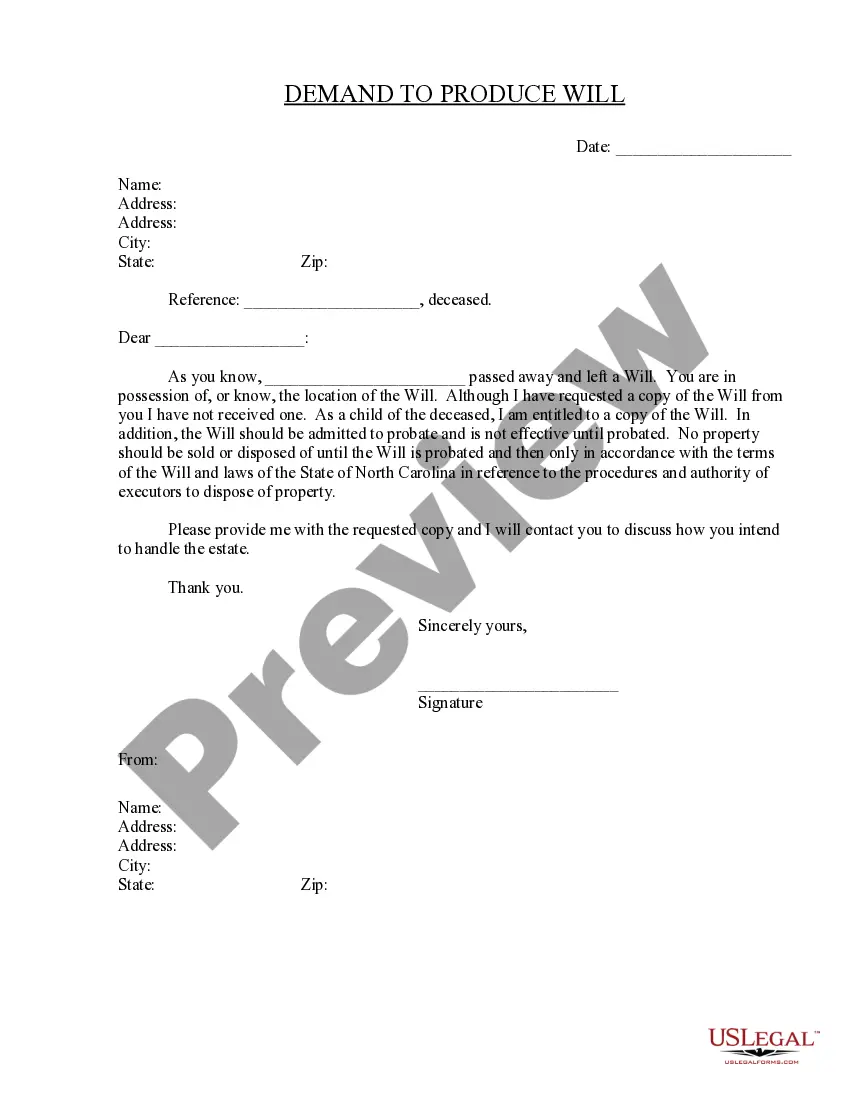

Raleigh North Carolina Demand to Produce Copy of Will from Heir to Executor or Person in Possession of Will

Description

How to fill out North Carolina Demand To Produce Copy Of Will From Heir To Executor Or Person In Possession Of Will?

We consistently endeavor to minimize or evade legal complications when engaging with intricate legal or financial matters.

To achieve this, we enroll in legal services that are typically quite expensive.

Nevertheless, not every legal issue is equally intricate. A majority of them can be addressed independently.

US Legal Forms is an online repository of current DIY legal documents encompassing everything from wills and powers of attorney to articles of incorporation and petitions for dissolution.

Simply Log In to your account and click the Get button next to it. If you misplace the form, you can always retrieve it again from the My documents tab. The procedure is equally simple if you are unfamiliar with the platform! You can create your account in just a few minutes. Ensure that the Raleigh North Carolina Demand to Produce Copy of Will from Heir to Executor or Person in Possession of Will complies with the laws and regulations of your state and area. Additionally, it's crucial to review the form's description (if available), and if you notice any inconsistencies with what you initially sought, look for an alternative form. Once you've confirmed that the Raleigh North Carolina Demand to Produce Copy of Will from Heir to Executor or Person in Possession of Will fits your needs, you can select the subscription plan and proceed to checkout. Then you can download the form in any format available. For more than 24 years of our operation, we’ve assisted millions by providing ready-to-customize and up-to-date legal documents. Take full advantage of US Legal Forms now to conserve time and resources!

- Our collection empowers you to manage your matters autonomously without needing to consult a lawyer.

- We offer access to legal form templates that aren’t always publicly available.

- Our templates are specific to states and regions, significantly easing the search process.

- Take advantage of US Legal Forms whenever you need to obtain and download the Raleigh North Carolina Demand to Produce Copy of Will from Heir to Executor or Person in Possession of Will or any other form promptly and securely.

Form popularity

FAQ

Most of the original wills and papers for the period 1663 to 1790, however, are at the North Carolina State Archives. Digital images of the original wills, arranged alphabetically by name of testator, are available on their website.

In general, a will is a private document unless and until a grant of probate is issued. While the testator is still alive, with limited exceptions, nobody other than the testator is entitled to receive a copy of the will. The will remains a private document following the testator's death until probate is granted.

Your child or descendants will inherit two thirds of the intestate real estate and whatever personal property remains after your spouse has received their share. If you die intestate, each of your children will receive an ?intestate share? of your property.

Fiduciary Services Failing to make sure that transferable assets that were bequeathed to heirs are indeed transferred correctly. Cancelling mortgage bonds in favour of the deceased when it is prejudicial to do so. Giving one-sided advice/instructions to a client, especially in the case of the massing of estates.

If you want to search for the will of a person who died recently, you can apply to the Probate Service for a standing search to be made. They will check their records to see if a grant of probate has been made in the twelve months before your application, and they will continue to check for six months afterwards.

State law allows for two years for the will to be entered into the court records. However, an heir may file sooner if the executor fails to file within 60 days of the death of the person.

When dealing with estates and estate contracts, the best practice is to have all parties sign all agreements. The heirs will need to sign because, more than likely, they will hold title to the property subject to the debts of the estate.

It is common practice (although again, not obligatory) to show a copy of the will to beneficiaries of the residuary estate (i.e. what is left once any debts have been paid and specific gifts have been made) but they are not automatically entitled to see the will, although they do have the right to know who the

If both parents are deceased, then your siblings (or the descendants of your deceased siblings) will inherit your property. If you are single, have no surviving descendants, and no surviving parents, surviving siblings, or nieces or nephews, then your property will be split into two halves.

Heirs' property occurs when land is passed down through generations and owned by many descendants with an undivided interest in the land. Owners of family-owned land are vulnerable to involuntary land loss resulting from a forced sale of the property.