trust or any other form swiftly and securely. Simply Log In to your account and click the Get button adjacent to it. If you happen to misplace the form, you can always retrieve it again from within the My documents tab.

The procedure is just as straightforward if you’re a newcomer to the website! You can set up your account within a few minutes.

Make the most of US Legal Forms now to conserve time and resources!

- Ensure the Fargo North Dakota Quitclaim Deed from an Individual to a Trust complies with the laws and regulations of your state and area.

- It’s essential to review the form’s description (if available), and if you notice any inconsistencies with what you were initially seeking, look for an alternative form.

- Once you’ve confirmed that the Fargo North Dakota Quitclaim Deed from an Individual to a Trust is suitable for your situation, you can select the subscription option and move on to payment.

- Then you can download the form in any appropriate file format.

- With over 24 years in the market, we’ve assisted millions of users by providing ready-to-customize and up-to-date legal documents.

Form popularity

FAQ

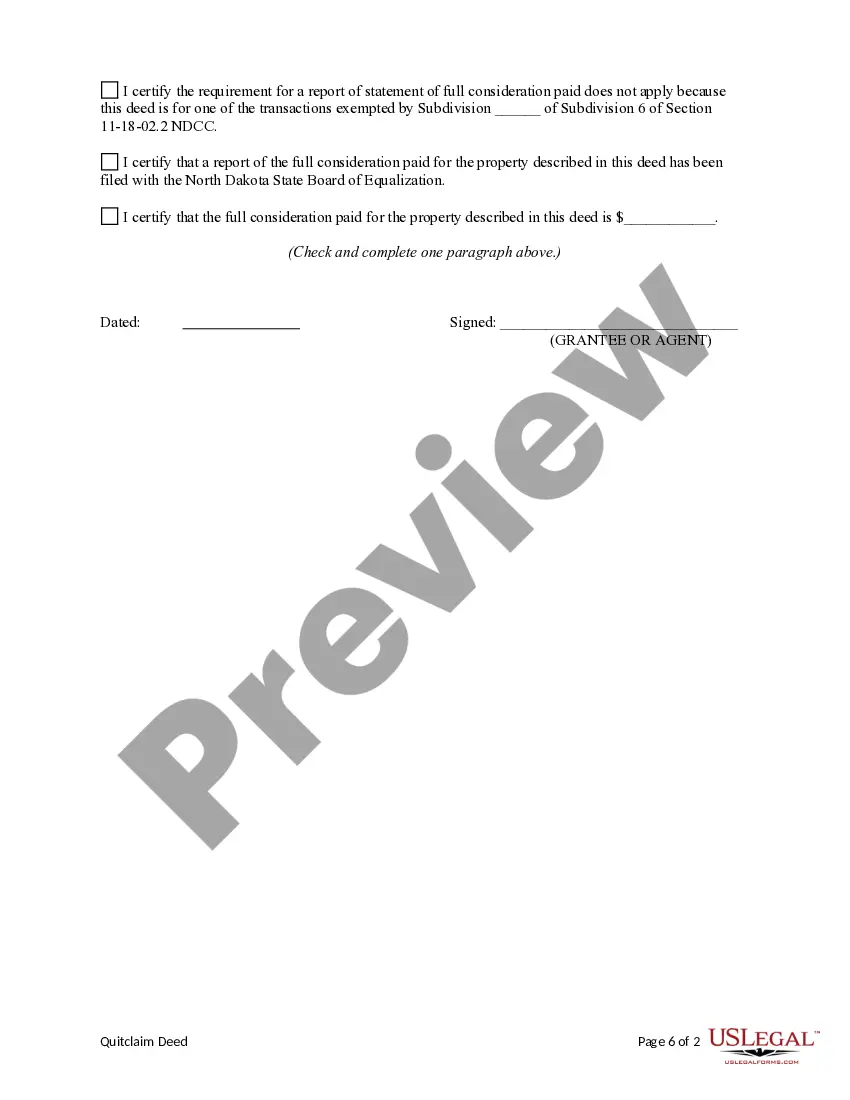

Filing a quit claim deed in North Dakota involves several straightforward steps. First, you need to prepare the deed, including the legal description of the property and the names of the parties involved. Next, you must sign the deed in front of a notary public and then file it with the appropriate county recorder's office. To efficiently navigate this process, consider using US Legal Forms, which offers helpful templates tailored for a Fargo North Dakota quitclaim deed from an individual to a trust.

