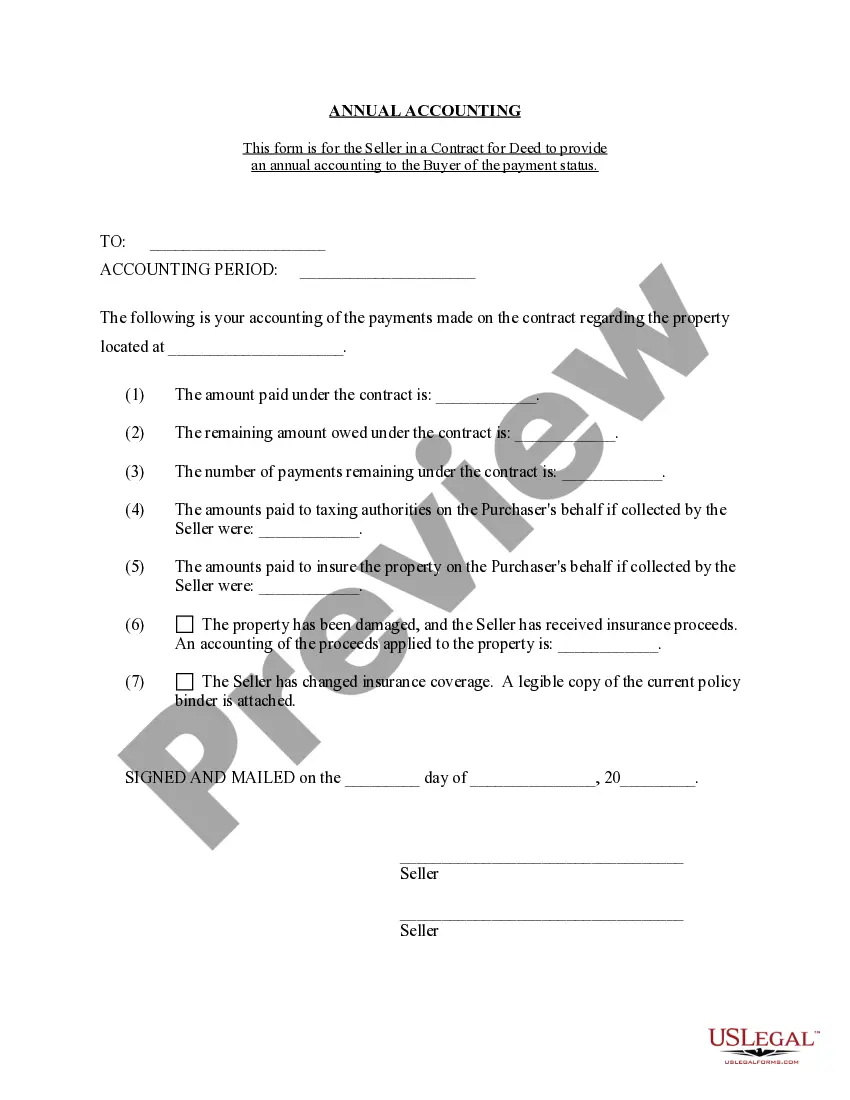

Fargo North Dakota Contract for Deed Seller's Annual Accounting Statement

Description

How to fill out North Dakota Contract For Deed Seller's Annual Accounting Statement?

If you’ve previously used our service, Log In to your account and store the Fargo North Dakota Contract for Deed Seller's Annual Accounting Statement on your device by selecting the Download button. Ensure your subscription is active. If it isn’t, renew it based on your payment arrangement.

In case this is your initial interaction with our service, follow these straightforward steps to acquire your document.

You have ongoing access to all documents you have bought: you can locate them in your profile under the My documents section whenever you wish to reuse them. Utilize the US Legal Forms service to swiftly find and save any template for your personal or business requirements!

- Confirm you’ve located a suitable document. Browse through the description and utilize the Preview feature, if available, to verify if it fulfills your requirements. If it doesn’t fit your needs, use the Search tab above to find the suitable one.

- Purchase the template. Click the Buy Now button and select either a monthly or yearly subscription plan.

- Create an account and process your payment. Use your credit card information or the PayPal option to complete the purchase.

- Obtain your Fargo North Dakota Contract for Deed Seller's Annual Accounting Statement. Select the file format for your document and save it to your device.

- Complete your document. Print it or use professional online software to fill it out and sign it digitally.

Form popularity

FAQ

Pros and Cons of a Contract for Deed Pro 1: Flexibility. Typically, when homebuyers set out to purchase a new home, there are several rules that must be followed.Pro 2: Less Time Waiting.Con 1: In Case of Default.Con 2: Higher Interest Rates.

A contract for deed is an alternative financing agreement in which the seller finances the sale of the property rather than a lender. No Mortgage Registration Tax (MRT) is due on the recording of a contract for deed because a contract for deed is exempted under the MRT law.

Risk to the Buyer A contract for deed has risk for the buyer. Because the seller keeps legal title to property until the contract price is paid in full, the buyer does not become the owner of the property until he or she completes his payment obligations and receives title from the seller.

The contract for deed is a much faster and less costly transaction to execute than a traditional, purchase-money mortgage. In a typical contract for deed, there are no origination fees, formal applications, or high closing and settlement costs.

Disadvantages of Common Law Contracts Contracts cost time and money to write. Whether they're drafted by a lawyer or reviewed by one, or even if they are written by an HR professional, contracts require a good deal of energy and are not an inexpensive undertaking.

Land contract cons. Higher interest rates ? Since the seller is taking most of the risk, they may insist on a higher interest rate than a traditional mortgage. Ownership is unclear ? The seller retains the property title until the land contract is paid in full.

In order to cancel a contract for deed, a seller needs to complete a form called a notice of cancellation of contract for deed, and have the notice personally served on the buyer.

If you fall behind on payments, the contract can be terminated and you will lose whatever equity was previously built. Furthermore, if the seller has a mortgage and defaults on their payments, you may lose the property even though your own payments to the seller are current.

The contract for deed is a much faster and less costly transaction to execute than a traditional, purchase-money mortgage. In a typical contract for deed, there are no origination fees, formal applications, or high closing and settlement costs.