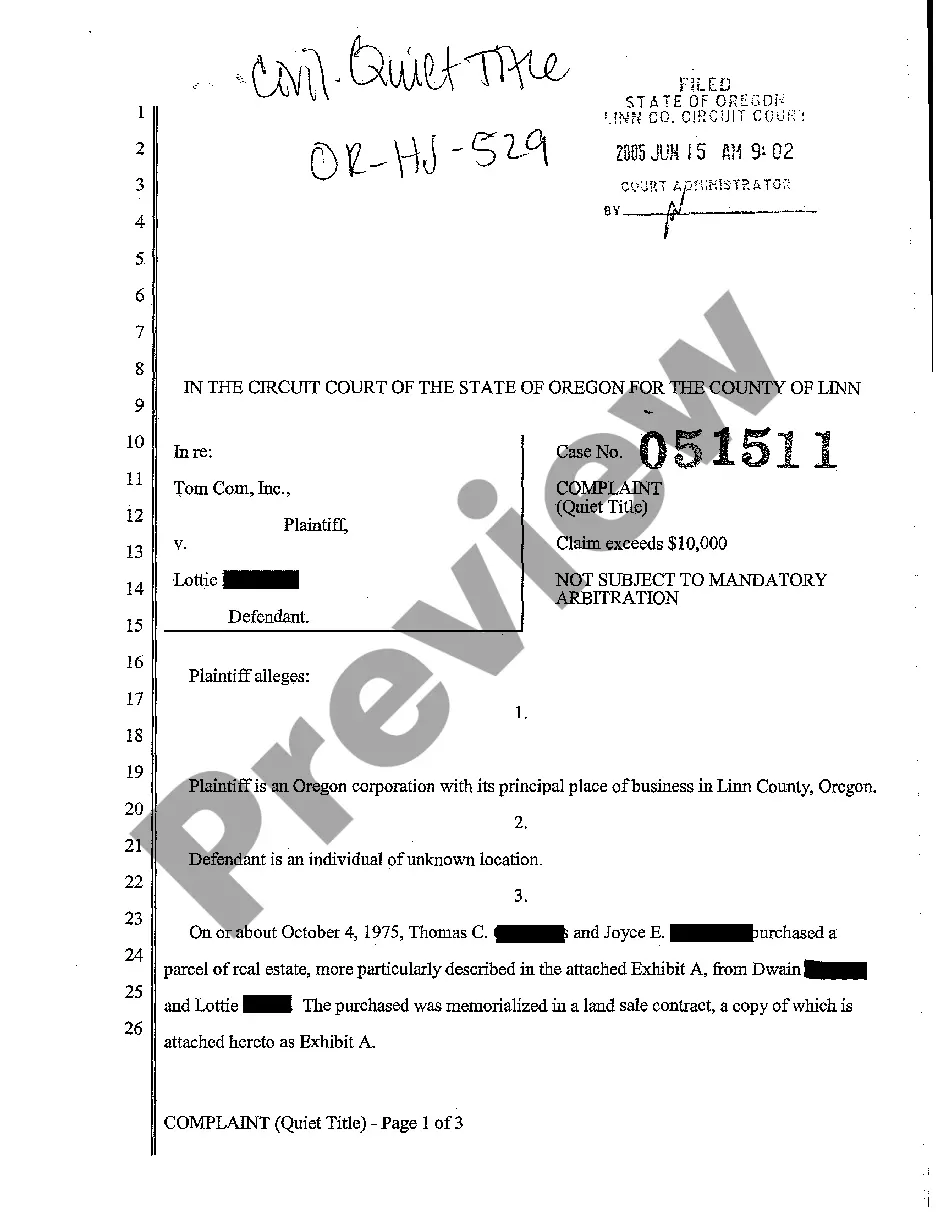

Yes, a quit claim deed can transfer property from a trust. In this process, the trustee executes the deed, effectively transferring the property to the designated recipient. It’s important to ensure that all documentation aligns with the legal requirements in Fargo, North Dakota, especially when handling the Fargo North Dakota quitclaim deed from an individual to a trust. Utilizing tools from US Legal Forms can help streamline this process, ensuring everything is completed correctly.

Deciding between a Fargo North Dakota Quitclaim Deed and a trust depends on your needs. A quitclaim deed allows for quick transfers of ownership without additional complexity. On the other hand, a trust can provide more control over how your assets are managed after your passing. Consider your goals and consult a professional to make the best choice.

While a Fargo North Dakota Quitclaim Deed from an Individual to a Trust can offer benefits, it can also present some downsides. One significant concern is the potential loss of control over the property; once it’s in the trust, the trust's terms govern its use. Additionally, there may be upfront costs associated with creating the trust and managing it, which should be carefully considered.

To execute a Fargo North Dakota Quitclaim Deed from an Individual to a Trust, first, you need to prepare the deed document. This document should clearly state that the property is being transferred to the trust. Make sure to sign the deed in front of a notary. Afterwards, file the deed with the local county recorder’s office to make the transfer official.

To properly fill out the Fargo North Dakota Quitclaim Deed from an Individual to a Trust, start by entering the names of the grantor, who is the individual transferring the property, and the trustee or name of the trust. Next, clearly describe the property being transferred, including the legal description. Make sure to include the date and any required signatures. For assistance with this process, consider using the US Legal Forms platform, which offers helpful resources and templates specifically for North Dakota quitclaim deeds.

A quitclaim deed, like the Fargo North Dakota Quitclaim Deed from an Individual to a Trust, cannot be used in transfers involving mortgages or when the property has multiple owners with differing interests. It may not be suitable for conveying property to a third party where assurances are essential, such as in sales or complex ownership situations. For those instances, more formal methods, including warranty deeds, might be necessary to ensure clarity of ownership and legal protections. Using platforms like uslegalforms can help you navigate these situations effectively.

Quitclaim deeds, including the Fargo North Dakota Quitclaim Deed from an Individual to a Trust, are sometimes regarded with caution because they do not guarantee ownership rights. They simply transfer whatever interest the grantor has without verifying title legitimacy, which can lead to disputes. Furthermore, because they lack warranties, recipients may inherit hidden liens or claims against the property. Thus, it's crucial to understand the risks involved before proceeding with a quitclaim deed.

When considering property transfers like the Fargo North Dakota Quitclaim Deed from an Individual to a Trust, a trust often provides more comprehensive benefits. A trust offers more control over the asset after the owner's passing, ensuring a smoother transition and potentially minimizing probate issues. Additionally, trusts can provide protection from creditors and may offer tax advantages. Therefore, while both tools serve unique purposes, a trust might be the superior choice for long-term asset management.